Domo Offers Injection Molding Simulation Database for Nylons

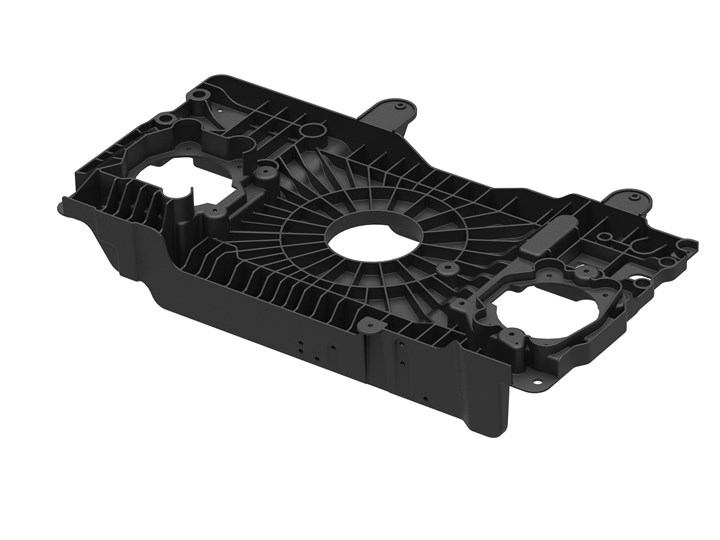

Domo’s new service provides customer with access to the most up-to-date extensive and validated Technyl nylon 6 and 66 products.

A new service covering its global Technyl nylon 6 and 66 portfolio has been launched by Belgium’s Domo Engineered Materials (U.S. office in Buford, Ga.). It is comprised of frequent updates of its injection molding simulation database for Autodesk Moldflow. Comparable injection material cards for other software (Moldex3D, CADmould, etc.) will also be made available upon request or through customers’ sales and technical managers.

By enabling customers to always have the latest injection molding simulation data from Domo, they will be able to save both time and effort in getting the appropriate data for their projects. These fitted and validated measurements for more precise simulation are expected to shorten development time and speed-up time to market.

Moreover, these direct updates will include new offerings from Domo’s development pipeline as well as newly validated data beyond the standard injection molding process characterization, such as fiber orientation prediction optimization.

“We are at the cutting edge in our approach to provide high quality data for injection molding and integrative structural – MMI simulation in the fastest and most direct way to our customers. This project is part of a broader scope aimed at improving our overall digitalization capability and is an instrumental contribution to our commercial digitalization strategy,” said Alexandre Chatelain, Domo’s simulation models database manager.

Related Content

-

Soft Prices for Volume Resins

While PP and PE prices may be bottoming out, a downward trajectory was likely for all other volume resins, including engineering types.

-

Prices of Volume Resins Drop--Except for PE

The downward trajectory appears to be continuing into the first quarter for most resin prices, though PE and possibly PP may remain somewhat stable.

-

Prices Up for All Volume Resins

First quarter was ending up with upward pricing, primarily due to higher feedstock costs and not supply/demand fundamentals.