China Reimagines Its Manufacturing Industry

Nearly 40 years ago, China’s “Open Door” policy revolutionized the country’s economy, particularly industry—Can “Made In China 2025” keep “the world’s factory” humming?

Nearly 40 years ago, China’s “Open Door” policy revolutionized the country’s economy, particularly industry—Can “Made In China 2025” keep “the world’s factory” humming?

Since liberalizing its markets in 1978 via the ‘open door’ policy of Deng Xiaoping, China’s manufacturing sector has been key to the country’s emergence as the second largest economy in the world. In recent years, however, China’s manufacturing sector has faced challenges on two fronts: lower cost countries undercutting it, particularly on labor, and higher-cost countries using high technology to nullify the “China cost.’ All the while, China’s service sector continues to grow with speculation that those jobs will hold more appeal to younger laborers than factory work.

There has been near double digit growth in wages for urban employees since 2004, according to China’s National Bureau of Statistics, with the national average annual wage reaching 56,339 yuan in 2014 (around $8600). In the manufacturing hub of Shenzhen, the average monthly pay of 2030 yuan ($310) outstrips both Shanghai (2020 yuan) and Beijing (1720 yuan). As the China Labour Bulletin stated:

Wages for Chinese factory workers are now significantly higher than for factory workers in Bangladesh, Vietnam and Cambodia. This has led to many low-cost labor-intensive industries such as garments, toy and shoe manufacturing to transfer some production to these cheaper locations.

The impact of rising wages, and other negative forces on manufacturing, was felt acutely throughout 2015. The Caixin Manufacturing Purchasing Managers’ Index, which measures the performance of the manufacturing sector and is derived from a survey of 430 industrial companies, marked 10 straight months of contraction last December.

The Government Steps In

Appreciating the importance of manufacturing to the country’s economy, China’s government has worked in recent years to develop a blueprint for a new manufacturing sector in the country, most recently revealed last March as Made in China 2025. Per Chinese Premier Li Keqiang:

“We will implement the Made in China 2025 strategy, and seek innovation-driven development, apply smart technologies, strengthen foundations, pursue green development and redouble our efforts to upgrade China from a manufacturer of quantity to one of quality.”

Specifically, the plan includes a stated goal of raising domestic content of core components and materials to 40% by 2020 and 70% by 2025. In addition, it calls for the creation of manufacturing innovation centers—15 by 2020 and 40 by 2025—and it seeks to strengthen intellectual property rights protection for small and medium-sized enterprises (SMEs).

When announced, the plan identified 10 “priority sectors”, several of which touch on plastics.

- New advanced information technology

- Automated machine tools & robotics

- Aerospace and aeronautical equipment

- Maritime equipment and high-tech shipping

- Modern rail transport equipment

- New-energy vehicles and equipment

- Power equipment

- Agricultural equipment

- New materials

- Biopharma and advanced medical products

Made in China 2025 augments and replaces a 15-year plan issued in 2006 which called for “indigenous innovation” and identified seven “strategic emerging industries” (SEI). Under this plan, SEI-related industries were to account for 8% of the economy by 2015 and 15% by 2020.

The State Council issued the “Made in China 2025” plan on May 19, 2015, replacing the SEI plan and formally identifying “nine tasks” as priorities to making the proposal a reality:

- Improving manufacturing innovation

- Integrating technology and industry

- Strengthening the industrial base

- Fostering Chinese brands

- Enforcing green manufacturing

- Promoting breakthroughs in 10 key sectors

- Advancing restructuring of the manufacturing sector

- Promoting service-oriented manufacturing and manufacturing-related service industries

- Internationalizing manufacturing

Scott Kennedy of the Center for Strategic and International Studies (CSIS) in Washington, D.C. noted that despite the initiative’s name, Made In China 2025 holds opportunities for non-Chinese multinational companies (MNC) as well.

“First, there will be greater investment and attention to the 10 industries, and MNCs that align themselves with these sectors and the general goals of this plan can benefit from its focus…It’s a guarantee that MNCs will be needed to provide critical components, technology, and management for this plan is to work.”

KraussMaffei, Chinaplas and Made in China 2025

Twice in the same week I came across references to Made in China 2025. The first, in my colleague Matt Naitove’s article on the acquisition of German plastics machinery giant, KraussMaffei by state-owned Chinese chemical company, ChemChina. In a release for that move, Jianxin Ren, Chairman of ChemChina, is quoted as saying:

We are investing in [KraussMaffei’s] strong management team and its technological expertise, which we believe will benefit our Chinese subsidiaries and position the chemical machinery business of ChemChina, which build and sell equipment for the rubber and chemical industry, to become a pioneer in achieving the “Made in China 2025” program which aims to enhance Chinese industry.

The next instance came in a release from Adsale, the organizer of the Chinaplas show, which celebrates its 30th anniversary this year in Shanghai. In this instance, the release acknowledged initiatives of other manufacturing leaders, including Germany’s Industrie 4.0 push, painting China’s plans in the same light.

The world’s leading manufacturing countries have launched national strategic plans to meet the challenges in the new era and to strengthen their industrial competitiveness…China also launched the Made in China 2025 strategic plan recently to boost its industrial growth, with the aim to comprehensively upgrade Chinese manufacturing industries.

Whether or not you believe in a government’s ability to centrally plan for progress, it is clear that manufacturing, and therefore plastics, are very much a part of China’s plans going forward, to 2025 and beyond.

Related Content

Processing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

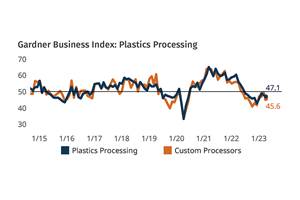

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

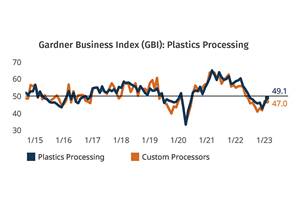

Read MorePlastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

Read MorePlastics Index Shows Supply Chain Improvement Despite Production Slowdown

Future expectations reach 2024 high on the heels of the recent election.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More