Commodity Resin Prices Drop

Downward trajectory resumes for all four commodity resins.

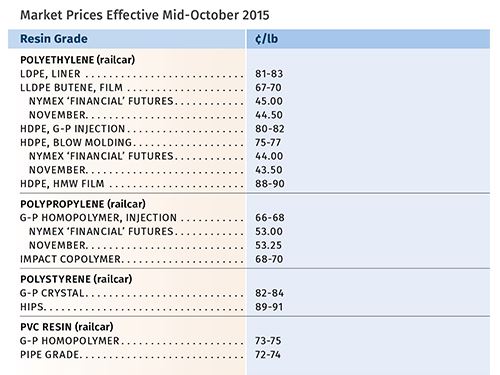

Prices for all four major commodity resins dropped again in September, though in significantly different amounts. A flat to downward trend was projected for the next two months, owing to falling global feedstock and energy prices in the third quarter. But keep an eye on polypropylene, which may prove an exception. These are among the views of purchasing consultants at Resin Technology, Inc., (RTi) of Fort Worth, Texas, and CEO Michael Greenberg of Chicago-based The Plastics Exchange.

PE PRICES DROP

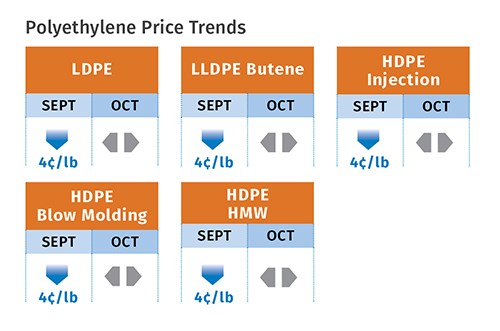

Driven by falling oil prices, polyethylene tabs slipped 4¢/lb lower in September, after a 5¢ decrease in August. Once oil prices began to steady, PE prices firmed up globally. At the same time, PE suppliers announced increases of 5¢/lb, with original effective dates moved from Oct. 1 to this month. Neither Mike Burns, RTi’s v.p. of client services for PE, nor Greenberg of The Plastics Exchange thought any of that proposed hike would stick.

Burns did forecast that domestic prices in October would firm up, but hold level through the rest of the year. He pointed out out that for the first time in a quite a while, the domestic PE market appears to be optimally positioned. “Polyethylene prices are not going to move upwards unless oil prices approach $60 a barrel, and early projections for 2016 are of prices in the $50 range.” He added that the domestic PE price advantage has resulted in major brands and retailers buying domestically, that exports have largely stayed at a healthy 20%, and there have been no finished-goods imports. Meanwhile, Greenberg reported in late September that “the surge of export supply has backed up a number of Houston warehouses causing packaging and shipping delays.”

PP PRICES FLAT TO DOWN

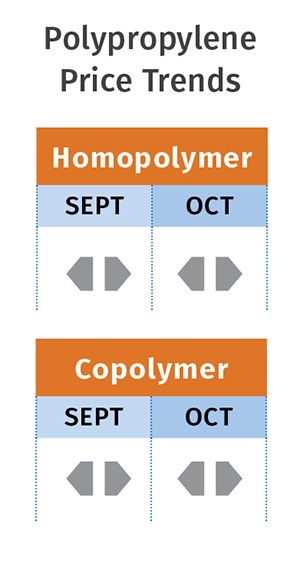

Polypropylene prices were flat or a penny lower in September, depending on when processors incurred suppliers’ margin expansions. While September propylene monomer contract prices dropped 3¢/lb, PP suppliers held onto their 3¢/lb margin expansion for that month.

Greenberg pointed out that the lower September propylene contract price was the seventh consecutive decrease and the 10th in 11 months. October propylene contract prices were expected to be unchanged. Meanwhile, PP prices this year dropped by about 18¢/lb through the third quarter. During that same time, domestic demand rose almost 6% over last year, while PP suppliers succeeded in implementing a margin expansion of 3-14¢/lb, says Scott Newell, RTi’s director of client services for PP. Suppliers were aiming for another margin expansion last month, averaging 5¢/lb, taking advantage of a tight supply/demand balance.

Global polymer-grade propylene (PGP) monomer prices began to drop late in the third quarter. "We no longer have the PGP advangtage," said Newell. "Plus, more margin expansion is getting implemented into the domestic PP price. Slowly, over the last few months, the domestic PP price has lost its competitiveness globally.” He said two things can result from such a scenario, if it continues: Either the domestic market will start to import more PP pellets, or it will start to import more finished goods. “Either one creates demand destruction for PP suppliers, and the import of finished goods creates demand destruction for domestic processors.”

Said Greenberg in late September, “U.S. PP exports are not competitive in the international arena. In fact, there is a good amount of imported PP currently on the coasts with more on the way.”

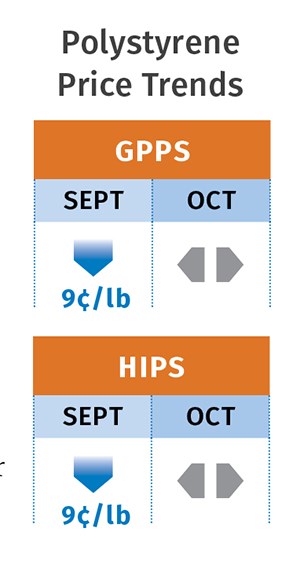

PS PRICES DROP

Polystyrene prices dropped 9¢/lb in September following that month’s benzene contracts settling 79¢/gal lower. PS prices had already fallen 2-3¢/lb in August, helped along by July/August ethylene contract prices dropping to 29.5¢/lb, the lowest level since 2008, as well as price competition among PS resin suppliers, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

October PS prices were expected to be flat. Kallman noted that October benzene contract prices saw a modest increase of 10¢/gal, while September ethylene contracts were expected to settle another penny lower.

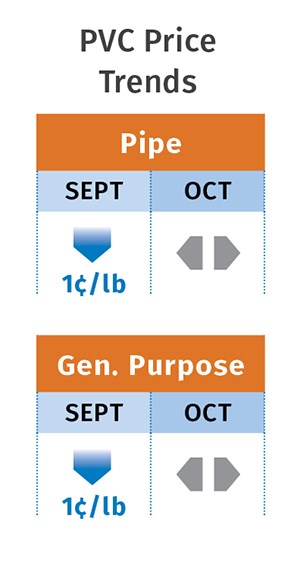

PVC PRICES DOWN

prices dropped by another 1¢/lb in September, as ethylene contract prices were expected to fall by a similar amount. Prices in October were expected to be mostly flat, according to RTi’s Kallman.

Export demand has been low, while domestic demand through August was level with that of 2014, despite higher expectations for this year’s building and construction sector. Kallman expected demand to “tail-off” by year’s end. But the potential looms for some supply/demand tightness as a series of PVC plant maintenance turnarounds were planned for September through November.

Related Content

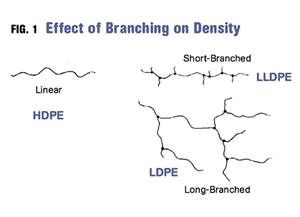

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreDensity & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More

(2).jpg;maxWidth=300;quality=90)