Packaging Outpaces Overall Economy

Wood on Plastics

Global market demand for processors of plastics packaging will grow at a rate of 4% to 5% in 2013 and beyond. Emerging markets and developing countries will experience the fastest growth, but gains in the developed countries will also be solid.

The total value of the global packaging industry will approach $1 trillion by the end of this decade, and the bulk of the growth will be in plastics. Global market demand for processors of plastics packaging will grow at a rate of 4% to 5% in 2013 and beyond. Emerging markets and developing countries will experience the fastest growth, but gains in the developed countries will also be solid.

Growth will be broad based, benefitting almost all types of plastics packaging. It will benefit processors regardless of whether their market reach is regional, national, or global. But there will be some variance in growth rates, depending on market maturity.

The largest markets for packaging products in the near term will continue to be North America and Europe. These markets are characterized by a large number of middle-class consumers and an aging population. And despite their sluggish economies, these markets will still experience rising demand for packaging products that are lightweight and sustainable.

Consumers in these markets are becoming increasingly aware of the connections between fossil-fuel consumption, greenhouse-gas emissions, recycling, and their consumption of plastics packaging. Many of the big-box retailers in these countries continue to build major marketing initiatives around the concept of sustainability. This will not only continue, but will increase in the coming years.

Issues with plastics de-selection (such as bag bans) will persist, but thanks to rapidly improving technologies and heightened environmental awareness, the overall consumption of the ever-improving array of plastics packaging products will steadily expand.

Emerging countries such as China, India, Brazil, and the nations of Eastern Europe are in the early stages of developing a middle class. A middle class means that large numbers of households have disposable income, and this spurs consumer demand. If any of these countries are able to achieve a sustained expansion in the ranks of their middle-class households, then their appetites for plastics packaging could expand quickly.

The rest of the world comprises poorer nations, and plastics packaging is playing an increasingly important role in these countries also. Food safety, food quality, and basic medical care are highest priorities in these markets. Consumers in these countries must deal with many problems such as a shortage of clean water, inadequate refrigeration, and poor distribution infrastructure.

Fortunately, many of these issues can be improved, perhaps even eradicated, with plastics. For instance, suppliers have developed blow molded containers for milk that can be filled hot and then sealed, thus eliminating the need for refrigeration.

WHAT THIS MEANS TO YOU

•Packaging made from biobased or compostable resin will continue to emerge. This segment will still be relatively small two years from now, but it could be dominant in 10 years.

•Development of the natural-gas industry in North America will rapidly become a huge factor in the plastics packaging sector because it will provide basic feedstocks for plastics at lower cost than if they were based on oil. It will also increase the relative cost advantage of North American packaging processors vs. their counterparts in Europe and Asia, where feedstocks are more oil-based.

•Improvements in consumer recycling patterns are still agonizingly slow to develop. The gap between the availability of post-consumer recycled material and the demand for products made of recycled material will get worse before it gets better.

Related Content

Processing Megatrends Drive New Product Developments at NPE2024

It’s all about sustainability and the circular economy, and it will be on display in Orlando across all the major processes. But there will be plenty to see in automation, AI and machine learning as well.

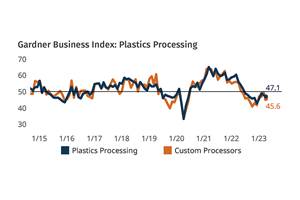

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MoreProcessing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More