OPP Bottles: Has Their Time Come?

Maybe this time the often-predicted breakthrough will actually occur. What could make the difference are improved resins, clarifiers, and machinery.

Maybe this time the often-predicted breakthrough will actually occur. What could make the difference are improved resins, clarifiers, and machinery.

You’ve heard it all before: Oriented polypropylene (OPP) bottles are going to come on like gangbusters and replace glass, PET, and PVC in a broad spectrum of food and non-food containers. Yet predictions of a breakthrough have not panned out. Sure, PP is less costly and more heat resistant than PET—but it is also less stiff, less clear, lower in barrier properties, and less forgiving to process. Worst of all, its slow processing rates put OPP’s economics out of the running. Now, market interest in OPP bottles and jars is rising again and talk of the long-awaited breakthrough is re-emerging. Clear, rigid OPP containers made on one-stage injection stretch-blow molding (ISBM) and two-stage reheat stretch-blow (SBM) machines once again are heralded as an opportunity to transform the cost of packaging water, juice, hot-filled foods, dry powders, and personal-care products.

“We’re looking to OPP bottles for a step change in manufacturing cost,” states Surendra Agarawal, R&D director at Kraft Foods, Glenview, Ill. Compared with glass, OPP bottles are lighter, less breakable, and easier to handle.

Bottle-grade PET has a density of 1.35 g/cc and currently sells for 63¢/lb, while clarified PP random co polymer used in oriented bottles is roughly 0.910 g/cc and costs about 56¢/lb. That makes OPP bottles 40% less costly on a volumetric basis than PET bottles. Agarawal also notes that OPP bottles weigh less than PET and their “practical clarity” is equal to PET bottles.

Some 57 billion PET bottles were used in North America in 2002. Up to 60,000 bottles/hr can be blow molded on high-output, rotary reheat SBM machines. In contrast, OPP bottles are currently limited to niche uses like pediatric nutritional supplements and pill bottles, mainly in Asia and South America. They are primarily made on one-stage ISBM units, an approach that has failed to take off in high-volume U.S. packaging markets. Many industry sources are skeptical that throughputs of PP preforms and OPP bottles can ever match those for PET.

Battling OPP’s deficits

Until now, OPP bottles have been held back by disadvantages in processing speeds and physical properties relative to PET. However, PP’s proponents say those obstacles are now being overcome by advanced equipment, optimized preform and bottle designs, and improved PP resins and additives tailored for bottles.

“Our studies show that use of high-output equipment, along with appropriate design of PP preforms and OPP bottles, make it feasible to match PET in throughput, clarity, stiffness-toughness properties, and organoleptics,” claims Robert Portnoy, a market developer at ExxonMobil. He and others addressed cost-performance issues at the recent NovaPack 2004 Conference sponsored by Schotland Business Research. Portnoy says OPP bottles are highly competitive when run on high-speed, rotary reheat SBM machines such as those made by Sidel, SIG Corpoplast, and others. Competing equipment suppliers, however, argue that one-stage ISBM machines and in-line reheat SBM machines are also viable alternatives.

PP’s problem is that it is more resistant to absorbing and dissipating heat than PET, while preforms for OPP bottles typically have thicker walls. Thus, despite PP’s lower processing temperature (230 C) in the preform injection molding step, cycles are slower. OPP bottle blowing is done at 130 C and involves more energy use and longer molding and cooling cycles than PET. The result is OPP throughput rates that have been up to 25% slower than those for PET.

| Opportunities For Opp Bottles To Cut Unit Manufacturing Costsa | ||

| Package Type | Contents | OPP Advantage vs. PET, % |

| Beverage, Narrow-Neck, Single Serve Monolayer/Hot Fill | Isotonic | 20 |

| Monolayer/Cold Fill | Isotonic | 7 |

| Barrier/Hot Fill | Juice, Juice Drink, Tea | 12 |

| Barrier/Cold Fill | Juice, Juice Drink, Tea | 1 |

| Prepared Food, Narrow-Neck Monolayer/Cold Fill 24-oz. | Dressings, Toppings | 11 |

| Prepared Food, Wide-Mouth Barrier/Hot Fill, 24-oz. | Pasta Sauce, Salsa | 13 |

| Barrier/Hot Fill, 48-oz. | Pasta sauce, Salsa | 8 |

| Non-Food, Narrow-Neck Monolayer/Cold Fill, 24-oz. | Detergents, Cleaners | 11 |

| aReheat SBM processing. Includes material and capital cost. Assumes PP/PET price | ||

PP’s processing window in stretch-blow molding is narrower (5° C versus 15° C for PET), increasing risks of downtime and rejects. PP also stretches differently—something preform and bottle designers will have to become familiar with. To get OPP clarity nearly equal to that of PET, orientation and stretch ratios must be optimized. Certain areas of the preform, such as the base and neck, can experience less orientation than the bottle body, making them vulnerable to cloudiness.

