Commodity Resin Prices Generally Trending Downward Heading to Year's End

Falling raw material and feedstock costs are one common denominator driving prices of PP, PS, PVC and PET down, while PE is flat.

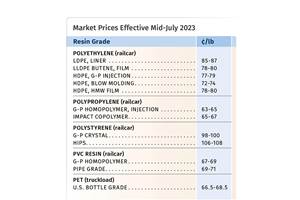

A downward trajectory as we approach the end of the year appeared to characterize the pricing trend for at least four of the five large-volume commodity resins. Going into the second week of November, key drivers were lower cost feedstocks, slowed demand, year-end destocking, and in some cases competition from lower-cost imports. Prices of PE, though also impacted by some of these factors along with slower exports activity, were expected to remain flat despite two looming price hikes.

Overall projections for the remainder of the year are for continued soft pricing, according to purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; senior editors from Houston-based PetroChemWire (PCW); and CEO Michael Greenberg of the Plastics Exchange in Chicago. Here’s a look at how things were shaping up:

PE: Prices remained flat in October and November, following the September 3¢/lb price hike. Suppliers moved up their October 3¢/lb increase to November, and their November 3¢/lb increase to December. Mike Burns, RTi’s v.p. of PE markets, ventured prices would remain flat this month as well, but come early first quarter, that could change. “Eight out of the last 10 years, we saw PE prices move up in first quarter due to strong exports and domestic restocking. For this coming year, it’s not clear what will happen with exports. But domestic demand is likely to continue to be strong, so I don’t expect PE prices to go down.”

Burns sees domestic demand as the key driver for the next round of announced increases. He did not expect feedstocks and inventory levels to be the short-term price drivers. In early November, the cost to produce ethylene was near 17¢/lb, and the cost to make a PE pellet was 33¢/lb, down 5¢/lb from the end of September. He saw the strong demand in North America as driven by tariffs. “All low-cost commodity-grade finished goods—from a broad range of bags to shrink wrap—are no longer being imported from China. Major distributors of these products have turned to domestic film processors.”

Weighing in, PCW senior editor David Barry, noted that there is no momentum to support the domestic price increases, and highlighted flat exports as one key issue. He noted that suppliers would need to decrease export prices and that they were initiating discussions to ramp up exports before the end of the year. There were also reports of slowed domestic demand, particularly in film sectors as a result of destocking in the aftermath of hurricane season, forecasts of lower prices before year’s end, and year-end inventory management.

The Plastics Exchange’s Greenberg reported on a very strong October for the spot PE market, with LLDPE and LDPE film grades and HDPE injection grades shining in terms of low-cost offers. Going into November, he reported spot PE prices as moving up 1-3¢/lb, which helped a bit to reduce the large gap (about 10¢/lb) between spot and elevated contract pricing. Greenberg also noted that export demand was also starting to sap as a result of sharply lower crude oil pricing. “If oil continues to fall and bearish sentiment accelerates worldwide, export demand and pricing could soften and generate another wave of lower priced offers.”

PP: Prices rolled flat in October, in step with propylene monomer contracts but the potential for as much as a double-digit drop emerged in early November. “It was a surprise that prices did not drop as spot monomer prices were unwinding—down about 12¢/lb from the end of September to end of October,” said Scott Newell, RTi’s v.p. of PP markets. Meanwhile, nominations of what appeared to be margin increases of 2-3¢/lb were issued by Braskem, effective Nov. 1, and LyondellBasell, effective Dec. 1, with no apparent support from other suppliers.

Both Newell and PCW’s Barry expected that November monomer contracts would settle down between 8-12¢/lb, with PP prices dropping in kind. Said Barry, “I think it would be a bit of a stretch for suppliers to expect to get a margin increase…plus there are 2019 contract negotiations taking place.” These sources also noted that monomer availability issues were trending positive, and that PP demand appeared to be down since September with competitive PP imports growing.

By the first week in November, the Plastics Exchange’s Greenberg reported that spot PP trading had slowed as buyers were looking at plummeting feedstock costs and either walked away from the market or purchased lower volumes. He also cited improved availability of both homopolymer and copolymer, with spot prices dropping by as much as 3¢/lb. These three sources characterize the PP market as still somewhat tight to relatively well-balanced.

