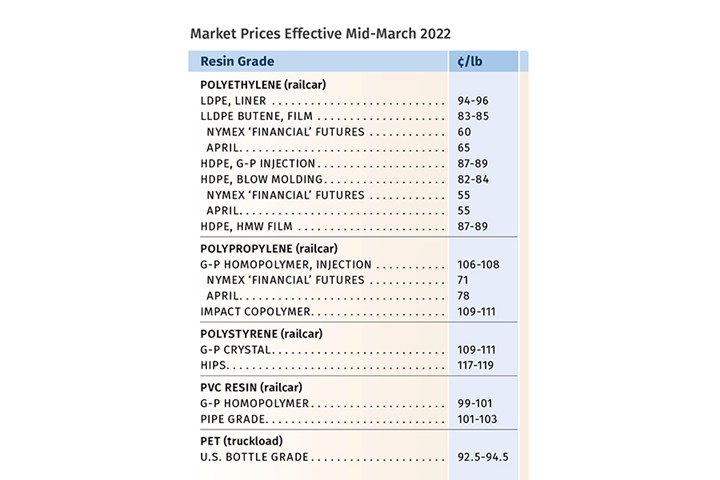

Prices Rising for Most Volume Resins

With the possible exception of PVC, high energy and feedstock costs exacerbated by Russia’s war on Ukraine were leading resin prices higher.

While price trends among the nine major-volume commodity and engineering resins have continued to be mixed, all have been impacted by the significant spike in global prices of crude oil and derivatives, exacerbated by the significant uncertainty resulting from Russia’s war on Ukraine. Prices of both PE and PP appeared to have bottomed out, and prices of PS, PET and nylons 6 and 66 were on the way up. While prices of PVC saw some decline, they too were likely to firm up, as was the case with ABS and PC, despite all three enjoying very well-balanced supply/demand fundamentals.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior editors from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. for polyolefins at Spartan Polymers.

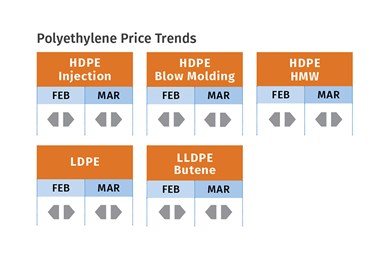

PE Prices Flat to Higher

Polyethylene prices in February rolled over and flat-to-higher pricing was projected by Mike Burns, RTi’s v.p. of PE markets, as well as PCW senior editor David Barry and The Plastic Exchange’s Greenberg. In March, suppliers were aiming for the third time to gain at least 4¢/lb. In his assessment that prices ought to stabilize soon, Burns cited factors such as suppliers’ inventory buildup due to constriction of exports by container shortages and other shipping and transportation issues. “Typically, domestic suppliers need to export 10% of supply. Just from December to January, exports dropped by 300 million lb,” he noted.

PCW’s Barry characterized the market as balanced to long, with continued steady demand. He ventured that the Russia/Ukraine conflict could result in opportunities for U.S. exports of PE, from resins to end products. Greenberg reported that despite unchanged contract prices, most spot PE grades moved up by another cent or so in late February, reaching their new highest levels of 2022, up as much as 6¢/lb. “With crude oil prices surpassing $100/bbl for the first time since 2014, other commodities priced sky-high alongside rampant inflation, and the threat of massive geopolitical disruptions, resin prices currently down some 40% from the 2021 highs seem like a bargain and seem poised to surge again this year,” he commented.

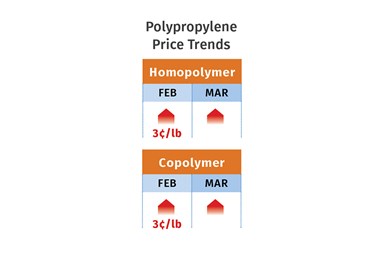

PP Prices Up

Polypropylene prices bottomed out in January, as had been expected, and prices moved up in February by 6¢/lb in concert with propylene monomer contracts, according to Scott Newell, executive v.p. for polyolefins at Spartan Polymers, along with PCW’s Barry, and The Plastic Exchange’s Greenberg. At least one of the major resin price indices, CDI, showed a non-monomer-based drop or giveback of about 3¢/lb in PP prices, which offset part of the increase.