The lower stiffness of PP also means that OPP bottles have less top-load and hoop strength than PET. This, along with poor CO2 barrier properties, has excluded OPP bottles from carbonated beverages. To get equal stiffness, OPP bottles need thicker walls than PET equivalents. Yet OPP bottles usually end up lighter than PET versions because PP’s lower density compensates for the added wall thickness.

OPP bottles also have around 30 times the oxygen and CO2 permeation of PET, which precludes their use as barrier containers unless coated or coinjected with a barrier resin.

Materials advances are closing some gaps in OPP bottle performance. One factor is clarifiers such as Millad 3988, a high-performance, low-residual product from Milliken Chemical. It is used widely outside the U.S. in OPP bottles for vitamins, water, tea, juices, detergents, and pharmaceuticals.

“Our clarifier ad dresses critical issues affecting OPP bottles,” states Raj Batlaw, Milliken’s market-development manager. Those factors are haze (mostly in neck and base), extended preform cycle times (countered by increased nucleation), and poor process stability in stretch-blowing.

The launch of clarified PP grades by ExxonMobil, Basell, Atofina, and BP Petrochemicals has boosted OPP’s prospects in bottles. Dedicated stretch-blow grades offer high clarity and flowability plus outstanding stiffness-toughness balance. New-generation PPs use low-residual catalysts and eliminate visc-breaking peroxides that once contributed to organoleptic deficits.

Basell offers a metallocene PP (mPP) grade for the stretch-blow market. Metocene X50182, an 18-MFR material, has been tested on Sidel equipment. It reduces bottle sidewall haze to 1.5% and boosts gloss to 82%. Atofina is also evaluating its mPP for OPP bottles, viewing it as a candidate for blending with conventional PP to enhance clarity.

OPP bottles’ advantages

One of the few companies actually making OPP bottles in North America is Container Corp. of Canada (CCC). Norman Gottlieb, the company’s CEO, says combined cost and environmental advantages prompted CCC’s foray into OPP bottles several years ago. He describes EnviroClear bottles as “uni-polymer” packages in which the OPP body is combined with a PP cap, tamper-evident ring, and sleeve label in a fully reclaimable, all-PP system. Gottlieb adds that a standard PP cap effectively hides a cloudy OPP neck finish.

“We also saw opportunities in the moisture barrier, squeezeability, and hot-fillability of OPP bottles,” says Gottlieb. CCC blow molds 250-, 500-, and 600-cc OPP bottles for flavored water using a common preform. The company also makes OPP bottles for dry powders and hot-filled foods that require a moisture barrier, like mayonnaise. CCC’s hot-fillable OPP bottles cost around 35% less than heat-set PET bottles.

Although the oxygen and CO2 barrier of monolayer PET bottles are modest, they far exceed those of monolayer OPP. This restricts monolayer OPP to applications with a very short shelf life—mostly bottles under 500 cc that do not require much gas barrier, says Robert Miller of Business Development Associates, a consultant in Bethesda, Md. Examples are sports drinks, water, certain foods, and most non-food markets.

A second opportunity arises from OPP’s superior heat resistance, which withstands hot filling at up to 205 F. PET bottles can be hot-filled only to 160-170 F without heat-setting. They also need vacuum panels to prevent collapse when hot filled beyond 180 F. Most hot-fill PET applications need heat setting, which adds 20% more to cost due to thicker walls and slower production.

Monolayer OPP bottles don’t need heat-setting and are viable in many hot-filled food markets, especially when filling is done at the upper range (180 to 205 F) of hot-fill temperatures. This opens potential in barrier and non-barrier packaging for juices, jams, jellies, pickles, salsas, and tomato-based sauces.

There’s a third opportunity in markets where PET and OPP bottles both need added gas barrier. As long as the cost of a barrier material is about equal for each container type, barrier OPP bottles would be a better candidate for glass replacement due to their underlying cost advantage.

Three roads to production

In response to previous limits on OPP throughput, Bekum and CCC (which designs and markets its own machines) have modified PET equipment for OPP. They view in-line, linear reheat SBM systems of up to eight cavities as cost-effective for medium-volume OPP applications.

