PP, PS Prices Drop; Others Soften

Polypropylene prices have dropped significantly and may have hit bottom, while PE prices flattened out and face downward pressure from increased supplier inventories, lower feedstock prices, and soft demand.

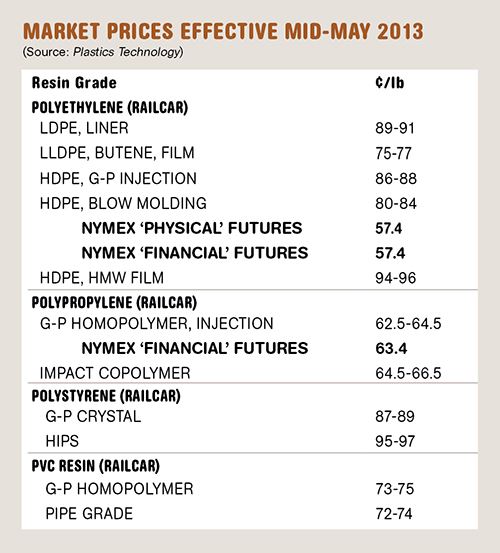

Polypropylene prices have dropped significantly and may have hit bottom, while PE prices flattened out and face downward pressure from increased supplier inventories, lower feedstock prices, and soft demand. Polystyrene prices slumped, although suppliers are aiming to recoup some of the loss. And PVC prices are likely to ease up starting this month. These are the observations of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of Chicago-based The Plastics Exchange.

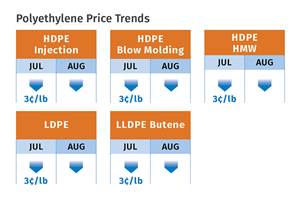

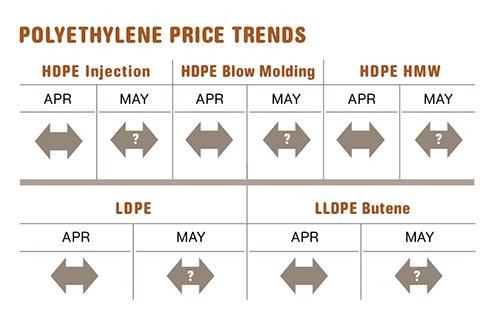

PE PRICES FLAT TO DOWN

Polyethylene contract prices were flat through April, as suppliers postponed a 4¢/lb price hike that seemed no more likely to take effect in May. Industry sources see PE prices as having peaked and are likely to shed some of the 9¢/lb increase during the first quarter. “Growing inventories at suppliers, softer demand and an easing of feedstock prices are key contributors to the flat-to-downward pricing pressure,” said Mike Burns, v.p. for PE at RTi. He pointed out that low supplier inventories at the beginning of the year played a big role in pushing prices up, but those inventories in early May were at what has become an average level nowadays.

Burns anticipated prices remaining flat through May and into June, despite downward pricing pressure. Greenberg from The Plastics Exchange noted that spot ethylene monomer prices for April/May were down about 15¢ to around 57¢/lb. He also reported spot PE prices sliding by 0.5¢/lb in early May, and he noted that material availability was good but that most traders and processors were holding off buying in expectation of lower prices.

For June and July, both Greenberg and Burns expect PE prices could drop in response to weaker ethylene prices, improved resin supply, and potential supplier actions to reduce inventories by pricing material more attractively for exports.

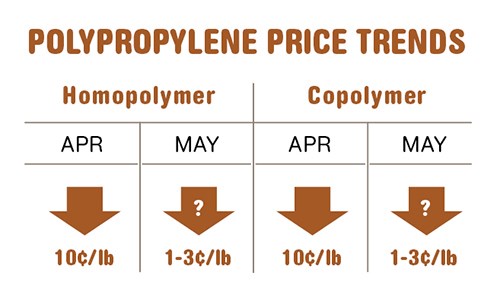

PP MAY HAVE HIT BOTTOM

Polypropylene prices dropped 10¢/lb in April, in step with propylene monomer tabs. Combined with PP’s 6¢ drop in March, this left intact only 5¢ of the 21¢/lb of increases implemented in the first two months of the year.

Monomer nominations for May were 1¢ to 3¢ lower than the 63¢/lb April contract price, and PP prices were expected to follow. According to Scott Newell, RTi’s director of client services for PP, there were earlier nominations of a 4-6¢ price drop for propylene monomer, but planned and unplanned outages and a rising hedging interest in the market have propped up monomer prices a bit.

Greenberg reported in early May, that spot PP trading was active, with generic prime resin prices down 0.5¢/lb, while spot offgrade prices firmed up a bit. He noted that PP processors had drawn down their inventories and were returning to the market—both contract and spot—to restock.

RTI’s Newell said he expected a sizeable upswing in demand from May to July. “Not only do people need to restock their inventories, but they are also likely to prebuy as PP prices hit bottom,” he said. Newell noted that PP demand was off 10% in the first quarter compared with 2012, largely as a result of PP price volatility. He expects this full year to be down, as well, but possibly only by 5%.

PS PRICES DOWN

Polystyrene prices dropped 3¢/lb in April, wiping out the penny that was left from the January hike. Some suppliers issued a 4¢ increase for May 1, while at least one came in with a split of 2¢ for May and 2¢ for June.

After the significant drop in benzene prices in March, they moved up in April by 11¢/gal, which is not enough to justify even a 2¢/lb PS increase, according to Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC. He ventures that PS suppliers might be able to push through a 1-2¢/lb price hike, based on their claims that recent Ohio river flooding made it difficult to bring benzene to their plants. However, Kallman does not see much chance of another 2¢ increase going through, as ethylene prices are easing up and benzene prices are generally expected to trend downward. While seasonal demand for PS is up, it’s not sufficient enough to warrant a price increase, he said.

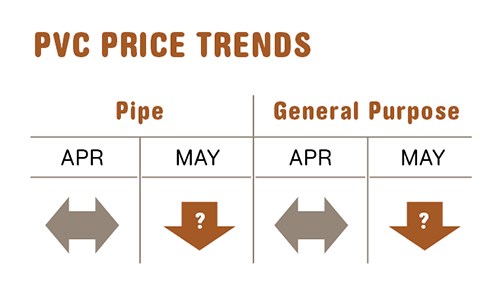

PVC PRICES FLAT TO DOWN

PVC prices were flat through April, after moving up 5¢/lb in March. Downward pressure was building for May and June, despite some suppliers’ hopes to put through another hike.

Contributing factors include lower ethylene monomer prices and lower export resin prices after suppliers slashed export tabs to move product. PVC exports have been at least 18% lower this year. Domestic processors are pressuring suppliers for lower resin prices in view of the significant differential that has emerged between export and domestic PVC pricing.

Says RTi’s Kallman, “Expect PVC resin prices to ease up due to lower feedstock prices and exports.” Kallman further notes that if oil prices remain high, domestic PVC producers will reap the benefit of their ethylene cost advantage (based on natural gas rather than oil), setting the stage for a potential rebound in the PVC export market.

Related Content

Prices of All Five Commodity Resins Drop

Factors include slowed demand, more than ample supplier inventories, and lower feedstock costs.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRecycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

(2).jpg;maxWidth=300;quality=90)