Developing Tomorrow’s Containers: Inside Amcor’s R&D Center

How award-winning package design, full-service laboratory facilities, and game-changing process development support a world-class injection and blow molder.

Ever wonder what kind of research, development, and application engineering resources it takes to support one of the Big Three North American bottle makers? You may have seen or read about the prize-winning bottle designs and the innovations in process technology, and wondered where all that comes from. They probably only show that to customers, you might think.

Not necessarily. A month ago, this reporter was granted a behind-the-scenes tour of Amcor Rigid Plastics’ Research & Development Center in Manchester, Mich. It was just the kind of tour usually reserved for customers, accompanied by interviews with more than a dozen executives, engineers, and design specialists. This unusual degree of access provided insight into how a top-tier packaging producer strives to respond to market demands and to anticipate demands the market hasn’t even formulated yet.

ON A NEW PATH

Amcor Rigid Plastics (ARP), headquartered in Ann Arbor, Mich., is a $3.2 billion business with 58 manufacturing sites and 5300 employees in 12 countries in the Americas. Beverages—soft drinks, water, and custom beverages—constitute about half its volume; the rest encompasses food, pharmaceuticals, spirits/wine/beer, and personal and homecare.

ARP is part of Australia-based Amcor Ltd., a $10 billion company said to be the largest publicly traded packaging firm in the world. ARP grew by a number of acquisitions that included operations of Twinpak, Schmalbach-Lubeca (the former Johnson Controls PET business), Alcan Pharma Plastics, and Ball Plastic Packaging North America. The latter two purchases, both in 2010, significantly expanded ARP’s product range by adding injection-blow and extrusion blow molding of polyolefins to its mainstay in PET stretch-blow molding.

Last year, ARP produced 31 billion units. The total includes a few billion injection molded caps and closures produced by ARP’s 50/50 Bericap joint venture (based in Toronto, with three North American plants). ARP also injection molds preforms, both for its own bottles and for other blow molders. ARP sells mostly preforms for water and soft-drink bottles, since the majority of these are blown at the filling site.

How did this heavyweight in packaging production also get to be a power in container innovation? It wasn’t by accident. As recounted by Michael Hodges, director of communications (formerly in sales and marketing as far back as the Schmalbach-Lubeca days), in 2007, ARP conducted a private survey of its customers’ views of ARP as a supplier. Based on customer feedback, Amcor needed to expand its focus beyond operational excellence to include a greater emphasis on R&D.

In 2009, Amcor renovated and expanded its R&D Center in Manchester. Today Amcor employs around 100 desigers, engineers, and other technical professionals at Manchester, Miramar, Fla., and Saline, Mich. Most recently, Amcor brought engineering teams from Bericap to Manchester, giving Amcor improved ability to integrate development of containers and closures.

Says David Feber, v.p. of research, development & engineering, “We wanted to go all the way from start to finish on how a product gets made. So we invested heavily in design, advanced engineering, prototyping, pilot-plant production, and laboratory testing. We make approximately 200 new packages a year, about half of them brand-new and half are refreshes—a size or weight change, for example. We can make anything from a few prototypes to large-scale runoffs of 100,000 containers for a customer’s market test.”

To explain how all those capabilities function and interact, Feber and his colleagues provided a tour of the various departments, following roughly the stages a product might go through from conception to market launch.

DESIGN: ART & SCIENCE

Mike Enayah is director of industrial design for “ScorCreative at Amcor,” the company’s in-house package design studio and agency. It functions mostly as a studio to design and engineer a package to meet a client’s aesthetic, marketing, and functional goals—or sometimes from ScorCreative’s own inspiration. But it also has the talents to function as an agency—engaging in branding and other more comprehensive marketing functions. ScorCreative even works on design projects for packaging to be produced outside of Amcor.

Amcor has a team of seven designers in Manchester, plus two in Florida and one in Brazil. They include designers who come with experience in automotive, furniture, and packaging design.