“We supply equipment for OPP bottles by default,” states Gottlieb, who says CCC’s initial efforts to mold OPP bottles six or seven years ago were delayed by the lack of appropriate machines and tooling from commercial sources. As a result, CCC designed a proprietary in-line reheat SBM machine line for OPP. Its EnviroClear units (which can run PET too) are built by a partner in China and are offered with two to eight cavities. Delivered cost of a four-cavity unit in the U.S. is $250,000. Machines run 900 bottles/hr per cavity, but an upgrade to 1100/hr is expected in the next machine generation. A version that can produce wide-mouth jars will be introduced shortly. CCC offers Chinese-made preform and SBM tools with up to 32 cavities for prices 40% to 80% lower than domestic tools.

CCC says optimized preform design is critical. Its own preforms are designed for 50% higher stretch than PET to enhance clarity. CCC recently began to supply OPP preforms and bottle-prototyping services.

OPP applications set to emerge from CCC in coming months include wide-mouth jars for salad dressing, pickles, and powders, as well as squeezable containers for shampoo, mouthwash, and medicines. To increase top-load and hoop strengths, CCC injects nitrogen into OPP bottle headspaces after filling (see alsoKeeping Up With Blow Molding).

Bekum America engineers its reheat SBM units (like the two-cavity RBU-225) to switch between PET and PP bottles. A few years ago, Bekum designed its first all-electric reheat SBM machine specifically for PP. That six-cavity SB-6 has a nominal capacity of 7200 bottles/hr, which is just 15% slower than for PET with the same number of cavities.

A different manufacturing approach is advocated by Scott Steele, v.p. of Plastic Technologies Inc. (PTI), which designs and prototypes PET preforms, tools, and bottles. He says the best way to reap the cost benefits of OPP bottles is to run them on high-capacity rotary reheat SBM machines at a consistent rate of 1000 bottles/cavity/hr. PTI has computer-simulated production of a 24-g OPP bottle on a Sidel machine at that rate and predicts average unit cost to be 10¢ lower than for a PET bottle. But at conventional rates for OPP bottles (600 bottles/cavity/hr), projected unit cost exceeds that for a PET bottle.

Optimizing OPP bottle output calls for rigorous process control, Steele says. If bottles are blown slightly under the OPP temperature range they fail to stretch properly, causing poor clarity or blowout of preforms. Blowing OPP bottles above the temperature window causes cloudy bodies, necks, and bases, plus poor material distribution in walls and bottle tackiness that can disrupt downstream operations. The 1000-bottle/cavity/hr rate is an economic imperative, Steele says. To reach it, PTI used laboratory studies and its Virtual Prototyping software to predict the effect of “fast-heat” additives that speed heat absorption by PET preforms. PTI also modeled air and water cooling methods currently used to accelerate PET bottle processing. PTI found these techniques transfer successfully to OPP bottle manufacture, making the target rate feasible.

PPI worked with fast-heat additives in masterbatch form from Colormatrix. According to Colormatrix business manager David McBride, the same additives that speed PET preform heating are also effective in OPP bottles.

ExxonMobil has also conducted prototyping and computer modeling of OPP bottle production on rotary reheat SBM systems. The company used modified Sidel machines, a special preform design, and its specially tailored PP resin, PP9505E1. This 30-MFR material has 6% haze at 1 mm thickness and 166,000-psi flexural modulus. In OPP bottles, haze is less than 2%.

ExxonMobil prototyped and compared 750-cc versions of PET and OPP bottles of the same design and weight. Portnoy describes the OPP preforms as being wider and longer than PET versions, yielding a lower composite stretch ratio but superior balance of stretch in the axial and radial directions. OPP preforms had a thin-wall design to accelerate reheating and cooling.

ExxonMobil found that OPP preforms ran faster than PET in free-drop mode, while robotic takeout resulted in roughly equal cycles. Computer-simulated molding of OPP preforms on a 48-cavity mold generally predicted faster cycles than for PET. The simulation showed that OPP bottles could be blown at the maximum capacity of the Sidel lab machine.

As for OPP bottle performance, ExxonMobil found organoleptic properties to equal those of PET. Top-load strength was slightly lower than for equal-weight PET bottles but quite adequate for many applications. Drop-impact strength of OPP bottles was lower than for PET yet still sufficient for monolayer OPP bottles in refrigerated applications.

