Prices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Heading toward the end of the third quarter, prices of nearly all volume resins appeared to be flat and there was potential for downwards movement through the fourth quarter. This would hold, barring major production disruptions, which could yet come from a projected active finale to the hurricane season. Contributing factors include a slowdown of domestic and, in some cases, export demand, as well as generally lower feedstock costs. Except for PE, PP and PVC, resin suppliers were not seeking price increases.

These are the views of purchasing consultants from Resin Technology Inc. (RTi); senior analysts from Houston-based PetroChemWire (PCW); CEO Michael Greenberg of The Plastics Exchange (TPE); Scott Newell, executive vice president polyolefins at distributor/compounder Spartan Polymers; and Mike Burns of Plastic Resin Market Advisors.

PE Prices Flat?

Polyethylene prices in August appeared to be rolling over, although suppliers were out with a 5¢/lb increase for September, in addition to the August 5¢/lb price hike, according to PCW’s Associate Director for PE, PP and PS David Barry; TPE’s Greenberg; Plastic Resin Market Advisors’ Burns; and Kevin Mekaru, RTi’s senior business leader commodity plastics.

Both Barry and Burns doubt that either of these increases would be implemented, barring a disruption event. Barry notes that suppliers were lucky to have implemented the July 5¢/lb increase, which was primarily supported by export business. Barry also ventures that processors might even see a price drop, as they have kept their inventories stocked. “The long-term outlook does not foresee the sustainability of any of these new increases without an event,” Burns says. “Reduced exports to China will challenge supplier’s inventory levels.”

Mekaru ventures that PE prices would move up in August by 3¢/lb, owing largely to higher ethylene costs, which were returning to lower levels by August’s end. Prices are forecast to rollover for the September-October time frame. “Favorable supply/demand fundamentals helped suppliers implement the 5¢/lb increase for July contracts,” Greenberg says. “The added increases could come into play if the hurricane season ramps up.” Greenberg notes that all spot PE grades were relatively snug, considering suppliers drew down more than 330 million/lbs of inventory during June and July, according to the ACC.

PP Prices Up, Then Down

Polypropylene prices in August moved up by 2¢/lb, in step with propylene monomer, but a change appeared to be underway, according to PCW’s Barry, Spartan Polymers’ Newell, TPE’s Greenberg and Paul Pavlov, RTi’s vice president of PP and PVC. This was due to projections that monomer prices would drop come September, as the supply situation improves. In addition to the August price hike, PP contracts rose 7¢/lb during June and July in “a perfect correlation with the rise in propylene monomer,” Greenberg says. Supplier efforts for nonmonomer increases went by the wayside.

Both Barry and Pavlov speculate that a drop of 3¢ to 5¢/lb within the September-October time frame was possible. Newell also saw potential for such a drop within the fourth quarter but not as early as September. “We need things to be running well, particularly with the on-purpose propylene units before prices come down,” Newell says. All sources characterize demand as pretty good — with an increase of 5% through July — but also showing signs of slowing. Some of that demand was attributed to hurricane season prebuying, while the slowdown was partially attributed to processors anticipating lower prices. Barry notes that, except for PP impact copolymer (which was tight due to a couple of force majeure actions), demand has not been strong enough to cause supply tightness. Percentagewise, plant operating rates continue to be in the low 80s, and Formosa Plastics is expected to bring on new PP capacity before year’s end.

Spot market prices going into September rose by 7¢/lb for PP homopolymer since bottoming out in the middle of May, and 9¢/lb for the very tightly supplied PP impact copolymer resins, according to Greenberg. As for exports, Barry says there is a lot of competition coming from much lower cost Chinese PP, which is making a big impact in Latin America. “For U.S. producers to compete there, they could need to be at least 10¢/lb lower,” Barry explains.

PS Prices Flat

Polystyrene prices in August were reported as a rollover amid a relatively balanced supply, making it the fifth consecutive month of flat prices, according to PCW’s Barry and RTi’s Mekaru. According to Barry, spot prices were on average mostly assessed as flat toward the last week of August. Both sources reported that supply continued to be adequate despite a couple of ongoing unplanned outages. Both INEOS Styrolution and Americas Styrenics were due to restart their Chicago-area PS plants in September.

