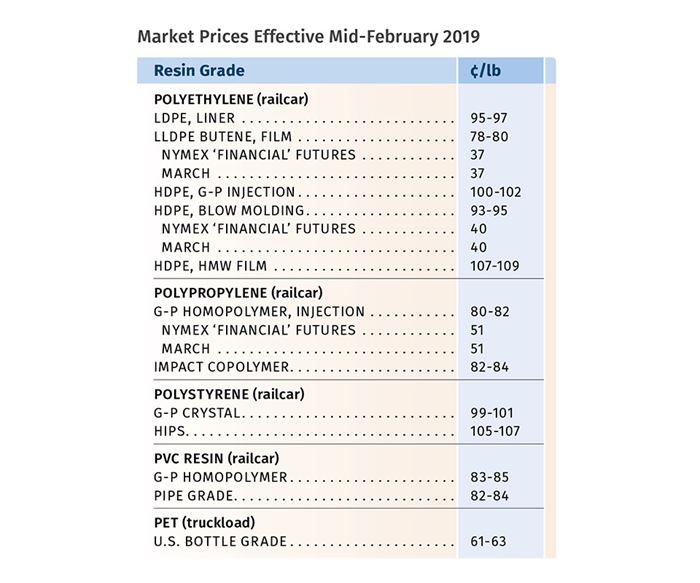

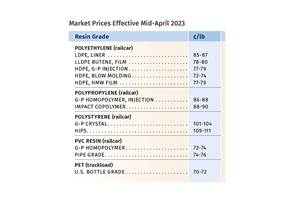

Commodity Resin Prices Bottom Out

Flat-to-upward pricing trajectory predicted for the five highest-volume commodity resins.

Higher global crude-oil prices, firming prices of key feedstocks, higher export volumes in some cases, and a rebound in demand in some other cases, are key drivers in projections for flat to at least slightly higher prices ahead for PE, PP, PS, PVC, and PET.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW), and CEO Michael Greenberg of The Plastics Exchange.

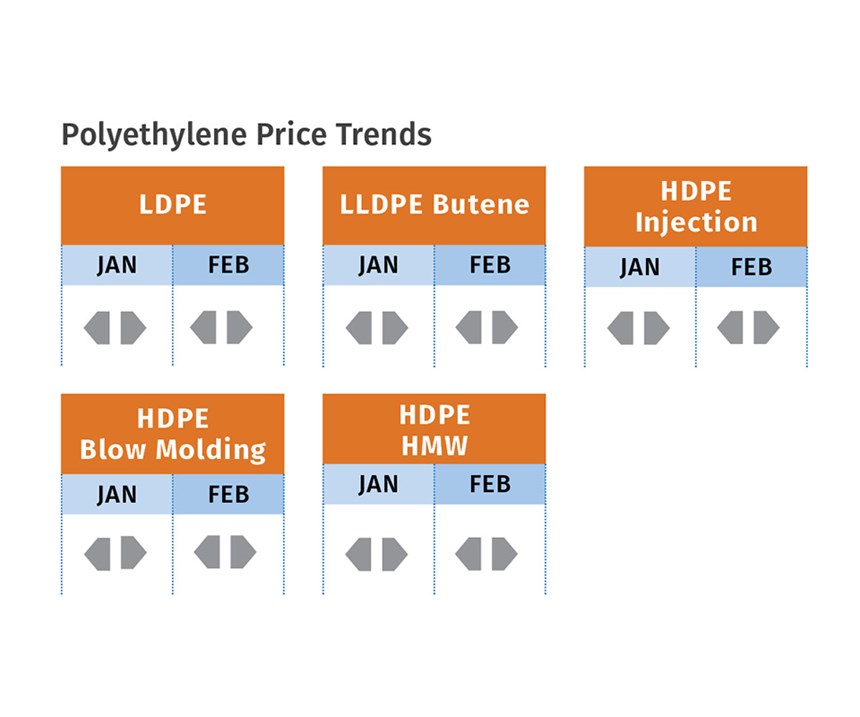

PE PRICES FLAT

Polyethylene prices rolled over in January, with no sign of the announced industrywide 6¢/lb increases. Suppliers delayed the increase, generally splitting it in half—3¢ in February, 3¢ in March. Both Mike Burns, RTi’s v.p. of PE markets, and PCW senior editor David Barry thought there was a pretty slim chance that suppliers would get even a 3¢/lb hike.

