Pricing on Flat-to-Down Trajectory for Volume Resins

Sustaining some first quarter price hikes seems unlikely.

In the first week of second quarter, we are seeing a somewhat mixed bag for commodity resin prices. Following price increases for most resins through first quarter, a flat-to-down trajectory looks to be shaping up. The big exception is PP, with a double-digit drop going into April. Driving this trajectory are lower-cost feedstocks, improved monomer and polymer availability, and slowed exports, depending on the resin. This according to purchasing consultants Resin Technology Inc. (RTi), PetroChemWire (PCW), and Michael Greenberg, CEO of the Plastics Exchange.

● PE: Prices remained flat through March. RTi’s v.p. of client services for PE Mike Burns, PCW senior editor David Barry, and The Plastic Exchange’s Greenberg all wager that PE suppliers could aim to push through their the 3¢/lb March increase this month but were doubtful of implementation.

“Producers will take another shot in April but processors feel the top of the PE market might already be in place,” reported Greenberg. PCW noted that the momentum appeared lost amid soft domestic demand. Both sources characterized spot PE prices as flat to lower, with weakened buying activity on both the domestic and international fronts.

Said Burns, “Global PE prices were much lower heading into April as there’s a lot of supply available. Also, China is not importing any resin right now, which has been clogging things up.” He emphasized that North American PE prices must remain no more than a 7-10¢/lb delta above the global price level to retain export demand. He noted that off-grade PE prices are back down to pre-Hurricane Harvey levels, while spot ethylene prices in March were near a 10-year low.

Burns pointed out that processors are now paying 14¢/lb more, than they expected when doing their budgets in late 2017. The expectation was for a 3¢ decrease this year and instead, prices went up 11¢/lb. While he ventured there would be downward pressure going into this month, he did not expect a major decline.

● PP: Prices dropped by another 6¢/lb in March, one-to-one with propylene monomer contracts, following the 6¢/lb February drop. Meanwnhile, several PP suppliers are out with price increases of 3-5¢/lb, effective April 1. This despite the expectation that late settling April monomer contract will be flat to down by 1-2¢. As with PE, these industry sources were doubtful about full, if any, implementation of such increases, which they describe as margin-enhancing price initiatives.

RTi’s v.p. of PP markets Scott Newell ventured PP prices in April would be close to flat—despite the margin expansion variable, with potential for plus or minus 1-2¢/lb. He expected a similar relatively stable pricing scenario for May, barring any major unplanned event. He noted that PP suppliers claimed supply tightness and being sold out, though plant utilization rates dropped to under 80% for the first couple of months of the year. Newell expected an increase in production rates and an increase in demand between March and May, of at least returning to normal levels.

PCW reported that PP spot prices were steady, and availability of prime material was limited—attributing the scarcity of material to low operating rates in the first quarter. The Plastics Exchange’s Greenberg reported that spot market demand was off as buyers anticipated further price decreases…this, while those suppliers with very little inventory feel otherwise. Regarding some suppliers’ price increase initiative for April, he noted, “It has been a while since a margin enhancing increase has held, but fundamentals are currently leaning toward some levels of success.”

● PS: Prices generally moved up 4¢/lb in March, as suppliers forced through that increase—a move attributed to tight styrene monomer supplies due to unplanned outages. However, both Mark Kallman, RTi’s v.p. of client services for engineering resins, PS and PVC and PCW’s Barry, were projecting a shortened life for that increase.

Kallman ventured a reduction of at least 1-2¢/lb in PS prices in April, with all of the 4¢ increase coming off by early May. PCW reported that overall spot PS availability was adequate as the first quarter styrene monomer outages appeared to be having minimal impact on PS operations. “The U.S. supply styrene situation was loosening up significantly as evidenced by the fixing of cargoes from the U.S. to Europe that were planned for loading in the first week of April.”

Kallman noted that, as is typical, raw material prices would once again push the monomer’s influence on PS pricing out of the way. He noted that benzene contract prices for April dropped by 7¢/gal to $2.99/gal, while the yet unsettled March ethylene contracts were expected to drop for a second consecutive month by another 1-1.5¢/lb

● PVC: Prices appeared to have moved up 2¢/lb in March, following implementation of the February 3¢/lb price hike. PCW’s senior editor Donna Todd reported that while suppliers were aiming to roll over the other 2¢/ of their March 4¢/lb hike in April, it appeared that neither this nor an attempt by two suppliers for a new April increase would be implemented. In agreement with this, RTi’s Kallman also ventured that the 2¢/lb gained would come off in April due to improved PVC capacity following planned maintenance turnarounds.

Kallman also cited lower ethylene contract prices with more expected, a softening in exports demand with lower prices, and a delay in the construction season building momentum due to weather conditions. He ventured stable prices for May, barring sharp demand spikes.

PCW’s Todd ventured that suppliers would aim to cement their total of 5¢ in price hikes and hold them level for as long as possible. “Their hope is to repeat last year’s feat of stable pricing for six months. The consensus in the market is that their success will be determined in large part by what happens in the ethylene market, as continued weakness in ethylene pricing will undoubtedly put pressure on PVC prices in turn.”

PET: PCW’s Senior Editor Xavier Cronin reported that domestic bottle-grade PET resin started April at 72-74¢/lb truckload and railcar delivered Midwest, up 1¢/lb from March. However, he ventured prices would be flat or down by 1-2¢/lb during April, driven by falling PE feedstock costs and a steady supply from domestic production and imports. Meanwhile, imported PET with an IV of 78 or higher was at 69¢/lb delivered duty-paid (DDP) to the West Coast, and 72¢/lb DDP to the East Coast, steady from March 1.

Anti-dumping duties were slated to be imposed on U.S. PET imports from South Korea, Indonesia, Taiwan, Brazil and Pakistan in late April. This was expected to result in an overall drop in imports starting in May and through the summer months as the five countries combined accounted for about 42% of all U.S. PET imports in 2017.Related Content

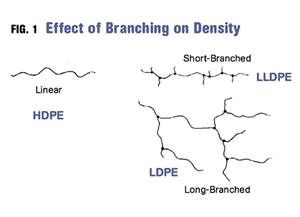

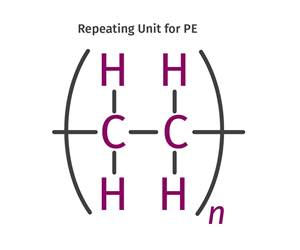

Density & Molecular Weight in Polyethylene

This so-called 'commodity' material is actually quite complex, making selecting the right type a challenge.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More