“We do the product silhouette—what the customer sees,” Enayah said. “It’s both art and science.” The science part comes from design engineers located in the same open cubicle workspace as the “artistic” side of the design group. “We have an organic flow back and forth between the teams to meet processing and functional needs while keeping the customer’s aesthetics intact.” It’s this blend of talents that distinguishes ScorCreative from the competition.

“A customer may come in with a concept from a design agency that has no technical background. A soft-drink bottle comes to us as a 2D sketch. But there’s no provision for the fact that internal pressure from carbonation will change the shape. That’s why we like to work with the customer and its agency early in the process.”

ScorCreative also works to coordinate the various customer teams working on a project. “We have a meeting called the ‘8-hour month.’ We get everybody together to accomplish in 8 hours what would otherwise take a month of back-and-forth discussions.”

Taking the example of a container for coffee drink now in production, Enayah describes the thought process that went into converting this from a gable-top paperboard carton to a PET bottle: “The first step was to benchmark the market and see what’s already out there. Second is to identify the brand cues—what reflects this brand name? Then we start with the silhouette: What signifies ‘coffee’?” He points to sketches evoking a thermos and coffee-cup shapes.

“We designed different shapes, all having the same volume and height so they will fit on the filling line. We asked, ‘Who’s the targeted demographic?’ So we designed the shape to fit both larger and smaller hands.”

If needed, ScorCreative can model the visual environment for the finished product—simulating the lighting conditions on a store shelf or display case, using virtual modeling to “see what the consumer sees.”

After the finished design came a little surprise. “We found out that coffee consumes oxygen, which creates a partial vacuum in the headspace that causes denting in the container. So we had to strengthen the container. We added ribs, like those in a coffee can. But as artists, we wouldn’t know exactly how to design ribs—what radius and spacing are needed—but our engineers in the cubicles next door do.”

Amcor then performed finite-element analysis (FEA) on the coffee-drink container. According to Enayah, “It’s coldfilled, so we didn’t expect any problems. But oxygen scavenging makes the shoulder collapse.” So engineers created an animated simulation of the bottle’s response to vacuum over time, starting from when it is filled to six months out, when the loss of water vapor would add to the problem. To counteract this, the design team looked at various rib patterns and at adopting a base design from hot-filled containers.

Then, CAD designers turned artists’ sketches into engineering drawings. They used proprietary software tools developed in-house. For example, they can specify a PET preform from ARP’s extensive library, and the software goes into the database to populate a spec sheet on the bottle, including the fill level in the container. That speeds up productivity.

Prototyping is another capability at Manchester. The facility has a 3D printer that uses inkjet technology to deposit a polymeric binder selectively on a layer of starch or plaster powder. Unique to Amcor is software that uses the 3D printer’s four-color print heads to print FEA models of the deformed shape of a bottle subjected to internal vacuum, showing the stress profile in the same colors as in the FEA screen display.

The engineering team also uses a 3D laser scanner for reverse engineering and for quality checks. The scanner can acquire 2 million data points on the surface of a bottle in 5 min and then can display a deviation analysis that shows where and by how much the molded bottle differs from the CAD model.

With all these resources, plus the ability to CNC machine an aluminum blow mold in one or two days, “We can go from a drawing to a bottle in one week,” says Enayah. “The customer comes in expecting to see a 2D model and gets an actual bottle.”

