They've Been Working on the Railroad

Composite RR ties could finally be on their way to becoming the next big thing in plastic lumber. They are attracting interest from makers of marine pilings, another category of structural wood replacements.

For a decade, processors have pursued the vision of a bonanza in HDPE composite railroad ties. They dream about the annual replacement volume for wooden ties: In the U.S. alone, that amounts to 15 million ties, worth roughly $500 million. Marine pilings and bridge cladding use similar high-strength composites and have a comparably bullish outlook. The Army, Navy, and Coast Guard each have annual multi-million-dollar budgets to replace creo sote-treated wood pilings, and private shoreline owners have shown a willingness to pay more for longer-lasting composite docks, too.

Reinforced plastic RR ties and marine pilings are made by a handful of small companies with proprietary technologies. These firms have struggled for a decade to establish standards, qualify products, and get them into test applications.

Composite ties weigh 200 to 280 lb apiece, depending on formulation and length. Transit ties are 8.5 to 9 ft long, freight ties 7 to 9 ft long.

Laboratory measurements of stiffness and insertion/extraction forces for spikes are generally lower in composite ties than in wood. But in-track performance of the plastic ties is comparable, and they last much longer.

The railroads could use a lot more composite ties, especially for freight lines in hot, wet environments like the Southeast and for remote spur and feeder lines where installation costs are high. The U.S. leads the world in composite tie technology, so there is considerable interest from foreign railroads in tropical countries like India, Thailand, and the Philippines.

Composite ties also have a big advantage over concrete ties. They can be installed with the same equipment as wooden ties and can replace wooden ties on a piecemeal basis. Concrete tie installation requires different equipment, and the track bed has to be all concrete or none.

Many false starts

Use of composite marine pilings, which cost three times as much as wooden ones, is growing steadily at 4% to 5% per year, well ahead of competing concrete and wooden pilings. However for, composite railroad ties, which cost only twice as much as wooden ones and about the same as concrete, growth is negligible. Out of 600 million installed RR ties in the U.S., perhaps only 300,000—or 0.05%—are in plastic, including all the test track.

“We’re still pessimistic about composite RR ties,” says James Morton, a senior partner at Principia Partners, a business consulting firm in Exton, Pa., that reports on composite materials markets. He pegs the production total at only around 225,000 composite ties in the past two years, vs. a concrete tie market of 1 million ties a year. “Either there will be a breakthrough, or we will see a couple more years of developmental ties here and there.” The history of composite RR ties is rife with start-up technology companies that promised too much too early, issuing press releases every time they shipped a few samples. Today, out of perhaps a dozen companies that won patents, ecology prizes, and trial orders for testing, only three firms have commercial production: Polywood Inc. in Edison, N.J.; Tie Tek Inc. in Houston; and U.S. Plastic Lumber Corp. (USPL) in Boca Raton, Fla. The others typically failed when they couldn’t produce more than sample quantities, which confused the railroads and damaged the credibility of this fledgling industry.

Until 2000, railroad orders consisted largely of samples. “Our first sales order was for two ties, the next for six, then 20, then 100, then 1200,” recalls Henry Sullivan, president of Tie Tek. In 2000, Tie Tek landed the industry’s first big order—200,000 ties for the Union Pacific Railroad. In 2002, the order grew to a million ties over a six-year period.

Over the hump?

The long-awaited breakthrough for composite ties may actually be under way. Tie Tek and Polywood are both shipping large volumes. Tie Tek delivered 60,000 ties/yr for the past two years. Polywood says it shipped 50,000 ties last year, and USPL about 20,000.

Composite ties have leaped many of the hurdles to acceptance. Last year, the American Railway Engineering and Maintenance of Way Association published the first standards for composite ties. Tie Tek and USPL have both made ties able to carry heavy freight on the railroads’ FAST/HAL (Facility for Accelerated Service Testing/Heavy Axle Load) test at the Transportation Technology Center in Pueblo, Colo. Both firms’ ties have carried over 800 million gross tons since 1997 without failure. Tie Tek also has ties in testing on Union Pacific track that have logged over a billion tons of freight. Polywood has ties in the FAST/HAL test track in Pueblo that have carried over 130 million gross tons since 2003.

The three commercial producers’ formulations are different, but they all start with mixed, unwashed, recycled HDPE and use some form of flow molding from an extruder into closed molds, with diverter valves to alternate the flow into two cavities. They keep the contents under pressure with blowing agents to prevent voids. Most processes tend to be hard on machinery and require substantial downtime for preventive maintenance. All are slow to fill and slow to cool. Full molds go into a water-cooling bath for one to several hours before parts are demolded and air cooled. All three firms use equipment from Superior Polymer Systems in Canada.