Costs of feedstocks were mixed, with benzene soft and ethylene up. Going into September, the implied styrene cost based on a spot formula (30% ethylene, 70% benzene) was at 41.9¢/lb, which is down from 43.2¢/lb four weeks earlier, according to Barry. Mekaru ventures that PS prices would stay ‘steady’ going into fourth quarter as AmSty was looking to sell its business and Total Energies was exploring this option as well.

PVC Prices Down, Then Flat?

PVC prices in August dropped by 2¢/lb, but the four domestic suppliers had issued an increase of 3¢/lb for September, a move viewed primarily as ‘hurricane insurance,’ according to RTi’s Pavlov and as indicated by PCW’s Associate Director of PVC & Pipe Donna Todd. In fact, the former ventured there was potential for a drop of 2¢ to 3¢/lb within the September-October time frame, noting that new capacity was being brought onstream by Formosa. Also notable: despite an 11% increase in demand for the first half of the year, demand had been winding down. She also notes that domestic suppliers continued to have an advantage in exports as global PVC prices were much higher.

Todd reports that some resin buyers saw no contributing factors to pushing prices higher, barring a storm. She notes that a key factor in the August price drop was continued weakness in export prices because domestic prices often fall following lowered export prices. She also said Formosa has announced that it would not be exporting PVC in September as it had in previous months due to a planned turnaround at its Point Comfort, Texas, plant along with unplanned production issues.

PET Prices Flat, Then Down

PET prices remained flat in August for the third consecutive month, after May’s 1-1.5¢/lb drop, and had the potential to fall by 1-2¢/lb within the September-October time frame, according to RTi’s Mekaru. This in accordance with forecasts of lower raw material formulation costs. Despite some earlier force majeure actions, he characterizes domestic supply as ample along with competitively priced imports.

ABS Prices Flat, Then Down

ABS prices remained largely flat through most of the third quarter, and going into fourth quarter there was potential for a decrease of 3-5¢/lb, according to Mark Kallman, RTi’s vice president of PVC, PET and engineering resins. This was due to a combination of relatively stable feedstock costs, following a spike in the second quarter that resulted in ABS increases of 4-5¢/lb, and potential competition from well-priced imports. Kallman characterized overall demand as steady, similar to third quarter 2023.

PC Prices Flat to Down

Polycarbonate prices were flat to up by 5¢/lb, in some cases, for third-quarter contracts but going into fourth quarter, contract prices had the potential to be flat, if not down, by 5¢/lb, due to forecasts of lower feedstock costs, according RTi’s Kallman. Other key factors include static demand and a well-supplied market, including economically priced imports. Due to major new PC capacity brought on by China, SABIC has shut down one PC plant in Europe, and Trinseo is scheduled to shut down another by year’s end.

Prices of Nylon 6, 66 Flat

Prices of nylon 6 were flat through most of third quarter, following second quarter increases of 7-9¢/lb. Moreover, going into the fourth quarter, flat pricing was likely to continue based on generally stable feedstock costs, according to RTi’s Mekaru. He characterized demand as relatively soft with plenty of supply. This despite a force majeure by BASF.

Prices of nylon 66 were stable through third quarter, following second quarter price hikes of 5-7¢/lb, according to RTi’s Kallman. He ventures prices would continue largely flat with potential for some decrease in fourth quarter, owing largely to projected flat-to-lower feedstock costs. He saw demand as relatively steady, despite typical slowdown in the automotive sector in the summer months.

Related Content

Prices of Volume Resins Generally Flat or Lower

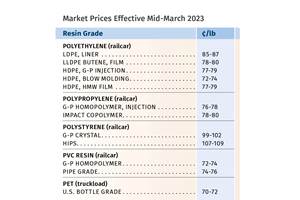

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreCommodity Resin Prices Flat to Lower

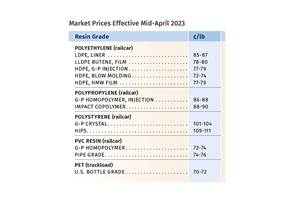

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePP Prices May Plunge, Others Are Mostly Flat

PP prices appear on the verge a major downward trajectory, with some potential of a modest downward path for others.

Read MoreRead Next

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MorePrices of PE, PP, PVC Up; PS, PET Flat

While prices moved up for three of the five commodity resins, there was potential for a flat trajectory for the rest of the third quarter.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read More