Prices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Heading toward the second quarter, the trajectory of prices for all volume resins looked to be flat-to-down. This was despite upward movement of PP and PS prices, attributed solely to higher feedstock costs due to supply constraints, and some slight increases in PVC and PET tabs, again mostly linked to feedstock costs. The downward trend for ABS, PC and nylons looked to be even somewhat stronger. Lackluster domestic and global demand was the key driver, along with generally ample resin supplies and, in some cases, lower feedstock costs and lower-priced imports. Generally, industry projections were for a better second half of 2023, which could bring firming of resin prices.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

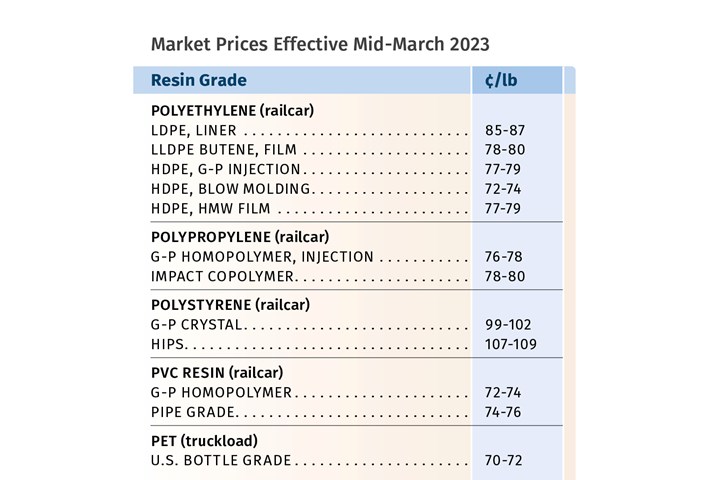

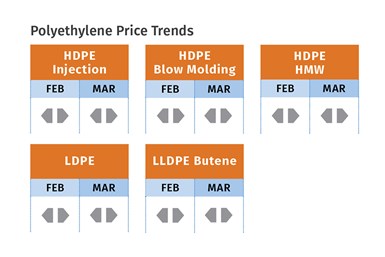

Flat PE Prices Ahead

Polyethylene prices moved up 3¢/lb in January and suppliers were aiming to implement further price hikes. They adjusted their February increases down to 3¢/lb from a previous 4¢ to 5¢lb, and then issued new increases of 3¢ to 5¢/lb. The latter amount appeared to come from at least one supplier that called for a 5¢/lb increase for HDPE and 3¢/lb for LL/LDPE. This stemmed from several unplanned HDPE production disruptions, according to David Barry, PCW’s associate director for PE, PP, and PS; as well as Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets; and The Plastic Exchange’s Greenberg.

RTi’s Chesshier saw no market fundamentals supporting the “shocking” implementation of the January increases, given slowed domestic demand, flat-to-lower feedstock prices, and a buildup of supplier inventories. Similarly, PCW’s Barry thought the February-March increases did not appear to have much connection to market fundamentals: “I feel that there’s too much discounted resin activity in the spot market.”

Moreover, while HDPE supply may have tightened — particularly for bimodal HDPE and HMW-HDPE — Barry did not hear of domestic buyers having difficulty getting material, and expected PE prices to be relatively flat for the next few months, with very little chance of any increase being implemented in March or April. All three sources noted that new capacity from Shell and SABIC was becoming a factor in the market.

Greenberg said preliminary January resin data from the American Chemistry Council (ACC) showed that production and inventory levels for both PE and PP bounced back strongly, along with some improvement in domestic sales and still solid exports. But he noted, “Production for both PE and PP recovered more than sales and led to inventory builds for both resin groups.”

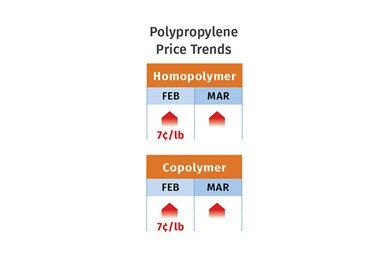

PP Prices May Turn Downward

Polypropylene prices in February rose 7¢/lb, in step with propylene monomer, which settled at 50¢/lb, after both moved up 11¢/lb in January, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. Meanwhile, suppliers were still holding out for increases of 3¢ to 6¢/lb going into March, in addition to any monomer change. Newell considered it more likely that PP prices generally would follow monomer price swings this year, noting that the “margin increases” gained by PP suppliers last year are pretty much a dead issue. Still, he and Barry ventured that some further price increases — most likely smaller than the January-February increases — related to monomer supply tightness were possible for March.

Barry noted that while PP production rates have risen to about 80% of capacity, that is still nowhere close to the typical utilization rates of recent years — in the low-to-mid 90s. He and Newell ventured that this month the PP market could potentially start to correct, ending this upward pricing trend, which was not supported by supply/demand fundamentals. They saw monomer price volatility stopping after March, particularly as two major new monomer units would be up and running. Newell predicted a quick reversal in the PP pricing trajectory.

Greenberg reported, “Even though there will be another sizable cost-push price increase implemented for February PP contracts, neither spot demand nor pricing have kept up with the pace, so we are seeing some compression in spot margins. We imagine that downstream resin and finished-goods inventories are dwindling, but processors still complain of slow consumer demand and they seem to be holding out on their resin restocking orders until this cost-push rally subsides. Time will tell which side blinks first.”

