Incoming Orders for European Plastics and Rubber Machinery Ended 2023 Down

Noting that geopolitical changes require new corporate strategies, European plastics and rubber machinery trade groups announced that incoming orders fell 22% in 2023.

In a June 5 meeting in Dresden, Germany, the trade associations of plastics and rubber machinery, waste and recycling technology, EMINT, and the project group for hybrid lightweight technologies shared sector statistics reviewing 2023 and, looking forward, discussing challenges that remain for the plastics machinery sector in Europe.

The groups reported that incoming orders dropped 22% last year. Despite that, the sector finished 2023 with a price-adjusted 13% increase in revenue. In Germany, according to the German Plastics and Rubber Machinery Association (VDMA), new orders decreased in 2023 by 16%, after falling by 10% in 2022. The VDMA reported that its domestic and export business both shrank in 2023 by 14% and 16%, respectively.

In a release, Ulrich Reifenhäuser, VDMA chairman, said most companies have worked through their order backlog and are currently dealing with lower capacity utilization. From 2022 to 2023, VDMA say capacity utilization fell 7% from 93% to 86%. In addition to the wars in the Ukraine and the Middle East, shrinking demand was chalked up to high energy costs, inflation and high interest rates.

Ulrich Ackermann, head of VDMA Foreign Trade, said that globally, China and the U.S. are turning inward, forcing the European mechanical engineering industry to “have its own production facilities in large target markets and being able to offer market-specific products.”

At NPE2023, Arburg, Engel and Wittmann all detailed plans to shift some production based on market demands and economic challenges in Austria and Germany. Regarding interest rates, on June 6, one day after the Dresden meeting, the European Central Bank announced that it was cutting interest rates because inflation was on track to return to the bank’s goal of 2%. “Our goal is to keep inflation at 2% over the medium term,” the bank says in a statement. “Now that inflation is coming closer to that target, we no longer need to keep interest rates quite so high.” The bank began raising rates in July 2022 and kept doing so until September 2023, lifting them by a total of 4.5 percentage points over that time.

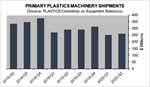

Thus far, 2024 remains “challenging,” with VDMA reporting that for the first quarter overall new orders were down 17%, dropping 40% in Germany, 31% in Europe and 11% overall in exports. The Plastics Industry Association (PLASTICS) announced similar difficulties for the North American plastics machinery sector in the first quarter.

At NPE2024, Engel announced plans to add some production to Mexico, following a trend among European machinery manufacturers. Source: Engel

Related Content

-

See Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

-

Impacts of Auto’s Switch to Sustainability

Of all the trends you can see at NPE2024, this one is BIG. Not only is the auto industry transitioning to electrification but there are concerted efforts to modify the materials used, especially polymers, for interior applications.

-

At NPE2024, Follow These Megatrends in Materials and Additives

Offerings range from recycled, biobased, biodegradable and monomaterial structures that enhance recyclability to additives that are more efficient, sustainable and safer to use.