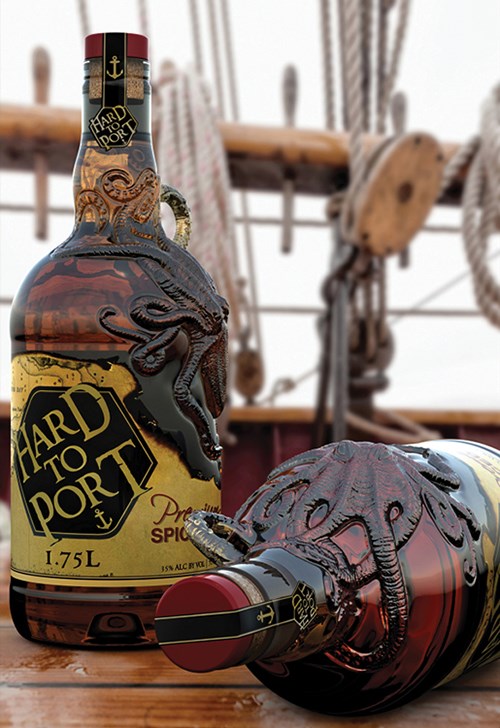

Although most design projects are initiated by customers, “We do proactive design, too,” notes Enayah. An example is the liquor bottle design shown on the front cover of this issue and at the start of this article. This “concept bottle” was not created for any specific customer or product, but to show off Amcor’s design talent and proprietary software capabilities for more highly sculpted and finely textured surfaces than have yet been attempted. “Our goal with this concept design was to go beyond traditional etching and engraving and open up our customers’ eyes to the possibilities,” says Enayah.

This bottle won a bronze Pentaward, the worldwide packaging design competition. For the 1.75L growler-type PET bottle, Amcor used multiple software systems, some of them proprietary, to create one of the first hand-sculpted PET liquor bottles. “This breakthrough design delivers etching and engraving that isn’t possible with traditional 3D modeling software,” says senior designer Greg Hurley.

Another area of “proactive” design research involves Amcor’s design team in efforts to incorporate elements of biomimicry—adapting designs from nature to industrial purposes. Team members cite the example of an insect’s wing, which is very light but very strong and might potentially provide insights for future ultra-lightweight bottle designs.

‘LIGHTS-OUT’ PILOT PLANT

Another stage in container development can be testing production in the Manchester pilot plant. “We have two high bays for injection and blow molding,” says Feber. “We ran 2 million bottles for customers here last year.” Among the equipment are Husky injection presses, including a new HyPET design, for molding preforms. “They can run lights-out 24/7 if we need to.”

Feber notes that the facility also includes a new small press for closure development to support Bericap’s R&D efforts. For blow molding, the pilot plant has several Series 1 Sidel reheat stretch-blow molders and Sidel SBO Univeral machines. After the Ball Plastics acquisition, the facility gained a small eight-station wheel extrusion blow molder.

FULL-SERVICE LABORATORY

The Manchester lab has six technicians and fielded over 1000 test requests last year. Certified by both Coca-Cola and PepsiCo, its capabilities include automatic, camera-based dimensional inspection; thermal analysis (TGA); oxygen barrier testing; melt flow and melt index; percent crystallinity; FTIR to inspect for contaminants; topload testing of full and empty containers to simulate transport and storage; burst testing; vacuum testing for hot-fill products; and environmental chambers with controlled temperature and humidity—to simulate, for example, the back of a truck parked in the sun in the Southwest in summertime. The lab also can test container response to hot filling, carbonation, and pasteurization (all using plain water).

HOW IT ALL COMES TOGETHER

Two recent projects show all these resources in action. In 2013, Crystal Geyser Water Co., Calistoga, Calif., launched an eye-catching 18-oz bottle for Tejava iced tea in a bottle from Amcor described as “the first-of-its-kind hand-sculpted PET hot-fill bottle.” Making it happen required close coordination of Amcor’s CAD and FEA teams.

First, ScorCreative designers realized Crystal Geyser’s initial design idea for a bottle that resembled a bundle of tea leaves. It required seven CAD software systems adapted from the gaming, animation, movie, and automotive industries. Then Amcor’s Advanced Engineering team used three more software systems to ensure the bottle would be functional in the real world. An essential feature is Amcor’s PowerFlex base that enables a panel-less design that withstands hot filling at up to 185 F. Amcor also used rapid-prototype tooling to provide timely samples to the customer for test marketing.

Early this year, Agua Enerviva introduced a 20-oz PET hot-fill bottle for its “energy water” that was created by ScorCreative and other Amcor teams in a compressed time to market of just six months. It also uses Amcor’s patented panel-less design with the PowerFlex vacuum-absorbing vase for hot filling at 185 F. Amcor’s pilot plant provided 10,000 bottles for focus-group and test-marketing studies prior to production testing.

