Shining Opportunities In Solar Films

Photovoltaic markets are growing explosively, and so are opportunities for specialty film producers. Solar cell and module production, which was forecasted to grow at 50% a year for the next few years before the recession hit, is now expecting slightly more healthy 30% annual growth, according to DuPont, a major supplier of photovoltaic film materials. Solar cell and module manufacturers are expanding, and large numbers of new companies are entering the field.

Solar cells, surrounded by special films, are just one component of a fully assembled and functional solar module. The market for new modules is expected to grow from 6 gigawatts a year in 2008 to 34.7 GW/year by 2015, according to Nanomarkets, a photovoltaic industry analyst, in Glen Allen, Va.

The problem with solar modules has always been their high cost to manufacture. So now many module makers are trying to convert from batch production to continuous roll-to-toll methods to achieve higher volumes and lower cost. They are making new second-generation “thin film” solar cells, which are expected to grow from 10% of today’s market to about 40% in a decade. Thin-film solar modules are less expensive and lighter weight than previous modules made with crystalline silicon solar cells, but thin-film modules may not last as long or be as efficient.

Solar module production is largest in Europe (where installations are heavily government subsidized) and in Asia, where many new module plants are being built. The U.S., however, is ahead in building plants for the new thin-film cells, which can be built into both flexible and rigid solar modules. Flexibles are the ones to watch.

“There are literally dozens of start-up companies for ‘thin-film on flex’ that are pre-commercial or just barely commercial,” says Marc Doyle, business director for DuPont Photovoltaic Solutions. The ultimate goal for thin-film flexible modules is to be integrated into building materials like rolls of roofing, instead of requiring separate panels. This is already being tried with industrial roofing.

For flexible solar modules to be widely used in roofing, however, they will have to provide 20 to 25 years of product life. “We need better plastic barrier films for outdoor environments,” says Dan Williams, v.p. of product and business development at Konarka Technologies Inc., Lowell, Mass., which is pioneering flexible all-plastic solar cells.

Module makers buy their plastic films from specialized processors. Older-style photovoltaic films of fluoropolymers and EVA haven’t changed much in three decades since solar cells were first introduced. But the combination of high growth, new cell technologies, and a big push to cut costs is spurring lots of new film technologies. A market that had few choices for films 18 months ago, is now bursting with new film choices and alternative manufacturing methods.

Introducing new films into the photovoltaic market isn’t easy. For example, it can cost a global module maker as much as $100,000 for third-party testing to qualify a new back-sheet material. But for a high-growth market, manufacturers are deciding it’s worth the effort.

THE TYPES OF SOLAR CELLS

There are two types of commercial solar cells. Crystalline silicon (c-Si), produced for about three decades, constitutes about 90% of the market. “Thin-film,” introduced 10 years ago, makes up the remaining 10%. Older-style c-Si solar cells all share similar construction, with slight variations. They use silicon wafers sawed from rods of pure silicon to convert light waves into electricity. Silicon is expensive, and the wafers are fragile, so modules require special handling throughout

production.

Crystalline silicon modules consist typically of a glass top sheet, followed by EVA encapsulation film, silicon-wafer solar cells, another EVA film, and finally a back sheet of laminated fluoropolymer and other films. All these components make c-Si modules expensive, but they have an operating life of 20 to 25 years and electrical efficiency of 14% to 23%. The world’s largest producer of c-Si solar modules is Suntech Power Holding Co. in China.

Thin-film solar cells are the second generation, holding the promise of lower cost. Many are made by continuous roll-to-roll production, whereas crystalline silicon is a batch process. “Thin-film” refers to the light-absorbing semiconductor layer, which is indeed a thin film of conductive metal, vapor-deposited in a vacuum on a thin substrate like glass, aluminum, stainless steel, or polyimide.

Thin-film modules are much thinner, less expensive, and less fragile than crystalline silicon, but they have a shorter track record since most are recently developed. Their electrical efficiency ranges widely from 6% to 20%, depending on the semiconductor. Thin-film cells use one of three major semiconductor materials: a-Si (amorphous silicon), CdTe (cadmium telluride), or CIGS (copper-indium-gallium selenide). They also have one or two protective encapsulation layers of plastic films, a front sheet of glass, and sometimes a back sheet of glass or plastic.

Amorphous silicon (a-Si) is the oldest and most widely used thin-film semiconductor. It’s not as efficient as crystalline silicon, but less expensive. (It can also be deposited on glass and heated to convert it into micro-crystalline silicon.) The biggest commercial producer of a-Si thin-film solar cells is Sharp Corp. of Japan, also a large producer of conventional c-Si solar cells. Sharp pairs a-Si with micro-crystalline silicon to get higher efficiency.

