Fuel Cells Jolt Plastics Innovation

Optimists view fuel-cell vehicles and power appliances as a coming bonanza for plastics processors. They see potential demand for billions of pounds of thermosets and engineering thermoplastics in plates, membranes, manifolds, pumps, plumbing, and more. But molding challenges and cost hurdles mean success won’t come easily.

Interest in proton-exchange membrane (PEM) fuel cells was already strong before it got an extra charge from the recent terror attacks on the U.S. The Sept. 11 events prompted a quick rise in the value of shares of PEM fuel-cell makers like Plug Power in Latham, N.Y., and Canada’s Ballard Power Systems in Burnaby, B.C. At a moment when future oil supplies were open to doubt, the tragedy highlighted the potential of fuel cells as a clean, renewable energy source (see sidebar).

Yet plastics’ potential in fuel cells was already spurring development by a handful of pioneers before the crisis. For decades, polymer membranes have played a crucial role in fuel cells for small-scale uses such as space craft. Plastics figure even more prominently in fuel-cell prototypes now in development for mass-produced consumer products.

The biggest opportunity for plastics in fuel cells is in functional components of the fuel stack and peripheral systems for fuel-cell vehicles and stationary power plants. Thermoset compression molders are pressing developments of plastic fuel-stack components, notably bipolar plates (which conduct current), end plates (which support fuel-cell stacks), and seals (which prevent escape of gases from the stack). Driving this effort are compounders like Bulk Molding Compounds Inc. (BMCI) and Quantum Composites (a Premix subsidiary), as well as several suppliers of compression and injection molding equipment.

Some thermoplastics suppliers hope to see their engineering resins replace thermosets in fuel-cell plates, and are grooming products for roles in the support systems of fuel-cell devices. But others are skeptical: One remarks that fuel-cell OEMs aren’t interested in any plastic that costs more than a dollar a pound.

Ticona, for one, is upbeat about prospects for thermoplastics in fuel cells. “They promise low-cost, mass produced components,” says Ami El Agizy, the company’s fuel-cell market development manager, who views cost reduction as critical to success. Until now, commercial inroads by fuel cells have been blocked by their high cost, but some initial introductions of residential and portable power units are expected in early 2002.

Eric Sattler, new-business manager at DSM Engineering Plastics, is equally optimistic. “For fuel cells to penetrate markets, the OEMs will have to draw on materials that increase design freedom and facilitate manufacturability and cost reduction.” He adds, “The finger points to thermoplastics.”

Forecasts of future demand for fuel cells are highly speculative, but discussions with various sources make it clear that the long-term potential for plastics is considerable. Poundage consumption would depend on the specific end-market and device sizes, but average fuel-cell stacks are likely to contain around 100 lb of plastic in bipolar plates and 50 lb in end plates. Peripherals would add at least another 50 lb per fuel-cell unit and perhaps more. In short, every million fuel cells sold could generate demand for at least 200 million lb of plastics.

A smaller and more specialized plastics opportunity in fuel cells is the membrane. The dominant membrane material in current fuel-cell designs is DuPont’s Nafion, an engineered film of polyperfluorosulfonic acid. Improved versions of Nafion and alternatives to it from Celanese (parent of Ticona), Victrex, and Dow Plastics will be the subject of a story in next month’s issue.

Inside the stack

In fuel-cell stacks, bipolar plates serve as both anode for one cell and cathode for the adjoining cell. They are flat, thin (under 0.125 in.), and rectangular (2 x 3 to 12 x 18 in.). What makes them challenging to mold are the 1-mm-wide flow channels machined or molded into each side to ensure uniform distribution of fuel. Until recently, most plates were machined out of graphite or compression molded blanks of filled PVDF fluoropolymer. Graphite is highly conductive but also brittle and expensive. Machining is also relatively costly. On the other hand, compression molded thermoset plates with molded-in channels typically cost only about one-fifth as much as graphite plates.

BMCI and Quantum have developed plate-molding compounds incorporating 70-90% by weight graphite powder in a vinyl ester matrix. The latest version of BMCI’s compression moldable bipolar-plate compound, BMC 940-8596, has the stiffness, toughness, tensile strength, chemical resistance, compressive creep resistance, and heat resistance to survive the 80 C operating temperatures and acidity of fuel-cell environments (Table 1).

The compound reportedly also has the homogeneous distribution of graphite needed to balance in-plane (X-Y) and through-plane (Z) conductivity. Its through-plane conductivity now stands at 70 Siemens/linear cm, up from 26 S/cm in the initial version developed a year ago. “The key is to get the highest possible graphite loading while providing flow necessary to mold fully densified plates,” says Joseph Carfora, BMCI’s v.p. of business development.

BMCI is also tackling the end plates used to lock numerous cell assemblies into a stack. Two of the 0.5-in.-thick parts are required per stack. “They require stiffness and corrosion and creep resistance sufficient to hold the pressurized stack together,” summarizes Wil Conner, BMCI’s fuel-cell market-development manager. The company’s BMC 845 compound of glass-reinforced vinyl ester reportedly meets those needs and is “seal-friendly” in terms of preventing leaks and emissions.

