Resin Buying Strategies - September 2010: Prices May Stabilize… Briefly

Prices of commodity resins, except for polypropylene, fell a bit more last month.

Prices of commodity resins, except for polypropylene, fell a bit more last month. But they may be bottoming out. Both PE and PP suppliers have price hikes on the table, although they may be delayed, say resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. Here’s more of what RTi experts foresee.

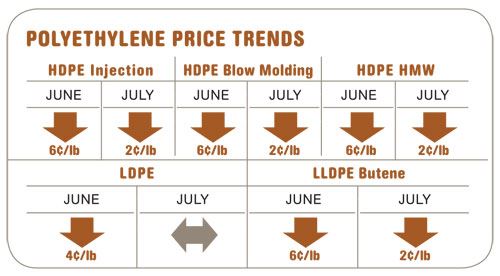

PE PRICES FLAT OR LOWER

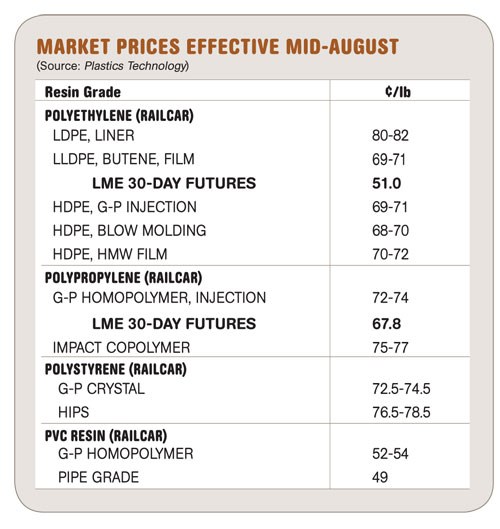

Polyethylene prices in July dropped another 2¢/lb for LLDPE and HDPE and stayed flat for LDPE. Tight supplier inventories appeared to halt further price erosion in August, and most major suppliers issued a 5¢ across-the-board increase for Sept.1. The move appears to have been initiated by Dow, which originally announced a 4¢ hike for Aug. 1. Meanwhile, the London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film-grade in August was 51¢/lb, up from 48¢ in July. July PE prices in the secondary market for off-grade material moved up 1¢ to 2¢.

PE suppliers have been scaling back plant operating rates and some have delayed restarting idle plants. Their inventories dropped by an average of six days. LDPE availability continues to be tight here and in Europe, but Asia is beginning to see some relief, which is expected to reduce U.S. exports.

There’s no upward pressure from the monomer side. Spot ethylene prices averaged 31.8¢/lb in July, down about 6.5¢ from June. June contract prices were 5.25¢ lower at 39.5¢/lb and were expected to hold even in July.

Outlook & Suggested Action Strategies

30-60 Day: Buy as needed. For the remainder of the third quarter, a further increase in exports is possible, which will bolster suppliers’ attempts to raise prices.

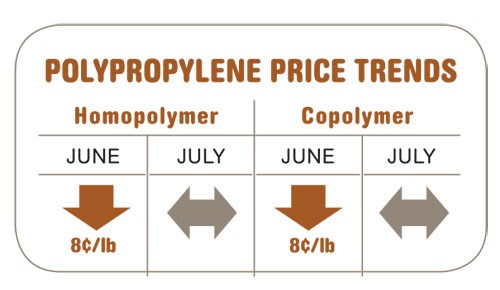

PP PRICES STABLE FOR NOW

Polypropylene prices were flat in July, as in June, following the trend in propylene monomer contract prices, which remained at 55.5¢/lb. PP suppliers issued price hikes of 3¢ to 5¢ for Aug. 1, but they had no effect by mid-month. The LME short-term futures contract in August for g-p injection-grade homopolymer was 67.8¢/lb, up sharply from 58¢ in July.

Spot PP prices increased by 2¢ to 5¢ from June levels. The spread between spot and contract resin tabs disappeared and, in some cases, spot tabs rose above contracts. Spot prices were expected to move up by the end of August in light of pending price hikes.

PP secondary markets remained tight through July and August. Continued strong demand into the third quarter reduced supplier inventories to 31.9 days from 36.1 days. This tightness bolstered suppliers’ decision to issue price hikes.

