BOPET Films' Growth Prospects Look Very Good

Market demand to be driven by significant use in both packaging and technical applications.

Market demand to be driven by significant use in both packaging and technical applications.

Biaxially-oriented PET film (BOPET) appears to have become one of the fastest growing polymer substrates, with demand expected to be over 8 billion lb in 2016, a growth of over 2 billion lb since 2010. This, according to a new report, BOPET Films—the global market 2016, by Bristol, U.K.-based AMI Consulting.

Check too our September issue’s feature K 2016 Preview: Extrusion and Compounding, and a recent blog on “biobased” BOPET film for solar-control-windows.

Driving this impressive growth is BOPET film’s extensive use in both packaging and technical applications due to its novel combinations of properties, excellent processability, as well as adhesion to coatings and adhesives. The report points out, however, how volatile this market has been, noting the rapid demise of BOPET-based magnetic tapes for music and video cassettes after the development of CD—an example of applications that come and go.

Yet, the AMI Consulting report discusses emerging applications such as photovoltaics—the fastest one, with a whopping 29%/yr growth since 2010, driven by an increased demand for renewable energy sources often supported by government initiatives. Another: display and optical films, which have seen double-digit growth by expanding sales of smart phone, tablets and flat screen TVs.

Moreover, in terms of absolute growth, packaging has grown the most, which AMI says is most evident in emerging markets, particularly in China and India. On the other hand, the AMI consultants note that the increasingly competitive and commodity nature of traditional packaging film markets is driving film processors to seek added value opportunities through either diversification into thick films, technical applications or investment in secondary processing such as metallization or offline coating. The report indicates that new investments are more and more in hybrid lines capable of making a range of films that cut across the traditional supply divisions between thin films (<50 micron; 0.002 in.) and thick films (50-350 micron;0.002-0.014 in.) as companies look to diverse their portfolio.

It appears that in the 2010-11 time frame, there was strong growth in BOPET demand, which led to tight supply and relatively high margins; thus a boom in investment in the BOPET business. Over the last several years, this led to an explosion of new capacity, with some 4.8 billion lb installed since 2010. While global capacity was boosted by over 70%, demand only increased by half that rate, which has led to significant oversupply.

AMI notes that this “oversupply scenario”, combined with the falling crude oil prices, resulted in weak pricing and poor margins, making the operating environment for BOPET film processors increasingly challenging. “Much of this new added capacity has derived from high productivity low-cost operations with a focus on flexible packaging applications…This has put pressure on heritage businesses with older and less efficient assets particularly for the production of low-cost commodity grades in developed markets of North America, Europe, and North East Asia,” said AMI Consulting senior market analyst Marta Babits. The industry has seen many of these companies shifting their focus on specialized technologies and high-end value applications. At the same time, some, such as DuPont Teijin, have opted to shutter obsolete plants as part of cost-cutting measures.

The report characterizes this industry as becoming increasingly fragmented driven by new players entering the market in recent years. The top ten producers accounted for over 60% of the total production 10 years ago and less than 50% today while there are many more manufacturers holding smaller market shares. The largest producers worldwide include DuPont Teijin Films, Flex Films, Jiangsu Shuangxing Color Plastic New Materials, Mitsubishi Polyester Film, SKC Films, and Toray Films.

The BOPET demand forecast from AMI Consulting is for 10-billion lb by 2020, a CAGR of 6% from 2015-2020, but growth in some developing countries will be well above the average. “The industry will continue to bring value-added opportunities but to maintain market power, industry players need to anticipate change and formulate response strategies quickly and direct R&D investment accordingly,” Babits said.

Related Content

Roll Cooling: Understand the Three Heat-Transfer Processes

Designing cooling rolls is complex, tedious and requires a lot of inputs. Getting it wrong may have a dramatic impact on productivity.

Read MoreHow to Decrease the Extrudate Temperature in Single-Screw Extruders

In many cases, decreasing the discharge temperature will improve product quality and perhaps even boost rate. Here are ways to do it.

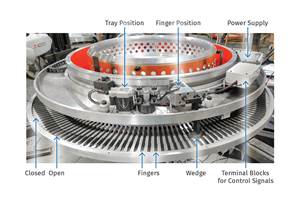

Read MoreNew Blown-Film Cooling Technologies Set to Debut at NPE2024

Cooling specialist Addex to roll out new auto-profiling air ring for rotating dies, and new single-plenum air ring.

Read MoreNovel Air Ring Solves Gauge Variations for Film Processor

Crayex installs Addex gauge-controlling air ring built for rotating/oscillating dies on a problematic line and notices dramatic improvement in thickness variations.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More