Foam PP to Improve Sustainability and Cost

Cost-effective use of PP is a major consideration, but the biggest driver of PP foaming is pursuit of sustainability.

PP foams are making inroads in automotive and packaging to boost lightweighting and sustainability. (Photo: Avient)

Foaming of polypropylene has been gaining significant traction over the last several years, starting with extruded PP foam and joined increasingly by injection and blow molded foam. Leading markets are automotive and packaging, followed by building and construction, consumer products and industrial goods. Cost-performance is a major incentive, especially during the last couple of years that have seen domestic PP prices outpace global prices due to supply constraints amid strong demand. However, a more important factor in heightened demand for foamed PP is meeting sustainability initiatives and mandates by simply using less resin and by providing an alternative to PS and EPS, which are sometimes perceived as less “eco-friendly.”.

Lightweighting in automotive is gaining even further traction with the industry’s focus on electrical vehicles (EVs) and is expected to contribute to foamed PP growth. Ditto for packaging, driven by sustainability initiatives. Enabling foam’s growth prospects are recent technological advances in physical and chemical foaming—and sometimes a combination of both. For example, Trexel, a leader in physical foam molding with its MuCell direct gas injection process has made further improvements to its technology within the last three years that allows thin-wall molding to levels not previously possible.

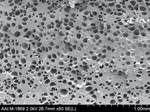

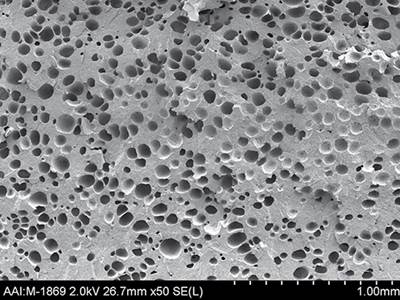

Similarly, iD Additives, Avient and Trexel are among chemical foaming agent (CFA) suppliers that have introduced formulations that produce microcellular foams with very small cell size, uniform distribution and excellent aesthetics. In addition, PP resin suppliers such as SABIC and Asahi Kasei Plastics have introduced grades with superior melt strength, specifically for extruded or molded PP foam structures, as well as specialty reinforced compounds specially suited to foaming. Sources at another leading PP resin supplier, Borealis, noted that the company is committed to supporting the further development of the extruded foam market through it Daploy (High Melt Strength) HMS-PP products and by offering PP foam solutions. The company was a pioneer in bringing high melt strength PP to commercial fruition, specifically aimed at developing the PP foam market.

“Parts that have been molded in solid need to be requalified when foamed.”

A 2018 study from market-research firm Markets & Markets projected the global extruded PP foam market to grow nearly 7% annually to 2023. Sources at SABIC’s global Foam & Lightweight business noted that their ultra-melt-strength PP was developed to support the extrusion process in automotive, construction and packaging, but they see opportunities in new injection and blow molded applications where light weight and sustainability are imperatives.

“New legislation for packaging is also a key growth driver to substitute current solutions with PP-based foam,” notes one source. Craig Sibol, product manager for Avient’s additives business, says his firm sees foam PP growth in the low double digits, but mainly in injection molding. “PP supply issues have more affected foamed extrusion applications in sectors such as building and construction, so growth there is constrained.”

Todd Glogovsky, executive v.p. of sales and technology at Asahi Kasei Plastics North America, puts it this way: “Foaming and thin-walling are continuously being evaluated to improve costs, weight and production cycle efficiency. Customers will always evaluate all options to reduce weight. Lightweighting options are constantly reviewed against one another, and the option with the largest impact on cost savings and performance upgrades will be selected.”

Notes Nick Sotos, president of iD Additives, “This year, when PP prices started to spike up, we started getting requests for samples of our foaming agents. There was so much activity that we decided to do a Zoom chat called ‘Foam It or Fill It’ to tell people about ways to help mitigate the rising resin costs. That goes back to when I started iD Additives and hired Ron Bishop, who told me that there are two ways to cut costs: ‘You can foam it or fill it.’”

“There are two ways to cut costs: You can foam it or fill it.”

Trexel president Brian Bechard comments that his company has not yet seen significant evidence of rising PP prices driving molders to foaming, because with MuCell, and to a lesser extent with CFA, it takes considerable time and commitment to realize a commercial success producing a foamed part. “Parts that have been molded in solid need to be requalified when foamed. Often this necessitates some tweaking of part design to get the physical properties to meet requirements,” states Bechard. “With MuCell, there is equipment sourcing or modification as well. These tend to not be the obvious fixes to short-term resin-price fluctuation. Now, if resin prices are rising and the general consensus is that they will continue to rise, then the economics of foaming become more attractive, and naturally this will drive more customers to us.”

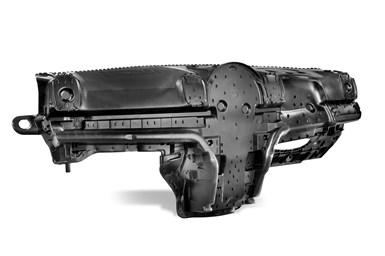

The SPE Automotive award-winning instrument panel carrier was made with SABIC’s long-glass Stamax PP and a foaming process with core-back technology to cut weight by 15%.