Tie Tek, which makes only RR ties, uses a more complex formula than its competitors. It mixes 50 wt% HDPE with long glass fiber, crumb rubber, vermiculite, and foaming agent. It also has made test ties with recycled nylon carpet.

Tie Tek’s HDPE formulation is harshly abrasive, so it’s combined in a Banbury-style high-intensity mixer and then conveyed to a single-screw discharge extruder, which fills a series of closed molds under pressure. The molds travel through a long water bath for several hours before the ties are demolded hydraulically and placed on an even longer conveyor for ambient air cooling. Unlike its two main competitors, Tie Tek doesn’t trim the ends off its ties to promote interior cooling. An intact skin eliminates any possible post-blowing of the foam interior, which could weaken the tie. Finally, ties are embossed on three sides with a diamond medallion pattern.

To fill Union Pacific’s million-tie order, Tie Tek bought a 200,000-sq-ft plant in Marshall, Texas, on a main line of that railroad. The first of two automated production lines will start up this month and the second in July, bringing combined capacity for Tie Tek’s two plants to 350,000 ties/yr. The firm’s stepped-up production will use around 50 million lb/yr of recycled HDPE, which will be supplied through a strategic partnership with recycler Avangard Industries Ltd. in Houston.

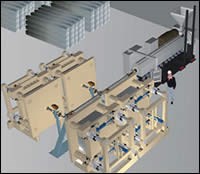

The new plant uses an automatic mold- and parts-handling system built exclusively for Tie Tek by Precision Systems Engineering. Tie Tek will license the technology outside North America and already has one licensee in Oz-Tex Solutions Pty. Ltd. in Temora, Australia. Oz-Tex started production last month and has bought equipment for two more lines.

Polywood is the newest RR tie producer. It makes mainly ties but also produces marine pilings. Its tie business is growing rapidly in freight track, and its largest customer is Burlington Northern Santa Fe Railway. Polywood licenses Rutgers University’s immiscible polymer technology (see Learn More box), using a blend of 35% high-melt-strength polystyrene and 65% post-consumer HDPE plus a little blowing agent and colorant. The immiscible mixture creates an intertwined mass of PS fibers within the PE matrix. The fibers form in situ during blending because of the difference in the two polymers’ melt temperatures.

Polywood molds 7 x 9 in. ties 9 ft long at a rate of 10 per hour, using a Davis-Standard single-screw extruder. Ties cool in the mold before being demolded and cooled again in a water bath. The cooling cycle is said to be faster than for glass-filled composites. Polywood also extrudes dock pilings using a water jacket to freeze the outside of the profile (to prevent warping) before it enters a water bath.

U.S. Plastic Lumber makes ties, marine pilings, wood-filled decking, and other composites. USPL sells ties for both freight and transit, though mainly for transit. It acquired a patented formulation of recycled HDPE plus 10% to 20% short glass from Tri-Max, a maker of pilings that went bankrupt. USPL obtains some plastic flake from its own recycling operations in Chicago and applies the Tri-Max recipes to extruded marine pilings and to molded Dura-Tie RR ties.

USPL uses an extrusion process for continuous molding with SPS molds. Water cooling is followed by air cooling, and the ends are trimmed off the ties after they are fully cooled. USPL has experimented with using 10% to 40% recycled nylon carpet fiber in RR ties. It is doing development work with CARE, the Carpet America Recovery Effort, to shred used nylon carpet and cold pelletize the waste using a pellet mill.

New players jump in

Several other hopefuls have made RR tie test samples but no commercial product. “Tie Tek put in the years, made the investment, created the standards, and met them. That opens the way now for other players to qualify RR ties with other technologies a lot faster,” says Murray Fox, a recycling investor in Webster, Mass. He recently bought an unusual “cold” extrusion process for RR ties from the bankrupt I-Rock, which in the early 1990s built a $3.5-million plant in Bradley, Ill., but could not get the process into production.

The newly revived I-Rock has set up a manufacturing test facility in Brighton, Mich., and is producing 12 x 12 in. pier chocks and parking-lot stops for the U.S. Navy, as well as squares of industrial flooring and test quantities of RR ties. Its process combines a shredded mix of recycled polyolefins, crumb rubber, and styrenic resins (HIPS, ABS, or oriented PS scrap) in a modified 6-in. Werner & Pfleiderer twin-screw compounder.