Over 100 new companies are setting up to make a-Si thin-film modules in the next few years. Many of them are using turnkey processing equipment from Applied Materials Inc., Santa Clara, Calif.; Spire Corp., Bedford, Mass.; and Oerlikon Solar in Trubbach, Switzerland. This is a significant new development, since previous production systems were mostly proprietary.

Thin-film cells on a flexible substrate can be built into older-style rigid or new-generation flexible modules. United Solar Ovonic LLC, a unit of Energy Conversion Devices Inc. in Auburn Hills, Mich., makes flexible thin-film laminated modules with three different a-Si alloys (called “triple junction”) to absorb blue, green, and red photons of light. Uni-Solar cells have a flexible stainless-steel substrate with an ETFE front sheet and adhesive layers of ethylene-propylene copolymer.

Last October, Energy Conversion Devices announced a joint program with CertainTeed Corp. to develop these flexible thin-film modules into residential roofing and siding materials. Energy Conversion also announced that it would rapidly accelerate production of the new flexible modules from 70 MW annually to 420 MW/yr by 2010, 720 MW by 2011, and 1 GW by 2012.

Power Film Inc. (formerly Iowa Thin Film Technologies), started by former 3M scientists in Ames, Iowa, makes plastic-based solar cells by depositing a-Si on a 1-mil flexible polyimide substrate. Power Film makes custom modules, typically with an ETFE front sheet and fluoropolymer/polyester back sheet. Individual cells are laser-cut from a continuous sheet with electrical connections printed on the surface of the panel, reportedly increasing reliability and reducing cost. Power Film targets low-voltage navigational aids for the military and will launch a “20-year” module for building integration later this year.

Nanotechnology is also being used in thin-film semiconductors for solar cells. Innovalight in Sunnyvale, Calif., has a technology to print light-absorbing inks that contain silicon nano-crystals.

CdTe semiconductors account for about 30% of thin-film solar cells. CdTe is similar in efficiency to a-Si, but more sensitive to moisture. First Solar Inc. in Tempe, Ariz., the world’s largest producer of thin-film modules, uses CdTe cells, starting with a glass front sheet, a thin layer of tin oxide, a semiconductor on a metal substrate, EVA encapsulant, and glass back sheet.

Bloo Solar Inc. (formerly Q1 Nano Systems) in West Sacramento, Calif., a spinoff from the Univ. of Calif. at Berkeley, has thin-film technology that deposits rod-shaped nano-crystals of CdSe (cadmium selenide) and CdTe upright like brush bristles to increase the material’s light absorbency. Instead of an electrode layer with positive and negative sides, pairs of CdSe and CdTe molecules give and receive electrical charges.

CIGS is the newest type of thin-film metal semiconductor. It’s potentially the most efficient and least expensive, but also the most sensitive to moisture. Early entrants in CIGS solar cells use different production methods, and most aren’t fully commercial yet, so they account for only about 1% of the market. Nanosolar in San Jose, Calif., prints CIGS as an ink (like printed circuits) onto a metal substrate in a roll-to-roll process. Commercial cells have up to 15% efficiency, developmental cells up to 20%. Global Solar Energy, a 10-year-old firm in Tucson, Ariz., and Helio Volt in Austin, Texas, both started up plants last year to make CIGS solar cells and modules.

NEXT: ORGANIC CELLS

Thin-film solar cells with metal or mineral semiconductors are still in their infancy, but the solar industry is already looking ahead to the next-generation electrode—“organic” thin-film cells on plastic. Organic semiconductor materials are dissolved in solvents or inks and printed or coated onto a plastic substrate in a continuous roll-to-roll process.

Substrates for organic semiconductors can be plastic because organic coatings don’t need to withstand high temperatures like sputtered metal. Organic conductive materials are less expensive than silicon, cadmium, or tellurium, the metals used in current thin-film solar cells, but organics are also less efficient.

The first organic thin-film solar modules are in prototype production now. Power Plastic modules from Konarka, for example, have a clear plastic top layer, a coating of prepolymer adhesive, then ink containing fullerene conductive nano-carbon clusters (or “buckyballs”), and another liquid polymer coating, applied onto DuPont Teijin Mylar polyester film with SiOx coating.

The efficiency of Konarka’s test cells is now up to 6%. Longevity is also short (3-5 years), but Power Plastic is intended to generate power for portable electronic devices that typically won’t be used for more than a few years, like laptops and cellphones. Power Plastic also targets tents, awnings, tarps, and even clothing with a built-in emergency power supply.

