See-Through Plastic Cans Enliven Paint Packaging

Improved technologies for molding see-through plastic paint cans—both clear stretch-blow molded PET and translucent injection molded PP—are adding dash to paint marketing in the U.K. These trends present a lively example to the U.S., where gray steel cans still dominate the shelves in retail paint packaging.

The most striking example of the shift to transparent cans in the U.K. is a 750-cc, 55-g PET can being injection stretch-blow molded by RPC Containers in Blackburn, Lancashire. RPC uses technology licensed from PCC Group in London. The PET can is being used to package three special-effect, metallic colors launched by Kalon Decorative Products of Birstall, West Yorkshire.

"PET cans add a new dimension to paint packaging, creating excellent on-shelf impact and enabling color to be merchandised effectively for the first time," claims Matthew Baines, a Kalon marketing official. He says the vast majority of buyers of "seasonal" paints make color decisions in the store. Since clear PET shows off the paint color, it is expected to enhance appeal and boost sales. Industry sources add that return rates due to mistaken color selection may fall if customers can see the contents, so that overall retailing costs could decline.

"PCC's technology enables RPC to blow mold a PET container with a box rim and drip grooves, all made in a single machine in one step," states Richard Graham, the managing director at PCC Group. Previously, it had not been feasible to put lever lids (with their superior leak and drop resistance) into a blown PET container. RPC has exclusive rights to practice PCC's patented technology in the U.K. The technology can also be applied to other resins besides PET.

Meanwhile, RPC is pioneering a second approach to see-through paint cans. The company has long used its own patented technology to injection mold 2.5- and 5-liter opaque PP cans, which have widely replaced steel ones for water-based paints in the U.K. But the role of PP containers is limited by the vulnerability of polyolefins to attack by solvents and oils, which excludes them from 90% of the paint market.

However, RPC has extended the reach of its technology to include molding of translucent PP cans with physical properties equal to opaque ones. This option, while still limited to packaging of solvent-free paint, does open potential for color marketing in about 10% of the market. This adds to the appeal of molded PP cans, which are already favored due to their light weight and rust-resistance. The first commercial user of RPC's see-through PP can is Homebase, a top U.K. paint retailer that has adopted them for emulsion paints made by Kalon.

PET's pluses and minuses

The breakthrough by PCC and RPC is the incorporation of a lever lid in a PET can. Lever lids are more drop resistant than exterior lids, provide a raised lip to facilitate opening, and include drip channels. PCC's contribution lies in a parison design that makes possible a rim comparable to those spin welded onto steel paint cans. PCC is able to precisely control the inner surface of the parison, said to be the best way to integrate rim details into the overall design of the PET container.

Jonathon Britton, inventor of the PCC technology, claims this PET can performs far better in drop tests than spin-welded lids used on competing containers. The flange of PET rims used for levered opening is also said to be less prone to deform than is a spin-welded steel rim.

Sean Dyer, RPC's sales and marketing manager, concurs that sparkling clarity and a molded-in rim for a lever lid are important attributes of the blow molded PET container, but he argues that this is just the tip of the iceberg. "It's PET's solvent resistance and potential for new design features that make the difference," Dyer declares. He says PET's solvent resistance "opens new market areas for plastics in oil- and solvent-based paints." As for design, PET potentially could be used to make straighter-walled and square containers more readily than PP. Further use of blown PET cans in 500-cc and one-liter sizes is being investigated by RPC.

RPC blow molds the 750-cc PET container using an SBIII-250/100 integrated (single-stage) injection stretch-blow molder from by Aoki Technical Laboratory of Japan. (Aoki Laboratory America is in Elk Grove Village, Ill.) RPC uses a two-cavity mold and achieves a 20-sec cycle time. The Aoki machine costs about $500,000 and makes around 6 million cans per year.

Several sources question whether that level of productivity can keep pace with the high-volume paint packaging and filling lines typical in the U.S. PCC's Graham says work is under way to develop tools with up to five cavities. Meanwhile, he claims that PET cans already cost less than steel in sizes under one liter.

"There's no intrinsic reason why PET containers using our lid technology can't be made on two-stage (reheat) stretch-blow machines and in high-cavitation tools," adds Britton. He says PCC is working with a European manufacturer of two-stage PET systems to adapt that high-output equipment for blow molding PET paint cans.

Resin pricing could be a hurdle to widespread PET adoption, since virgin PET costs more per pound than either PP or steel. But PCC's Graham counters that reclaimed PET beverage bottles lend themselves to use in paint cans and cost less than virgin PET. Others are skeptical about the availability of reclaimed PET in the large volumes required for this application.

PCC reports that development is in progress on a blow molded PET container designed to replace the popular 1-gal steel can in the U.S. The PET design closely imitates the steel version, including integral bale lugs used to hold the plastic handle.

PP adds assembly cost

RPC's translucent injection molded PP cans have also met with some success in the U.K. for emulsion-based paints. RPC's Fabcan 2.5L and 5L PP cans are molded at RPC's plant in Oakham. Dyer says see-through properties are achieved by using selected PP random copolymers and novel clarifiers.

RPC patents are said to overcome difficulties facing the injection molded PP can, namely the ejection of cans with deep undercuts and handle lugs, and spin welding and assembly of lever lids on PP cans. For PP cans, the body, rim ring, lid, and handle are all separate parts whose assembly adds to final container cost.

U.S. poses challenges

The infrastructure of the U.S. paint business presents serious challenges to adoption of either PET or PP cans. One factor favoring steel is regulations that permit warehouse stacking of up to 20 cans in order to conserve space. Steel cans have the top-load strength to withstand that weight, while plastic cans have yet to prove their suitability for such high stacking. In Europe, regulations allow cans to be stacked only five high.

Further, sources say paint in the U.S. tends to be shipped considerable distances and under severe environmental conditions. That tends to exacerbate risks of "paint skinning"—i.e., solidification of paint in the container. Plastic cans have yet to demonstrate an ability to resist skinning as well as steel. However, PCC reports that ACI Plastics, an Australian subsidiary of Owens Illinois, has developed methods for coping with skinning in plastic cans.

Another obstacle to plastic paint cans is the use of magnetic handling of steel cans in some high-speed filling operations. Plastic cans would have to be run on alternate, non-magnetic filling lines, or special adaptation of existing lines would be needed.

In the U.S., most paint is shipped to the retailer in primary colors, with final color attained by custom tinting at the retailer. This factor wipes out the marketing advantage of see-through containers, other than for specialty paints. Also, violent shaking to which cans are subjected by the in-store color-tinting apparatus also tends to favor steel, some sources say.

Nevertheless, RPC is now developing a new generation of its injection molded PP cans for the U.S. Dyer says the challenges are to make sure the lid prevents leaks during the tinting process and to prevent "color hang-ups" or incomplete mixing, a problem that tends to occur with current plastic lids. Dyer says both issues are addressed by the new PP can and lid design.

Several PP and PET resin suppliers, who asked not to be identified, voiced skepticism about the prospects for the plastic paint can in the U.S. They view paint packaging as driven more by container cost than marketing concerns. One supplier even questioned whether PET's solvent and deformation resistance can match the claims made by advocates of blow molded cans.

Related Content

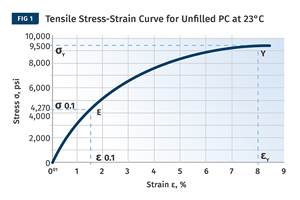

The Effects of Stress on Polymers

Previously we have discussed the effects of temperature and time on the long-term behavior of polymers. Now let's take a look at stress.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More