Plastics Processing Activity Continues to Contract

September’s survey results mark a third month of a very similar GBI.

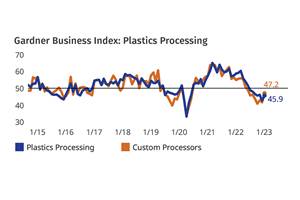

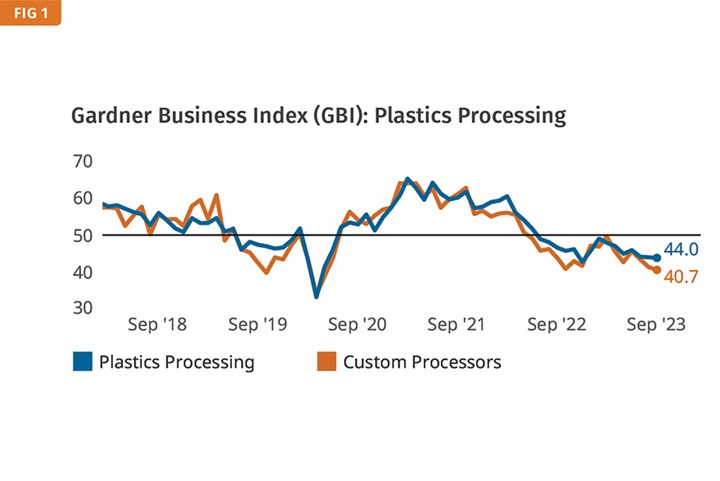

The Gardner Business Index (GBI) for plastics processing closed September at 44, about the same as August’s 2023 low of 44.1. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

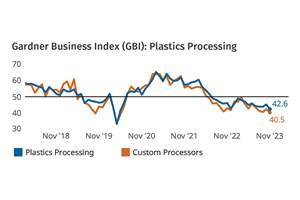

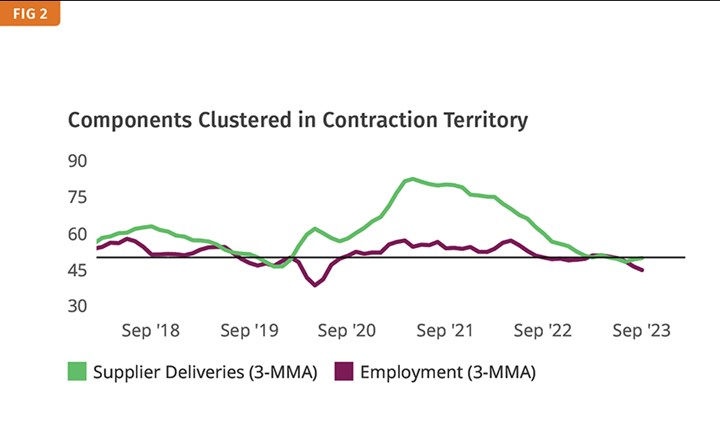

All components contracted faster again in September, with the exception of supplier deliveries, which slowed contraction, inching back to flat (50) for the month.

The slowing new order contraction observed in August did not carry over into September. Rather, new orders joined four other components, production, exports, employment and backlog, in contracting faster in September.

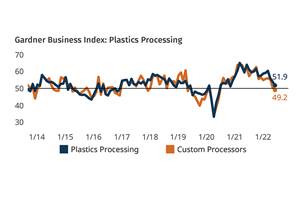

FIG 1 Plastics processing activity contracted in September at about the same rate as August, while custom processors marked a third straight month of GBI decline.

Employment has contracted at a particularly accelerated rate, contributing to this month’s biggest cumulative component drop since June. Absence of pressure on employment from growing orders and production may be a silver lining short-term with just about everything costing more.

Overall business activity for custom plastics processing contracted faster, dropping not quite one point and landing over three points lower than overall plastics processing in September.

FIG 2 Supplier deliveries contracted slower in September while employment saw continued accelerated contraction.

ABOUT THE AUTHOR: Jan Schafer is director of market research for Gardner Business Media, parent company of both Plastics Technology magazine and Gardner Intelligence. She has led research and analysis in several industries for over 30 years. She earned a bachelor’s degree in psychology from Purdue University and an MBA from Indiana University. She credits Procter & Gamble for 15 years of the best business education. Contact: 513-527-8952; jschafer@gardnerweb.com.

Related Content

Processing Slips as Summer Simmers

Monthly index suggests slower growth in June for plastics processors overall and contraction for custom firms.

Read MoreProcessing Activity Contracts More Slowly in January

Despite contracting again in January, plastics processing activity rebounded a bit from a rather significant drop in December.

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MoreNPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry as we head into NPE2024.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More

(2).jpg;maxWidth=300;quality=90)