Noted Burns, “This would be a totally supplier-driven increase. They had the highest export volume for December, and the previous five to six months were also record months. Suppliers added 300 million lb to their inventories in December, the highest ever in the last decade.” He added that even scheduled plant turnarounds planned for March and April by LyondellBasell (LBI), Nova Chemicals and CP Chem would make no dent in material availability.

The Plastics Exchange’s Greenberg reported spot PE volumes to be markedly improved from the last two months of 2018 and plentiful overall. “Export interest remains exceptionally strong and Houston-area warehouses are still full and playing catch-up from the year-end rush. More new resin production is on the way, so it will be worth watching how the growing infrastructure will be able to handle it all.”

PCW’s Barry reported that in their fourth quarter reviews, PE suppliers conceded that their increased capacity had impacted PE margins. He noted that ExxonMobil Chemical expected downward margin pressure to continue in 2019, whereas LBI sources noted that the slower pace of capacity additions in 2019-20 would provide time for 4-5% global demand growth to absorb the new supply. Barry reported that Sasol had nearly completed commissioning its new 1-billion-lb/yr LLDPE unit at Lake Charles, La.; while ExxonMobil confirmed that its new 1.4-billion-lb LLDPE unit at Beaumont, Tex., was on track for midyear startup; and LBI expects to start up its 1.1-billion-lb HDPE project in Point Comfort, Tex., in the third quarter.

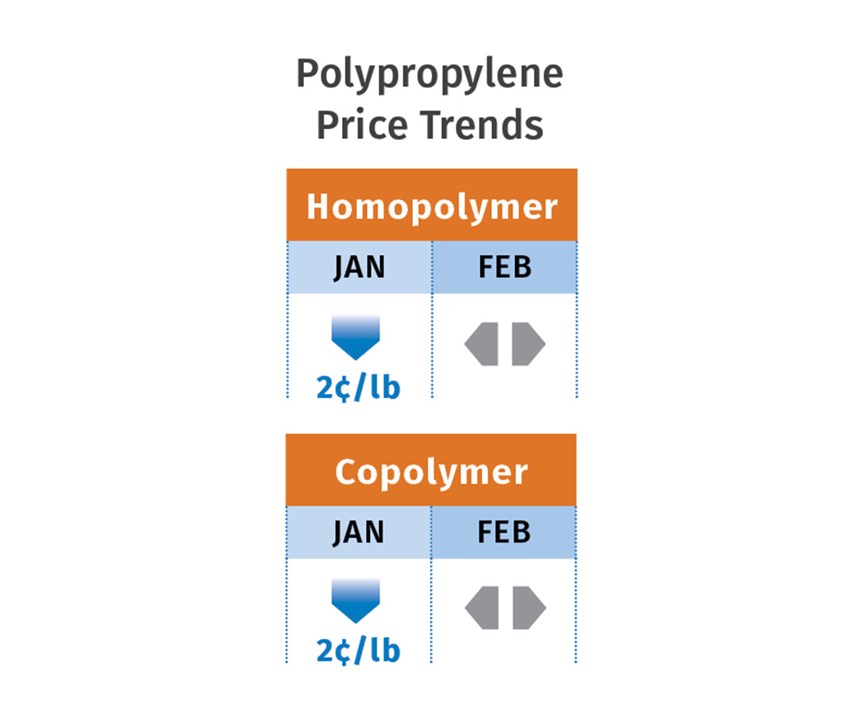

PP PRICES BOTTOM OUT

Polypropylene prices dropped 2¢/lb in January, in step with propylene monomer prices, which settled at 40¢/lb. As we entered February, PP and monomer prices had each dropped by 21¢/lb since November 2018. Not only was there no sign of suppliers’ announced profit-margin increases, but there were industry reports of some margin erosion. Still, both PCW’s Barry and Scott Newell, RTi’s v.p. of PP markets, ventured that PP prices were bottoming out. Newell projected flat February prices and potential for a 4-6¢/lb increase in monomer and PP during March or April. Still, neither source anticipates PP prices to rise this year to the high levels of 2018.

Said Barry, “Right now, PP prices are pretty much in parity with global prices, which last was the case in the first half of 2018.” He noted that PP plants were operating at high utilization rates—mid-90s—due to low monomer costs.

The Plastic Exchange’s Greenberg reported that despite growing supplies of propylene monomer upstream, prices had stabilized and were pointing to slowly rising ahead.

