Sustainability Will Change Your Business

Do you have a sustainability officer yet? You might need one. It's probably even more likely that your customers have one, and you will have to pay attention to them if you want to continue to supply them with plastic parts or products.

Do you have a sustainability officer yet? You might need one. It’s probably even more likely that your customers will have one, and you will have to pay attention to them if you want to continue to supply them with plastic parts or products.

Within the last few years, the position of Chief Sustainability Officer (CSO) has appeared at a wide range of companies, from big-box retailers and brand owners to smaller privately owned suppliers of film and bottles. And this is no passing fancy. These executive appointments suggest that the greening of America will continue to influence the way plastics processors do business in the future.

“Having a sustainability chief on the executive team supports developing new business opportunities and avoids costly risks,” says Ellen Weinreb, CEO of the Weinreb Group (weinrebgroup.com), a consulting and executive recruiting firm that helps companies build capacity to address sustainability issues. “Business dynamics are changing and so must those who manage. These CSOs are charting new territory that will increasingly define which organizations are successful in the long run.”

The function of a CSO varies from company to company (see sidebar). In broad brush strokes, the responsibilities include embedding sustainability into the corporate fabric; reducing waste, emissions, and costs; engaging the workforce to create an environmental ethic; revising procurement policies to increase green purchases; ‘greening up’ buildings, facilities, and vehicles; and keeping the company out of activists’ sights by partnering with those that offer expertise or political cover.

HOW TO 'GET WITH THE PROGRAM'

Plastics processors will be expected to offer more and more hard data on the environmental impact of their products to their supply-chain partners. “Sustainability has to be ‘designed in’ from the beginning, and all aspects should be reviewed, from material, energy, transport method, and cube utilization to all end-of-life scenarios,” says Jad Darsey, director of sustainability and plastics at TricorBraun, St. Louis (tricorbraun.com), one of North America’s largest suppliers of bottles, jars, and other rigid packaging. “It is not an easy task yet, but it is part of this business and should be done for every package the same way any other performance properties are taken into consideration.”

The most visible activity to date has been in packaging, instigated by Wal-Mart Stores in February 2008. That was when the company rolled out its Sustainable Packaging Scorecard, with the goal of reducing by 5% the total packaging used in its supply chain by 2013. All Wal-Mart USA and Canada direct suppliers are required to enter packaging data for each product they supply.

“It was the first time packaging was being assessed not just on quality or price, but on greenhouse-gas emissions and carbon footprint,” notes Chandler Slavin, sustainability coordinator and marketing manager at Dordan Manufacturing, Woodstock, Ill., (dordan.com), a thermoformer that took an early proactive stance on the issue.

Wal-Mart teamed with Efficient Collaborative Retail Marketing (ECRM) of Solon, Ohio, to develop its environmental initiatives. ECRM developed the software for Wal-Mart’s Sustainable Packaging Scorecard and Package Modeling 3.0, which let companies see how their products stack up against others’. ECRM also offers a sustainability education program on topics such as how to efficiently enter items into the Scorecard; finding potential packaging improvements; discovering new raw materials and converted packaging suppliers; technical and sustainability aspects of packaging; and examples of packaging sustainability innovations.

Another tool currently being used by forward-thinking packaging suppliers was developed by the Sustainable Packaging Coalition (SPC), Charlottesville, Va. (sustainablepackaging.org), an industry working group of nearly 200 companies representing materials suppliers, processors, packagers, and retailers. SPC’s brainchild is a life-cycle-analysis (LCA) packaging assessment tool, COMPASS, which has been partially funded by the EPA.

“Tools like COMPASS and ECRM’s Wal-Mart Packaging Modeling Software 3.0 allow us to quantify the environmental ‘scores’ of different packages and take a proactive approach with our clients to incorporate the requirements of the end customer/retailer into the packaging development process,” says Dordan’s Slavin.

Last September, the Global Packaging Project (globalpackaging.mycgforum.com), part of the Consumer Goods Forum in France, released the Global Protocol on Packaging Sustainability (GPPS) to provide a common measurement system for companies to assess the relative sustainability of packaging. The aim of GPPS is to help companies reduce the environmental impact of their packaging by providing a common framework and measurement system to address packaging sustainability. The framework, titled A Global Language for Packaging Sustainability, was first published in June 2010. The metrics presented in the recently released protocol now deliver the measurement system.

The GPPS was designed by a group of retailers and manufacturers aided by packaging material suppliers and packaging manufacturers and steered by a team that included representatives from retailers Wal-Mart, Target, and Tesco; and brand owners Kraft Foods, Procter & Gamble, Nestle, and Unilever. It is based on earlier packaging sustainability guidelines developed by the European Organization for Packaging and the Environment (EUROPEN) with ECR Europe and similar work by SPC in the U.S.

