Beyond Decking: Wood Composites Branch Out

Extruded decking still drives the embryonic wood-filled plastics market. But injection and compression molded wood composites are coming on strong, and extruded profiles are moving toward more complex millwork shapes.

Wood composites are taking on a lot of new shapes besides simple deck boards. They’re replacing fancy millwork and routed parts, where high filler levels hold a net shape without creep. New parts include post ends, toilet seats, carpenter’s levels, door and window sills, office partitions, roofing shingles, and flooring.

Newer applications are being made with a lot of processes that are new for wood composites, like injection and compression molding and dual-belt forming. Some of these new methods are also being used to make traditional decking. It’s all part of a ferment of product and process development in the emerging wood-plastic composites field. At the cutting edge of this market, some parts don’t even look like wood.

Wood-composite profiles have been an extrusion success story for over a decade. Profiles still account for 97% of all wood-filled products, according to Principia Partners, a research firm in Exton, Pa. Most profiles are decks and railings, plus small amounts of window and door components, Venetian blinds, and pencils.

Developments at Crane Plastics Manufacturing in Columbus, Ohio, illustrate two trends in extruded profiles. One is toward more complex hollow composite profiles, such as wood/PE office partitions. Another is toward new applications for simple rectangular profiles. Crane is extruding the lower parts of door frames using wood/PE. These profiles are joined to natural wood and then milled and primed as one piece.

The first injection molded wood composites are probably only four years old, and they still make up only 3% of wood composites volume, or 19 million lb/yr, according to Principia, which excludes compression molding from its market totals.

Decking drives most of the demand for injection molded wood-plastic finials, skirts, and end caps that cover the cut ends of decking profiles. Decking is growing at close to 20% with a steady influx of new capital as smaller producers are being taken over by bigger companies. Carney Timber Co. bought Xtendex decking earlier this year; Universal Forest Products acquired EverX decking; and at least one other deal is in the works.

Trex Co., which makes more decking than the rest of the industry combined, is growing too, thanks to a deal signed earlier this year with Home Depot. Trex is building its third plant in Olive Branch, Miss.

That deal and others like it will necessarily boost injection molded composites, which will grow 70% a year for the next four years, Principia predicts. By comparison, the overall injection molding business will grow only around 4% a year. One custom molder, Atlas Precision Plastics in Arden, N.C., says its wood composites business has grown from nothing four years ago to 40% of its business now.

Injection molding wood

Molded caps and skirts for decks and posts must match the deck in color and texture and weather in the same way. Some decking companies make their molded parts in-house. Many outsource some or all to custom molders, though perhaps no more than a dozen injection molders have experience molding wood.

The first molded parts were simple and basic. In 2000, the maker of Xtendex decking in Barrie, Ont. (now part of Carney), was one of the first to injection mold board ends and post caps. The board ends were initially plain right angles that overhung the end of the board. Now Carney uses a more elegant half-round cylinder that fits flush into the board end.

“At first I didn’t think this injection molding development would go anywhere,” recalls Stewart Kemper, president of TimberTech in Wilmington, Ohio, the decking division of profile extruder Crane Plastics. “But the quality has gotten better. Some modifications had to be made to the formula to make it work, and it has gotten more consistent.” Last year, after long-term development, TimberTech introduced its first injection molded post caps and skirts, molded both in-house and by outside vendors. “Now we’re looking at a variety of projects,” Kemper says.

Decking producers Brite Manufacturing (maker of Lifelong decking), Carney (Xtendex), Composatron (Premier), Correct Building Products (CorrectDeck), Fiber Composites (Fiberon), Louisiana-Pacific (Weatherbest), Master Mark Plastics (Rhino), and U.S. Plastic Lumber (Carefree) also produce at least some of their injection molded parts captively.

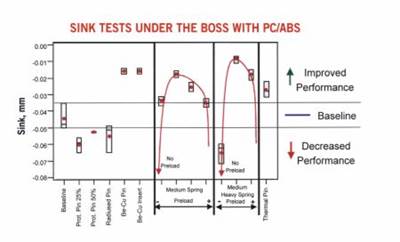

Makers of decking are extremely secretive about their composite moldings, whether made in-house or outsourced. High wood content prevents sink marks. But only a couple of custom molders can achieve close to the same high-fiber levels in molded parts as in extruded profiles. Blue Ridge Industries in Winchester, Va., molds post skirts and tops for Trex that do have about the same loading of wood as in its decking, Trex says. Trex, also in Winchester, puts about 50% wood in its PE deck profiles. Atlas has molded 45%-wood parts for Fiberon decks and rails from Fiber Composites in New London, N.C. Atlas says it can mold up to 60% wood.

Most injection molded composites, however, use far less wood or other fillers than the decks and rails they match. “Above 25% filler, the changes in rheology are considerable,” says Peter Simko, senior engineer at Carney. Carney’s end pieces, molded in house for Xtendex decking have only 20% fiber vs. 50% in the decking. The composites are filled primarily with rice hulls, flax, and hemp and only occasionally include wood fiber.