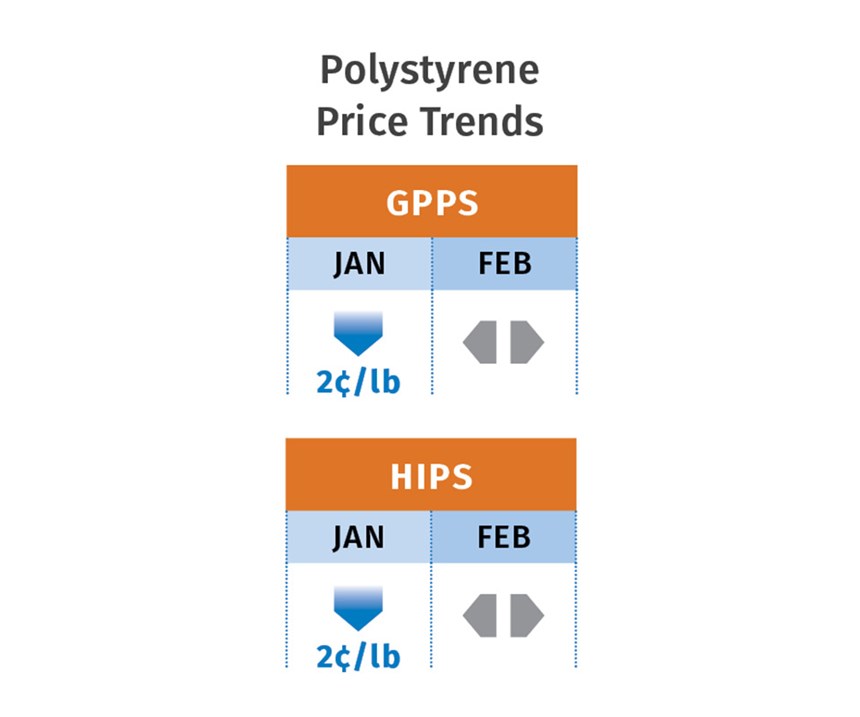

PS PRICES BOTTOM OUT

Polystyrene prices dropped by 2¢/lb in January, following a 7¢/lb drop in December, and last month appeared to be holding even with January levels, barring an unplanned disruption, according to both PCW’s Barry and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets. Both sources thought PS prices had bottomed out, and projected flat-to-upwards movement this month or in April.

PCW’s Barry noted that implied styrene production costs based on a 30/70 formula of spot ethylene and benzene feedstocks were 23.6¢/lb, up from around 22¢/lb at the start of the year. He said the monomer pricing trajectory would depend largely on crude-oil and benzene prices and demand for styrene exports. Chesshier noted concern going forward about adequate benzene supplies—both domestic and imports She expected higher benzene prices, which could result in monomer increases of 3-7¢/lb in March-April, depending on how PS demand shapes up at the start of the second quarter. Upward price movement in spot styrene monomer and butadiene, in addition to benzene, would appear to help support a firming up of PS prices. Chesshier noted higher monomer export demand, coming from new destinations—primarily Africa—to offset export tariffs imposed on China.

