Commodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

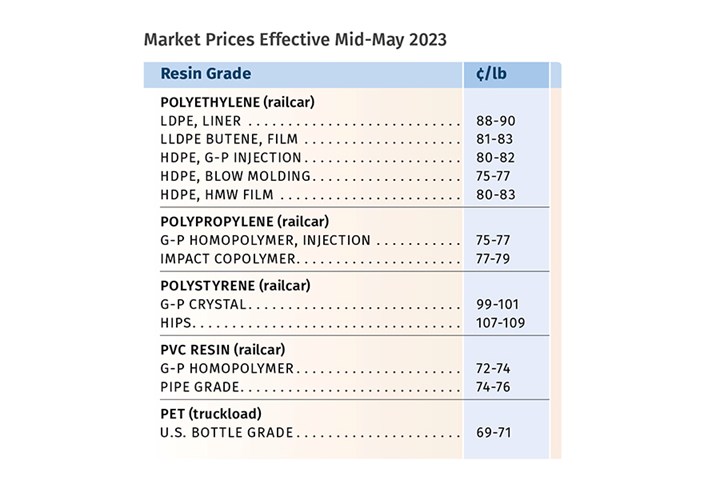

Heading into May, the price trajectory for commodity resins was projected to be largely downward, with PP expected to face a double-digit correction and more modest declines for other volume resins. These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. for polyolefins at distributor/compounder Spartan Polymers. Their predictions, of course, do not account for any unforeseen major production disruptions or a spike in crude oil and natural gas prices.

Addressing polyolefins, in particular, The Plastics Exchange’s Greenberg summed it up this way: “This weaker price direction comes amid looser availability for both major resin groups (PE and PP) as producers contend with plentiful inventories that regrew in the first quarter, making the impact of current force majeures – four for PE and two for PP – pretty much irrelevant.”

PE Prices Up, Then Flat-to-Down

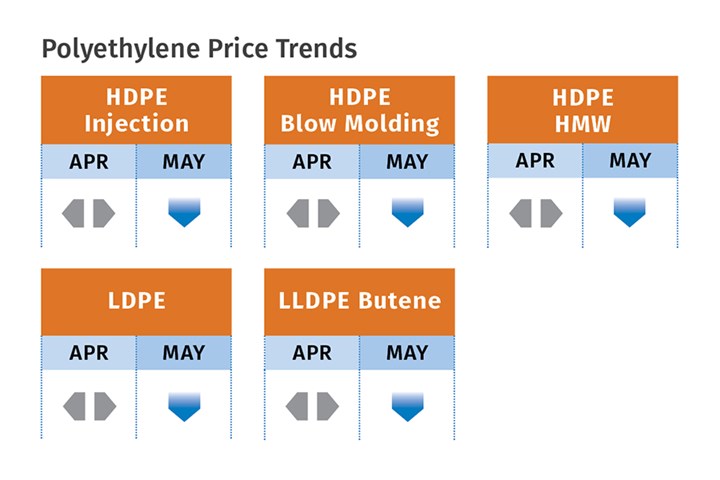

Polyethylene prices in March rose unexpectedly by 3¢/lb, with suppliers attributing the move to a combination of increased demand and force majeure actions, according to Greenberg; David Barry, PCW’s associate director for PE, PP and PS; and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets. Greenberg noted that while suppliers were announcing increases of 5¢/lb for April, the market would likely remain flat, “holding onto the 6¢/lb increase implemented during the first quarter, which includes 3¢/lb that somehow managed to take hold in March.”

These sources noted that suppliers had increased plant operating rates to 90%, even while supply inventories mounted by triple digits and domestic demand rose only 1%. Chesshier saw April prices staying flat with a potential drop in prices in May-June. “There is no cost -push for suppliers in making PE; and based on supply/demand fundamentals, prices ought to come down,” she commented. Barry ventured that prices would be flat in May and could drop in June. He noted that demand in some market sectors, like HDPE pipe, fared better than others, while demand for stretch film was estimated to be off by about 10% year-over-year. Though demand for food packaging has been steady versus 2022, it is still “a stark departure from robust double-digit growth in recent years,” he said.

