NAFTA Color and Additives Concentrate Market Growing

Market is expanding at rates not seen since the 1990s.

Market is expanding at rates not seen since the 1990s.

The latest research from Applied Market Information (AMI) Consulting (U.S. office in Wyomissing, Pa.) reveals that the NAFTA market for thermoplastic color and additive concentrates continued to have strong prospects for growth and market penetration. At the same time there are new opportunities to profit from increased customer service needs among major brands.

In fact, AMI’s detailed market report “Thermoplastic Concentrates in NAFTA”, indicates that in recent years, this market has seen a period of sustained growth not experienced since the 1990s, with North America increasingly a key center of innovation and global brand developments, making it an ideal place to develop new colors and property enhancing products.

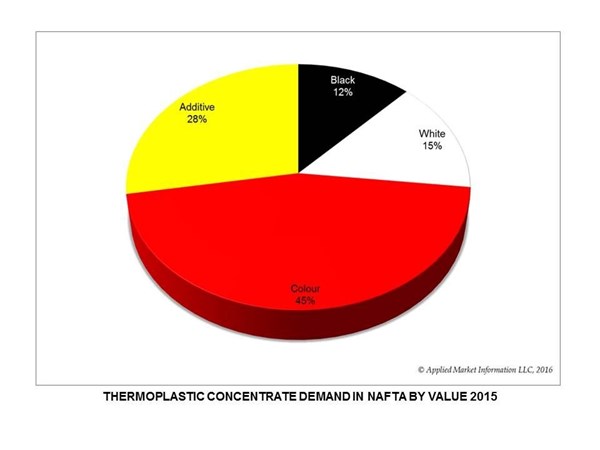

According to AMI, the largest market for concentrates in NAFTA is still for additive types—especially mineral-based products, which account for 47% of demand. The color segment is, however, the most important in value terms in a market which now exceeds $3 billion in sales.

For many years, the concentrate industry in NAFTA tended to outperform the overall polymer industry as plastics processors recognized the technical and business advantages of using concentrates over compounds or other systems. Although in the future, the delta between polymer growth and the concentrate market advance will narrow, with the prospects in value-added areas such as custom color and additive materials still being very good.

The NAFTA market is seeing a considerable volume of new investment both from the traditional major players but also new market entrants. This will only emphasize the competitive nature of the market where there have been clear winners and losers in recent years with some players cutting back their activities and closing plants while others have sought new markets to sustain their business. AMI’s research highlights the way in which a number of new names in the industry are coming to the fore in the color segment.

AMI also notes that NAFTA continues to have a strong export surplus in concentrates of well over 50 million lb. This is further testament, says AMI, to the strength and size of the concentrate industry in NAFTA. The surplus is most significant in additive and color varieties, but all product types show net levels of exports.

The AMI report concludes that the market in NAFTA will continue to grow, albeit at levels much lower than has historically been the case because of much slower growth in the traditional volume market for concentrate in PE film and blow molding. Opportunities will arise in more specialty sectors such as glass yarn and high performance packaging and in the growing use of recycled materials that will require additive packages to modify performance.

Look for a special PT supplement on plastic colorants that will accompany our September issue. It offers tips and best practices on how to avoid typical challenges encountered when choosing, processing, metering and measuring color.

For more on color and additive concentrates, see PT’s additives database.

Related Content

-

Tosaf’s Investments in North America Result in 40% Increase in Production Capacity

Backed by a global presence, Tosaf provides localized additive and color solutions, and services for the plastic industry in North America.

-

Get Color Changes Right In Extrusion Blow Molding

Follow these best practices to minimize loss of time, material and labor during color changes in molding containers from bottles to jerrycans. The authors explore what this means for each step of the process, from raw-material infeed to handling and reprocessing tails and trim.

-

Additive Masterbatch for Permanent Etching on Black and Dark Plastics Products

Ampacet’s new ColorMark reveals color in dark plastic surfaces exposed to laser light