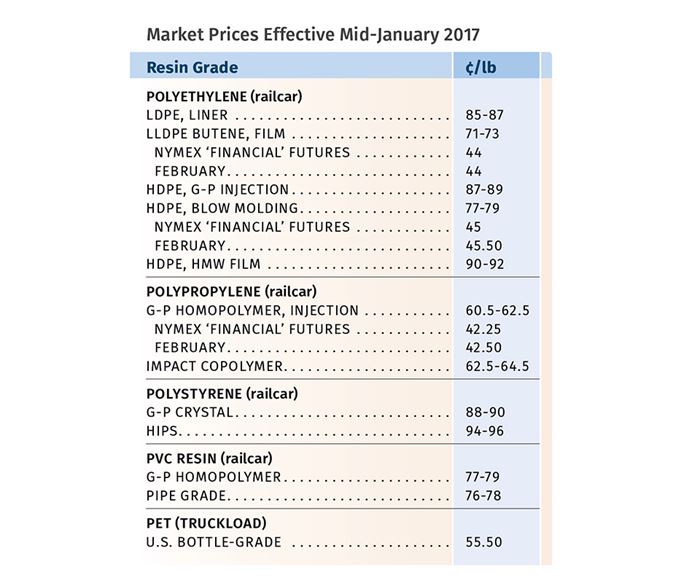

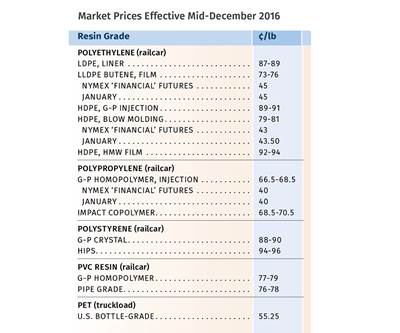

Prices Bottom Out for Polyolefins; PET, PS, PVC Move Up

Flat or falling prices have turned upward for all five commodity resins.

Globally rising feedstock costs and, in some cases, favorable resin export opportunities for domestic suppliers, along with better managed production output, spikes in domestic demand, and planned maintenance outages are reversing 2016’s flat-to-down- ward resin pricing trajectory. This appears to be true for PP in the longer run, as well as for the near-term prospects for PE, PS, PVC, and PET.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas, CEO Michael Greenberg of Plastics Exchange, The, and Houston-based PetroChemWire, noted, “It could add a little fuel to the fire before a glut of resin from planned production expansion hits the market in spurts throughout 2017.” Burns points out that, unlike PP (see below), PE production output has not been curtailed nor is it likely to be.

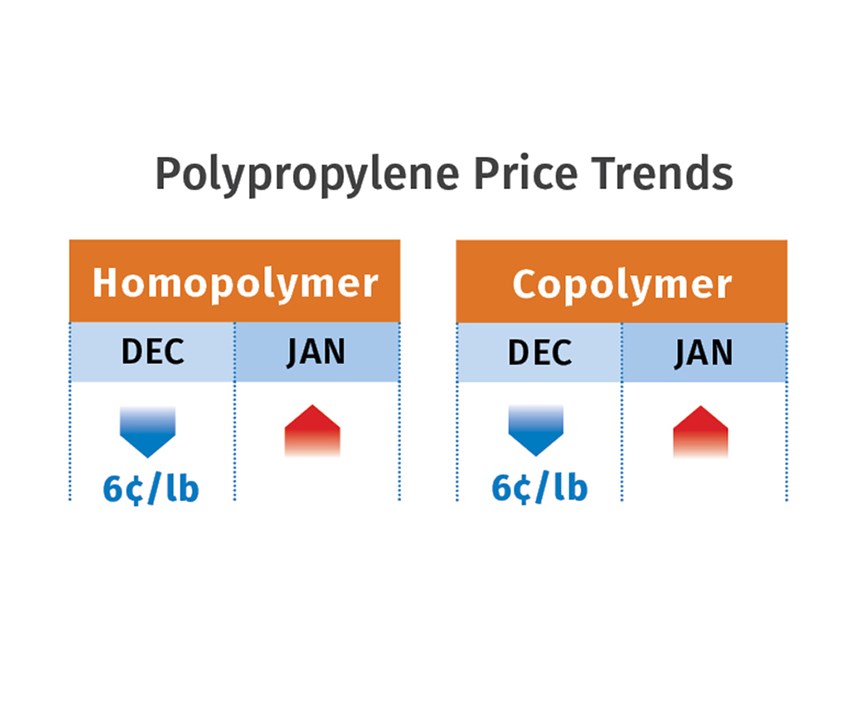

PP PRICES REACH BOTTOM

Polypropylene prices generally dropped 6¢/lb in December—4¢ in step with propylene monomer which dropped to 31.5¢, and 2¢ shed from suppliers’ margins. The latest drop followed the November 8¢ decrease, bringing PP prices to a very competitive low. However, those prices may have bottomed out, leading to good probability of an increase within this first quarter, according to Scott Newell, RTi’s v.p. of PP markets. As 2017 rolled in, PP suppliers clearly took steps to balance the market in their favor, while reducing prices to levels that made