BMCI’s goal for plate compounds is to eventually reach a price level of $2/lb or less, but that has yet to be achieved. BMCI is also working on formulations that will boost output in compression molding.

Quantum Composites has developed Pemtex vinyl ester bipolar and end-plate compounds for injection and compression molding (Table 2). It currently emphasizes compression molding as more viable than injection molding for the near term. Pemtex molding material is being used by the Premix Molding Group in Ashtabula, Ohio, to make bipolar plates.

Marc Imbrogno, Pemtex product manager, says Quantum’s compression grade offers outstanding flowability and corrosion resistance. He considers the material’s excellent thermal properties significant, since the industry appears to be evolving to fuel cells that operate more efficiently at 120 C or higher.

Beyond mechanical and thermal properties, Imbrogno says materials for bipolar plates must meet subtle performance requirements such as high purity, including elimination of decomposition byproducts from the thermoset curing agent. Another is compatibility with primary and secondary seals that are insert molded to plates.

Vinyl ester may have an edge in fuel-cell plate development, but other materials are still in contention. For instance, an epoxy/ graphite compound has been developed by Cytec Engineered Materials (the former Cytec Fiberite). Versus vinyl ester, epoxy is said to offer higher cost and performance properties. Critics, however, say handling and curing control are issues for epoxies that still need to be addressed.

Fuel Cell Concepts, a start-up compression molder in Warminster, Pa., is exploring use of various thermosets, including phenolics, for bipolar plates. Phenolics are generally lower in cost-performance than vinyl esters and epoxies.

Compression vs. injection

For the moment, compression molding seems to have gained more credibility than injection molding for producing fuel-cell plates. Hull/finmac and C.A. Lawton, both of which supply injection as well as compression molding machinery, are putting their emphasis on compression.

Dan Bellerud, director of marketing at C.A. Lawton, says compression molding currently has the edge because thermoset injection molding of highly loaded graphite compounds can seriously erode injection barrels and screws. Further, metal contamination of the compound can impair a fuel cell’s function. Injection molding shear also tends to degrade the graphite particles that are essential to conductivity, Bellerud says.

Tim Holland, v.p. at tool maker Metro Mold and Design, says compression molding at this time works best for bipolar plates because it achieves better precision and conductivity than injection molding. Metro Mold has developed tool-cutting techniques said to achieve precise depth tolerances in flow grooves.

Nonetheless, industry sources candidly describe today’s graphite-filled vinyl ester BMC compounds as flowing like concrete. “Bipolar plates push the limits of BMC processing,” states BMCI’s Carfora. He says precise control of preform weight is critical to optimizing mold fill and minimizing flash at parting lines. Other sources say dosing control is one area in which injection molding has advantages. They also credit injection with faster cycles and easier automation of the process.

“We’ve found that the keys to bipolar plate molding are dosing accuracy, tooling quality, and ability to control equipment when running highly loaded compounds,” notes Lawton’s Bellerud. One useful practice, he says, is chilling preforms prior to molding. That allows mold filling without premature curing, resulting in excellent flow-channel definition.

Hull/finmac has addressed the need for repeatability, high productivity, and automation with its new line of compression presses and auxiliaries, states v.p. Mark Bahmueller. They are designed to run vinyl esters, phenolics, and epoxies. The advanced unloading system removes cell plates and holds them flat under vacuum after they leave the mold area to improve dimensional stability.

Ferromatik Milacron has demonstrated a thermoset injection molding system for bipolar plates using its Magna 400HP machine with a special screw, barrel, and stuffer developed by Apex Plastics Technologies. Milacron continues to refine the process to achieve levels of conductivity and precision needed to compete in bipolar plates.

Another impediment to injection molding has been getting high enough loadings and the proper alignment of graphite particles in the melt. That is especially important, since the trend is toward ever more conductive plates. This issue is being addressed in several ways. For instance, a Milacron spokesman says better synchronizing of the injection screw and stuffer has allowed more precise tailoring of the alignment of graphite particles.

Quantum’s Imbrogno argues for an eventual shift to injection molding of fuel-cell plates. He notes the inherent advantages of a closed-mold process that operates unattended around the clock. Injection molded prototype plates are comparable to compression molded versions in flatness and parallelism, he states, adding, “There will be commercial applications within the next year.”

Roles for thermoplastics

Meanwhile, engineering thermoplastics suppliers are actively assessing roles for their conductive and reinforced resins in fuel-cell plates. DuPont’s new Fuel Cells Business unit is set to introduce late this year a bipolar-plate compound of graphite-filled Zenite liquid-crystal polymer (LCP). The material is converted into plate using proprietary fabrication methods, followed by the machining of the flow channels. A version with molded-in channels is in development.