The fibers also have to be shorter for molding. Typically deck makers use extrusion-grade wood fiber, which is 30 to 40 mesh, whereas 60 to 80 mesh works better in injection molding, says William Crostic, president of Onaga Composites, which compounds wood-filled pellets for injection molding.

The type of wood is also critical for injection molding, whereas extrusion is more forgiving. “You have to know the shear properties of the wood. Oak shears more quickly than pine and burns faster,” says Robert Bulla, sales manager for Atlas. “You can mold 60% pine with no problem, but you couldn’t get to 60% with oak.”

Drying wood-filled pellets is far more critical for injection molding than for extrusion because injection presses aren’t typically vented. Lack of venting also leads to corrosion. Oak flour, which is high in tannic acid, corrodes injection molds, whereas pine flour doesn’t. Maple has the least undesirable outgassing. But pine contains terpenes, which are gummy. Pine also is easier to color, but has a lower flex modulus than oak.

Some injection molded composites look more like profiles but take advantage of molding to incorporate seals and weather strips as inserts to save secondary labor. Atlas and Dinesol Plastics Inc. in Niles, Ohio, both mold door sills with such inserts for Z Series doors from Endura Products in Greensboro, N.C.

A couple of custom molders have developed sophisticated processes using coinjection and foaming. “A lot of people think a wood composite has to replace wood or look like wood, but that’s not true,” says Atlas’s Bulla. “It’s just a filled resin. If you color the composite black, most of the wood fiber disappears. You can also heat the tooling so the polymer comes to the surface and the fiber disappears, just the way fiberglass does.”

Atlas molds some shiny white PVC trim parts that look painted, but aren’t, and show no fiber at all. Atlas also is developing cabinet doors that have a shiny white styrenic surface.

Another unusual recent development is a coinjected toilet seat with a wood-filled core and a shiny white surface of polypropylene with no wood. It’s molded by Centoco Plastics in Windsor, Ont., which has a patent on the process.

Foaming agents are used in tiny amounts to help pack out injection molded parts. One molder uses 0.016% blowing agent to prevent sink marks. Typically blowing agents are used at levels of 1% to 2%.

New ways to precompound

Injection molding wood-filled composites is costlier than extruding them because injection molding requires pre-compounded and predried material. All of the material doesn’t have to be precompounded, however. “A 60% wood-fiber concentrate works well in injection molding,” Onaga’s Crostic notes.

Brite Manufacturing in Bolton, Ont., supplies regrind from its extruded Lifelong decking to a nearby custom molder that produces Brite’s injection molded components.

One processor is also trying a Pallmann model PFV Plast-Agglomerator to preblend and dry wood flour and plastic before it feeds a counter-rotating twin-screw extruder. The agglomerator softens the plastic, but doesn’t melt it, allowing moisture to escape from the wood. It operates in continuous mode, forcing agglomerated material through holes in a die, where it is cut into pellets by rotating knives. To distinguish its agglomerator from typical batch types, Pallmann recently re-christened the machine the “Palltruder.” Two Palltruders said to be capable of processing up to 80% wood-filled compounds were delivered to U.S. customers this summer. One unit went for a decking application and one to the test lab of extruder builder American Maplan in McPherson, Kan.

Compression molding wood

Compression molding has also been used recently for wood composites, though most compression molded products use mixtures of natural fibers with wood as one option. Epoch Composites Inc. in Lamar, Mo., compression molds wood-filled decking using HDPE and wood flour in 12- to 20-ft sections and four colors. Epoch has compression molded its planks for five years. Epoch is building a new plant this year to increase its capacity.

Compression molding tends to be more limited than other processes in throughput capacity, but it has the advantage of not breaking fibers, Epoch notes. Compression molding can also incorporate higher wood loadings than injection molding. One compression molder in Arkansas makes handles and other small parts using up to 80% wood in HDPE. Compression molding is also forgiving of compound variations since material doesn’t have to flow through narrow mold passages.

Wellington Polymer Technology Inc. in Chatham, Ont., compression molds Enviroshake composite shingles to look like taper-split 12 x 20 in. cedar shakes. They contain high filler loadings, intentionally varied to give the shakes random thickness. Ninety percent of the mix is a combination of post-industrial PE and PP film, crumb rubber from tires, and natural fiber. Most of the fiber is flax, but wood fiber or hemp are substituted when available. The other 10% is a mix of nine chemical additives and processing aids. Wellington runs one fully automated compression molding line whose output is limited by the dwell time on the clamp cycle. They are adding a second line this fall.

Another new building product—flooring—is being developed with an unusual composite process. Called Thermofix, it’s a a dual-belt forming technology developed by Schilling-Knobel GmbH in Germany (represented here by Zima Corp.). The process compresses composite pellets between two heated PTFE belts to form a continuous sheet up to 0.75 in. thick. The granules are 60% wood flour and 40% flexible PVC and are produced in a Palltruder. The first commercial Thermofix line is in the Czech Republic and a second will go to the Toronto area to make wood-composite flooring from recycled carpet tiles.

