Plastics Processing Pattern Prevails With an Uptick in December

Like December 2022, the December 2023 index represents increased activity following dips in November.

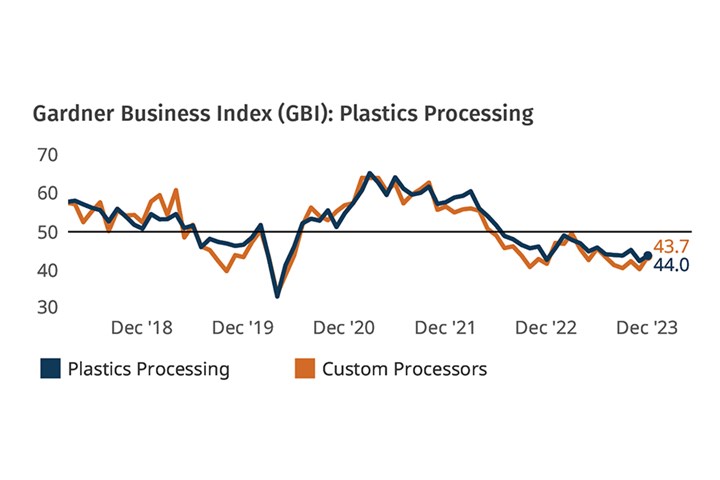

The Gardner Business Index (GBI) for plastics processing contracted more slowly in December, up to 44, 1.4 points above November’s number. The index is based on survey responses from subscribers to Plastics Technology. Indices above 50 signal growth; below 50, contraction.

FIG 1 Plastics processing activity continued to contract in December, albeit a bit slower than in November. The same is true for custom processing activity.

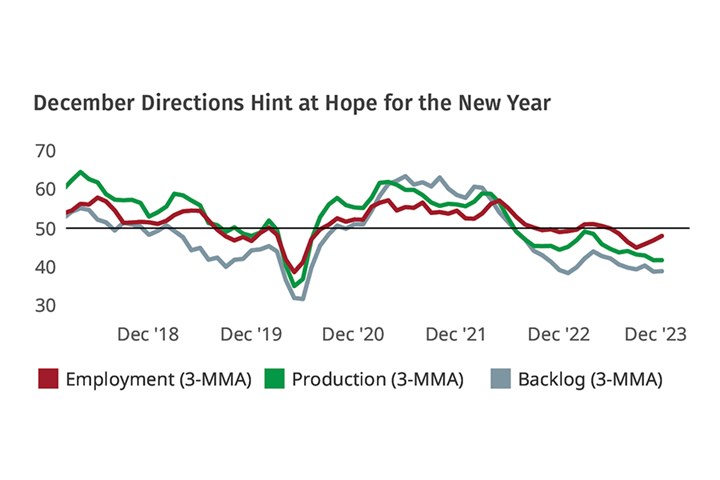

Like December 2022, the December 2023 index represents increased activity following declines in November. Plastics processing activity remains contracted in the big picture. The direction of December’s index appears to have been driven by stabilized contraction in production and backlog, and slower contraction of employment. Rising optimistic business sentiment for the next 12 months may have processors poising for new orders or it could be “normal” variation. The next couple of months will be telling.

Exports continued on a steady path of contraction, while supplier deliveries hovered around 50 (flat, meaning that as many see supplier deliveries taking longer as see them coming faster) like it has since September 2023.

FIG 2 Stabilized production and backlog combined with slower employment contraction may be signs of better things to come in 2024.

Overall business activity for custom plastics processors is up almost 3.2 points versus November 2023, though it still contracted like it has since June of 2022.

ABOUT THE AUTHOR: Jan Schafer is director of market research for Gardner Business Media, parent company of both Plastics Technology magazine and Gardner Intelligence. She has led research and analysis in several industries for over 30 years. She earned a bachelor’s degree in psychology from Purdue University and an MBA from Indiana University. She credits Procter & Gamble for 15 years of the best business education. Contact: 513-527-8952; jschafer@gardnerweb.com.

Related Content

NPE2024 and the Economy: What PLASTICS' Pineda Has to Say

PLASTICS Chief Economist Perc Pineda shares his thoughts on the economic conditions that will shape the industry as we head into NPE2024.

Read MorePlastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MorePlastics Processing Growth Slows Slightly

May reading for plastics processors is, for the most part, a continuation of what we saw in April.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More

.png;maxWidth=300;quality=90)

(2).jpg;maxWidth=300;quality=90)