U.S. Plastics Industry Expands in 2017, Outpacing Manufacturing in General

U.S. employment in plastics and plastics industry shipments both expanded in 2017, rising 2.4% and 6.9%, respectively.

The U.S. plastics industry generated an estimated $432.3 billion in shipments and supported 989,000 jobs in 2017, according to the 2018 Size & Impact Report, an annual publication of the Plastics Industry Association (PLASTICS). Including suppliers to the plastics industry, the total jobs figure nearly doubles to 1.81 million. Further signaling the sector’s health in relation to the broader economy, plastics employment growth outpaced all manufacturing, coming in at 1.6% versus 0.9%.

State-By-State Look

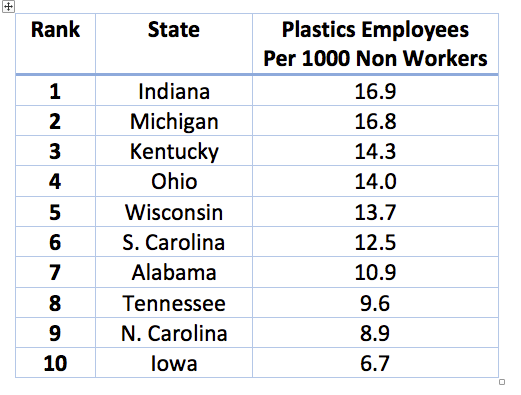

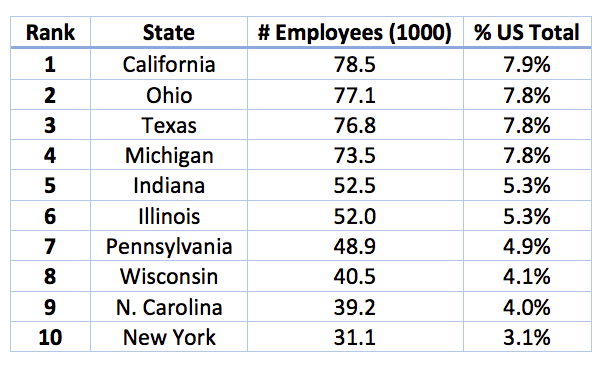

In 2017, California was the top plastics employer with 78,500 total jobs, while Indiana leads in terms of concentration with plastics occupying 16.9 out of every 1000 non-farm jobs in the state. In total employment, Ohio came in second with 77,100 workers, followed by Texas, with an estimated 76,800. In terms of concentration, Michigan was a close second behind Indiana, with 16.8 plastics employees per 1,000 non-farm workers. In terms of plastics shipments, Texas lead the way followed by Ohio and California.

There were nearly 13,000 total plastics related companies in the U.S. in 2017, lead by plastics product makers (10,696); materials and resins manufacturers(1133); mold builders (707); and working machinery makers (414).

Trade Continues to Flow

In 2017, the U.S. plastics industry generated a $2.9 billion trade surplus, exporting $60.3 billion in plastics while importing $57.4 billion. The top destinations for exports, despite bluster from the U.S. government regarding the former NAFTA trade deal and China, were Mexico, Canada and China. Through the first nine months of 2018, trade with all three of those countries was ahead of 2017 pace.

Mexico, Canada and China were also the three biggest importers of plastics-related goods and products into the U.S., with all three on pace through the first three quarters of 2018 to see imports into the U.S. rise for the year.

Measured Outlook

In a presentation to trade press, PLASTICS Chief Economist Perc Pineda noted some potential headwinds in 2018 include uncertainty in the global trading environment; rising business costs; labor shortages; divergence in global economic growth and sustainability issues. Despite those potential challenges, looking forward in 2019, PLASTICS forecast growth for GDP (2.4% in every quarter save Q2 2019 with 2.5%), with the U.S. unemployment rate forecast to average a very low 3.6%. Plastics employment is projected to rise slightly (+0.8%) in 2019, while shipments are forecast to increase by 2.2%.Related Content

-

Breaking the Barrier: An Emerging Force in 9-Layer Film Packaging

Hamilton Plastics taps into its 30-plus years of know-how in high-barrier films by bringing novel, custom-engineered, nine-layer structures resulting from the investment in two new lines.

-

In Sustainable Packaging, the Word is ‘Monomaterial’

In both flexible and rigid packaging, the trend is to replace multimaterial laminates, coextrusions and “composites” with single-material structures, usually based on PE or PP. Nonpackaging applications are following suit.

-

How to Extrusion Blow Mold PHA/PLA Blends

You need to pay attention to the inherent characteristics of biopolymers PHA/PLA materials when setting process parameters to realize better and more consistent outcomes.