Prices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

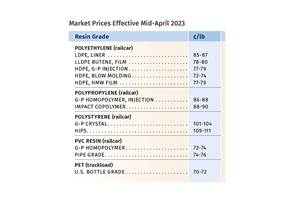

Commodity resin prices were forecast to start the fourth quarter with lower prices. Source: Baerlocher

Prices of the five commodity resins appeared to be heading downward by the start of fourth quarter. PP and PET prices dropped in September, while PE, PS and PVC prices rolled over, despite supplier price hike attempts. Moreover, a buyer’s market had emerged, due to across-the-board lower feedstock costs, rising resin inventories, slowed domestic and exports demand, as well as the impact of new capacity in the case of PE and PVC. Lower prices by year’s end were forecast for all.

PE Prices Flat, Then Down

PE prices in September rolled over, though suppliers were out with a 5¢/lb increase being pushed up to October. ExxonMobil adjusted its increase to 3¢/lb, which was likely to be supported by others, though it was unlikely that any increase would be implemented. This outlook is according to PCW’s Associate Director for PE, PP and PS David Barry; CEO Michael Greenberg of The Plastics Exchange (TPE); Mike Burns of Plastic Resin Market Advisors; and Kevin Mekaru, RTi’s senior business leader commodity plastics.

As for the October-November time frame, sources indicated that the prevailing industry sentiment was downward, with some consultants projecting a 5¢/lb decrease, according to PCW’s Barry. Based on the decline of PE spot prices, he ventured that a total drop of 5 to 7¢/lb was possible. He noted this is a very competitive marketplace with new supply making an impact and that reduced price negotiations were already taking place ‘behind the scenes.” Barry also said suppliers were entertaining lowering export prices as export activity had been lackluster. Concurring, RTI’s Mekaru noted that demand had softened while supplier inventories were very high.

Reporting for TPE on September’s end, Greenberg said prices of all spot PE commodity grades were flat. “This is bucking producers’ intent to implement a nickel price increase for September contracts,” Greenberg said. “To the contrary, challenging export conditions have led to bulging upstream resin stocks and backups at packaging warehouses, which has shifted the implementation of the current domestic nickel nomination from still possible to unlikely.”

Plastic Resin Market Advisors’ Burns noted that reduced prices and improved resin availability in the secondary market are leading indicators heading into the last quarter of the year. “Processors should expect favorable pricing and additional opportunities to improve prices,” Burns said.

PP Prices Drop

PP prices in September dropped by 4¢/lb in step with propylene monomer, according to PCW’s Barry; Spartan Polymers’ Newell; TPE’s Greenberg; and Paul Pavlov, RTi’s vice president of PP and PVC. Moreover, further decline within the October-November time frame was very possible. Both Barry and Newell saw potential of at least another 5¢/lb decrease, particularly if propylene monomer assets continued to run well.

Barry noted that PP suppliers were losing market share due to higher prices and were running at high operating rates, while spot prices were dropping. Asian PP resin and finished goods continued to add to an already competitive market. Newell noted that for six straight months this year, PP demand was ‘impressive,’ citing an increase in domestic sales of 5.95% through August, compared to year-to-date with 2023’s average. Barry added, however, that 2023 was not a good year for PP overall.

RTi’s Pavlov ventured that PP prices had potential to drop a total of 10 to 12¢/lb by year’s end, including the September decrease. These sources confirm that the strongest sectors have included rigid PP in housewares, as well as packaging, including caps and closures; thermoformed sheet for takeout containers; and BOPP film. They also agree that industry sentiment, which is generally neutral to pessimistic, does not reflect these gains, with processors being very cautious as to how things progress into 2025. While propylene availability was good in the fourth quarter, these sources cautioned that this could change fast in the first quarter of 2025 due to unscheduled shutdowns. “Monomer has had a real history of going up in price within first quarter over the last few years,” Barry said.

At September’s end, TPE’s Greenberg characterized the spot PP market as more active as sellers sensed a downward shift and lowered prices to keep material moving. “While plenty of processors are well stocked with resin, having beefed up their supply buffer during the hurricane season, others welcomed the softer prices and picked away with purchase orders,” Greenberg said. He noted that PP contract prices were cost-pushed by 9¢/lb between June and August, but due to the monomer’s price trajectory reversal, PP contract prices followed suit in September, with potential for further decline in October.

PS Prices to Flatten Then Drop

PS prices in September rolled over for the sixth consecutive month, despite lower costs of feedstocks, including benzene and ethylene. A downward trajectory was likely through fourth quarter, according to PCW’s Barry and RTi’s Mekaru. Barry reported the implied styrene price — based on a 30% ethylene/70% benzene spot formula — at September’s end as down more than 3¢/lb over four weeks.

September benzene contracts settled down to $3.61/gal from August’s $3.80. Moreover, spot benzene prices of $3.18/gal going into October were expected to translate to an equal drop in October contract prices — about a 40¢/gal decline. As such, Barry and Mekaru strongly anticipated downward movement for PS resin prices in the 4-to-5¢/lb range before the end of fourth quarter. Still, Barry noted that benzene prices during first quarter have historically climbed due to both scheduled and unscheduled plant shutdowns.

Meanwhile, PS supply remained adequate despite the outages at Chicago area plants operated by Americas Styrenics and Ineos Styrolution, though restart was expected for a general-purpose PS line at Ineos Styrolution’s Channahon, Illinois, plant by early October.

PVC Prices to Rollover Then Drop

PVC prices in September rolled over after August’s 2¢/lb drop, despite the 3¢/lb increase sought by all four domestic suppliers — a move that was viewed a as “hurricane insurance,” according to RTi’s Pavlov. Moreover, he ventured that another 1-3¢/lb was likely to come off by year’s end. He cited slowed domestic and export demand and high supplier inventories, along with new capacity from Formosa by year’s end. While domestic suppliers saw an 11% increase in demand for the first half of the year — which included an export advantage as global PVC prices were much higher — the trajectory of the latter had reversed to much lower.

Meanwhile, an antitrust class action was underway which alleges that several PVC pipe manufacturers have conspired to artificially inflate, fix or manipulate the price of finished PVC pipes sold in the U.S.

PET Prices Down

PET prices were on the way down by 5¢/lb within the September-October time frame, based on lower raw material formulation costs, according to RTi’s Mekaru. He saw potential for further downward movement by year’s end, barring unscheduled shutdowns.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreRead Next

Prices of PE, PP, PVC, PET Largely Firm, Flat for PS

By most measures, pricing for the five commodity resins appeared to be holding firm going into the third quarter.

Read MorePrices of PE, PP, PVC Up; PS, PET Flat

While prices moved up for three of the five commodity resins, there was potential for a flat trajectory for the rest of the third quarter.

Read MorePrices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read More