Commodity Resin Prices Shoot Up

Unplanned disruptions in polymer feedstock production in December, to be followed by a number of planned cracker outages slated for the first four months of this year, helped drive up monomer and resin prices, especially of PP, but also including PE, PS, and PVC.

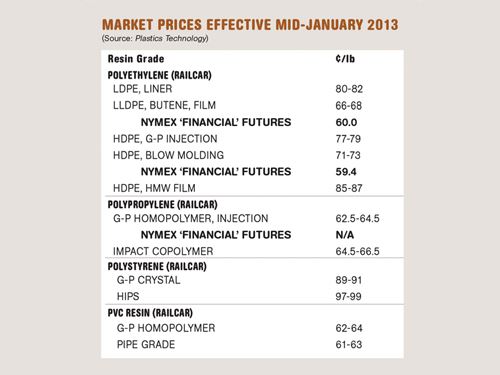

Unplanned disruptions in polymer feedstock production in December, to be followed by a number of planned cracker outages slated for the first four months of this year, helped drive up monomer and resin prices, especially of PP, but also including PE, PS, and PVC. Further price increases are expected in this quarter by purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Tex., and by CEO Michael Greenberg of The Plastics Exchange in Chicago. Here’s more on their outlook.

PE PRICES MOVING HIGHER

Polyethylene contract prices were flat in December, as spot prices rose to approach premium prices. Suppliers rallied around a 5¢/lb price hike for Jan. 1, and an additional 4¢/lb increase initiated by ExxonMobil was expected to pick up support.

Three drivers behind these increases are higher monomer costs, low supplier inventories, and export opportunities prompted by the Chinese New Year and higher Asian PE prices, according to Mike Burns, v.p. for PE at RTi. A series of unplanned ethylene cracker outages propelled spot ethylene prices upward by nearly 10¢/lb from early December levels to around 60¢/lb, at year’s end.

According to Greenberg of The Plastics Exchange, these disruptions affected mainly short-term supplies, but several more cracker shutdowns are planned from now through April. Both Greenberg and Burns anticipate tighter ethylene supply and higher prices in the near term. But once these maintenance turnarounds are completed, industry sources generally project the return of a well-balanced ethylene supply situation and lower prices.

Meanwhile, there was a significant drawdown of suppliers’ inventories in November and December, which included strong exports to Europe and Africa, while domestic processors stocked up as prices dropped and then bottomed out. Spot PE offers were few and far between when January rolled in, and prices moved up by 1¢/lb, according to Greenberg. By the second week of January, it was unclear how much of the 5¢ increase would be implemented or whether the additional 4¢ hike had full support.

Burns ventures that based on higher ethylene prices, low inventories, and suppliers’ renewed export opportunities to China, at least 5¢/lb of the two increases will likely be implemented by March 1.

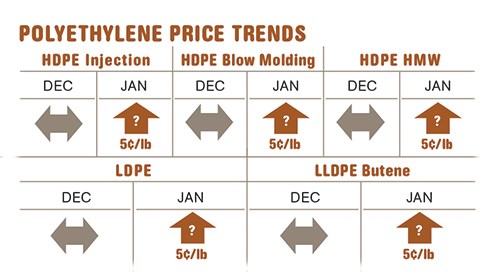

SUDDEN PP PRICE JUMP

Polypropylene contract prices moved up 1-2¢/lb in December, in step with the 1¢ increase in monomer contract settlements. Then PP suppliers fired off whopping increases of 11.5¢ to 13¢/lb for Jan. 1, following yet unsettled January monomer contract price nominations. This sudden spike in resin prices was brought on by unplanned outages of crackers, which have particularly high yields of propylene in the latter half of December. Greenberg says spot PP prices gained 6¢ in December and early January.

Spot monomer prices shot up more than 10¢/lb and there was a flurry of spot buying of PP. Although monomer production issues were largely resolved in the first week of January, several more cracker and refinery outages are planned from now into the early second quarter. Thus, there is the potential for a tight propylene monomer scenario, which could support higher resin prices, depending on demand.

