PE Film Market Analysis: Stretch Film

The stretch film market continues to be one of the largest and most rapidly evolving polyethylene PE film markets.

The stretch film market continues to be one of the largest and most rapidly evolving polyethylene PE film markets. Stretch film processors remain optimistic about increases in demand for their products, as stretch film continues to displace other conventional means of pallet unitization and product bundling like plastic and metal banding, PE shrink film and pallet wrap/shrouds, pressure sensitive tape and adhesives, etc.

These are among the conclusions of the most recent study of the PE Film market conducted by Mastio & Co., St. Joseph, Mo.

Three distinct types of stretch films are commonly produced: hand-wrap, machine rotary or power stretch wrap, and silage-wrap stretch films, the Mastio research revealed. However, within each category there are several highly customized sub-grades of stretch films designed for specific end-use applications. Stretch film application equipment is more cost-effective, faster, more user-friendly, more energy efficient and safer to use than shrink-wrapping equipment. Shrink film requires the use of heat lamps or hot air guns, which require greater amounts of energy and labor than power stretch wrapping equipment. New applications for specialty grades of stretch film continue to be developed and commercialized in North America, and more sophisticated stretch films are designed for existing applications.

MATERIALS TRENDS

The Mastio study notes that one of the most significant changes to manifest over recent years in the stretch film market is increased use of metallocene single-site catalyst based linear low density PE (mLLDPE) resin. When used in blends or in coextrusion with conventionally produced PE resins, mLLDPE resin greatly enhances the physical properties of the films in lower gauges, according to the report.

In 2014, approximately 1,935.8 million lb of PE resins were consumed in the production of stretch film, making this PE business one of the largest and fastest growing markets within the PE film industry, according to the Mastio study. With an average annual growth rate (AAGR) of 4.5%, PE resin consumption for the production of stretch film should reach 2,213.1 million lb by the year 2017.

During the second quarter of 2014, a few of the top producers of stretch film had announced plans for non-resin price increases, Mastio reports. The reasons stated for necessitating the increases included the rising costs of health insurance, fuel, freight, and shipping. Some participants in this market were optimistic about increased growth in demand over the next three years, while a few others felt that growth would result from gaining market share from other competitors.

Generally, the reported overall production of stretch film has increased despite the sluggish demand resulting from the slow economic condition that prevailed three years ago.

All of the processors that participated in this Mastio study seemed to agree that the increased costs of resin, transportation, and energy have had a negative impact on their profit margins. Further film downgauging, as a way to save material costs, is expected to continue in the future. Higher quality grades of PE resins and incorporating more layers in coextruded stretch film have allowed manufacturers to produce stronger films in thinner gauges. The result was more square feet of stretch film produced while overall PE resin consumption increased less significantly.

TECHNOLOGY TRENDS

Current methods for producing stretch film include: monolayer blown film extrusion, multi-layer blown film coextrusion, monolayer cast film extrusion and multi-layer cast film coextrusion. During the past several years the stretch film industry has continued to experience a shift from blown film extrusion process to the cast film extrusion process and from monolayer construction to more multi-layer coextruded film constructions, the Mastio report concluded. Some numbers: during 2014, approximately 1,376.2 million lb (71.1%) of stretch film were produced using the cast film extrusion process, and 559.6 million lb (28.9%) were produced utilizing the blown film extrusion process.

During 2014, Mastio says, stretch film constructions were broken down accordingly: 1,467.4 million lb (75.8%) consisted of multi-layer coextruded film, and 468.4 million lb (24.2%) was monolayer film. Another benefit of the coextrusion process is the ability to mix and match different combinations of resins that yield the greatest properties and economies in the stretch films. One increasingly common trend in the stretch film market is coextrusion of mLLDPE resin with other conventionally produced butene, hexene, super hexene, or octene grades of LLDPE resin (LLDPE-butene, LLDPE-hexene, LLDPE-super hexene, and LLDPE-octene). mLLDPE resin enhances the film’s clarity, elongation, tear resistance, and puncture resistance in much thinner gauges, for only slightly higher material costs.

