Resin Buying Strategies: Higher Prices Going into 2010

Prices of commodity resins are generally on an upswing as we enter the new year.

Prices of commodity resins are generally on an upswing as we enter the new year. The exception is PVC, although a rebound in vinyl demand of as much as 5% is projected for 2010 by purchasing consultants at Resin Technology, Inc., (RTI) in Fort Worth, Texas. Only polypropylene shows signs of a temporary halt in climbing prices. Here are more of RTI’s projections and buying strategies for commodity resins in the first quarter.

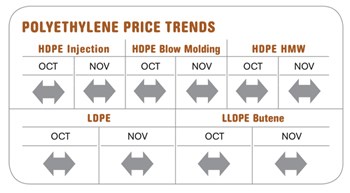

PE PRICES MOVE UP

Polyethylene market prices appeared to be moving up last month, following a flat November. The November hike of 4¢ to 5¢/lb was pushed to December, while a 3¢ increase for Dec. 1 was moved to this month. It looked likely that PE tabs would rise 4¢ by New Year’s. Meanwhile, the London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film grade in December took a sudden leap to 51.2¢ from November’s 40.8¢/lb.

Despite relatively stable crude oil and natural gas prices, mid-December ethylene monomer spot prices remained at their highest level of 36¢/lb, up from 30¢ in September. Cash cost to produce ethylene has risen to 33¢/lb, putting further upward pressure on monomer tabs. The margin between spot ethylene prices and PE is still 20¢ to 25¢/lb. Driving all this was record-high export demand for PE since September, which offset poor domestic demand. Nonetheless, producers’ inventories accumulated a bit more: 33 to 35 days for LLDPE, 45 to 47 days for LDPE, and 17 to 22 days for HDPE.

North American PE producers’ operating rates averaged 95% to 97% for LLDPE and 87% to 90% for LDPE and HDPE. Demand rates are about 90% of capacity for LLDPE, 85% for LDPE, and 70% for HDPE.

Anticipated new capacity in the Middle East has yet to hit the global market, as many of the units that were scheduled for 2009 startup were delayed because of the global economic slump. By year’s end, some units were up and running off-spec material, with production of prime material slated for the first quarter.

Outlook & Suggested Action Strategies

30-60 Day: Manage your inventories and buy as needed. Watch oil prices, as they are the strongest indicator for PE prices. If oil stays at the mid-December level of $70/barrel or moves up, PE exports will remain strong and ethylene prices will rise, creating an impetus for further PE price hikes.

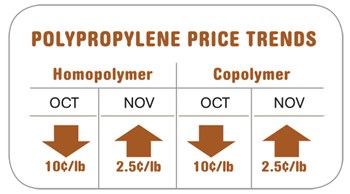

PP PRICES UP

Polypropylene prices moved up 2.5¢/lb in November and another 4¢ in December, following on price increases for monomer. The LME contract for g-p injection-grade homopolymer in December rose to 49.9¢/lb from November’s 44.4¢.

Propylene monomer contracts for December settled 4¢ higher at 53.5¢/lb. However, spot price offers in early December were below 48¢/lb, an indication that monomer prices may have peaked.

PP demand was on the low side, as many large processors were planning some downtime for the holidays. Exports of PP remained at minimal levels as the U.S. price could not compete in other regions. PP makers’ operating rates were in the 75% to 80% range—about even with the market demand rate. Producers’ inventories were between 33 to 35 days.

Outlook & Suggested Action Strategies

30-Day: Consider buying as needed and watch energy prices. If oil prices remain around the mid-December price of $70/barrel, propylene monomer prices could drop.

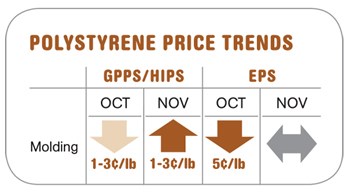

PS PRICES UP

Polystyrene prices gained 2¢ to 3¢/lb in November and December. An additional 5¢ increase was in the works for Jan. 1, as producers cited a recent run-up in their feedstock costs. EPS prices remained soft through the fourth quarter due to both poor domestic demand and more competitively priced imports. Soft demand is expected to continue through first quarter of this year, along with the continuation of a very aggressive spot market. PS makers’ operating rates averaged around 79%. Demand rates were 75% to 77% of capacity.

December’s benzene contract price rose 5% to $2.98/gal. That adds a net 1.5¢/lb to the cost of PS production. In fact, PS supplier’s cost increases related to benzene totaled 4¢/lb in the fourth quarter, following a two-month drop of nearly 10¢/lb. However, spot benzene prices softened to $2.90/gal immediately after the December contract settlement. November butadiene contract prices held at 68¢/lb, but spot prices were in the low 60s. December butadiene contracts were expected to remain flat or to drop. That could change during the first quarter if the economy picks up.

November styrene monomer contract prices rose 1.75¢ to 54.50¢/lb. That is 30¢ below the monomer’s peak in 2008. December contract nominations were 3¢ to 4¢ higher. Styrene spot prices also were edging higher in December to around 50¢/lb.

Outlook & Suggested Action Strategies

30-Day: There were year-end deals to be had as producers and distributors aimed to cut inventories. But pricing economics support implementation of at least part of the January increase.

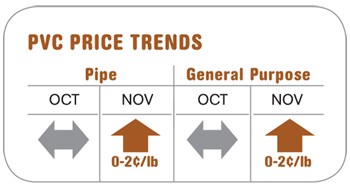

PVC PRICES UP MODESTLY

Last month, PVC producers aimed to implement 1¢ of the November 3¢/lb increase. A new 5¢ increase emerged for Jan. 1. Despite the weakening domestic market, pushing pipe-grade prices down by as much as 5¢ at year’s end, PVC producers have continued to find export opportunities.

Higher spot ethylene prices in October and November and an expected further hike in December eroded PVC producers’ margins during the fourth quarter. November chlorine prices retreated 1¢ to 2¢/lb following a 5¢/lb increase in the third quarter that had added 1¢ to 2¢/lb to the cost of making PVC. Vinyl plant operating rates were in the low 80% range by year’s end, and demand rates were about 75%.

Outlook & Suggested Action Strategies

30-Day: Softer PVC prices in the first quarter usually follow seasonally lower construction demand. But keep an eye on ethylene price and availability as well as crude oil volatility. And we see potential for a rebound in both domestic and export PVC demand in the second quarter by up to 5% overall.

Related Content

Improving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MorePolyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreFormulating LLDPE/LDPE Blends For Abuse–Resistant Blown Film

A new study shows how the type and amount of LDPE in blends with LLDPE affect the processing and strength/toughness properties of blown film. Data are shown for both LDPE-rich and LLDPE-rich blends.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More (2).jpg;maxWidth=970;quality=90)

(1).jpg;maxWidth=970;quality=90)