Officials at Sipa say the company’s “one-and-a-half-stage” integrated ISBM machine is an efficient third option for OPP bottle manufacture. This machine design combines preform injection and bottle blowing steps that are mechanically separate but linked by an integral takeout robot and linear conveyor. Jon Elward, Sipa’s marketing v.p., says a version of its model FX20/80E adapted for OPP is rated at 30,000 bottles/hr. It uses a special screw and a redesigned reheat oven. Sipa favors use of thicker, high-stretch OPP preforms, saying they yield excellent clarity and wall-thickness distribution. It claims the equipment accomplishes easier handling and faster reheating of OPP preforms. Sipa has prototyped a broad range of OPP water, milk, and hot-fill containers.

Nissei ASB reports that a version of its one-stage ISBM platform tailored for OPP bottles is making inroads in U.S. markets, notably in applications that need a moisture barrier or must survive autoclave temperatures (medical packaging, for example). Nissei ASB-650EX3 units for OPP include a special barrier screw, a preconditioning station for treating preforms, and independent valves and timers for each cavity’s blowing-air actuation.

OPP barrier bottles coming

Chicago-based Pechiney Plastics Packaging Inc., now part of Alcan, manufactures three-layer PP/EVOH/PP oriented barrier bottles on modified Sidel rotary reheat SBM equipment. PPPI modifies the PP skins so they adhere strongly to the EVOH barrier without tie layers. PPPI’s Gamma Clear bottles are made in 16- and 26-oz versions. The latter has a wide mouth (63 mm) and 205 C heat resistance at a cost competitive with glass and PET.

“Our focus is to replace glass in applications requiring extended shelf life, good oxygen barrier, and higher hot-fill temperatures,” says John Hoeper, v.p. of marketing at PPPI. The initial target is pasta sauce, now typically in glass and hot-filled at 195 C. This package would otherwise require a costly heat-set barrier PET bottle. “OPP bottles are a lower-cost alternative to glass in the dominant 26-oz size in this 800-million-bottle/yr market,” says Hoeper, who anticipates commercialization in 2005. PET bottles can be designed for hot-filling at up to 180 C by using vacuum-resistant panels and pinch-grip designs. Yet OPP bottles can survive hot-filling at even higher temperatures without these features, liberating label space and offering a marketing edge. PPPI sees further potential for its PP/EVOH bottles in salsa, applesauce, and other hot-filled packaging.

Kortec is evaluating the potential of multi-layer OPP containers. John Kermet, marketing v.p, sees them complementing rather than competing with barrier PET containers. He foresees inroads for heat-resistant OPP in hot-filled, pasteurized, and retortable foods now in glass and metal cans. OPP barrier bottles could replace steel cans by exploiting see-through properties.

A different road to OPP barrier containers is to adapt coating techniques already developed for PET bottles. PPG Industries claims its Bairocade epoxy-amine coating improves oxygen barrier of OPP bottles at a cost comparable to coated PET. Coatings are sprayed onto the exterior of bottles and then heat cured.

Mike Gajdzik, PPG’s global sales manager, says commercial use of Bairocade on OPP bottles is expected later this year. PPG can vary coating formulation and thickness to achieve oxygen barrier equal to monolayer or barrier-enhanced PET containers. “OPP bottle barrier improves because our thermoset coating is applied at a higher temperature than PET, which improves cure,” says Gajdzik.

With OPP bottles, good coating adhesion requires plasma, flame, or corona treatment. These techniques can be incorporated in-line at marginal extra cost, Gajdzik says. A proprietary dip-coating technique for adding oxygen barrier to OPP bottles has been developed by CCC. “Our flexible dip-coating process is an efficient option for smaller-size, non-spherical, and odd-shaped OPP bottles,” Gottlieb says. CCC has developed a unit to treat 3600 to 5600 bottles/hr.

Related Content

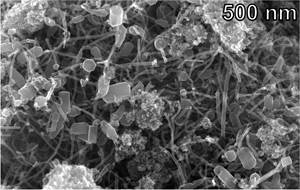

Research Suggests Path From Waste Plastics to High Value Composites

Flash joule heating could enable upcycling of waste plastic to carbon nanomaterials.

Read MoreRead Next

Super-Clear PP Barrier Bottles Are Now Stretch-Blow Molded

In a first for stretch-blow molding, Chicago-based Pechiney Plastic Packaging, Inc. (PPPI) is launching a family of polypropylene barrier food containers that are claimed to be as clear as multi-layer PET bottles.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More