Tips to Sell Your Company at the Right Value

M&A expert offers her advice in part two of this three-part blog series.

In part one of this-three part blog series, we featured a Q&A with Deborah Douglas in which she offered tips on what plastics processors need to know to get more savvy on evaluating the worth of the their company. Her insights are both useful and timely in light of the spate of M&A activity in plastics processing of late.

Ms. Douglas is an expert on such matters. Sheis the managing principal of Douglas Group, a St. Louis-based M&A firm that specializes in selling plastics processing companies. Ms. Douglas is a published author of two books, her most recentRipe: Harvesting the Value of Your Business: . She is frequently asked to speak at varied industry and trade events and often serves as luncheon speaker for general business forums. She has been published in numerous trade and business periodicals including Plastics News, ISHN, The Wall Street Journal, Fortune Magazine, and Profit Magazine to name a few.

In part two, she provides tips on how owners of processing businesses can get better at selling.

Plastics Technology: As companies prepare to move forward in the selling process, what are the “keys” to ensure they do well in the end?

Ms. Douglas: First and foremost, it is critical for owners to keep the process highly confidential. We have never had an owner sorry about keeping the sale confidential. Unfortunately, we have had owners who insisted upon open discussion, who were sorry in the end. If your employees know that you are considering sale, they may become afraid. That doesn’t mean that all will race out to look for alternative jobs, but your best people encounter those opportunities without really trying. If they’re insecure at the moment, they may just think, “Maybe I should at least look. You never know…” Also, customers too may become insecure to know you are thinking of sale. They may think, “At least I should try to make sure I have alternative vendors I could turn to. Just in case…”

The most successful owners who sell for the true home run pricing usually find the “best” buyers in unusual places. Many of the seller owners we talk with tell us at the outset, “I probably know who’s going to buy me. It will be one of these three or four companies.” Usually they’re thinking about competitors who they know.

Plastics Technology: And is this how it usually turns out?

Ms. Douglas: After 24 years in this business, I have learned that those top three or four are almost always wrong. The best buyer is not the obvious. It’s the company that’s not in your business, but does something slightly adjacent. They get more when they buy you. They can, for the first time, now do something they could not do before They’ll pay a premium for that head start. If you want to have a chance for the true homerun sale—the grand slam of a lifetime—hire help who will look exhaustively to identify the perfect buyer.

Plastics Technology: Let’s talk a bit about pricing. How do you work that into the conversation?

Ms. Douglas: In early conversations with buyers, they will always ask how much you want for your company. Professionals never set price. We make the buyer set the price. The open market will decide who wins. It is easy for us to maintain that policy, but it is hard for the do-it-yourself owner to do. Buyers tend to make you feel disingenuous for not responding to that question. “How can you expect me to move forward if you won’t tell me your price?” Buyers big enough and smart enough to have the money to make acquisitions know how to set price. (We would never get the huge prices for transactions that we sometimes do get, if we set the price ahead of time.)

In presenting information about your company, it is important to be thorough and honest. Even if there’s bad news sometimes, or a weakness that you must acknowledge, buyers generally take it quite well if you’re up front about it. In fact, in many cases if you find the perfect buyer, they will think of it as an opportunity! (“If this company is making this much now, just think how it will do when I fix the problems!”) Great deals are consistently made from a foundation of honesty and thorough information. In this case, honesty pays.

Buyers looking at your company may be amazingly fast to offer you a “letter of intent.” Novice sellers get excited about such offers, and are often far too quick to accept. A letter of intent gives the seller nothing. It says the buyer has an interest in buying, it says a price (or sometimes a price range), and it says the seller, by signing, agrees that the buyer can now do due diligence to actually decide if he wants the deal. In the meantime, the seller, by acceptance, normally agrees to deal exclusively with just the one buyer, and not talk to others. If you’re thinking of accepting such a letter, consider the following:

If the buyer needs a “stop shop” (an exclusive dealing clause) to continue, consider requiring a nonrefundable deposit first. If you chase away other alternative buyers, they usually will not come back later. It’s a big deal to pull yourself from the market.

Plastics Technology: What kind of information should be included in a letter-of-intent?

Ms. Douglas: If you are contemplating a letter of intent, first make sure you have all of the critical transaction details worked out in advance. If you have to stay with the company—for how long, and what will your compensation be? Will there be a cap on the indemnifications the buyer will ask for in the purchase agreement? What happens to profits or changes in balance sheet between the letter of intent date and closing? Will the physical property be purchased or leased as part of the deal, and if so at what price? If there’s any noncash piece to the deal, what is the collateral or guarantee that it will really be paid? The more thorough the seller can be in working out details before exclusivity, the stronger the deal.

Plastics Technology: Any other considerations?

Ms. Douglas: If you enter into a letter of intent, be sure to define timeframes tightly for the period until closing. Normally 60 days should be adequate. You may want to put in interim dates for completion of certain elements of their due diligence. Silly long timeframes to close increase risk of failure and are extremely costly to the seller, who must provide time and attention constantly to buyers as due diligence progresses.

Make sure to insert a provision to say that if the transaction price or terms change materially, the exclusivity for the buyer is void. Such a provision encourages buyers to think long and hard before proposing changes, and can make the difference in preserving the deal or not.

Selling is a complex process, and sellers generally need good professional help to get it done. Look for a representative who does only the sale of companies. Our normal time to get a sale done is something over 2000 hours (and we’re efficient and know what we’re doing). It’s time-consuming, and it’s important. Your attorney knows how, for the legal mechanics, but he does not know the competitive marketplace, and he does not have that kind of time to spend focused on your deal. Your accountant is not terribly motivated; he’ll probably lose a client when the deal is done. And he can’t represent you on a success fee basis, because then he wouldn’t be independent. There are good intermediaries out there, who serve clients reliably and competently. It is worth the time and effort to find them.

Business owners do great things for our country. They create jobs, and opportunities for people. They improve goods and services for everyone. They fill the public coffers with tax dollars. They deserve success in the end. Sale of the company is often the culmination of a lifetime of hard work. It’s worth the time and attention to do well.

Related Content

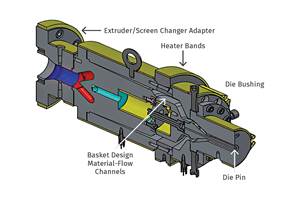

How to Select the Right Tooling for Pipe Extrusion

In pipe extrusion, selecting or building a complementary set of tooling often poses challenges due to a range of qualitative factors. Here’s some guidance to help you out.

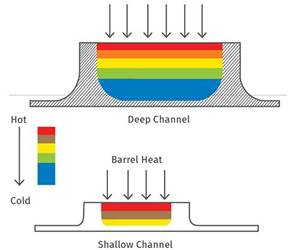

Read MoreThe Importance of Barrel Heat and Melt Temperature

Barrel temperature may impact melting in the case of very small extruders running very slowly. Otherwise, melting is mainly the result of shear heating of the polymer.

Read MoreWhy Are There No 'Universal' Screws for All Polymers?

There’s a simple answer: Because all plastics are not the same.

Read MoreHow Polymer Melts in Single-Screw Extruders

Understanding how polymer melts in a single-screw extruder could help you optimize your screw design to eliminate defect-causing solid polymer fragments.

Read MoreRead Next

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More