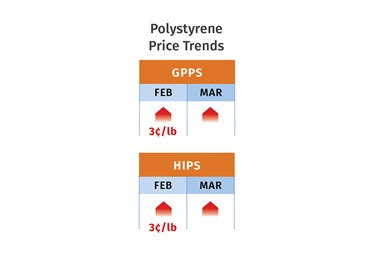

PS Prices Up

Polystyrene prices in February moved up by 3¢/lb, in direct response to the higher benzene contract price of $3.58/gal. Meanwhile, spot benzene prices were climbing to as much as $3.80/gal by month’s end due to tight domestic supply and low volume of imports, according to PCW’s Barry and RTi’s Chesshier. Moreover, March benzene contracts settled upward to $3.78/gal, an increase that would translate into 2¢/lb higher cost to produce PS resin, according to Barry. At press time, one major supplier had issued a 3¢/lb hike for March 1.

Chesshier said the emergence of another price increase on the order of 3¢ to 5¢/lb for March-April was not unlikely, based solely on elevated benzene prices, despite prices of other key feedstocks — ethylene and styrene monomer — remaining largely flat. Barry noted that while demand remained slow, there were expectations of some improvement heading into the busier summer season for food-service applications. Chesshier noted that resin capacity utilization moved up a bit in the first quarter to about 50% (typical production rates are in the low 70s), owing to PS exports, up 80% in early 2023, to volumes not seen in quite a long time.

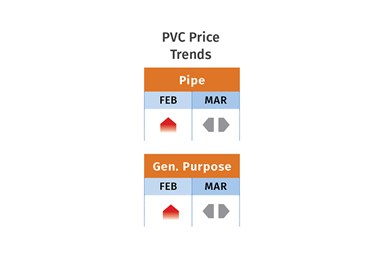

PVC Prices Flat to Higher

PVC prices rose 1¢/lb in January, while suppliers came out with a split Jan.-Feb. hike of 1¢ and 5¢, respectively, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Kallman thought prices would move up a bit in February, but that market fundamentals did not support a 4¢ to 5¢ increase. And for March-April he projected mostly flat pricing as supply of both feedstocks and PVC resin would improve. “Suppliers saw an increase in both exports and domestic demand, which led to production rates being raised from the low 70s to 80%,” Kallman said.

Looking forward to the second quarter, Todd reported that PVC prices were forecasted to rise 2¢/lb in April, be flat for May and then increase by 1¢/lb for June. “PVC prices were not being lifted by strong demand and rising monomer costs. Instead, demand in the domestic market has been lackluster during the first quarter as pipe converters faced the headwind of significant downstream inventories.”

PET Tabs Flat to Slightly Lower

PET prices moved down about 1¢/lb in January and were expected to settle flat or fractionally lower in February and the same in March-April, according to RTi’s Kallman. This was based on feedstock costs, continued slow domestic demand and well-priced imports. “The market is static as we see an improvement in production of both paraxylene/PTA and MEG feedstock components going into second quarter.”

ABS Prices Continue Their Slide

ABS prices dropped 5¢ to 10¢/b in the first quarter, having fallen 20¢ to 30¢/lb in the third quarter and another 10¢ to 15¢/lb in the fourth quarter of 2022, according to RTi’s Kallman. He noted, “Demand is still slow in key markets like automotive and construction, and attractively-priced Asian imports are coming in.” He predicted flat-to-lower prices in March-April, barring any major uptick in prices of key feedstocks such as benzene and propylene, though no such issues were projected as supply improved.

PC Prices Flat to Lower

Polycarbonate prices dropped 5¢ to 10¢/lb in December-January, after slipping 10¢/lb in third-quarter 2022, according to RTi’s Kallman. He expected PC pricing to be flat to lower by the end of March, based on ample domestic supply and well-priced imports, with continued slow demand in all key markets and a projected softness in prices of key feedstocks benzene and propylene, as supply improved.

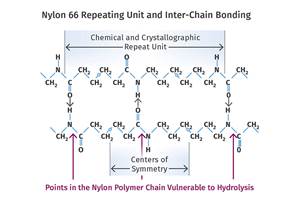

Prices of Nylon 6, 66 Head Lower

Nylon 6 prices dropped in the first quarter by another 5¢ to 10¢/lb, for a decline of 30¢ to as much as 50¢/lb since August 2022, depending on the supplier and grade, according to RTi’s Chesshier. She said that despite a typical pickup in demand during a second quarter, the current economic outlook pointed to flat-to-down. Chesshier noted that the contributing factors included continued slowed demand in all key markets, lower feedstock costs and the continued inflow of Asian imports priced 20% to 30% below domestic material.

Nylon 66 prices dropped another 5¢ to 10¢/lb in the first quarter for both resins and compounds, following 15¢ to 30¢/lb lower prices (with compounds on the lower end) during the third and fourth quarters of 2022, according to RTi’s Kallman. He expected a similar trajectory in the second quarter or even longer due to slowed demand in markets such as automotive, construction and appliances. Still, he noted that the industry was hoping for an improved second half with prices firming up but not to the levels of 2022.

Related Content

General Polymers Thermoplastics to Further Expand Distribution Business

NPE2024: Following the company’s recent partnership buyout, new North American geographic territories are in its sight.

Read MoreTracing the History of Polymeric Materials, Part 26: High-Performance Thermoplastics

The majority of the polymers that today we rely on for outstanding performance — such as polysulfone, polyethersulfone, polyphenylsulfone and PPS — were introduced in the period between 1965 and 1985. Here’s how they entered your toolbox of engineering of materials.

Read MoreWhat is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MoreScaling Up Sustainable Solutions for Fiber Reinforced Composite Materials

Oak Ridge National Laboratory's Sustainable Manufacturing Technologies Group helps industrial partners tackle the sustainability challenges presented by fiber-reinforced composite materials.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More