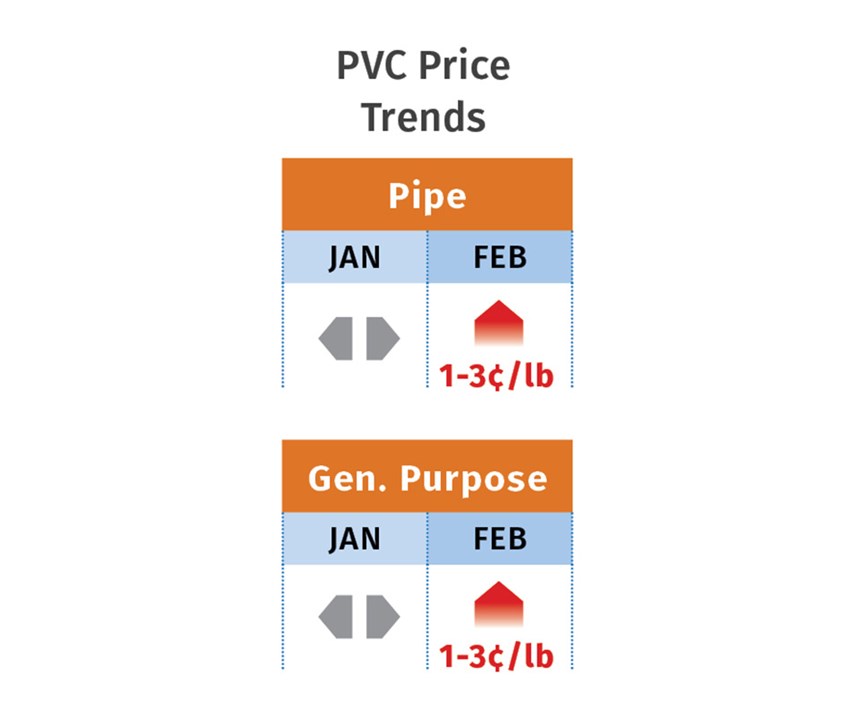

PVC PRICES MOVING UP

PVC prices held even for the third month in a row in January, but the landscape was likely to change with PVC suppliers seeking a 4¢/lb increase in February, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resin markets, and PCW senior editor Donna Todd. Kallman ventured that flat pricing or a 1-3¢/lb increase between February and March were equally possible, depending on demand, which appeared to have slowed domestically and globally. The second quarter, when demand typically “heats up,” could result in a change in direction for prices, he noted.

Todd noted that one industry pundit was predicting suppliers’ increase would be split in half for February and March. “As usual, resin buyers were divided in to two camps over the impending 2¢/lb increase for February. Pipe converters were mostly pleased to see a PVC price increase announced, as they figure it will enable them to push up their own pipe prices. Non-pipe PVC converters were not pleased with such an early price hike and “flimsy reasoning”—with no key drivers to support the increase,” Todd reported.

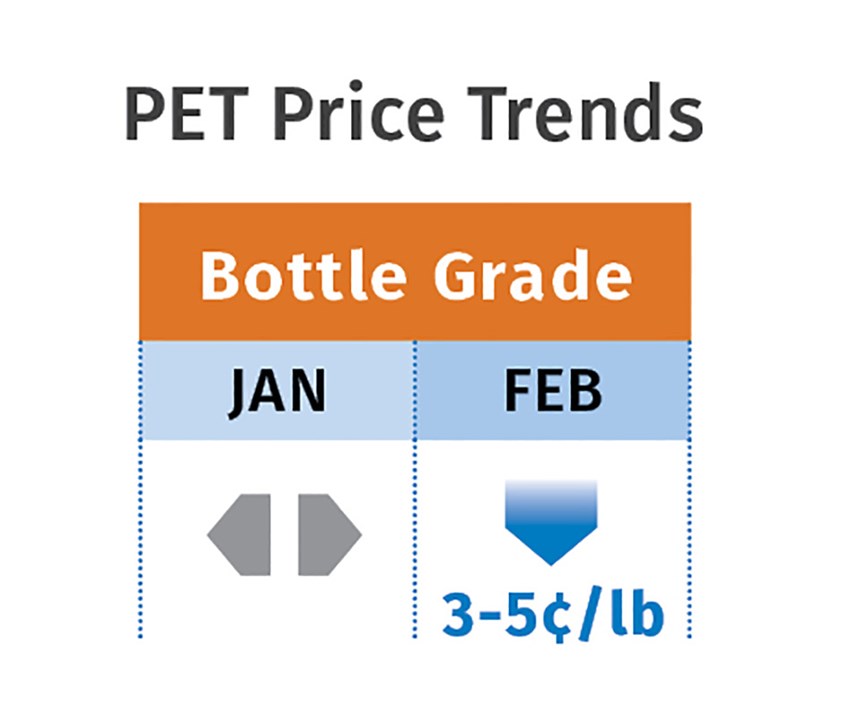

PET PRICES DOWN, THEN UP

Prices for domestic bottle-grade PET going into February were about 63¢/lb, down 3-5¢ from January. Bloated supply from U.S. producers and imports from around the world are making it a buyers' market, according to PCW senior editor Xavier Cronin. Imported PET was in the low-to-mid-60s ¢/lb for delivery to port—higher for East Coast than West Coast destinations.Truckload business was 2-5¢/lb higher, depending on distance.

Cronin reported that market sources saw prices rebounding this month by 1-3¢/lb for prime PET as demand for PET bottles and packaging expands ahead of the warm-weather heavy-consumption period for carbonated soft drinks and other beverages in PET bottles. At the same time, demand for rPET clear FDA pellets remains strong and competes in some instances with prime PET (and offgrade) as consumer brand owners seek more recycled plastic in their packaging. Meanwhile, the removal last fall of U.S. anti-dumping duties from five countries that accounted for about 40% of all imports in 2017 was expected to increase PET imports this year.

Related Content

Recycled Content to be Incorporated in PS Foam Packaging

Pactiv Evergreen and Amsty announced a collaboration that will bring ISCC plus certified product into select food packaging.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More