One compression molder of wood and natural-fiber composites uses a pellet mill to compound a highly filled mix. This method doesn’t actually cut the pellets, but extrudes blobs that look like piles of thick rope. Later the blobs are ground into chips.

Fiber substitution grows

Injection and compression molders are modifying their formulations and replacing some wood filler with agricultural fibers like hemp, flax, rice hulls, or wheat straw. Some are partially substituting mineral fillers like talc, and one patented process uses starch in place of some of the wood. Blends of fillers reportedly can improve stiffness, creep resistance and other properties.

Processors also add other fillers to wood fiber to avoid drying. Luzenac America, which sells mineral fillers, notes that wood-composite profiles absorb up to 23% moisture after extrusion. Adding about 30% talc, however, cuts moisture absorption in half.

Substituting “agro fibers” for wood can have drawbacks. Flax, for example, is especially abrasive on tooling. Users report that agro fibers also have strong smells. Flax’s odor when heated is compared to rotten fish. Wheat straw smells like manure. Hemp smells like marijuana (though suppliers dispute this), and rice hulls like toasted cereal. Such smells will dissipate from molded parts and won’t matter much if the part is used outdoors like decking or shingles. But smell could be a factor in kitchen cabinets or car interior parts.

Fasalex, a new Austrian venture-capital firm, has a patented process and formula combining wood flour, resin, and starch. Starch adds stiffness and draws moisture away from the wood flour. Fasalex says using starch allows it to process wood flour containing as much as 12% moisture without predrying. Fasalex provides processing and formulation know-how. It works with three Austrian equipment suppliers: Greiner Extrusionstechnik and Technoplast Kunststofftechnik (which has a U.S. office) for tooling and Cincinnati Extrusion (which will come to the U.S. next year) for conical twin-screw extruders.

Fasalex doesn’t require customers to take a license, but it sells a formulation and a proprietary additive. Josko Fenster und Turen GmbH in Austria is a development partner of Fasalex and uses its material to make door and window profiles.

Fasalex also sells precompounded materials. LEX 452 contains 70% wood, 20% starch, and 10% of a polymer normally used in glue, plus additives. LEX 468 is 75% wood, 10% starch, and 15% PP plus additives. And LEX 474 is 60% wood, 10% starch, and 30% PVC with additives. Precompounded materials reportedly make thinner walls in extrusion than direct-compounded materials—e.g., 1.5-mm walls with precompounded material vs. 2.5 mm with direct compounding, Fasalex claims. An equivalent wood-starch-plastic formulation for injection molding is called Fasal.

An unusual combination of mineral and wood-based fiber was patented by Kadant Composites, which was established eight years ago to develop commercial applications for the sludge left over from paper making. First Kadant created a porous, granular material (1.5 g/cc density) called Biodac out of the fine kaolin, calcium carbonate, and short cellulose fibers used in paper. Because the granules are porous, they fill up with plastic in compounding, giving unusual strength properties. Three years ago Kadant used Biodac to formulate composite decking, called Geodeck, out of equal parts Biodac, HDPE, and additional cellulose fibers. Kadant now sells over 10 million lb/yr of Geodeck, a ribbed profile that comes with injection molded end caps that Kadant makes itself.

University R&D programs are also testing ways to improve composite properties. Univ. of Toronto researcher Tieqi Li proposes using an extrusion grade of HMW-HDPE instead of standard resin to improve composite properties. Conventional wisdom had been that wood composites need lower-MW/lower-viscosity PE to wet out fibers and provide good flow, even though a higher-viscosity resin could contribute greater strength. But Li found the processability of wood composites was determined more by the wood fiber than by the molecular weight of the polymer.

Conventional wisdom also held that longer fibers are stronger than shorter ones. Univ. of Idaho (Moscow) researcher Lance Gallagher found that ball-milling 100-mesh wood fiber to sizes as small as 20 microns increased the filler’s surface area, so that polymer bonded better and yielded higher tensile strength. A 50% loading of 100-micron fibers in HDPE had ultimate tensile strength of 3190 psi, Gallagher reported, while the same loading of 38-micron fiber had breaking strength of 3625 psi, a 14% increase. Processability also improves with shorter fibers.

Related Content

How to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.

Read MoreHow to Optimize Injection Molding of PHA and PHA/PLA Blends

Here are processing guidelines aimed at both getting the PHA resin into the process without degrading it, and reducing residence time at melt temperatures.

Read MoreMaking a Play With PHA

Processors with sustainability goals or mandates have a number of ways to reach their goals. Biopolymers are among them.

Read MoreAt NPE2024, Follow These Megatrends in Materials and Additives

Offerings range from recycled, biobased, biodegradable and monomaterial structures that enhance recyclability to additives that are more efficient, sustainable and safer to use.

Read MoreRead Next

Wood-Filled Plastics: They Need the Right Additives for Strength, Good Looks, and Long Life

Wood-plastic composites, or WPCs, are already a 1.3-billion-lb market and are growing at 20% annually.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More