Still, Barry noted that while monomer contract prices settled at 62¢/lb, spot prices at February’s end spiked up to 72¢/lb. He described the spot PP market as somewhat slowed by the rise in monomer pricing and the perception that propylene was more susceptible to upstream price effects from the Russia/Ukraine conflict. All three sources ventured that PP prices in the March-April timeframe were likely to be flat to higher.

By the start of March, Greenberg characterized the spot PP market as strong, with prices increasing by 2¢/lb . “They now are up 7¢/lb for the year and could just pick up steam. Processors are still a bit shaken from 2021, when PP prices were $1.50/lb or even higher; and while prices have since retreated some 40% to 50% to more familiar levels, any sort of meaningful price jump has buyers shaking again, and this past week was a stark eye-opener,” he reported.

Newell said that propylene monomer supply is still tight and lower yields along with much higher oil prices are driving monomer prices upwards. Still, he and Barry noted that demand continues to struggle. Even though there was some uptick in the first two months of the year, it was below average as it had been for the previous five months. While suppliers had reduced inventories in December, they expanded again to 38 days of supply in February. Barry noted that, as with PE, the Russia/Ukraine conflict and higher energy prices could create opportunities for PP exports—from resins to end products.

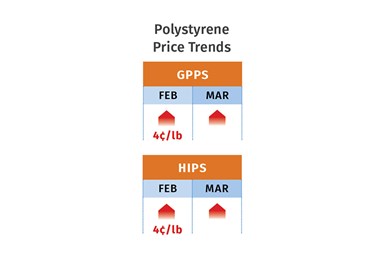

PS Prices Rising

Polystyrene prices moved up 4¢/lb to 5¢/lb in February, based entirely on higher benzene/ethylene prices. While “justified” only from the feedstock cost point of view, levels of PS prices are very high, according to Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, as well as PCW’s Barry. Chesshier noted that the Russian/Ukrainian conflict was expected to make things worse and that processors should brace themselves for another price increase in March, with further upward pressure into this month from higher feedstock and energy costs and the startup of seasonal demand.

In fact, the three major suppliers came out with new price increases for March, two asking for 5¢/lb and one for 4¢. PCW’s Barry expected further upward pressure if crude oil prices continue to climb. He noted that while demand for GPPS remains below par and bans on PS packaging products continue, demand for HIPS, particularly in the appliance sector, continues to be quite solid.

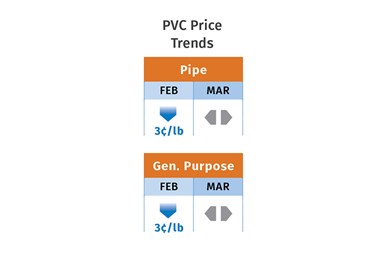

PVC Prices Down

PVC prices dropped by 3¢/lb in January and while another 2¢/lb decline was originally predicted for February, prices rolled over, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins and PCW senior editor Donna Todd. Meanwhile, suppliers were aiming to push through a 3¢/lb increase last month, but both industry sources projected flat pricing, barring further energy and feedstock cost hikes.

As for this month, Kallman ventured that prices could also be flat. “Demand continues to be healthy and new capacity has come on stream Once we have passed March, during which planned maintenance shutdowns are scheduled, the market will be very well supplied.” Noting that the typical construction demand surge begins this month, PCW’s Todd reported, “Some PVC buyers fully expect to see further price increases announced for April and probably for May.