PS: Prices rolled over in October, following the previous month’s 2¢/lb price hike. While November prices had yet to be determined, one supplier had signaled that prices would remain flat. “This was a surprise to the industry, as most people expected that 2¢/lb gained in September would be given back,” said Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets. Both she and PCW’s Barry cited the falling prices of all PS feedstocks—both domestically and globally as well as the slowed seasonal demand.

Moreover, Chesshier noted that lower-priced PS import volumes this year were up 17-18% year-to-date. “Buyers are pushing for lower prices and they have the right to do so,” adding that this could open-up the door for a switch to imports as well as other plastics. Noted Barry, “There’s definitely pressure from buyers to reduce prices in November based on feedstock costs alone. Even if suppliers keep prices flat, they will have a very difficult time keeping prices flat in December; a substantial price drop in benzene contracts is expected as evidenced by spot benzene prices.” He added that the ‘rule-of-thumb’ is that every 10¢/gal benzene price move translates to 1¢/lb for PS prices. Both sources noted that spot benzene prices had dropped by nearly 50¢/gal between September and early November, while early-settlement of October ethylene contract prices dropped by 2.5¢/lb.

PVC: Prices rolled over in October and were likely to be flat-to-down through the remainder of the year. This despite the 2¢/lb October price hike still on the table, according to both Mark Kallman, RTi’s v.p. of PVC and engineering resin markets, and PCW senior editor Donna Todd. Their reasoning: the market fundamentals do not support an increase including falling feedstock prices, lower export prices, and seasonally slowed demand.

PCW’s Todd reported that suppliers had aimed to get their 2¢/lb increase in October and then keep prices flat through year’s end. But an industry pundit projected the failure of the October price hike and prices remaining flat or dropping by 1¢/lb in November. “Once a whiff of a possible price decrease was proposed, resin buyers leapt at its and were considering a penny price drop in Nov. to be a fait accompli,” she noted.

Kallman noted that as 2019 resin contract negotiations were taking place, processors would aim for lower prices based on fourth quarter lower ethylene and export prices, along with slowed domestic and exports demand since September. “The trade war with China will continue to impact PVC finished goods imports. To a certain degree, domestic demand could be advantageously impacted.”

PET: Prices for domestic bottle-grade PET began to drop in early fourth quarter driven by a drop in seasonal demand along with bloated supply of imports, according to PCW senior editor Xavier Cronin. Off-grade PET ended October at 72 ¢/lb delivered U.S. South, truckload and bulk truckload (48,000 lb), down 2-3 ¢/lb from the start of the month. Prime PET resin—for non-contract truckload/bulk truck business—dropped by 3-4 ¢/lb to the high 70 ¢/lb range, for both domestic and imported resin, on an FOB U.S. South and Midwest.

Prices in November were expected to fall by another 2-3 ¢/lb due to the typical seasonal slowdown in demand after the high-consumption summer season for PET bottles (water, carbonated beverages and other warm-weather drinks). At the same time, a glut of PET imports is making it a buyer’s market. December PET prices were expected to fall on the order of 1-3 ¢/lb by most estimates, as this imports dynamic continues while the holiday season kicks into gear and many PET sector plants see a reduction in production, according to Cronin.

The PET import dynamic was further intensified in October when the U.S. International Trade Commission announced that it had determined that the domestic PET industry had not been "materially injured or threatened with material injury" by PET imports from Brazil, Indonesia, South Korea, Pakistan, and Taiwan. Earlier this year, the U.S. Department of Commerce had determined that imports from these countries had been sold at less-than-fair value in the U.S. But on its side of the investigation, the ITC made the no-injury decision. As such, no antidumping duty orders are to be issued on imports from these five countries, which accounted for about 50% of all domestic PET imports in 2017. Also, the preliminary duties that had been collected this year as the ITC investigation proceeded—in the form of cash deposits posted with U.S. Customs and Border Enforcement—will be reimbursed.

Related Content

Nexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MoreChemical Recycling Process for Crosslinked PE

Borealis announces capability to produce recycled PE for use in wire & cable, infrastructure industries.

Read MoreInfrastructure May Prove Big Landing Spot for Recycled Plastics

As the government funds infrastructure improvements, a hot topic at NPE2024 – exploration of the role recycled plastics can play in upcoming projects, particularly road development.

Read MorePS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More