Market conditions do not appear to support a rise in August monomer contract prices, despite proposals for increases of 2.5¢ to 3¢/lb. RTi expected August monomer contracts to hold even or rise no more than a penny or two.

Outlook & Suggested Action Strategies

30-60 Day: RTi thinks it will be very difficult for suppliers to raise PP prices without the support of higher monomer costs. RTi does not see any indicators of another run of PP price hikes on the horizon. Rather, price stability appears more likely, barring unforeseen events or monomer supply disruptions.

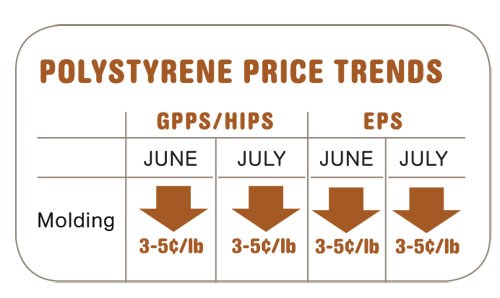

PS PRICES LOWER

Polystyrene prices dropped another 3¢ to 5¢ in July, following an average decrease of 4¢ in June. Another reduction of 2¢ to 3¢ is possible, though suppliers are fighting hard to hold onto their profit margins. Decreasing feedstock costs and growing resin inventories are driving lower PS prices.

Spot prices fell to about 60¢/lb for generic GPPS and 67-70¢/lb for HIPS. EPS prices dropped an average of 3¢ to 4¢ in July and there was potential for further decreases last month. Also, competition from EPS imports has returned, with prices FOB Northern Asia as low as 53¢/lb.

PS suppliers’ inventories remained flat at about 22 days—below the normal 25-day level—for most of the year. Resin plant operating rates were at 77% of capacity and EPS operating rates at 80%. Demand rates fell slightly for PS and rose sharply for EPS.

June styrene monomer contract prices dropped 9.25¢ to 58.25¢/lb and were expected to settle slightly lower for July. Spot monomer was trading near 45¢ in July and 1¢ to 2¢ higher in August.

selective-grinding and dry-sortation process

July butadiene contracts settled 2¢ higher, which affects HIPS. Imports have helped ease the supply tightness. Still, prices will stay high through this month.

Outlook & Suggested Strategies

30-60 Day: Further drops in PS prices are expected in August/September. Explore various supply options, including imports. Continue to buy as needed but “keep an eye on the weather.” Evaluate your purchasing strategy for the fourth quarter, as price increases are possible.

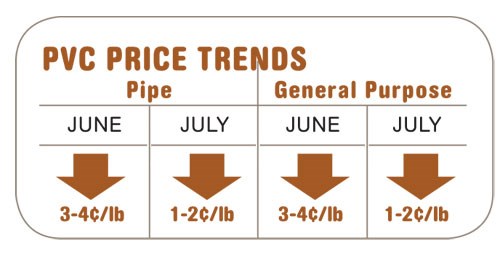

PVC PRICES LOWER

PVC prices sank another 1¢ to 2¢/lb in July, following a 3-4¢ drop in June. Falling ethylene monomer prices have played a key role. PVC suppliers enjoyed lower-cost ethylene in the second quarter and into the third. Chlorine prices, which had been low, are starting to rise, adding 0.5¢ to 1¢/lb to the cost of making PVC.

PVC plant operating rates trended downward in June/July after having held around 90% through the first half. Plants were running at 88% of capacity, with demand rates slipping to 84%. Suppliers built up stock in advance of an anticipated active hurricane season. As a result, their inventories grew by over 40% in the second quarter. Shintech is starting up its long-awaited second-phase expansion of 660 million lb, which will affect operating rates.

Outlook & Suggested Strategies

30-60 Day: Lower ethylene costs, reduced exports, and higher supplier inventories contributed to further resin price decreases in July/August. To minimize your resin costs in August/September, you can use the leverage of higher supplier inventories as the hurricane season wanes (assuming no major storms actually develop). Some rebound in PVC demand is possible through this month, and prices are expected to be flat or rise as a housing recovery resumes or exports rebound as the U.S. dollar weakens. Buy as needed.

Related Content

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreRecycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More

(2).jpg;maxWidth=300;quality=90)