MANAGING INNOVATION

With around 200 new products to develop each year, how does Amcor target its resources most productively? “Product development is 90% customer driven,” answers Dr. Brian Carvill, director of product development. “We are closely aligned with the commercial team to identify what our customers need—lightweighting, a new base design, something to accommodate a change in filling technique. Our business management team reviews project ideas and more than 60% of them turn into actual products.”

The other 10% of R&D activity is what Carvill calls “strategic innovation” or developing things the customer hasn’t even asked for yet. “We identify innovation priorities for the company and the market. We have identified a half-dozen strategic imperatives, like lightweighting, barrier capability, and improved hot-fill package designs.”

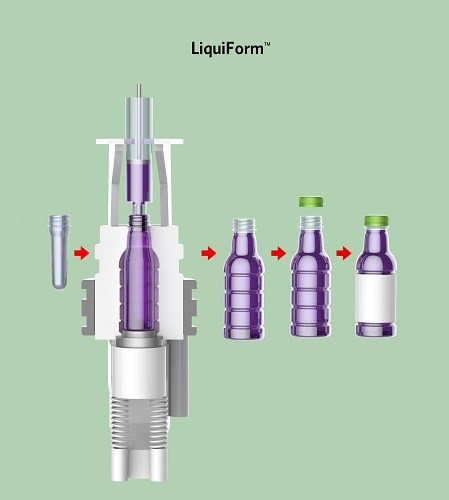

David Feber elaborates: “Our innovation team looks beyond today or the next 12 to 18 months. They ask what’s coming next.” He says the company’s two biggest R&D projects of recent years—the A-PEX63 jar with a metal-lug closure and the LiquiForm liquid form-fill process—exemplify that focus on “what’s next.”

As Carvill noted, lightweighting is a major focus of strategic innovation. “A couple of years ago, we redesigned a 64-oz PET bottle to cut weight from the standard 68 g to 59 g, a 13.2% reduction, largely through a new base design.” It was a stock bottle, designed proactively, not for a specific customer. “That was a rectangular bottle, and now we want to do the same thing for round bottles and smaller sizes. We see another round of lightweighting to be achieved this way.

“And for carbonated soft drinks, we are also working on a new base design to save another couple of percent in weight, which is worth a lot in that market. We’re almost ready to present it to customers.”

Feber adds, in a disarmingly casual tone, “We have a target for 50% weight reduction over the next five years in hot-fill containers.” A major obstacle is filling technology: “There’s a lot of older filling equipment out there that’s not compatible with today’s downgauged bottles, which are more delicate and dent easily.”

A number of Amcor’s achievements in hot-fill—such as the new A-PEX63 jar—cut weight out of the neck via the company’s innovative blow-trim process, in which a dome is stretch-blown above the neck finish and then trimmed off. In this way, the neck is blow molded rather than injection molded, cutting weight.

The other place to save weight is in the base, which is Amcor’s major focus today. Its patented PowerFlex vacuum-absorbing base (VAB) technology, which has been used in a number of projects, allows bottles to withstand hot filling at 185 F without need for panels that restrict the bottle’s aesthetic design and label placement. A unique inverted-cone diaphragm within the base draws upward as the liquid cools to take up the vacuum.

Barrier properties, another target of strategic innovation cited by Carvill, intersects with the others. As packages get lighter and lighter, anything that could deform the container—whether cooling after hot filling or head-space vacuum from oxygen scavenging—becomes more of a concern.

MANAGING SUSTAINABILITY

Amcor’s focus on lightweighting is economically driven, of course, but it also reflects the company’s mission statement, “We believe in Responsible Packaging.” For Charlie Schwarze, global sustainability manager, that mission involves understanding and quantifying how Amcor’s activities affect environmental factors such as carbon footprint and greenhouse gas emissions. Among his key concerns, he says, are “quantifying the effects of lightweighting, sustainable sourcing, and end-of-life responsibility. I help innovation teams understand the risks and opportunities in sustainability.”