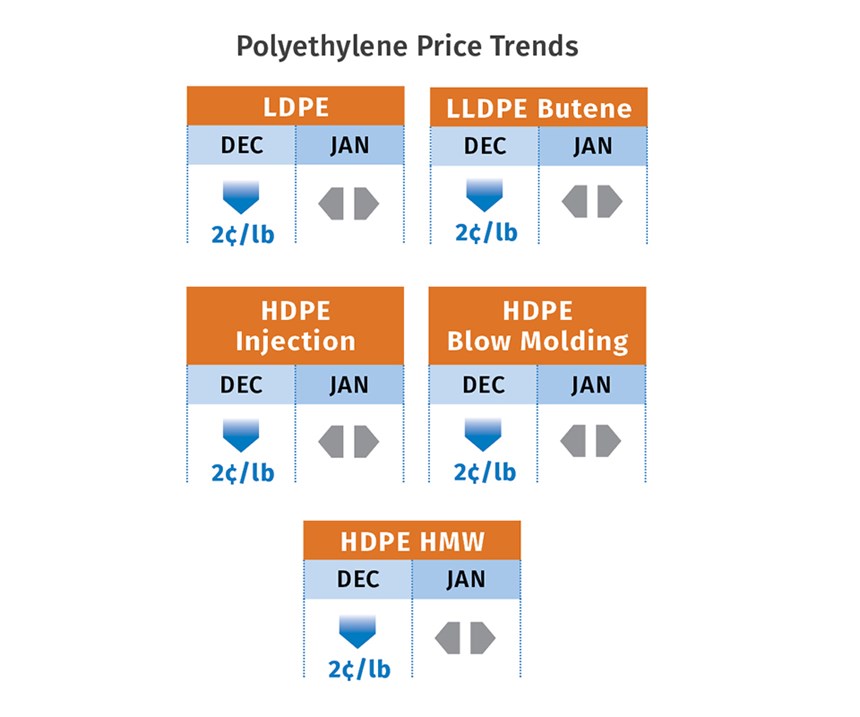

PE PRICES BOTTOM OUT

Polyethylene prices dropped 2¢/lb in late December, following November’s 3¢ drop, but all indications were that they had reached bottom. In fact, suppliers came out with a 5¢/lb increase for this month, though it may not be implemented on schedule. The move is viewed by Mike Burns, RTi’s v.p. of client services for PE, as common practice among suppliers who are looking to shortstop any further decline and as a hedge against uncertainty caused by factors such as crude-oil prices, export opportunities (particularly to China), and unplanned production disruptions in the winter months.

One thing is fairly certain: If oil prices remain at current levels above $50/bbl, there will be upward pressure on global PE prices. The Plastics Exchange’s Greenberg reported at year’s end that PE spot prices had firmed up across the board, with limited availability of generic prime resin. Similarly, PetroChemWire (PCW) reported that December saw slowed domestic prime market sales and limited spot availability, as surplus inventory was targeted for export. Commenting on the February 5¢ increase, Greenberg

it difficult for PP imports to compete. Suppliers sought to address the domestic supply glut in the fourth quarter by drastically throttling back production to lows of 80.6% capacity utilization, taking 100 million lb of PP capacity out of the market in one month, according to Newell. “Polypropylene prices will follow the monomer, for which there is upward pressure, partly from the rallying of oil prices,” he said. “It is unlikely that suppliers will part with any more of their margins as they did in the fourth quarter.”

Newell sees suppliers as having positioned themselves for what could turn out to be a good demand year for domestic PP—one resembling 2015 more than 2016.

Newell, Greenberg, and PCW indicated that this projected upward trend was already seen in secondary markets, with less material availability and spot prices rising—no longer with a 10¢/lb discount from contract prices. “Spot PP prices continued to recover into year-end as fresh railcars were virtu- ally non-existent. Special year-end deals were not as plentiful as in years past,” reported Greenberg as January loomed. These sources concede that if suppliers continue curtailing production and selling well offshore, new margin-expanding increases could be in the offing.