The styrenics are dissolved in a proprietary solvent to form a matrix that encapsulates the polyolefins, rubber, and any ground thermosets in the mix. This aggregate reportedly performs like a block copolymer with a very high Young’s modulus of 140,000 psi.

The mix is extruded at 8000 lb/hr into profile-shaped molds. After about 15 minutes, parts are demolded and put on racks for two weeks to cure completely. Parts can be used with the as-molded rough surface or can be trimmed smooth.

Another new RR tie contender is setting up a fully automated molding process. GaMra Composites Inc. in Baldwin, Wis., is the first extrusion licensee for Pushtrusion technology developed by Woodshed Technologies in Winona, Minn. Pushtrusion equipment is built and marketed by PlastiComp Inc.

Pushtrusion’s direct-compounded long-fiber thermoplastic (DLFT) process starts with continuous glass fiber and ends with extrusion of a reinforced profile. GaMra’s extruder can accommodate up to four molds, each with two cavities.

The DLFT process is followed by an automated demolding, cooling, and handling system from ForcePro LLC, a maker of multi-station molding systems (see Learn More). Its patented molds split open like standard injection molds and close with tie rods, but they lock with mechanical wedges, so that they can apply up to 600 tons of closing force with minimal hydraulic power. Unlike profile extrusion, the split molds in ForcePro’s Linx-RR system can mold patterns into ties, saving an embossing step. A hydraulic lift table comes up under the parts and ejects them onto a shelf, from which conveyors pull parts through a spray cooling bath. ForcePro says its Linx-RR production line at GaMra will produce 200,000 ties a year. Test composites should be ready in the second quarter, and the automation will be installed by the third quarter. GaMra will initially make structural profiles out of glass-filled PP and PVC for railings and window systems.

“RR ties are a logical product, but not initially,” says GaMra co-owner Gregory Mitch. GaMra is, however, buying RR tie molds from ForcePro.

ForcePro president Bryan Kirchmer says his process can reduce RR tie processing cost by 50% or more. “We expect to be able to drop the total cost of manufacture from about $50/tie down to about $38/tie,” he says, based on a 200-lb tie and material cost of 15¢/lb.

Polysum Technologies LLC in Baton Rouge, La., has a patent on a RR tie formulation using calcium sulfate (gypsum), which is claimed to impart better spike retention. The firm has produced limited test samples, but has no production facilities. It also has a patent on a marine piling containing photoluminescent crystals that glow in the dark.

Marine pilings are steady

Most makers of marine pilings are looking at RR ties. Polywood and USPL already make pilings, and Tie Tek plans to do so. Plastic Pilings Inc. in Rialto, Calif., launched its first RR and bridge ties this year. Called Envirotie, these ties contain a cage of steel reinforcing bars encapsulated with recycled PE—an approach the firm also uses to make marine pilings.

Pilings are a more established, steady-growth business. Plastic Pilings has extruded them since 1988 by encapsulating steel rebar, a welded steel cage, or steel pipe. It also has a glass-reinforced formulation.

American Eco-Board in Farmingdale, N.Y., makes marine pilings, decking, outdoor furniture, and other composites. It has also supplied ties to the Chicago Transit Authority for elevated train stations but doesn’t currently make them. Eco-Board’s pilings use recycled HDPE and LDPE film resin reinforced with long glass to encapsulate thermoset fiberglass composite rebar. Seaward, div. of Trelleborg Engineered Products, Inc. in Sweden, is the biggest maker of composite pilings and runs a piling plant 24/7 in Winchester, Va. Its piling process starts with slowly extruding square or round solid cores of unwashed recycled HDPE. Two more layers of HDPE are extruded over these cores through a crosshead die.

Seaward, based in Clearbrook, Va., is increasing output by adding a third extruder and puller that allows in-line extrusion and overcoating of the cores in a single step. The company is in the R&D stages of applying this process to flow molding of RR ties.

Related Content

Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Extrusion simulations can be useful in anticipating issues and running “what-if” scenarios to size extruders and design dies for extrusion projects. It should be used at early stages of any project to avoid trial and error and remaking tooling.

Read MorePart 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

Read MoreHow to Select the Right Cooling Stack for Sheet

First, remember there is no universal cooling-roll stack. And be sure to take into account the specific heat of the polymer you are processing.

Read MoreWhy Are There No 'Universal' Screws for All Polymers?

There’s a simple answer: Because all plastics are not the same.

Read MoreRead Next

Entrepreneur Puts Mixed-Polymer Recycling On Track to Success

Polywood Inc. in Edison, N.J., uses mixed recycled plastics to make fiber-reinforced structural profiles for railroad ties, I-beams, and decks.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More