Construction Markets Forecast

There is general agreement amongst economists that the residential construction and real estate sectors in the U.S. will "cool off" this year.

There is general agreement amongst economists that the residential construction and real estate sectors in the U.S. will "cool off" this year. However, it is not clear just how steep the decline will be, or how this anticipated slowdown will affect other sectors of the economy such as the plastics industry. Construction market demand for pipe, conduit, windows, decking, fencing, siding, crates, pails, buckets, and films has been strong in recent months, but will this demand continue through this year? There is a multitude of factors to weigh, and fortunately there is plenty of data readily available for analysis.

Housing starts: Housing starts have long been recognized as not only a good indicator of construction activity, but they are also a good leading indicator of the trend in the overall economy. Many types of purchases follow the start of a new house, and when times are good for building new homes, they are generally good for all other types of economic activity. In 2005, housing starts increased 6% to nearly 2.1 million units, a huge number by historical standards. It is not surprising that this increase occurred in the same year that a record number of existing homes were sold, and there was also a strong surge in the median value of homes. So far in 2006, the number of housing starts has increased when compared with the first two months of last year. But interest rates have increased steadily during the past year, and at the same time demand has been used up. This will eventually put the brakes on new residential construction activity. Our forecast calls for a moderate decline of 6% to 8% in total housing starts in 2006. A bigger drop of 10% would still mean that nearly 1.9 million new houses be started this year, and from a historical perspective, this number is still quite high.

Construction Spending: Another indicator is the trend in construction spending, which includes spending for residential as well as nonresidential buildings, roads, sewers, communications projects, etc. In 2005, construction spending expanded by 9%. Spending on residential projects advanced 11% while nonresidential spending grew by more than 6%. The biggest gainers in the nonresidential category last year were highways and streets (up 11%); sewage and waste disposal (up 14%); water supply (up 12%); and manufacturing facilities (up 22%). The rates of growth in these sectors are expected to slow in 2006, but the actual amount of money spent should still be at or near record levels. We expect total construction spending to grow by 5% this year. So far this year, the total spending data is 6% to 7% higher than the same period last year.

Spending for Residential Improvements, Alterations, and Repairs: This data is not reported in as timely a manner as other construction data, but in 2005, the total spent on these types of projects expanded an estimated 7% to well over $200 billion. All of the existing homes that were sold in 2005 will be prime candidates for remodeling in 2006, so this figure is expected to grow another 5% to 7% this year.

Retail Sales at Building Materials and Supplies Dealers: If the materials for the aforementioned remodeling projects are purchased at building supply stores or home centers, then this activity will be captured in the data for retail sales. Total sales at these stores jumped an impressive 10% in 2005, and they are up 20% through the first two months of 2006. This rate of growth will not be sustained for the entire year, but our forecast does call for a solid gain of at least 8% in this category this year.

Construction Employment: One final indicator of construction activity is the employment data reported by the Bureau of Labor Statistics. During the past 12 months, construction employment has risen by almost 350,000 jobs, or 4.7%. This rate is three times the growth rate for overall non-farm employment. All types of construction jobs have increased so far this year, and payrolls have increased in fully 46 of the 50 U.S. states during the past 12 months. This expansion in construction data will slow this year, but there should not be any declines in overall construction payrolls in 2006.

So the outlook for 2006 is as follows: Single and multi-family residential construction will taper off as the year progresses, but at the present time, there is a backlog of paid-for but unbuilt houses that will keep single-family construction buoyant for a while. Remodeling activity will continue to expand at a solid pace. In the nonresidential sector, growth will be positive for factories, healthcare (hospitals), freight transportation, refineries and alternative energy facilities, roads and other public projects, and some sectors of retail.

Related Content

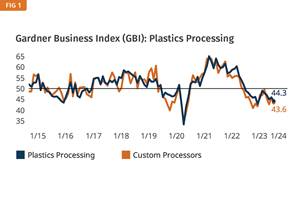

Plastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

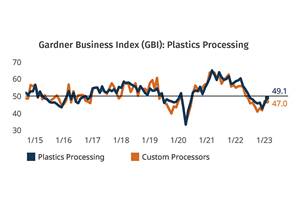

Read MorePlastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

Read MoreProcessing Activity Dips in May

Plastics processing took a downturn in May, the first appreciable dip since November 2023.

Read MorePlastics Processing Contraction Slows Slightly

While the market is still sluggish, future business outlook rose significantly from last month.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More