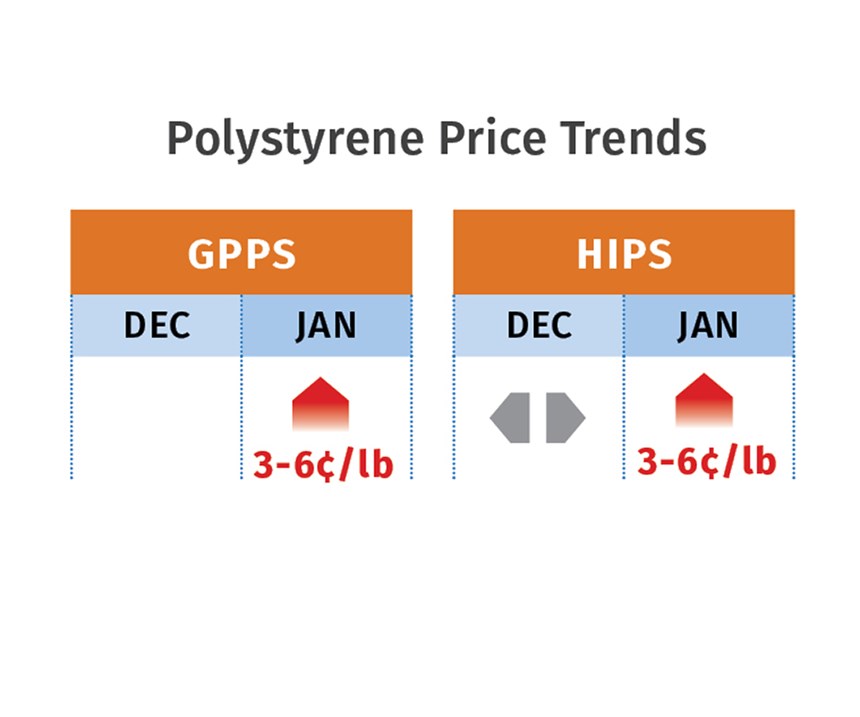

PS PRICES UP

Polystyrene prices were flat in December, but a change was underway. Late that month, PCW reported on 6¢/lb increases for all PS grades announced by two suppliers, effective January 1. By the first week of last month, a third supplier took similar action, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

While Kallman expected PS prices to move up last month, he ventured that actual implementation could be as low as 3¢/lb. His reasoning: January benzene contracts settled upward from December’s $2.35/gal, but unevenly, with some suppliers adding 32¢ and others 40¢ to previous tabs, which translates into around 3-4¢/lb additional PS production cost. Still, he noted that this is a slow season for PS demand in key markets like recreation and construction, which can help offset some of that nominal increase. On the other hand, factors in suppliers’ favor include a tightly balanced styrene monomer market and rising feedstock costs across the globe.

