2013 was good for N.A. equipment suppliers; Can 2014 Overcome a Slow Start?

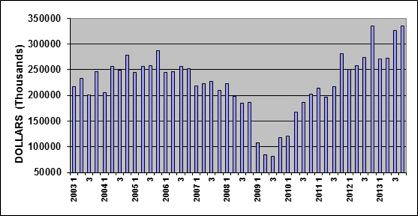

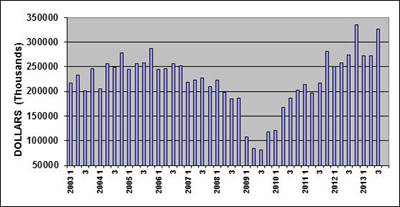

The North American plastics equipment market saved its best for last in 2013, delivering shipments valued at $335.1 million in the fourth quarter—the best three-month stretch of the year and up 3% from the previous quarter. Will that momentum hold in 2014, however?

The total value for primary plastics equipment shipments rose 8% for all of 2013 compared to 2012, according to SPI: The Plastics Industry Trade Association’s Committee on Equipment Statistics (CES), marking the third straight year of growth for the market.

Equipment suppliers polled by Plastics Technology confirmed solid growth in 2013, but several noted that 2014 has struggled out of the gate.

Some green shoots

Dave Skala, VP and GM of Uniloy Milacron, the blow molding machinery unit of machinery and mold component supplier Milacron, looked back and then forward. A strong finish to 2011 had carried over into 2012, and while 2013 started quickly, it slowed in the second half, and that sluggishness carried over into the first two months of 2014.

As winter gave way to Spring, however, some proverbial green shoots appeared.

“As of late, activity has significantly increased,” Skala noted, adding that he anticipates 2014 finishing at 2012-2013 levels with respect to bookings. Skala said the first quarter of 2014 is trending up more 10% vs. the same quarter last year for the blowmolding segment, with Uniloy enjoying a similar bump. “We expect March to be the strongest month of the first quarter,” Skala said. “If industry’s March 2014 is as strong as March 2013, this year will be exciting.”

Dave Preusse, president of the North American, Torrington, Conn. based arm of injection molding machine, auxiliary, and automation supplier, Wittmann Battenfeld, said 2013 marked the third straight year of 25% growth for the Austria-headquartered company.

The strong results were fueled by a sizable 2012 backlog to start the year; several large “multi-line projects”, where the company delivered machines, robots, and auxiliaries; and strong automotive demand.

2014, however, has gotten off to a relatively tepid start in Torrington.

“Honestly, 2014 has started slower for us, and in the SPI data,” Preusse said, describing business as moving at “a nice steady pace” versus the “fireworks we had hoped for.”

“Current quote levels are very high, and those last corporate signatures will be obtained on projects promised in Q1,” Preusse said, “so maybe Q2 has greater promise for us."

Last year was a record one for automation supplier Sepro Group, selling 1700 robots and sprue pickers globally, pushing sales 31% higher than 2012. North American sales were up 34%, as the region became Sepro’s top market globally.

In 2014, it is ‘so far so good,’ according to Jim Healy, Sepro’s VP sales & marketing. “The first quarter of 2014 was just about on par with Q1 2013, which was quite a strong quarter,” Healy said. “Early indications for April are positive with the sales pace continuing steady.”

Overall, Healy said Sepro expects 2014 to be more or less comparable to 2013. “Since 2013 was as strong as it was,” Healy said, “we’re not expecting major growth year-over-year but we’re not expecting any significant decrease either.”

Last year was a "record or near-record" one for auxiliary equipment supplier Conair, according to company president, Larry Doyle, thanks to improved conditions in the U.S. and growing global market share.

Looking forward to 2014, Doyle said the company will continue to see strong activity in the North American market, and abroad. In particular, the company is targeting Brazil, as it weighs establishing sales, service, and manufacturing operations there. "It's not really a question of 'if' we will expand there," Doyle said, "but rather 'how' we will expand. We fully expect Brazil will become a major market for Conair over the next decade."

In the same vein, Conair is looking to expand its Chinese operations, using the location to manufacture more products for the Asian market. In 2014, the company will begin making its ResinWorks drying systems and blenders in China for Chinese customers, with that product line joing small dryers, drying hoppers, feeders, conveying pumps and dust collectors.