Trends in Automotive

Sources at SABIC’s global automotive business note that foamed PP compounds have been used in automotive for nearly two decades for reducing part weight, both from foaming itself and from the ability to create thinner parts. An active player in this space, SABIC won an SPE Automotive Innovation Award in 2017 for the instrument-panel (IP) carrier of the 2017 Mini Countryman, which used SABIC’s long-glass Stamax PP compound and a foaming process with core-back technology to cut weight by about 15% vs. the unfoamed part.

But until fairly recently, foamed PP applications were restricted primarily to structural, non-visible applications due to poor surface quality, according to the SABIC team. Demand for lightweight, aesthetic interior parts, plus strong interest in reducing cycle times, material usage and costs, sparked efforts to develop next-generation PP foam materials with a higher-quality surface finish. Lightweighting in automotive interior aesthetic components is part of the megatrend to reduce fuel consumption and emissions.

Until recently, applications for foamed PP compounds have been restricted to structural, non-visible applications.

Said one SABIC Automotive source, “The sharp increase in electric vehicle production is contributing to this trend, as EV weight is tied to efficiency and range. Foamed PP compounds can make an important contribution and can help achieve applications with lower density that are 8% to 10% lighter. In addition, the higher flow of foamed PP can enable thinner parts and greater design freedom that can lower weight even more.” SABIC estimates that these factors taken together have potential for reducing part weight by 20% to 25% vs. a non-foamed part.

In recent years, SABIC has focused on producing a portfolio of foamable PP compounds that can contribute to weight savings while delivering excellent surface aesthetics. One key improvement is the minimization of surface streaks and defects and a second is the potential avoidance of sink marks, even in thin-wall parts. Typically, interior parts are designed with walls up to 3 mm thick, not for structural or stiffness purposes, but because thicker walls reduce the likelihood of sinks. Foaming creates sufficient internal pressure within the molded part to offset excessive shrinkage and reduce sink marks. According to the SABIC Automotive team, optimized design and processing are key to extracting the full value of PP foam materials, including maximum weight reduction. Their next step is to further enhance the technology’s aesthetics for use in exterior applications.

After significant industry experience with MuCell foaming of filled PP for automotive parts such as IPs, door panels and underhood housings/covers, Trexel’s Bechard says there is now increased activity in foaming unfilled PP for automotive and packaging. Interior visible automotive parts is one market where Trexel’s TecoCell CFA has been recognized for producing excellent surface finishes through chemical foaming. “We have several visible class-A auto interior parts that are soon to be commercial using TecoCell, as this CFA is quite unique in its ability to provide a class-A surface finish.”

Although foamed PP has been used primarily in non-Class-A, nonstructural areas such as underhood components like battery bases and covers, Glogovsky says Asahi Kasei Plastics is aiming to expand into semi-structural applications. A potential future example of that is floor consoles, he notes. Some existing applications include map pockets, headliners, and some lower interior-trim parts.”

Sources at Borealis point out that the entire range of Daploy HMS-PP are long chain branched materials which combine high melt strength and extensibility in the melt phase. Moreover, these materials can be blended with the full range of standard PP extrusion grades and other polyolefin-based materials. As such, they offer the opportunity to widely tailor the foam properties to meet the particular demands of end-use applications in automotive as well as packaging, and building and construction.

Avient’s Sibol notes that automotive potential for PP foam continues to be strong due to the focus on lightweighting, and even more so now that CAFE standards are on the agenda of the current U.S. administration. Transportation segments beyond automotive are also seeing good growth. Most of the foamed PP uses on which Avient has focused are in injection molding, such as large automotive components and certain packaging applications. Still, its CFAs are used both as the lightweighting agent in injection molding and as the nucleating agent in extrusion with direct gas injection, to create a finer foam structure.

Trexel’s second targeted area of growth for unfilled PP is thin-wall packaging applications, as MuCell enhances the material’s ability to flow freely and fill thinner parts molded on the same size press.

Growth in Packaging

Trexel’s second targeted area of growth for unfilled PP is thin-wall packaging applications like containers, cups, bowls, lids, and spouts. Says Bechard, “With MuCell, we enhance the material’s ability to flow freely, and this enables thinner parts to be molded on the same size equipment. We are working closely with several brand owners and large packaging molders toward bringing commercial products to the market using this technology.” He noted that at the latest Chinaplas, Chinese injection machine builder Yizumi (parent of Yizumi HPM in the U.S.) used MuCell to mold a bowl that achieved a 5% weight reduction, 15% lower injection pressure, and 20% clamp-tonnage reduction vs. solid molding. Similar results were achieved with a butter container at the last K show.

Sources at SABIC’s Foam & Lightweight business, are seeing increased demand for foamed PP in E-commerce returnable boxes and pallets, food packaging, and protective packaging. SABIC launched its PP-UMS (ultra-melt-strength) material at the end of 2017. Said a team source, “Developing the market and the applications takes time. Especially in the foaming industry, which can be quite conservative. Growth has been taking place since then, but it was definitely boosted in 2020 and is still continuing in 2021.”

