International Manufacturing Alliances Expand Processors' Reach

Processors looking to expand their business overseas or across the border into Mexico have several alternatives.

Processors looking to expand their business overseas or across the border into Mexico have several alternatives. For example, they could build a plant of their own or engage a sales agent. However, a number of processors are choosing another option—forming a manufacturing alliance, sometimes incorporated as a joint venture, in which firms exchange design, tooling, and manufacturing know-how to expand opportunities for both firms in a wider geographical area. This trend is spurred by the increasing globalization of customers in automotive, telecommunications, electronics, medical components, and packaging. In some cases, the arrangement simply permits each partner to serve its foreign customers from a local vendor. The partners may also collaborate to seek new business internationally.

As the following examples show, not all alliances are equally successful. For one thing, it’s important to find the right partner. According to Michael Troedel, director of sales and marketing for Pactiv Corp., a major producer of flexible packaging, such a partner ought to be compatible with your organization’s culture, strategies, and business practices. The partner should also be involved in similar markets. However, the products produced by each partner should not be identical in every way. “You want the alliance to be stronger than the individual partners,” says Troedel.

Adds Armen Kassouni, v.p. of custom molder N-K Manufacturing Technologies, “It is important to look for compatibility in the processes and technology used. It’s also important that the product lines complement each other. The goal is to share each other’s technologies and services to expand product offerings.”

Three-continent venture

After a couple of years of looking for ways to expand the medical-packaging segment of its business, Pactiv Corp. of Lake Forest, Ill., found the right partner in Rollprint Packaging Products, Inc. in Addison, Ill., which also had been searching for such an opportunity. In early 2001, the two firms formed a manufacturing alliance that brought together Pactiv’s German-based Ko busch Sengewald business unit, the third largest supplier of flexible medical packaging in Eu rope, and Rollprint Packaging, which is similarly positioned in the U.S. market.

According to the partners, there are only a handful of firms that have the manufacturing, sales, and marketing capabilities to deliver specialty medical packaging products on a global level. The multinational medical-products firms like Baxter Healthcare or Johnson & Johnson are looking for suppliers with these capabilities, which can help minimize the validation and qualification testing and expense required.

“We decided on Rollprint because we saw that their technology and manufacturing capabilities in the U.S. were very similar to ours in Germany,” says Pactiv’s Troedel. “One of the goals of this strategic partnership is to develop new, state-of-the-art medical packaging options. There was also an understanding that we would aim to find a partner in the Far East to establish a supply pipeline into that region’s medical packaging markets.”

There are differences between the two companies that enhance the alliance, according to Troedel. While they both make medical pouches and bags, as well as rollstock and laminations for food packaging, they specialize in different technologies that can contribute to new products. Pactiv is basic in blown-film extrusion. One of its fastest-growing product lines is Propyflex, a polypropylene-based film for intravenous bags that offers an alternative to PVC. Meanwhile, Rollprint is well known for its heat-sealable, peelable rollstock; Allegro peelable sealants that are compatible with a variety of plastics; and ClearFoil high-barrier structures used in hospital operating rooms and sterile environments.

In November of 2002, having spent significant time looking for the right fit in Southeast Asia, the two partners formed a strategic manufacturing alliance with Acme Packaging Co. (Pte) Ltd. of Singapore. That company has been prominent in Southeast Asian medical packaging for 25 years. It manufactures both flexible packaging and printed folding cartons, specializing in printed rollstock, formable bottom webs, inner wraps, die-cut lidstock, premade flexible pouches, folding cartons, paper trays, and die-cut blanks.

Many of the products sold by the alliance in Asia will be designed either by Rollprint or Pactiv. Whichever company comes up with the technology for a product will have its name on it when it is sold in Asia. “The key here is Acme offering its expertise in sales and marketing and its customer contacts in that region, which we didn’t have previously,” says Troedel.

Thermoformer goes global

While Pactiv and Rollprint are giant outfits, smaller firms can benefit from cross-border alliances, too. Two months ago, Alga Plastics of Cranston, R.I., a privately held custom thermoformer with a 60,000-sq-ft plant in Cranston, R.I., announced a strategic alliance with Vitalo Plastics of Meulebeke, Belgium. Both firms produce custom thermoformed packaging for medical devices, electronics, telecommunications, and industrial markets. Vitalo has plants in Belgium, the Philippines, Thailand, and China. It employs over 400 people and has sales of $50 million.