John Effmann, director of sales and marketing at Lebanon, Ore.-based ENTEK Manufacturing Inc., echoed the sentiment of a good 2013 giving way to a ‘meh’ 2014. Effmann said Entek, which is a supplier of co-rotating twin screw extruder systems used in compounding color and masterbatch formulations, as well as food products, decking materials, medical applications, and battery separator films, had some large projects from 2013 that have carried over into 2014, with activity in bioplastics as well as traditional compounding systems for the automotive market.

“So far, 2014 has started off a little slowly,” Effmann said, “We were a little surprised; maybe some of that has been due to the weather. At this time, the numbers I see on a monthly basis are not something to write home about.”

Reporting companies sip a half-full glass

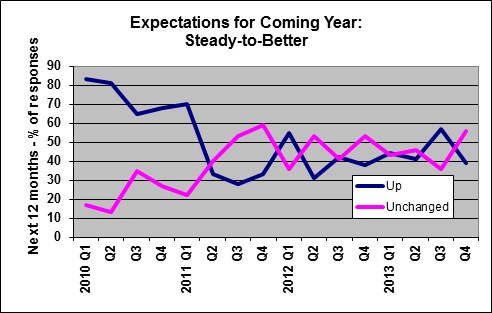

In an associated survey taken with the report, participants asked about expectations for future market conditions were optimistic. Fully 87% of respondents expected conditions to stay the same or even improve in the coming quarter, and 95% expected them to hold steady or get better during the next 12 months.

Highlights

Injection molding: The shipment value of injection molding machinery decreased 5% in the fourth quarter of 2013 when compared to the unusually large total from the year-prior period.

Extrusion, blowmolding, thermoforming: The shipment value of single-screw extruders slipped 2%, according to SPI, but the value of twin-screw extruders shipments spiked 72%, while blowmolding machine shipments jumped 91% in the fourth quarter. The shipment total for thermoforming equipment fell 34% in the final quarter of 2013 when compared with year-prior output.

Auxiliary equipment: Robotics, temperature control, materials handling, etc., saw new bookings for reporting companies total $101.3 million in the fourth quarter, essentially flat from the previous quarter. Year-prior stats were not available as the reporting structure has changed.

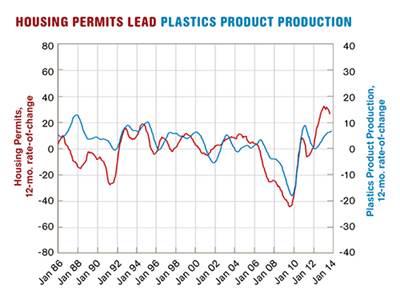

Other indicators: The Bureau of Economic Analysis reported that business investment in industrial equipment rose by 3% on a seasonally-adjusted annualized rate in the fourth quarter of 2013 compared to the fourth quarter of 2012. The Census Bureau reported that the total value of shipments of industrial machinery jumped 25% in the fourth quarter.

In January 2014, Plastics Technology publisher Gardner Business Media, reported that its capital equipment research indicated 2014 would be a strong one for plastics machinery purchases. The report projected investments of aourn $3.3 billion in primary machinery, auxiliaries, and molds—10% higher than the 2013 forecast.

Related Content

In Sustainable Packaging, the Word is ‘Monomaterial’

In both flexible and rigid packaging, the trend is to replace multimaterial laminates, coextrusions and “composites” with single-material structures, usually based on PE or PP. Nonpackaging applications are following suit.

Read MoreMedical Molder, Moldmaker Embraces Continuous Improvement

True to the adjective in its name, Dynamic Group has been characterized by constant change, activity and progress over its nearly five decades as a medical molder and moldmaker.

Read MoreFoam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

Read MoreHow to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

Read MoreRead Next

Double-digit gains for North American plastics equipment

Shipment of plastics equipment in the third quarter of 2013 jumped 20%, according to SPI data, reflecting gains seen the world over.

Read MoreMore Growth & Equipment Investment For Processors This Year

Gardner’s research projects that processors will invest around $3.3 billion in primary machinery, auxiliary equipment, and molds and related supplies this year, about 10% more than its projection for 2013.

Read More