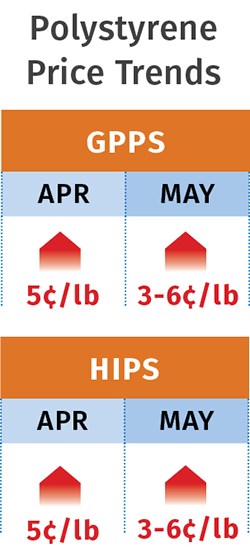

PE, PS, PVC Prices Up, PP Down

The pricing trajectory has been upwards for three of the four commodity resins, though it may be slowing for two.

Global and domestic tightness in feedstocks or resins and increased costs for some feedstocks continued to drive prices upwards for PE, PS, and PVC, though that ascent may be leveling off for PVC and PS. Meanwhile, PP prices dropped again last month, though the decreases are not on par with propylene monomer decreases—evidence of suppliers’ growing success in decoupling PP price from monomer tabs. Those are the views of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

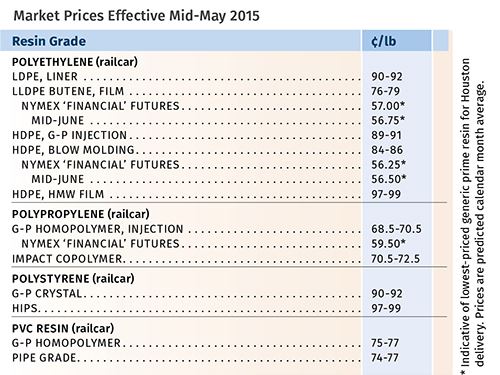

PE PRICES UP

Polyethylene prices were moving up 5¢/lb in May, with processors losing leverage due to a burgeoning export market. North American PE suppliers have the cost advantage globally.

North American ethylene monomer prices are not an influencing factor on PE prices. Last month’s resin price hike and the potential for additional ones depend heavily on both the price of oil-based pellets made from naphtha and tight ethylene supplies in other world regions, explains Mike Burns, v.p. for PE at RTi.

Planned ethylene turnarounds in South East Asia, and China and unplanned ethylene production disruptions in Europe and the Middle East, have resulted in ethylene abroad selling at prices as high as those of PE resins, which also have been rising. In contrast, cash cost to produce North American ethylene remains below 9¢/lb, and the cost to deliver pellets is still under 30¢/lb, according to Burns. “North America’s ability to meet any price globally will be one of the suppliers’ key drivers for managing inventories and influencing pricing.”

Greenberg reports “very aggressive” spot PE trading in April, ahead of the May price increase. “This is the first price increase with any realistic shot of implementation since September 2014,” he says. Greenberg also reports that rallying spot prices erased the previous discount versus contract prices.

While PE prices appear to be rising, Burns points out that PE film processors notified customers of a 7% increase, effective in May, exceeding that month’s resin price hike and thereby enhancing margins. “This is good for the industry and eventually we will see processors of other PE goods increase their prices.”

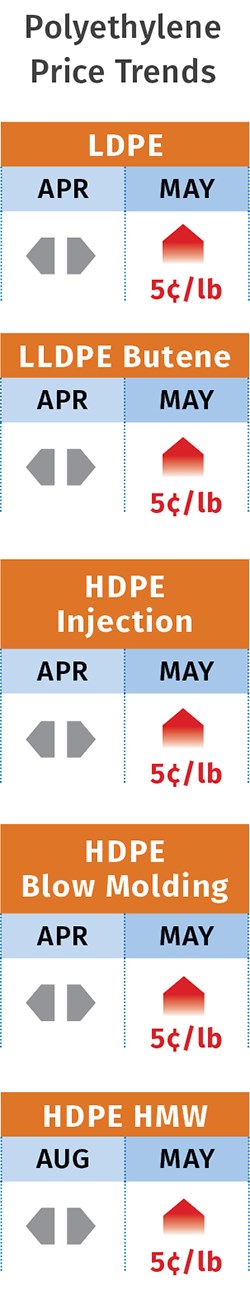

PP PRICES DOWN

Polypropylene prices dropped an average of 4¢/lb in April, though propylene monomer contract prices dropped 6¢/lb. Suppliers evidently were able to leverage supply/demand dynamics to implement another 2¢/lb margin expansion.

May monomer contracts were expected to be flat or lower by 1-2¢/lb, and PP prices would be likely follow. However, both Greenberg and Scott Newell, RTi’s director of client services for PP, concede that if current market conditions persist, PP suppliers may aim for additional margin expansion by holding onto any drop in monomer cost. Says Newell, “Margin expansion will continue to be a ‘talking point’ for the rest of the year.”

Greenberg reports that while PP spot trading continued to improve along with material availability as planned and unplanned production disruptions were resolved, there were still shortages of some grades and spot prices at a significant premium to contract. Newell points out that while American Chemistry Council numbers show improvements in supply—with inventory building in March, there seems to be a disconnect with what is happening on the street, so to speak. “There is definitely some improvement in supply, but the feeling out there is that things are pretty tight, with copolymers in general more difficult to get.”

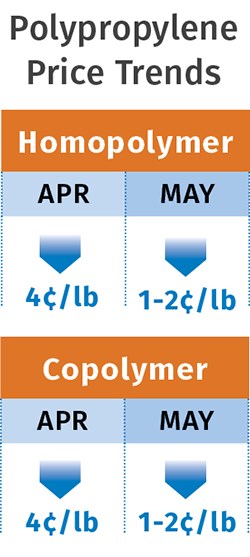

PS PRICES RISING

Polystyrene prices moved up 5¢/lb as suppliers implemented their March increase a month late. However, suppliers also issued May increases of 3-6 ¢/lb, which were unlikely to be felt until this month, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC.

Kallman ventures that 3¢/lb is more likely than a higher increase, based on benzene contract prices, which were up a total of 24¢/gal in April and May. “Benzene is now looking like a balanced market, and any additional increase will be small—about 10¢/gal,” he states. Kallman also notes that while the PS market has been tightly balanced, PS supply is improving and styrene monomer exports have slowed. Although there is the seasonal upsurge in demand for PS due to construction and recreational products, it appears to be a normal, not an extraordinary, uptick—all of which do not support a 6¢/lb increase.

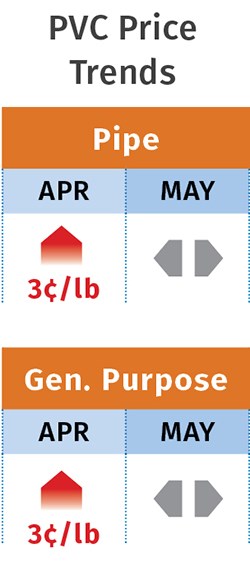

PVC PRICES MAY STABILIZE

PVC prices moved up 3¢/lb as suppliers implemented their March increase. Despite the April 3¢/lb hike that was also on the table, PVC prices remained flat through April and into May. RTi’s Kallman ventures that prices for this month would be flat to lower.

There are no cost- or supply- driven issues supporting the April increase, says Kallman. PVC resin plants are all back up and running after a series of planned maintenance turnarounds; the overall ethylene supply situation is looking good; and ethylene prices are expected to continue on the low side. A resin price hike could emerge for July or August if the construction market picks up. “The construction season started later than usual to begin with, and though it is expected to be stronger than in 2014, it is not expected to be as strong as originally projected,” says Kallman.

Related Content

Prices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MorePrices of PP, PET Drop; PE, PS and PVC to Follow

Going into fourth quarter, prices of the five commodity resins were heading downward, barring supply interruptions.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MorePS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More