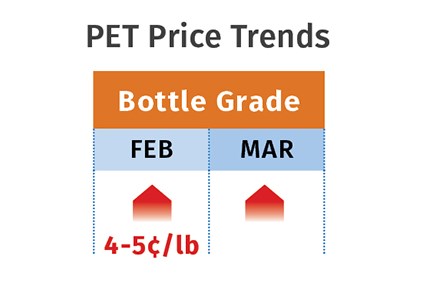

PET Prices Higher

PET prices in February were on the way up by another 4-5¢/lb after a 10¢/lb increase in January—in both cases owing to higher feedstock costs and resin supply constraints following an unplanned outage that further tightened supply, according to RTi’s Kallman. Demand remained strong, and this month marks the start of higher seasonal demand. Kallman thought prices in March and April could flatten as supply/demand achieves better balance, aided by imports. “Still, if crude oil prices surpass $100/barrel, prices would be pressured upwards, as the key raw material paraxylene would rise accordingly.”

ABS Prices Hold Even

ABS prices remained largely flat through most of the first quarter after gaining about 11¢/lb on average in fourth-quarter 2021. Noting that lower-priced ABS imports were expected to hit the market this month, RTi’s Kallman saw some potential for lower domestic prices in the second quarter. “PC prices could drop a bit due to competitive pressure from imports. However, all key feedstock prices were on the way up due to escalating oil and benzene prices, and that could offset the import effect.”

PC Prices Flat

Polycarbonate prices were largely flat in the first quarter, having moved up 56¢ to 60¢/lb during 2021. Characterizing the PC resin market as well-balanced, Kallman noted that this was not so for PC compounds and alloys due to the continued supply constraints and higher prices of a range of additives and reinforcements, and he expected compounders to issue double-digit price increases for this quarter.

Higher Prices for Nylons 6 & 66

Nylon 6 prices were flat in January but moved up 5¢/lb in February. Then, at the start of the Russian/Ukrainian crisis, suppliers issued prices hikes of 10¢/lb. “There were small feedstock cost increases, which translated to the 5¢/lb increase implemented in February, but the 10¢/lb increase is very aggressive. Supply/demand is now balanced and suppliers are using the Russian/Ukrainian conflict as leverage,” said Chesshier. She cautioned processors to brace for further increases, though she expected pushback as feedstock costs were not justifying such a move at the end of February. She noted that suppliers would blame higher energy prices for their price initiatives. April is also the start of an uptick in seasonal demand, but it was difficult to project whether demand would slacken or increase.

Nylon 66 prices moved up 10-15¢/lb by the end of January and suppliers were aiming for hikess of another 10-15¢/lb in March, according to RTi’s Kallman. Nylon 66 compounders were generally seeking higher prices—up to 30¢/lb, given higher prices and sourcing difficulties for additives such as heat and UV stabilizers, flame retardants, pigments, and particularly glass fiber, due to a combination of production issues and supply-chain logistics. Kallman expected higher energy costs to put further upward pressure on prices. He noted that demand in automotive was constrained by the continued shortage of semiconductor chips.

Related Content

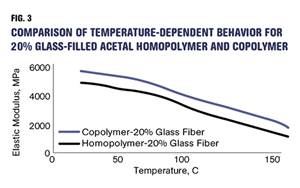

How Do You Like Your Acetal: Homopolymer or Copolymer?

Acetal materials have been a commercial option for more than 50 years.

Read MoreScaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

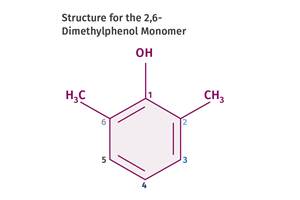

Read MoreTracing the History of Polymeric Materials: Polyphenylene Oxide

Behind the scenes of the discovery of PPO.

Read MoreTracing the History of Polymeric Materials: Aliphatic Polyketone

Aliphatic polyketone is a material that gets little attention but is similar in chemistry to nylons, polyesters and acetals.

Read MoreRead Next

Recycling Partners Collaborate to Eliminate Production Scrap Waste at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair will seek to recover and recycle 100% of the parts produced at the show.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More