In the last three years, lightweighting initiatives helped ARP North America save 24 million lb of plastics, or around 2% of its total throughput. Schwarze is also focused on renewable sourcing—opportunities to use biobased polyethylene or PET, as well as post-consumer recycle (PCR). Use of actual biopolymers like PLA or PHA is not a near-term focus. “The jury’s still out on their overall sustainability when you consider recycling,” says Feber, meaning both recyclability of biopolymers and their potential impact on other recycling streams. “And there’s the cost, which will involve a significant premium for the next five to 10 years.” Recycling is not an issue for PE or PET derived from renewable plant sources.

Amcor uses over 70 million lb/yr of PCR, says Schwarze, and “has invested significant time and resources in developing and securing reliable sources of the highest-quality PCR.” One recent initiative in this area was the announcement last September that Amcor would operate an on-site PET bottle production facility within the new Chicago manufacturing plant of Method Products. Method produces eco-friendly household, fabric-, and personal-care products. A group of 20-30 Amcor employees will work at the Method plant, which will run 24/7 making 100% PCR bottles.

THREE ‘GAME CHANGERS’

Three projects with far-reaching potential as “game changers” in a range of packaging markets have been major focuses of Amcor R&D in the last few years. One of these is the A-PEX63 wide-mouth PET jar, the first to achieve the long-sought goal of accepting a metal lug closure, such as is used on many glass jars for pasta sauces, salsa, jams, jellies, applesauce, and hot-fill juice and tea beverages (see January Starting Up). “Food jars still use a lot of glass,” says Bunlim Ly, senior marketing manager, who heads up the A-PEX63 project. A plastic hot-fill jar that can take a metal lug closure has been pursued for 15 years.

The announcement of a commercial jar that meets a 205 F hot-fill spec with an economical lug closure was “the ‘pop’ heard round the world,” Ly proclaims, referring to the sound on opening a lug closure, which consumers find a reassuring sign of freshness.

“We’re working with several customers to get products in A-PEX63 on the shelf before the end of the year. Everyone is working feverishly to be the first,” says Ly. Major retailers tell him this is a game changer by eliminating glass breakage—no more calls for “Cleanup on Aisle Six!” Another benefit is on hot-filling lines, where glass needs tempering so it cools gradually and doesn’t shatter. A plastic jar could save food processors several minutes.

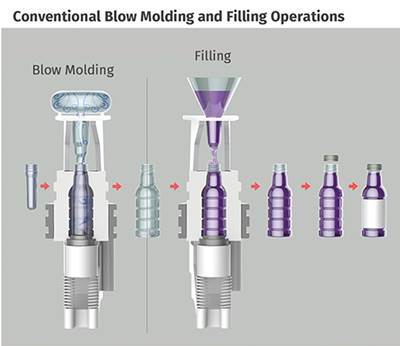

Perhaps an even bigger game changer is Amcor’s LiquiForm project to combine the stretch-blowing and filling processes into one step (see Sept. ’14 Starting Up). This 10-year effort, in which Amcor has invested significant resources and filed for hundreds of patents, is on track for initial commercialization in roughly two years, says Ann O’Hara, president of the LiquiForm Group, based in Saline, Mich. “Of course, it will still take the next five to 10 years to reach its full potential across a range of applications.”

Forming bottles with their intended liquid contents instead of high-pressure air has three major advantages, according to O’Hara:

1. Energy savings: Eliminating compressed air cuts energy consumption by 90% in the blowing step and around 50-70% overall. Since energy can be 25% of operating cost in bottle blowing, and operating cost is usually around 20% of bottle cost, this amounts to around 2-3% reduction in bottle cost from energy savings alone. LiquiForm has test molded PET bottles from 8 to 64 oz. “The bigger the bottle, the more energy saved,” notes O’Hara. There are also savings from lower labor and maintenance of the air compressor, for a total reduction in bottle cost of 3-5% without considering potential logistics and resin savings. (These estimates vary widely, depending on bottle size, the current air pressure used, and the cost of energy in each region, notes O'Hara.)

2. Improved quality: Forming, instead of blowing, with a nearly incompressible fluid (water, the main ingredient in most liquid foods and household products) instead of highly compressible air provides more uniform material distribution (stretch rods aren’t always necessary) and much improved replication of mold detail. LiquiForm engineers demonstrated the latter on a Sidel machine converted to the LiquiForm process. A single-serve water bottle shows crisper ribbing than a standard bottle and better definition of the stippled grip texture around the base.

