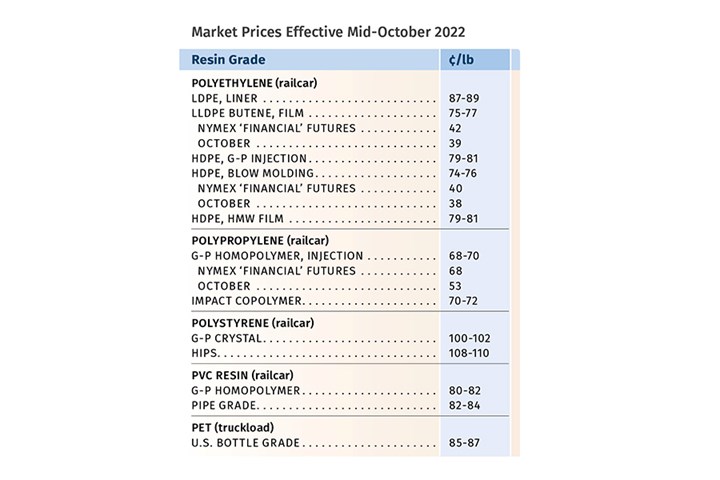

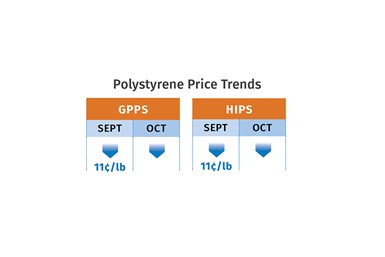

Going into the fourth quarter, the descent of PE, PP, PS, PVC and PET prices since July continued, owing to slowed demand, adequate-to-ample supplies, lower feedstock costs and the overall global economic uncertainty and slowed demand. In the case of both PE and PP, substantial new capacity coming on stream was yet another factor, and competitively-priced imports were an issue for PET and possibly PS.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), senior analysts from PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at resin distributor and compounder Spartan Polymers.

PE Prices Weak

Polyethylene prices dropped in August by at least 4¢ to 6¢/lb and were expected to drop by a similar amount in September, despite PE suppliers announcing increases of 5¢ to 7¢/lb for September-October, according to David Barry, PCW’s associate director for PE, PP, and PS, Robin Chesshier, RTi’s v.p. of PE, PS, and nylon 6 markets, and The Plastic Exchange’s Greenberg. Rather, these sources generally saw potential for modest declines in prices in October and this month.

RTi’s Chesshier noted that PE demand, which had held strong for a good part of the year, was showing a slowdown in most market sectors by end of September. PCW’s Barry noted that lower feedstock costs, no signs of pickup in demand, and major new capacity to be brought on stream by Shell would not support a price increase. He also noted that PE spot prices had fallen 4¢ to 7¢/lb through September: “Export demand remained soft, and traders had high inventories and uncertainty about price direction in the month ahead. Resellers reported hand-to-mouth buying activity, with customers anticipating lower prices ahead.”

These sources also noted that suppliers had throttled back on production. Going into October, Greenberg characterized the spot market: “Most processors are still generally only buying resin as needed, while some are starting to procure a little extra as the price level becomes advantageous, though downstream consumer demand in many sectors has slowed amid economic and inflationary concerns. Producers and other major resin suppliers continued to scoff at lowball bids, as the bearish tide has turned, alongside lower operating rates and an uptick in Asian prices, providing a slightly better minimum market-clearing floor price. This has encouraged better domestic demand as some buyers expressed their fear of missing out on great deals and bargain basement prices.”

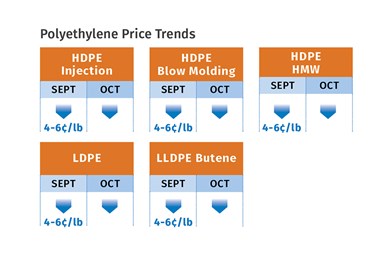

PP Tabs Continue to Fall

Polypropylene prices in August dropped 1¢/lb while propylene monomer moved up 2¢/lb, but there was 3¢ of supplier margin erosion. Then, PP prices dropped a total of 8¢/lb in September, as monomer contracts settled 5¢/lb lower and suppliers lost another 3¢/lb to margin erosion, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. Moreover, these sources saw potential for another substantial price dip in October and flat or even lower prices this month.

