Tea Leaves Point to Growth, Greater Connectivity in Mfg. in 2015

Many predictions about the literally nuts-and-bolts world of manufacturing for 2015 center on things that are decidedly less tangible then, well, nuts and bolts.

Apart from college football bowl games and resolutions, few things are as synonymous with the New Year as predictions. Below I’ve linked to some prognostications for the manufacturing sector over the coming year, many of which foreshadow similar story lines.

Back in September, I wrote about the ARC Advisory Group’s efforts to map manufacturing’s future through 2050, let alone the next 12 months, where the concept of broader connectivity and “information-driven” manufacturing were key elements.

On Dec. 5, International Data Corp. (IDC) released its worldwide manufacturing predictions for 2015, which pointed to the data-driven factory foretold by ARC. Simon Ellis, practice director IDC Manufacturing Insights, talked about “ubiquitous connectivity and data-driven insights” in the report, which included some specific forecasts.

- By 2017, manufacturers will actively channel 25% of their IT budgets through industry clouds that enable seamless and flexible collaboration models.

- In 2015, product quality, including compliance, will underpin two thirds of all IT application investments across the manufacturing organization.

- In 2015, 65% of companies with more than 10 plants will enable the factory floor to make better decisions through investments in operational intelligence.

- Investments that enable digitally executed manufacturing will increase 50% by the end of 2017, as manufacturers seek to be more agile in the marketplace.

Laura D. Reilly of the Georgia Tech Manufacturing Institute had six predictions for manufacturing in 2015, with two specifically focused on technology bettering plant floor output. In addition to ongoing reshoring, a manufacturing boom, increased capital investment, and sector growth that would outstrip GDP’s, Reilly talked about big data and predictive maintenance.

Big data will drive big efficiency: Sensor technologies will drive the concept of connected factories, and will fuel the introduction of mobility-based manufacturing. Web browsers will be used as dashboards to control equipment, identify snags, and make quick decisions that would have previously taken entire teams of people to handle. As connected factories go online, myriad amounts of data will be collected. But 2015 will see that data put to use in a smarter way that makes things operate more efficiently.

Increased investments in predictive maintenance technologies: The proliferation of better and cheaper sensor technologies combined with the trend of connected factories will allow for greater opportunity to implement predictive maintenance technologies that will cut downtime and boost bottom lines.

Boom…Renaissance…Bounce Back

In terms of manufacturing’s predicted performance in 2015, the forecasts are downright rosy. For her part, Reilly sees a “manufacturing boom” in the U.S. saying the sector can “reasonably expect between 4% and 5% growth” with “a new wave of domestic manufacturing” launching in 2015. As part of this wave, Reilly also forecasts the “replacement of aging legacy equipment and investment in new capital equipment that performs better, more efficiently and more reliably.”

Plastics Technology’s Jim Callari and Steve Kline recently tackled the capital spending outlook for plastics (full article here).

PricewaterhouseCoopers (PwC) sees a “bounce back” for the U.S. in 2015. While China slows and Europe adopts quantitative easing, India is expected to turn the corner and sub-Saharan Africa’s expansion will outpace global growth.

In our main scenario we are projecting the US economy to grow by more than 3% in 2015, the fastest growth rate since 2005. We still expect China to make the biggest contribution to global growth in 2015. However, its projected growth rate of 7.2% would be its slowest since 1990 and its high debt levels pose some downside risks to that main scenario.

Daniel J. Meckstroth, vice president and chief economist as well as council director of the MAPI Purchasing Council, is calling for an acceleration in manufacturing’s growth in 2015, fueled by housing (and subsequently appliances), as well as automotive. Meckstroth, who believes manufacturing growth will outpace that of the overall economy, forecasts that in 2015:

- Auto sales will increase 3%

- Housing starts will jump 29%

- Manufacturing production will grow 4%

The quote, “Never make predictions, especially about the future,” which is attributed to baseball great Casey Stengel, is sage advice, and while it is impossible to know everything that will happen over the next 12 months (I mean, who saw the polar vortex coming last year), manufacturing is starting the year from a very good place.

Related Content

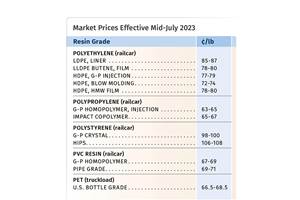

PS Prices Plunge, Others Appear to Be Bottoming Out

PS prices to see significant drop, with some potential for a modest downward path for others.

Read MoreChemical Recycling Process for Crosslinked PE

Borealis announces capability to produce recycled PE for use in wire & cable, infrastructure industries.

Read MoreIneos Nitriles Launches Biobased Acrylonitrile

The company’s Invireo is said to deliver a 90% lower carbon footprint compared to conventionally produced acrylonitrile.

Read MoreNexkemia Acquires Polystyrene Recycling Assets

The polystyrene manufacturer finalized its purchase of Eco-Captation, a recycler.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More