3. Space savings: “It appears that we are combining two machines into one, but it’s really three machines into one, when you count out the air compressor,” says O’Hara.

There are other advantages, such as better filling accuracy with volumetric control of the fluid blowing medium. “Older filling equipment can be gravity fed,” O’Hara notes, “so some food processors will overfill every bottle to prevent underfilling any bottle. If LiquiForm is more accurate than their current filler, they can target a lower fill volume and save on product cost.”

LiquiForm Group has a staff in Amcor’s Saline research site and at Sidel’s France and Italy sites. At these sites and two development partners—Yoshino Kogyosho, Japan’s largest plastic bottle maker, and Nesle Waters, the number-one bottled water company worldwide—there are six development machines in use.

One factor that impresses O’Hara about LiquiForm is that “very rarely do you have a project like this that touches so many different applications.” Besides liquid foods and beverages, LiquiForm has potential in a range of non-food items like home- and personal-care products. And while development started with PET, the process has been shown to work with PE and PP and to show benefits in more uniform material distribution. There’s also the benefit of using no trim scrap, which allows for production of clearer polyolefin bottles, O’Hara says.

But most striking of all is the prospect that detergent, soap, and ketchup bottles (for example) could move to high-output rotary reheat stretch-blow machines, whose productivity can’t be matched by today’s extrusion blow machinery.

LiquiForm is one adventurous initiative by Amcor R&D into process innovation. Another is Compression Blow Forming (CBF), a technology that evolved from continuous compression molding of caps and closures by Sacmi of Italy (U.S. office in Des Moines, Iowa; see July’12 Close Up). CBF involves continuous extrusion of a “hockey puck,” which is compression molded into a preform and then stretch-blown in a system of interlocking wheels.

In 2012, Amcor was first to put this process into commercial production. It has three 12-cavity CBF machines in Youngsville, N.C., making stock and custom HDPE pharma bottles for two large producers of generics and supplements.

Tod Eberle, v.p. of quality systems, engineering standards, and advanced new platform technologies, has no doubt that CBF will be a game changer for dedicated long-run applications, due to its energy savings of 30-35% over the injection-blow molding (IBM) process normally used for pharma bottles, plus CBF’s higher productivity than IBM, “dramatically” tighter weight control, and extremely low scrap generation on startup and shutdown.

But as with any brand-new process, there have been growing pains. “The primary long-term issue has been premature wear of the aluminum blow molds,” Eberle acknowledges. He says Sacmi and Amcor have made steady progress in improving mold durability, and a new-generation clamp design now being tested will provide further improvements as well as faster cycles. (More details on CBF next month.)

Related Content

At NPE2024, Follow These Megatrends in Materials and Additives

Offerings range from recycled, biobased, biodegradable and monomaterial structures that enhance recyclability to additives that are more efficient, sustainable and safer to use.

Read MoreBest Practices for Purging PHA and PHA/PLA Blends

Because bioplastics are processed at lower temperatures, purging between jobs requires a different process and purging agents than those applied for traditional resins.

Read MoreAvantium and U.S.’s Origin Materials Aim to Accelerate Production of FDCA and PEF

The partnership aims to bring together both companies’ technology platforms to produce FDCA from sustainable wood residues on an industrial scale.

Read MoreNPE2024 Materials: Spotlight on Sustainability with Performance

Across the show, sustainability ruled in new materials technology, from polyolefins and engineering resins to biobased materials.

Read MoreRead Next

Compression Blow Forming Process in Commercial Production

Expectations of higher productivity, improved quality, and energy savings for a novel blow molding process are now being realized in commercial production at Amcor Rigid Plastics in Youngsville, N.C.

Read MoreFirst Hot-Fill PET Jar With Metal Lug Closure

Amcor wins the race to give PET pasta-sauce jars that satisfying "pop" on opening.

Read MoreBlow a Bottle with Liquid Instead of Air

New technology--to be made widely available--blows and fills bottles in the same step.

Read More