Moreover, inventories throughout the supply chain were light at the end of December, and Greenberg noted then that this could lead to very tight conditions during the first quarter. “We have been advocating procurement of additional resin for the past month and maintain that view,” he stated in the Dec. 21 market update of The Plastics Exchange.

Domestic PP demand in January was “average,” said RTi’s Scott Newell, director of client services for PP. Industry inventories across the board can best be described as balanced to tight. Newell says many processors’ inventories are depleted, which means they will have to buy at the higher prices.

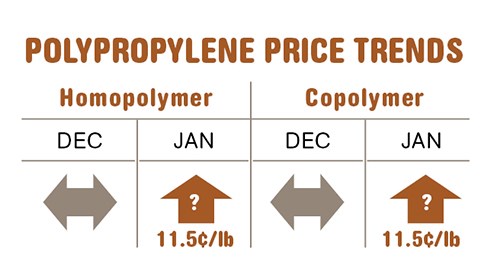

PS PRICES FOLLOW BENZENE

Polystyrene prices were poised to move up as early as the end of last month, as PS suppliers sought increases of 3¢/lb, effective Jan. 1. The key driver was a record escalation of benzene prices, with January contracts settling at $5.16/gal, up from $4.93/gal in November/December, which was then considered the all-time-high.

Putting further upward pressure on PS prices are rising ethylene cost due to planned and unplanned cracker outages. Butadiene is the only non-factor, as January contract prices settled flat again.

Will PS prices move up further? Although the 3¢/lb hike has a very good chance of being fully implemented, there may be some respite this month. By the second week in January, spot benzene prices were starting to drop, so there was some optimism that February benzene contracts would settle lower.

There are a couple of planned styrene monomer plant outages this quarter but monomer and PS demand has not been great. Says Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC, “Overall demand will help define how much further up, if at all, prices may go.”

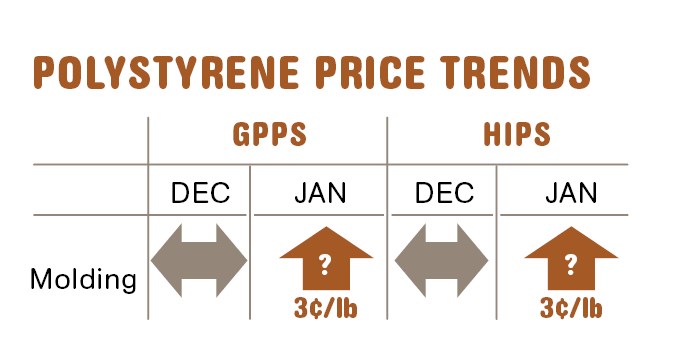

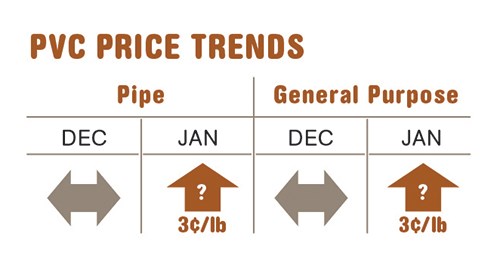

PVC PRICES UP

PVC prices were on the way up last month, as suppliers aimed to implement 3¢/lb price increases. The key factor supporting an increase during this seasonally slow market is rising ethylene monomer costs. Though both December and January ethylene contracts had yet to be settled at press time, spot prices were steadily hovering at around 60¢/lb. PVC suppliers also say planned PVC outages in the last two months of 2012 curtailed supply, but inventory levels are said to have remained balanced.

According to Kallman, you are likely to see at least 2¢/lb of the January increase, and he says a bit more upward movement is possible this month and then flattening out in March. Once the second quarter gets under way, Kallman anticipates higher pricing pressure coming from demand, in line with projections for healthy growth in the domestic construction market.

Related Content

The Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More