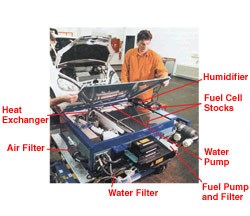

Jeff Straw, who monitors fuel-cell market developments at BP Amoco, likens automotive PEM cells to current internal-combustion engines. The latter require heating, electrical, cooling, and other under-hood management systems, which depend heavily on thermoplastics. He believes the same will be true of fuel-cell vehicles and power units (Fig. 2).

Specifically, PEM cells call for subsystems to input fuel, extract energy and heat, and remove byproducts. In Straw’s view, today’s engineering resins like BP Amoco’s Radel A polyethersulfone can meet performance requirements while beating metal or rubber in terms of parts consolidation, weight reduction, and overall cost.

Ticona’s LCP and glass-reinforced PPS are also said to be suitable candidates, since they possess the necessary electrochemical, mechanical, and thermal properties, plus excellent dimensional stability. Ticona’s El Agizy says LCP lends itself well to incorporating conductive fillers and is being tested in bipolar plates. PPS shows promise in end plates, Ticona says. Compounds with both short-glass and 50% long glass (Ticona’s Celstran GF50) are being used to lighweight prototypes.

Richard Okine, technical manager at DuPont’s Fuel Cell unit, views support subsystems in fuel-cell cars as a promising market for his company’s LCP, PBT, and nylon families, as well as elastomers for seals in fuel stacks. Okine expects DuPont materials to play roles in heat-exchange, electrical, humidification, and other systems.

A key requirement in fuel-conveyance pipe and tubing is resistance to hydrogen permeation. Ticona has tested a range of materials, and while specifications and test methods are still being developed, early data show that LCP and acetal are top performers in Germany’s DIN 53380 permeation test at 23 C. Other resins with good permeation resistance in descending order of performance are PVDF, PVDC, PVF, PPS, PS, and nylon 6.

DSM’s Sattler expects fuel-cell support systems to “draw heavily on traditional engineering thermoplastics, follow similar rules of design, and require cost-performance comparable to today’s under-hood systems.” He expects automotive OEMs to launch early programs conservatively, perhaps using traditional metals and rubbers. But Sattler says weight savings and parts-consolidation goals would inexorably push the market to thermoplastics.

DSM views its new Akulon Ultra-Flow nylon 6 family as promising materials for this market. They offer up to 80% higher flow rates than standard nylon 6, up to 25% cycle-time reductions, and outstanding filler wet-out, which makes them an attractive matrix for highly loaded compounds.

“All growth estimates for fuel cells are predicated on improving the easy manufacturability of parts,” says Frank Tortorici, general manager for technical polymers at AtoFina. He says the company’s Kynar PVDF is “an obvious choice” for some fuel-cell roles. As noted above, it was used in some early bipolar plate designs. Tortorici cites tubing and other plumbing parts, especially where purity and chemical resistance are critical.

BASF has formed a Fuel Cells Group to focus its broad effort in membranes, catalysts, and other related technologies. Andreas Fischer, head of that group says development programs are under way on humidification and other components for fuel-cell support systems using BASF’s polymer portfolio.

Table 1—BMCI Vinyl Ester Fuel-Plate Compounds (Compression Molding) Grade

Filler

ApplicationBMC 940-8596 Graphite

(Bipolar Plate)BMC 845 30% glass

(End Plate)Electrical Conductivity, S/cm

Through Plane (Z)

In Plane (X-Y)

70

95

—

—Specific Gravity

Shrinkage, in./in.

Flexural Strength, psi

Fluxural Modulus, 106 psi

Unnotched izod, ft-lb/in.

Compressive Creep, %

1000 hr@80 C

Thermal Conductivity,

V/m-K

UL Flame Rating1.82

0.001

6800a

1.7

0.5

0.3c

16

94V-O1.8

0.00

12,000b

1.6

7.0

2.0d

—

94V-O

Table 2—Quantum's Premtex Vinyl Ester Bipolar Plate Compound (Compression Molding) | |

Electrical Conductivity, S/cm |

|

Specific Gravity | 1.8 |

Related Content

Atop the Plastics Pyramid

Allegheny Performance Plastics specializes in molding parts from high-temperature resins for demanding applications as part of its mission to take on jobs ‘no one else does.’

Read MorePEEK for Monolayer E-Motor Magnet Wire Insulation

Solvay’s KetaSpire KT-857 PEEK extrusion compound eliminates adhesion and sustainability constraints of conventional PEEK or enamel insulation processes.

Read MorePlastic Compounding Market to Outpace Metal & Alloy Market Growth

Study shows the plastic compounding process is being used to boost electrical properties and UV resistance while custom compounding is increasingly being used to achieve high-performance in plastic-based goods.

Read MoreImpacts of Auto’s Switch to Sustainability

Of all the trends you can see at NPE2024, this one is BIG. Not only is the auto industry transitioning to electrification but there are concerted efforts to modify the materials used, especially polymers, for interior applications.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More