The partnership will combine the engineering, design, tooling, and manufacturing resources of both firms to serve customers throughout the world. Alga will serve customers in the Americas, while Vitalo will handle Europe and Asia. “With the combined assets of Alga and Vitalo, we can design and thermoform quality packaging in three continents faster and more competitively. We’re responding to customers’ requirements for faster time to market,” says Alga CEO Joan Parkos Moran.

“Time to market is critical because product life cycles are becoming shorter,” says Vitalo CEO Chris Heggerick. “Customers look for suppliers who can not only design, tool, and manufacture quickly but who can service global locations cost-effectively.”

Custom molding alliance

In February, custom injection molder N-K Manufacturing Technologies, Inc. in Grand Rapids, Mich., part of Nicholas Plastics, Inc., formed a joint manufacturing venture with Industrias Gesta of Monterrey, Mexico. Industrias Gesta specializes in injection molding, metal stamping, painting, and assembly for a wide variety of industries. The new entity—N-K Industrias Gesta—will initially manufacture and assemble products for automotive customers in Mexico. These products, which are currently produced in Grand Rapids, are light and susceptible to damage in transit, according to N-K’s Kassouni. “Allowing N-K Industrias Gesta to build these products will minimize damage during shipping and improve overall efficiency.”

Kassouni expects the new venture will increase the firm’s sales by 10% during 2003. “We are both privately held, family-owned businesses and so there is a similarity of corporate culture. Our company is more heavily involved in the automotive market, and they are more involved in consumer and industrial applications. The two product lines complement each other, allowing for expansion. For example, we have multi-shot molding while Industrias Gesta has metal stamping and painting expertise,” he says.

Going it alone

After considerable exploration of potential manufacturing partners in Asia, United Plastics Group (UPG) opted to form a wholly-owned foreign enterprise in Suzhou, China. This full-service manufacturer of injection molded products for industrial, automotive, electronics, medical, and consumer markets started up injection molding operations in China last October. It is said to be one of the few manufacturing facilities in the region to be organized from the ground up on lean-manufacturing principles—eliminating waste in all aspects of the business, from order management to manufacturing to accounts receivable.

One of the difficulties in finding a partner, according to Charles Villa, v.p. of sales and marketing, is that lean manufacturing is not part of the business culture in China, primarily because low labor cost encourages them to “throw a lot of people at manufacturing problems.” While it is helpful to have a local partner “to help you get though the red tape,” Villa says, “we didn’t think we could implement lean manufacturing with a partner. Instead, we focused on finding an expert of Asian descent to head up the venture and assist with issues ranging from location to financing and obtaining business permits. Most of the people working at the new plant are Chinese. They have excellent work ethics, and we have created a world-class plant.”

UPG had a two-year overseas manufacturing alliance making cell phones in Malaysia, but Villa says that operation is winding down since the opening of the Suzhou plant. “It is now very difficult to compete in places like Malaysia or Singapore as compared with China, due to the low labor cost and very aggressive tax structure in China.” The Suzhou plant is one of several plants UPG plans on opening there. “We will look to form manufacturing alliances with U.S. companies that are in China, if such potential partners have a unique technology within one of our key markets.”

The Chinese plant’s initial focus is on telecommunications and electronics (cell phone and laptop enclosures), as well as specialty automotive and medical disposables and devices. Most of these products are being sold worldwide, including in North America. “More recently, we started a company that will make consumer products like shaver components and other personal-care products,” adds Villa. These will be sold by our customers through major discount chains such as Wal-Mart.”

Related Content

How to Effectively Reduce Costs with Smart Auxiliaries Technology

As drying, blending and conveying technologies grow more sophisticated, they offer processors great opportunities to reduce cost through better energy efficiency, smaller equipment footprints, reduced scrap and quicker changeovers. Increased throughput and better utilization of primary processing equipment and manpower are the results.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MorePart 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

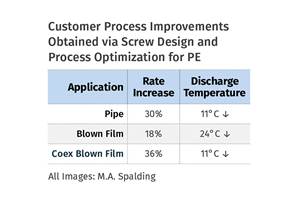

Read MoreHow Screw Design Can Boost Output of Single-Screw Extruders

Optimizing screw design for a lower discharge temperature has been shown to significantly increase output rate.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More