Key Takeways from IHS Markit Pros on PE, PP Outlooks

The polyolefins presentations at GPS 2016 signal better times for processors in terms of pricing leverage, options.

The polyolefins presentations at GPS 2016 signal better times for processors in terms of pricing leverage, options.

The fourth annual Global Plastics Summit (GPS 2016) co-hosted by IHS Markit and SPI: The Plastics Industry Trade Association provided a comprehensive view of the ever-changing global plastics industry, as well as perspectives from across the supply chain.

The well-attended summit included presentations from IHS Markit experts on the outlook for key commodity thermoplastics including engineering resins. Here are key takeaways from the PE and PP presentations, starting each with a focus on the North American market followed by global outlooks.

“A New Era for Polyethylene”, presented by global business director plastics & polyolefins Nick Vafiadis. Vafiadis sees the North American PE market continuing to be characterized by competitive production economics, high operating rates, and both domestic and export demand growth. However, he also pointed to the changes that are emerging that will impact the market differently than 2016:

• Near-term capacity additions…..

• Braskem Idesa + Ineos Sasol + Nova Chemicals=2 million m.t (4.41 billion lbs) in 2016.

• ExxonMobil + CP Chem +Dow= 3.2 million m.t. (7 billion lbs) by end of 2017.

• Some 2017 contracts are already reflecting increased discounts.

• Arbitrage is playing enhanced role in North American PE prices.

• Expect increased competition to trim suppliers’ margins as buyers gain options and leverage.

Vafiadis summed up key takeaways for the global PE outlook this way:

• Global demand growth outpaces GDP.

• Potential for record growth overcapacity during 2016-2018.

• Capacity overhang may dampen prices and margins as cost-competitive regions compete for global market share.

• Regional prices move toward netback parity as competition ramps up.

• Price and margin impact dampened if significant new-start delays develop.

• PE buyers increase purchasing leverage during 2017-2018.

• 5 million m.t. of new North American capacity in 2016/2017.

“Global PP: How Does Near-Term Oversupply in Asia Affect the Rest of the World? Have Global Producer Margins Peaked”, presented by senior director Joel Morales, started with the immediate outlook:

Not so good for PP suppliers; getting better for PP buyers; and, suppliers’ margins have indeed peaked! For the North American market, Morales’s key takeaways include:

• ‘Golden Goose’ of suppliers’ profit margin flushed out in 2016.

• Massive influx of imports sets a floor for most competitive segments like film and fiber.

• Pace of debottlenecking accelerates and domestic suppliers need to push out imports to run at full rates in 2017; opposite of 2015.

• Reinvestment economics for greenfield projects questionable though current margins on mostly depreciated assets exceptional.

• Growth for 2017 expected at near 4.5%; overall growth 2016-2021, a steady 2.8%.

Morales’ global PP market takeaways include:

• Timing of new Chinese capacity start-ups is likely the single biggest factor over the next 18 months.

• Global net exporters such as the Middle East and South Korea will continue to focus on alternative markets.

• Naphtha-based PP suppliers continue to benefit from the low-priced oil environment that allows for higher local production rates.

• Global non-integrated margins are in decline from this point forward; only PDH (referring to on-purpose propylene hydrogenation) operators benefit with slight oil-price recovery through the forecast period 2016-2021.

• North American PP pricing ‘experiment’ concluded and imports to remain a price ceiling.

Related Content

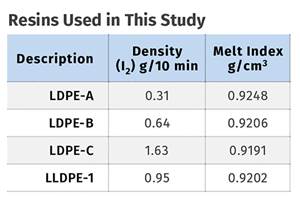

Formulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreRead Next

Recycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More

(2).jpg;maxWidth=300;quality=90)