Plextronics Inc. in Pittsburgh has developed and is licensing organic inks for solar cells. It makes solar modules only for R&D, not commercial sale. A Plextronics cell consists of a transparent anode layer that lets sunlight into a layer pigmented with photoactive ink, which passes electrons to an electrically conductive polymer layer on a plastic substrate. Efficiency of test samples is up to 6%.

NEW FRONT-SHEET FILMS

The advent of flexible thin-film modules has created a new market for plastic front sheets. Most are clear monolayer fluoropolymer films like ETFE or its derivatives. DuPont, Asahi Glass, and Saint-Gobain Performance Plastics Corp. make the fluoropolymer films.

Saint-Gobain is developing new coextruded multi-layer photovoltaic products that could combine ETFE top sheets and encapsulation layers or glass top sheets with encapsulants.

Other new optical films, most based on other fluoropolymers, are being introduced for this market. Ten months ago, Rowland Technologies Inc. in Wallingford, Conn., introduced the first PVDF front sheet, called Rowlar, using Arkema’s Kynar PVDF. Rowlar, which took 18 months to develop, has light transmission >93% and haze <9%.

Another new optical front-sheet material is Corin XLS polyimide, made by ManTech NeXolve Corp. (formerly ManTech SRS Technologies) in Huntsville, Ala. It comes as a sprayable resin or film and is used for photovoltaic arrays in space. An unusual ingredient in Corin XLS is a nano-scale additive, POSS (polyhedral oligomeric silsesquioxane) from Hybrid Plastics Inc. These “cage-type” molecules reduce color and resist atomic oxygen, a hazard to space vehicles orbiting the earth.

NEW ENCAPSULATION FILMS

All solar cells use encapsulation films, typically EVA, to protect the electrode. The two largest producers are Specialty Technology Resources Inc. (STR) in Enfield, Conn., and Etimex Primary Packaging GmbH in Germany (formerly part of BP Plastics). Mitsui and Bridgestone in Japan also make EVA encapsulation films. And 20 or 30 new companies are getting into EVA film extrusion in China and Korea, where conventional module manufacturing is growing the fastest.

For the module maker, crosslinked EVA is costly and slow to laminate and cure (10 to 20 min). Photovoltaic grades of EVA have high vinyl acetate ratios and special crosslinking aids for faster curing. Etimex, for example, offers “ultra-fast” EVA film that cures in 7-10 min, but that’s still considered slow.

Alternative thermoplastic encapsulant films are being introduced to reduce lamination time. Thin-film a-Si modules are sometimes sandwiched between glass front and back sheets using PVB (polyvinyl butyral) encapsulation films, because of PVB’s long use in automotive safety glass. DuPont and Kuraray make PVB encapsulation films.

Several companies have introduced TPU encapsulation films. An example is Etimex’s VistaSolar, made of Bayer’s Desmopan TPU. It’s used in conventional c-Si solar cells by SunWare Solartechnik GmbH in Germany to speed the lamination process and lower manufacturing cost. It reportedly bonds better to silicon wafers than EVA. VistaSolar TPU encapsulating films come in 0.3- to 1.2-mm gauges.

Two years ago, Stevens Urethane in East Hampton, Mass., got into encapsulant films. It introduced a TPU film and a conventional EVA film. Stevens had prior experience extruding optical TPU and EVA films for aerospace and armored glass laminations.

Bemis Worldwide, a formulator of specialty adhesives in Shirley, Mass., is ramping up production of several new encapsulation films, including a TPU grade and several polyolefin films.

Jura-plast GmbH in Germany (U.S. office in Goodland, Ind.) introduced thermoplastic Jurasol ionomer encapsulation films for photovoltaics five years ago. They are used on double-glass panels with c-Si by Schott Solar in Germany, which has U.S. plants in Albequerque, N.M., and Billerica, Mass.

NEW BACK SHEETS

Nowhere has the development of new materials been more frenetic than in back sheets. The standard material for 20 years has been a lamination of DuPont’s biaxially oriented Tedlar PVF (polyvinyl fluoride) film on either side of biaxially oriented PET film. The laminate is known to module makers as “TPT.” The PET film provides dielectric and mechanical strength, while PVF protects the PET film against UV.

DuPont is the only commercial producer of PVF resin and also makes Tedlar PVF film. It has announced several expansions of both resin and film. The first expansion of PVF resin started up in Fayetteville, N.C., in 2007. DuPont also launched unoriented Tedlar 2100 cast film as an alternative to biax Tedlar, which has been on allocation for years. Back-sheet suppliers were urged by DuPont to steer new customers to the new 2100 film, though it required new qualification to be used for back sheets.