These sources also noted that new capacity from Baystar and Nova Chemicals would also make an impact on the market, even though the Shell Polymers Monaca 3.5 billion lb/yr HDPE/LLDPE capacity was reported to be completely shut down until the third quarter. One of the three PE units, a slurry process HDPE blow molding line, was not expected to restart until first-quarter 2024. Among the reasons reported were cracker issues restricting production of on-spec ethylene monomer. Barry said this had made the spot PE market a bit tighter.

PP Tabs Begin Major Correction

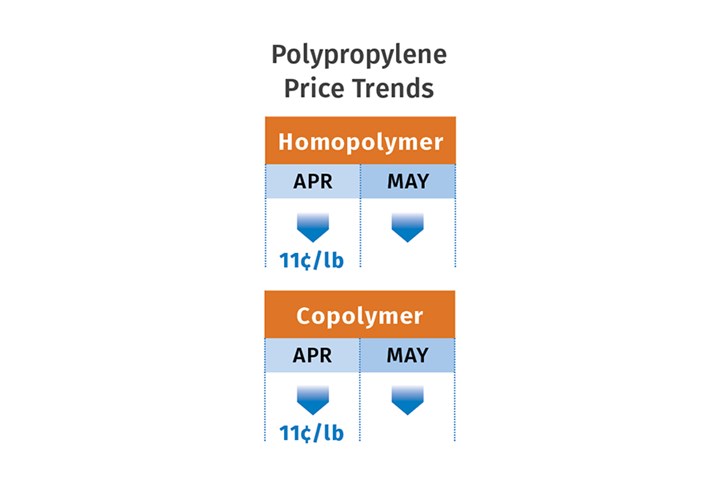

Polypropylene prices in April signaled the beginning of a big downward correction, after rising another 8¢/lb in March, in step with propylene monomer, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. These sources expected PP contract prices to drop by 11¢/lb in step with April monomer contract prices. Initial projections for May were for another 5¢ to 7¢ drop. Two suppliers had issued 3¢ and 6¢/lb “non-monomer” (i.e., profit-margin) increases for May, which were expected to go nowhere.

Both Newell and Barry ventured that April was just the start of a PP contract-price correction and that it would take a bit more time than a drop in spot-market prices. They also noted that the gap between contract and secondary market prices was very wide — 15¢/lb or more.

All three sources referred to preliminary data from the American Chemistry Council (ACC), which showed March PP operating rates to be 6% lower than February on a daily output basis, and March PP sales to be lower again on a daily average basis, resulting in an accumulation of just over 50 million/lb of supplier inventory.

Newell noted that the current 42.7 days of inventory was one of the highest levels in over a decade, compared with 32 to 34 days for a balanced market. Barry reported that PP exports were gradually seeing more activity, but some resin suppliers did not think it worthwhile to sell prime resin in the low 30¢/lb and low 40¢/lb range needed to gain offshore interest. Greenberg characterized spot PP activity as good, with more interest in copolymer than homopolymer, and prices dropping as they got a head start on the anticipated decline.