Barry saw a double-digit decrease as possible in October, citing low demand and oversupply. As for this month, he saw further potential for downward movement as ExxonMobil starts up its new PP plant and Heartland Polymer revs up to full production at its new facility. Newell expected a 5¢ to 8¢/lb drop in propylene monomer prices based on falling spot prices globally. He ventured there would be further margin erosion as well. He noted that PP suppliers were expected to throttle back production as they had overproduced by 175 million lb in July-August, while demand was dropping. Days of supply rose to 40 in September – whereas a balanced market is typically 30 to 31 days. These sources noted that spot market prices were being discounted by 10¢ to 20¢/lb.

Characterizing the PP spot market as lackluster as weak demand continued into October, Greenberg attributed this to the slowing global economy, near-term economic uncertainty, resin overproduction, and buyers flexing their negotiating strength. “If producers continue to step in front of each other to gain orders via share-shifting, rather than simply slow production to rebalance supply/demand, we could see additional margin declines ahead.”

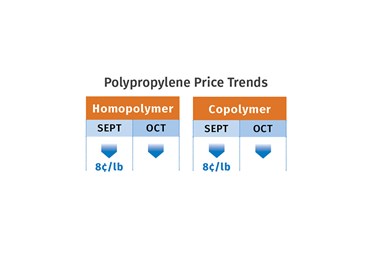

PS Prices Reverse Recent Climb

Polystyrene prices in September dropped by 11¢/lb, following August’s plunge of 22¢ to 25¢/lb, and further single-digit declines in October and this month were envisioned by PCW’s Barry and RTi’s Chesshier. The latter pointed out that the September PS decrease was less than the 14¢/lb drop in feedstock costs and noted that continued slow demand and dropping feedstock costs support further decline – barring a major production disruption.

PCW’s Barry proposed a similar scenario. He noted that since February, PS prices rose by 53¢/lb, but 36¢/lb had already come off by the start of the fourth quarter. He saw room for further reductions and noted that suppliers most likely will have to further curtail production of both styrene monomer and PS resin.

He also noted that while PS resin imports have traditionally accounted for about 5% of available supply, more attractively priced Asian PS resin imports were already making their way to this side of the globe, primarily Latin America, as freight costs are now significantly lower. “It remains to be seen if this becomes a challenge for North American PS suppliers,” he said.

PVC Price Drop: ‘Unprecedented’

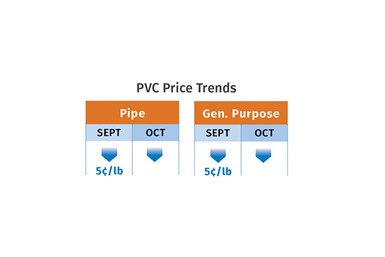

PVC prices dropped 5¢/lb in August and another 5 ¢/lb in September, for a total decline of 15¢/lb in third quarter, according to Mark Kallman, RTi’s v.p. of PVC and engineering resins, and PCW senior editor Donna Todd. Kallman saw a similar drop in October and this month as likely. Contributing factors include a slowdown in demand that has continued since May, a well-supplied market, and a very substantial delta between export and domestic prices.

Noting that a price drop of this magnitude in such a short period is unprecedented in the PVC market, PCW’s Todd reported that many market players had been hoping PVC prices would not fall as far as at least one market pundit predicted going forward into first-quarter 2023. At the start of October, she reported that “while PVC pipe converters want to see their resin costs reduced, having PVC prices drop like a runaway freight train could actually end up costing them money as resin prices pull down pipe prices with them and in some cases push pipe prices down faster than resin prices decline. Converters in other markets such as siding and flooring, where it wasn’t possible to push through all the resin price increases to their own customers, were on the other side of the equation. They were relieved to see prices fall as fast as possible in order to return some level of profitability to their businesses.”

PET Prices Slide

PET prices dropped by 2¢ to 3¢/lb in September after the major 20¢/lb decline in July-August, all based on feedstock cost reductions. RTi’s Kallman expected another 2¢ to 3¢/lb drop in October, and flat to slightly lower prices for this month. He noted that demand was still pretty good but characterized the domestic market is very well supplied while attractively priced exports continue to arrive.

Related Content

Fundamentals of Polyethylene – Part 3: Field Failures

Polyethylene parts can fail when an inappropriate density is selected. Let’s look at some examples and examine what happened and why.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MorePrices for PE, PS, PVC, PET Trending Flat; PP to Drop

Despite price increase nominations going into second quarter, it appeared there was potential for generally flat pricing with the exception of a major downward correction for PP.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More