According to SPC, many companies with strong connections to the packaging industry are now collecting data and monitoring their economic, social, and environmental impacts but often report similar metrics differently. There has been no industry-wide effort to aggregate data on actual impacts from companies. The new GPPS may help remedy some of these issues by providing a common language to encourage dialogue about the relationship between packaging and sustainability. Also, its emphasis on life-cycle assessment may result in a more complete way of assessing product impacts and lesser product-development mishaps.

David Clark, director of sustainability at global PET packaging company Amcor Rigid Plastics, Ann Arbor, Mich. (amcor.com), says nearly all of the company’s major customers have set up sustainability programs. “All start with the material you buy, as materials have the most impact. So almost all of these companies have developed surveys that they send out to their packaging manufacturers, which include questions like, ‘Are you measuring energy consumption? Are you calculating the carbon footprint of the packages you make for us? Are you measuring water use in the production of our products? Are you addressing social and ethical issues (e.g., paying workers fair wages, promoting safe work habits, ensuring sufficient breaks, etc.)?’” A group created to address social and ethical concerns is the London-based Supplier Ethical Data Exchange (SEDEX) with sponsors such as Unilever, Nestle, and Kraft (sedexglobal.com).

Clark says one of the best examples of such customer/supplier surveys is Procter & Gamble’s new Supply Chain Sustainability Scorecard, which P&G recently made public on its website. The P&G scorecard tracks improvement on key partner-related environmental sustainability measures in the company’s supply chain. Partners are requested to report sustainable results relating directly to the creation of P&G-specific materials and services. P&G is also encouraging partners to use this scorecard process within their own supply chains.

PROCESSORS WEIGH IN ON MATERIALS

In addressing material selection for sustainability, processors say one of the biggest trends is toward more post-consumer recycled (PCR) content. Says TricorBraun’s Darsey, “With the advent of FDA-approved recycled HDPE and cleaner recycling streams, we have seen more companies not only allowing but also feeling safer moving in the direction of higher and higher PCR content. We have a number of customers running 100% PCR for personal-care products—something unheard of just a few years back.”

According to Dordan’s Slavin, a lot of packages have been converted from PVC to RPET, and more thermoformed containers appear to be moving into PET from PP and PS because PET is the most-recycled resin in North America.

Most of Amcor’s products are PET and some are HDPE. Clark notes that while certain markets do seek 100% recycled content, most clients—representing the vast majority of the millions of pounds of PCR going into major commercial products—seek recycle content in the 10% to 25% range. Why this low? Because good PCR supply is tough to come by, and PCR-containing bottles aren’t as aesthetically pleasing as their virgin counterparts. “For plastics packaging, increasing the recyclability efforts in our country requires a bigger effort be undertaken,” Clark says. “There have not been enough incentives for private recycling companies or municipalities. But we are seeing industry now looking for ways to partner with local and state governments, and groups such as the SPC have been formed to support this.”

“Sustainability is becoming a part of everyday life, and making sure our cups can be recycled as part of that ongoing activity is a priority,” says Kim Frankovich, vp of sustainability for Solo Cup Co., Highland Park, Ill., (solocup.com). Solo has been proactive since 2008, when it launched the Bare by Solo brand, the first full line of “eco-forward,” single-use foodservice products using recycled, recyclable, compostable, or renewable materials.

In 2011, the company launched the Solo Cup Brigade, a cup-recycling program created with recycler TerraCycle, Trenton, N.J., for individuals, charities and others to collect Solo Squared plastic PS cups and return them to TerraCycle for recycling. For every Solo cup returned, 2¢ will be donated to Keep America Beautiful or to a non-profit or school chosen by the Brigade member. The recycled cup material will be used to make equipment for playgrounds, park benches, and outdoor furniture.

Biobased resins are also being considered, but many processors believe these materials are still in the embryonic stage. Says TricorBraun’s Darsey, “The move to biobased resins will be slower, as capacity is slow to come on line for things like biobased HDPE, PET, and soon biobased PP. Only the highest-profile projects will have material available over the next few years.”

Clark says Amcor is looking primarily at biobased PET and PP from Braskem of Brazil (braskem.com, U.S. office in Houston). “We are leaning toward biobased PET versus other biopolymers, as we feel it’s important to preserve our existing recycling systems, and these newer biobased materials are very compatible and a drop-in for the current recycling stream,” he says, adding they are also more expensive.

Dordan offers alternative-material consulting through its Bio Resin Show N Tell program, the result of two-year internal R&D research on the performance and environmental profiles of biobased, compostable, and biodegradable resins. Materials sampled to date include PLA, PLA plus starch, cellulose acetate, PHA, biobased PET, and foamed RPET. Thermoformed samples are presented to customers alongside comparative specs and pricing, with special attention to end-of-life requirements. “There is a cost premium associated with most of the non-traditional resins included in our BioResin Show N Tell; this is why we have yet to run a full production order in any of these resins,” says Slavin.