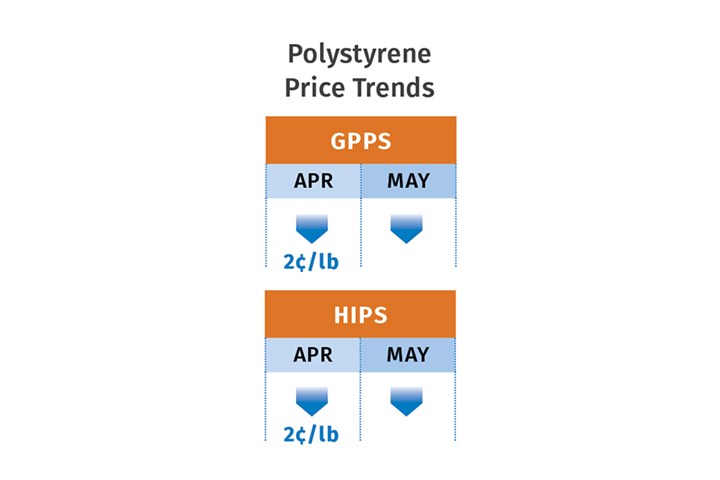

PS Prices Up, Then Down

Polystyrene prices in March moved up by 2¢/lb and then dropped the same amount in April in step with benzene contract settlements. However, benzene spot prices were on the rise — 20¢/gal above April contract levels – along with an 8% rise in crude-oil prices, which was likely to lead to a May PS contract price increase, according to PCW’s Barry and RTi’s Chesshier. Barry confirmed that at least one supplier had nominated a 4¢/lb price hike for May, but that implied styrene costs based on a 30% ethylene/70% benzene formula were down more than 3¢/lb at April’s end as spot benzene values dropped sharply.

Noted Chesshier, “Supply is outpacing demand since the seasonal PS demand has yet to materialize — partially due to conversion to other plastics or paper and the impact of lower-priced PS imports.” Moreover, production rates were increased by suppliers to about 70% capacity utilization from the low of mid-50% level, which reportedly resulted in supplier inventory buildup. Chesshier ventured that the likelihood of a decrease in PS prices in May-June was favorable as benzene prices typically fall during this period and benzene imports were increasing. Barry noted that demand remained weak and “suppliers saw little chance of stimulating additional sales by lowering prices more aggressively.” He characterized the spot market as having limited buying interest and flat-to-lower prices.

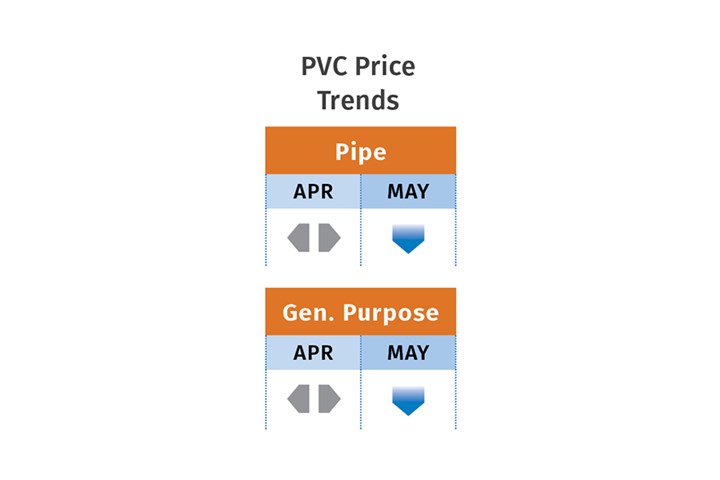

PVC Prices Flat to Lower

PVC prices moved remained flat in March-April, though three suppliers issued increases of 4¢ to 5¢/lb, according to Paul Pavlov, RTi’s v.p. of PP and PVC, and PCW senior editor Donna Todd. Pavlov ventured that prices for the May-June period could continue flat but had the potential to drop by 2¢ to 5¢/lb.

Todd reported, “While there have been no official announcements that the April price increase has been rescinded, the fact that one supplier (OxyVinyls) never supported it, and the continued erosion of export prices, plus a market forecast of flat pricing for April, have pretty much sounded its death knell.” She noted that buyers would resist any increase, barring a major supply disruption. Both sources characterized demand as sluggish.

Pavlov noted that first-quarter demand showed an uptick month-to-month, primarily due to exports, but demand year-to-year was down more than 15% for PVC pipe and more than 20% for all other PVC market sectors.

PET Tabs Modestly Lower

PET prices dropped by 1¢/lb in April in step with feedstock costs paraxylene/PTA and MEG. Prices for May-June were likely to be flat to fractionally lower, according to Mark Kallman, RTi’s v.p. of PVC, PET and engineering resins. He characterized demand as slowed, with plenty of domestic supply and continued good availability of imports that are typically lower in cost and now benefit from improved transit logistics.

Related Content

Flexible-Film Processor Optimizes All-PE Food Packaging

Tobe Packaging’s breakthrough was to create its Ecolefin PE multilayer film that could be applied with a specialized barrier coating.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More