Back-sheet suppliers must guarantee that they can ramp up supply once a customer’s module goes into production. But they ran into serious difficulties in obtaining the new Tedlar 2100, causing a scramble in 2008 for other solutions. Last fall, DuPont announced plans for further Tedlar resin expansions to support Tedlar films, but demand still exceeds supply for biax Tedlar films.

Tedlar and competing back-sheet materials are aimed at conventional c-Si modules. Only a minority of thin-film modules use plastic back sheets.

BioSolar Inc., a start-up in Santa Clarita, Calif., is challenging Tedlar with a new lower-cost back sheet made entirely of biomaterials. It includes nylon 11 derived from castor beans, cotton-fiber paper, and polylactic acid (PLA) film, and is said to be as effective as Tedlar/PET/Tedlar and much less expensive.

SBM Solar Inc., Concord, N.C., makes rigid modules using traditional c-Si cells with an unusual back sheet. It’s a composite of aluminum honeycomb and plastic with thermoplastic encapsulant films. SBM also uses an ETFE fluoropolymer front sheet. “One of my missions is to try to develop new solar modules with no glass, using different plastic materials,” says SBM president Dr. Osbert Cheung. SBM’s panels, though rigid, are lightweight and cool enough in operation to be integrated into roofs.

In 2007, Madico in Woburn, Mass., introduced two new Protekt back sheets, regular and HD (high-dielectric), that contain no Tedlar. They replace Tedlar’s UV protection with 13 microns of perfluoroalkyl vinylether coating at 10% to 15% lower cost. Another recent Madico back sheet uses seven layers, including PVF with aluminum foil and EVA and PET films.

Arkema Group in France has introduced a 30-micron Kynar PVDF blown film for back sheets of c-Si modules, replacing 25-micron Tedlar film. The PVDF film had been under development for 10 years, including three years of comparative testing against PVF, before it was introduced last year to fill the Tedlar shortage.

Big European suppliers of back sheets are Iso Volta Group in Weiner Neudorf, Austria, and Krempel GmbH in Vaihingen/Enz, Germany. Krempel introduced Akasol PVL 1000 V, a Kynar/PET/Kynar laminate, known to module makers as KPK, as a substitute for TPT. Krempel also offers a less expensive Kynar/PET laminate.

3M Company has developed new Scotchshield Film 17 as an alternative back sheet for c-Si modules. It is made of THV-PET-EVA. The THV fluoroplastic is made by 3M’s Dyneon subsidiary. The PET was especially developed by 3M for the application. 3M’s current production is in the U.S., and another plant is being built in Singapore.

Last year, Honeywell International launched five-layer PowerShield PV325 back sheet using Honeywell’s E1250 PW film, made of Honeywell’s ECTFE fluoropolymer. The back-sheet structure is ECTFE-adhesive-PET-adhesive-ECTFE.

Saint-Gobain is testing new multilayer back-sheet films based on its own ECTFE resins.

Potentially the least expensive of all is a special EPDM film from BRP Manufacturing (formerly Buckeye Rubber Products) in Lima, Ohio, which was co-developed over five years with researchers at the National Renewable Energy Laboratory in Golden, Colo. The 0.018-in. film is being sampled and tested as a novel monolayer back sheet that will reduce costs for both c-Si and thin-film modules. The crosslinked EPDM film replaces a lamination of three higher-cost films—EVA sealant, PET dielectric, and Tedlar PVF—with one inexpensive film. It is formulated to cure at the same temperature as the EVA top encapsulant layer in c-Si modules.

Related Content

How to Decrease the Extrudate Temperature in Single-Screw Extruders

In many cases, decreasing the discharge temperature will improve product quality and perhaps even boost rate. Here are ways to do it.

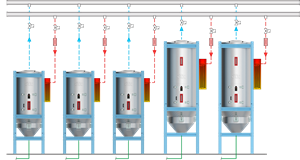

Read MoreHow to Effectively Reduce Costs with Smart Auxiliaries Technology

As drying, blending and conveying technologies grow more sophisticated, they offer processors great opportunities to reduce cost through better energy efficiency, smaller equipment footprints, reduced scrap and quicker changeovers. Increased throughput and better utilization of primary processing equipment and manpower are the results.

Read MoreBrewer Chooses Quick-Change Flexibility to Blow Wide Range of PET Beer Bottles

Beermaster Brewery found a “universal” stretch-blow machine from PET Technologies enables multiple changes per day among four sizes of beer bottles.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More