MY TWO CENTS

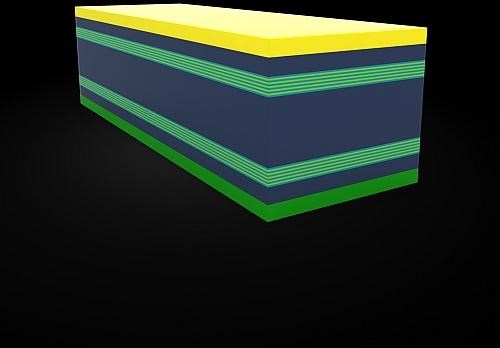

Heard of the 80-20 rule? How about 82-6…as in 82% of the market—measured in pounds consumed—is held by six processors. Some observers of the market believe this has stymied innovating—noting that five-layer stretch technology developed by Chaparral Films (now part of ITW) some 20 years ago is still considered “state-of-the-art” in North America. Patent disputes have restrained the development of more-sophisticated nano-layer structures that are more common in Europe. What’s more, stretch film in North America is sold through distributors separating the entity that produces the film from the entity that uses it.

Some feel that these dynamics are paving the way for European processors with more sophisticated products to enter the North American market. At NPE2015, Plastics Technology sat down with Eddie Hilbrink, who heads up strategic R&D projects for Apeldoorn Flexible Packaging B.V. (AFP). Click here and scroll down for the full report from that interview.

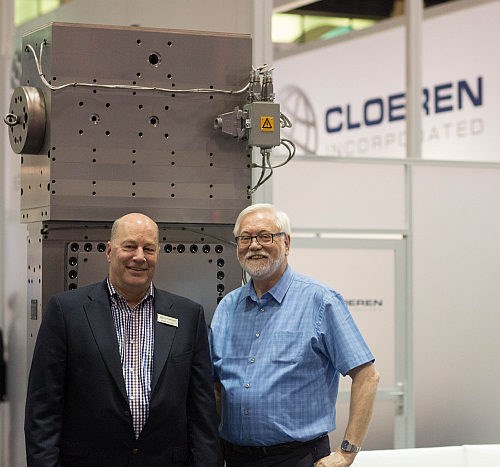

The gist of it is, AFP, working closely with Cloeren Incorporated, Orange, Tex., is currently producing 27-layer stretch film (image above, with a 55-layer line in the production pipeline. And its full product line (soon all of it will be nanolayer) was developed as a result of AFP’s direct contact with the end user.

Says Hilbrink: “We saw products that were sold by the pound. We saw a market in which it was difficult to discriminate one company’s film product from the next,” Hilbrink told Plastics Technology in an exclusive interview at NPE2015. “We saw a business that was unresponsive to customers. I thought to myself, ‘Let’s do something different.’”

In the future, Hilbrink (pictured below, right, with Peter Cloeren) would not rule out AFP supplying the U.S. market, in which 0.5% of retail sales is lost to damage.

Related Content

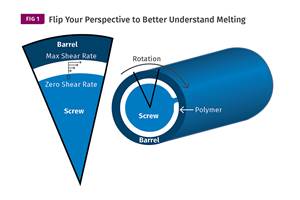

Understanding Melting in Single-Screw Extruders

You can better visualize the melting process by “flipping” the observation point so the barrel appears to be turning clockwise around a stationary screw.

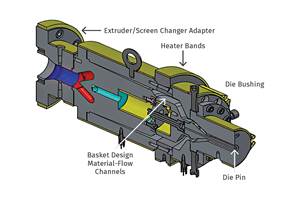

Read MoreHow to Select the Right Tooling for Pipe Extrusion

In pipe extrusion, selecting or building a complementary set of tooling often poses challenges due to a range of qualitative factors. Here’s some guidance to help you out.

Read MorePart 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

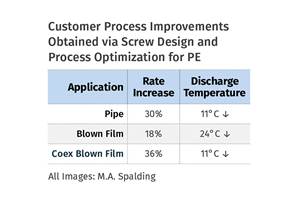

Read MoreHow Screw Design Can Boost Output of Single-Screw Extruders

Optimizing screw design for a lower discharge temperature has been shown to significantly increase output rate.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More