Sotos from iD Additives says a big foamed PP market for his company has been industrial packaging like gaylords and pallets “We have also gotten into blow molded bottles and caps & closures with our microcellular Micro Fine Cell Foaming Agents.”

Asahi Kasei’s Glogovsky sees potential for expansion into the packaging market, specifically for dunnage because of its thick walls, leaving room for cycle-time improvement. “For parts with a thick section, the molding process is very long due to the cooling time required to remove heat. With foaming, the time for cooling will be shorter because the material mass will be reduced. This could save from 5% to 35% of cycle time.”

Borealis sources note that Daploy HMS-PP resins and their blends are not crosslinked. This means that resultant extruded PP foams are fully recyclable, an increasingly important factor in the packaging and other industry segment of the plastics industry.

iD Additives’ Ron Bishop (r.) and a molding technician examine foam made with new Micro Fine Cell CFA.

Building/Construction and Other Applications

Sotos sees plastic lumber as an obvious candidate for PP foam, but his firm has also done some work on parts for roofing and other related applications, such as tool boxes and levels for construction.

Structural foams and pre-fabricated building components such as insulation for houses, pipes, and floor underlayment, are applications pursued by SABIC’s Foam & Lightweight team. Asahi Kasei’s Glogovsky doesn’t see lightweighting as a critical driver in this market, other than as it affects shipping costs. “If applications are expanded into the building and construction markets, the reasoning will most likely be for cost reduction resulting from lower material usage and cycle time.”

Meanwhile, Glogovsky views consumer and healthcare applications as possibilities for foam PP on a case-by-case basis, depending on the possibility of cycle-time improvement. Bechard notes that Trexel is working with a major household products company that is exploring the use of the company’s TecoCell CFA to reduce the cost and resin consumption across its product line. And ID Additives has worked with a number of companies on consumer goods such as foamed PP plastic hangers. And niche applications such as footwear are cited by SABIC’s Foam & Lightweight team.

Asahi Kasei’s Thermylene short-glass reinforced, chemically-coupled PP has been used in foamed sunroof modules to replace unfoamed long-glass/PP. (Photo: SPE Automotive)reinforced PP.

Latest Advances

SABIC’s automotive team will launch a new portfolio of foamed PP compounds for aesthetic auto interior applications by early 2022. Three initial compounds are said to demonstrate improved surface finish for such parts.

Asahi Kasei has developed materials for foaming that provide improved cosmetics and lightweighting. These technologies include Thermylene short-glass reinforced, chemically coupled PP, which has been used in foamed sunroof modules, where it was able to replace more expensive unfoamed long-glass PP, and has been touted for providing good cosmetics.

iD Additives’ Sotos says the launch of its Micro Fine Cell CFAs has been a game changer for the company as it has allowed it to target thinner-wall applications.

In a similar vein, at NPE2018, Trexel launched the MuCell P-Series gas system designed specifically for fast-cycle, thin-wall packaging solutions. According to Bechard, “Since then, we have greatly increased our flexibility in implementing MuCell by offering screw-tip dosing, where we manage the gas introduction and mixing in a shorter area, which enables us to equip standard screws with a special screw tip for dosing gas. This is particularly important for packaging applications where output is paramount, as this design doesn’t limit plasticating output like our traditional screw design does.”

Trexel has also recently complemented its satellite-based dosing units with a low-cost, powerful line of central gas boosters, which provides molders who will run several machines using MuCell a flexible and low-cost implementation option.

According to Sibol, Avient’s expanded portfolio of liquid and solid CFAs and testing support can assist customers that are looking to stretch the limits of lightweighting while maintaining mechanical properties, particularly for technical parts. “Smaller cell size and the ability to manipulate the aesthetics of the surface are important, but we’re also able to manipulate surface properties. We have developed technology that enables paint and/or decal stickers without corona or other surface treatment. Customer studies show that we can improve efficiencies as well. For example, at times, liquid CFA pumped in at the press makes more sense based on the operations and investment that would be required to implement solid CFAs.”

SABIC’s Foam & Lightweight team touts its PP-UMS as a next-generation high-melt-strength foamable PP. With a melt strength of more than 65 cN, it has been shown to create good foamability, especially if high expansion ratios are required. It is being commercially applied to automotive, packaging (including food containers as an alternative to EPS), and building/construction.

SABIC’s PP-UMS can produce foamed food containers that can replace EPS.

Related Content

Polyethylene Fundamentals – Part 4: Failed HDPE Case Study

Injection molders of small fuel tanks learned the hard way that a very small difference in density — 0.6% — could make a large difference in PE stress-crack resistance.

Read MoreThe Fundamentals of Polyethylene – Part 2: Density and Molecular Weight

PE properties can be adjusted either by changing the molecular weight or by altering the density. While this increases the possible combinations of properties, it also requires that the specification for the material be precise.

Read MorePrices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

Trexel Adds Chemical Foaming Agent to Its Product Line

Special additive offers economical microcellular foaming for low-volume jobs with PE, PP.

Read MorePP Formulations for Smooth-Surface Foam

Collaboration produces 10%-glass PP for the MuCell foam process without surface swirl.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More