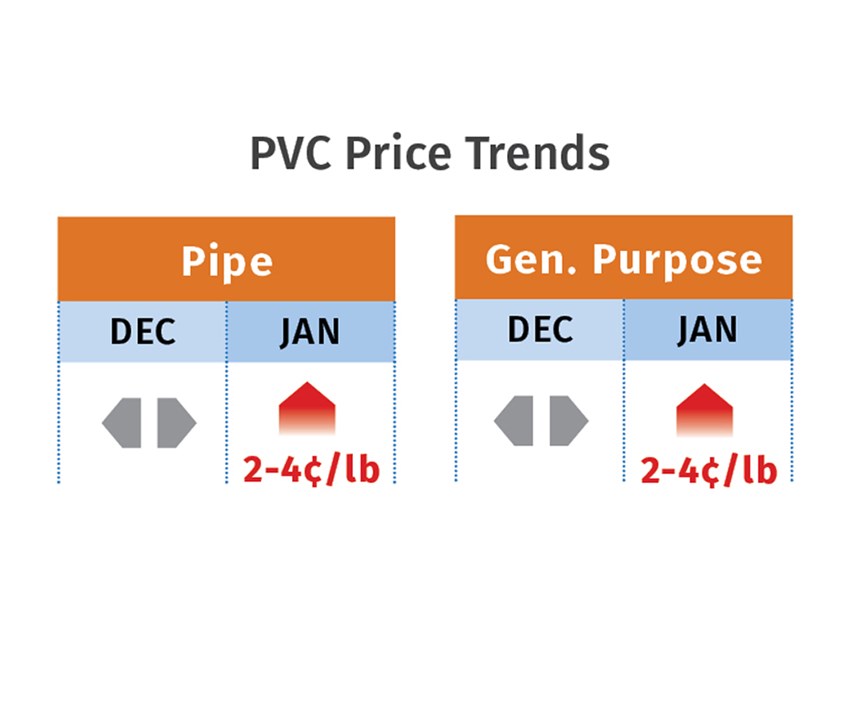

PVC PRICES ON THE WAY UP

PVC prices were flat in December, as they were for eight of the 12 months of 2016. Despite slow seasonal demand, PVC suppliers issued increases of 4¢/lb for February 1. How much gets implemented and when was to be deter- mined to some degree by the December ethylene contract price, which was still unsettled in the early part of last month. A key indication that ethylene contracts would settle higher was that spot ethylene prices had been trading upward through the last part of December and into January, according RTI’s Kallman. He ventured that the PVC increase would end up within the 2-4¢/lb range.

While Kallman characterized domestic supply/demand as balanced, he noted that there are some PVC plant maintenance turnarounds planned in the first quarter both domestically and in Asia, which could serve to create export opportunities for domestic suppliers.

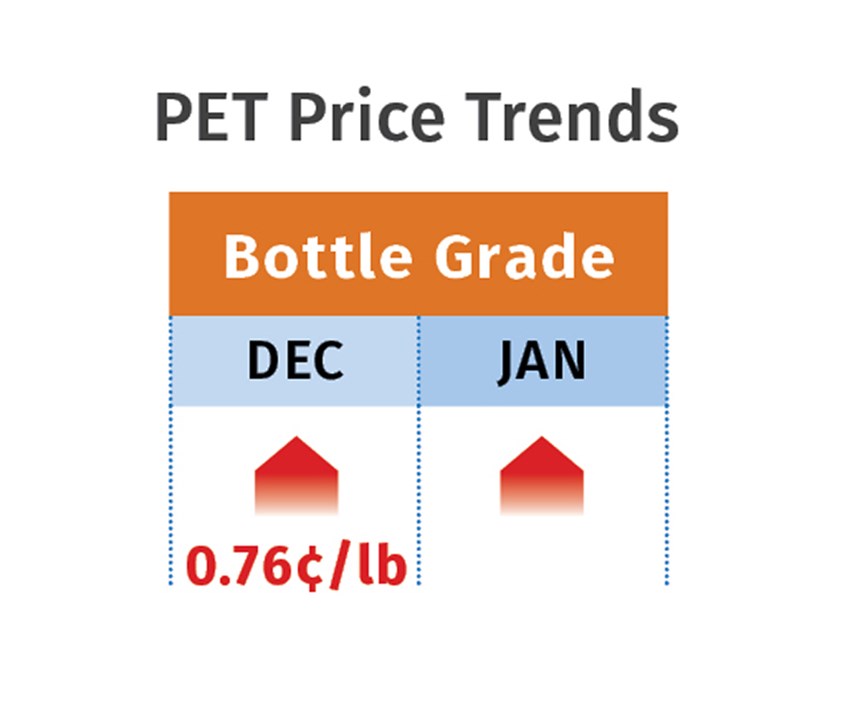

PET PRICES UP

Domestic bottle-grade PET prime resin prices in December averaged 55.2¢/lb, up 0.76¢ from November, based on PCW’s Daily PET Report. (That price represents a delivered Chicago basis.) On January 6, the price moved up to 55.5¢/lb as a result of strong domestic demand, according to Xavier Cronin, senior editor for this PCW report. Meanwhile, DAK Americas, with production facilities in the U.S., Canada, Mexico, and Argentina, issued a 5¢/lb increase on its prime PET resins, effective January 1.

Imported prime PET averaged 50.5¢/lb in December, the same as in November. (This represents a delivered, duty-paid U.S. port basis.) These imports were up 10.7% through October 2016 vs. 2015. In October, imports came from 31 countries.

M&G Chemicals’ 2.4-billion lb/yr PET plant under construction in Corpus Christi, Texas, is on schedule for startup at the end of next month. According to PCW’s Cronin, an M&G spokesman confirmed last month that the company will use all PTA produced at the giant plant (about 2.86 billion lb/yr) internally to produce its PET.

Ed. note: Read the latest on recycled PET prices.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreLanxess and DSM Engineering Materials Venture Launched as ‘Envalior’

This new global engineering materials contender combines Lanxess’ high-performance materials business with DSM’s engineering materials business.

Read MorePart 3: The World of Molding Thermosets

Thermosets were the prevalent material in the early history of plastics, but were soon overtaken by thermoplastics in injection molding applications.

Read MoreRead Next

Prices Drop for Polyolefins, Others Mixed

Prices of PS, PVC, PC & nylon 66 were flat, despite upward push for PET, ABS, nylon 6.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More