Of course, there have also been major U.S. processors who have braved the challenges of adopting biopolymers, such as cups thermoformed by Fabri-Kal, Kalamazoo, Mich. (f-k.com, see article in Dec. ’09), using PLA from NatureWorks LLC, Minnetonka, Minn. (natureworksllc.com); and ballpoint pens injection molded by Newell Rubbermaid’s Paper Mate Div. (newellrubbermaid.com) using Mirel PHA bioresin from Telles, Lowell, Mass. (mirelplastics.com, see article in Aug. ’10).

PROCESSORS RESPOND

Proactive processors point to several other factors that are changing the way they make their products to meet their customers’ sustainability goals. One is the increasing trend toward lightweighting or downgauging, which can result in savings—both economic and environmental.

“Rightsizing” has become another popular approach to designing more sustainable packaging and achieving lower product-to-package ratios, so that the overall material consumed per package is reduced, according to Dordan’s Slavin.

Another approach is redesigning a package so that it has better “cube utilization,” loading more product per pallet and more pallets per truck.

The movement is even affecting equipment choices. According to the SPC, a sustainable package should be made with as much renewable energy as possible. “In many cases, the availability of this energy is out of the manufacturer’s control, but as it becomes available it is something that manufacturers are looking to utilize. Energy saving not only makes sense from an environmental perspective, it allows for processors to cut operating costs,” says TricorBraun’s Darsey.

“Many company sustainability surveys ask how much energy is used to make a given number of our containers,” adds Amcor’s Clark, who sees all-electric injection molding machines as more energy efficient than their hydraulic or hybrid counterparts. He also notes that there have been significant improvements in the last five years in energy-saving air compressors and compressor controls.

Slavin says Dordan is constantly retrofitting its machines to ensure total systems efficiency. Waste reduction is becoming a must and makes perfect business sense, says Darsey from TricorBraun: “Zero-landfill policies turn product that companies pay to dispose of into additional revenue streams. It takes creativity to find outlets but the efforts are generally worth it in revenue and morals.”

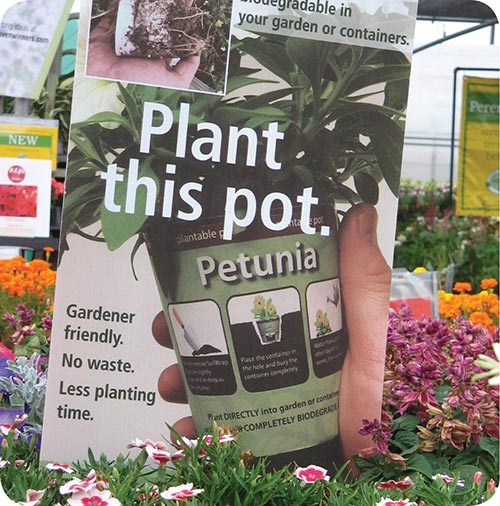

Debra Darby, director of marketing communications for Telles’ Mirel PHA, notes that a growing factor in material choice is whether it can be reused at the product’s end of life and, if it’s a biopolymer, can it go into a composting stream? “Everything that has to do with reducing waste should be considered in package design. We see interest from brand-name makers and retailers looking for biodegradability and performance as well as end-of-life solutions such as composting or anaerobic digestion.”

Darsey from TricorBraun sees a trend among large companies to focus on those things they can control. “That means they are focused upstream of their process and not downstream on where products may or may not end up. The thinking is to move toward the least disruptive package that allows them to effectively transport, utilize, and sell their product. This could be lightweighting, moving to PCR or a polymer with a lower carbon footprint, or shifting to a recyclable material. No one answer is right for all products, and each has to be evaluated individually based on all the product’s needs and the full life cycle.”

Says Slavin, “There is no silver bullet and ‘sustainability’ isn’t something that happens overnight. It’s the result of informed materials selection, lean conversion processes, smart supply chains and distribution, and efficient end-of-life recovery systems for packaging post-consumer materials.”

Related Content

Scaling New Heights With Vertical Integration

Eden Manufacturing was founded on a vision of vertical integration, adding advanced injection molding capabilities to a base of precision moldmaking and more recently bringing Swiss-type machining capabilities in-house.

Read MoreCompletely Connected Molding

NPE2024: Medical, inmold labeling, core-back molding and Industry 4.0 technologies on display at Shibaura’s booth.

Read MoreCustom Injection Molder Plugs into All Electric Machines

Formerly a showroom for early-aughts-era Van Dorn hydraulics, the newest additions to Drummond Industries’ transforming fleet are all-electric Niigata injection molding machines.

Read MoreCompact Hybrid Injection Molding Machine Launched

Sumitomo Heavy Industries Ltd. (SHI) has introduced the iM18E, promising the smallest footprint in 20-ton machines.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More