Drumroll, Please: How Mauser Rose to Number 1

On Site: Mauser Group

Drum blow molder Mauser has used acquisitions, home-made machine building and careful attention to processing details to take the leading position in the field.

The drum business isn’t huge compared with other so-called commodity plastics processing operations. According to the Plastics Drum Institute’s most recent statistics, 15 million plastic drums were sold in North America from the seven different companies that dominate the market.

Still, the industry is evolving. Sustainability is an issue, and the drum makers have responded with programs aimed at making greater use of recycled material, reconditioning previously used drums, and developing new products that use less material. According to PDI numbers and other sources, the industry’s bread-and-butter product, the 55-gal drum, now weighs in at about 20-21 lb, one-third less than what it weighed in 1974.

One processor, Mauser USA LLC, whose plastics drum business is headquartered in E. Brunswick, N.J., has led the way in developments in these and other areas. Mauser is a global company whose roots go back more than 100 years. It operates some 58 plants in 16 countries on four continents. It employs about 4000 people and has annual sales of approximately $1 billion.

Mauser entered the North American market in 2004 with the purchase of Hoover Materials, and a year later purchased Russell Stanley. Since then Mauser has been developing new products and taken other initiatives to remain the leading supplier of plastic drums in North America.

“We’ve been growing at a rate of about 20% a year since the acquisition,” says Jeff DeLiberty, Mauser’s director of business and market development. “A lot of this has been through acquisitions that support our core business.” In 2004, a year before the Russell Stanley purchase, Mauser bought National Container Group (NCG), a drum-reconditioning business with locations worldwide, including 10 in North America. With a U.S. headquarters in Willowbrook, Ill., NCG’s services include full reconditioning of both plastic drums and intermediate bulk containers. Services include container collection, cleaning, and resale in a one-stop operation.

More recently, Mauser purchased Varicon Solutions with operations in Greenville, S.C., and Cleveland, molding tight-head and open-head drums of virgin HDPE as well as of post-consumer reclaim. NCG absorbed Varicon’s reconditioning activities. Mauser has dubbed its acquisition philosophy, “buy and build.”

But acquisitions have not been the only way in which Mauser has grown. Both its product line and its customer base are diverse. “Our business is about 65% in the chemical industry, 20% lubricants, 5% pharmaceuticals, and 5% food and beverage,” states DeLiberty. “But no single customer accounts for more than 5% of our business.

In North America, Mauser has five processing operations that run around the clock and account for more than 450,000 ft² of manufacturing space. Its flagship plant is in Addison, Ill., a 132,000-ft² plant that houses all of Mauser’s coextrusion capacity, as well as a behemoth of a shuttle blow molding machine that can produce 55-gal drums at a rate of 100 drums/hr.

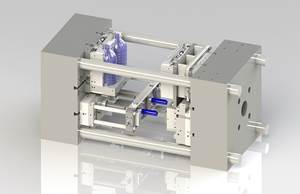

There is something a bit unique about this machine in addition to its capacity: Mauser built it. In fact, of the 40 machines that Mauser operates at its five plants, 24 are home-grown, says Christopher Lind, the company’s director of technology and regulatory affairs. Mauser has been designing, developing, and building high-performance blow molding equipment since the 1960s, originally just for its own production.

“Building our own machines is not completely unique in this business. In fact, one of our competitors does some of that as well,” says Lind. “But we think this capability provides us with a huge competitive advantage.” Mauser will also build machines for other blow molders on a licensing basis, a practice it started in the 1970s; in fact, Russell Stanley was a former licensee.

Addison houses the massive Mauser BM 202 blow molder, used mainly for larger drums, including Mauser’s L-Ring and open-top products. The 202 is fully automated for deflashing and weighing.

The L-Ring line is one of Mauser’s several patented innovations. It’s available in five sizes from 30 to 55 gal. Developed for U.S. chemical and foodservice industries, it is so named because it’s a one-piece design with the ring integrated into the drum around its entire circumference, eliminating the need for any snap-on pieces to add to strength and support.

ATTENTION TO DETAILS

Mauser’s business is distinct from most processing operations—just consider the extent to which its products are subjected to DOT, FDA, UN, and a myriad of other regulations covering transportation of food and hazardous materials. But that’s not to say that more conventional processing operations could not pick up a thing or two from some of Mauser’s practices.

Incoming raw-material inspection is one of them. Says Lind, who is stationed at Mauser’s E. Brunswick plant. “We test every railcar of material that comes in here, drawing material from two, if not all four, compartments of the railcar. This is standard practice at all our locations. We are very serious about materials testing. We have two plastometers (melt indexers) that are always running. We test material for tensile and elongation, too.”

The industry standard for drums Mauser produces is HDPE. Typical melt flow is in the range of 4.5-6.5 g/10 min, says Lind; typical density is 0.948-0.959 g/cc. Anything outside those parameters is retested, then sent back to the supplier if it’s still not up to specification.

The drum business is not a particularly huge one for the resin suppliers, accounting for an estimated 4% of their overall volume. Still, Mauser uses what clout it has to work with its material suppliers on a regular basis in joint R&D meetings.

Lind explains, “We are continually evaluating new resins, constantly challenging our suppliers. Our objectives are to take out weight where we can without sacrificing performance. We are always looking for improved processability and chemical compatibility. We don’t use a lot of additives, with the exception of UV stabilizer where it’s required. So we rely on our material suppliers to furnish products that we can use right out of the railcar.”

Mauser does use quite a few colorants, which it buys in masterbatches. It furnishes drums in six shades of blue, two grades of black as well and several greens, yellows, purples, and white.

Mauser is the only North American drum maker that is also a DOT-certified testing facility. “Some chemical companies actually prefer to make their own drums, and all of our plants are equipped to certify them,” Lind notes. Inside a specially designed heat room, drums sit for 28 days at temperatures above 100 F to check for deformation. Mauser also can test drums for leaks and other problems.

In E. Brunswick, seven blow molders run around the clock producing the full range of Mauser products. A new addition is the Infinity line of tight-head drums made of up to 100% post-industrial repelletized resin. At this plant and elsewhere, Mauser is moving more and more toward fully automated post-molding systems, where drums are deflashed, checked for leaks, weighed, labeled, and sometimes even barcoded without the need for operators.

THE ‘FIVE Rs’ OF SUSTAINABILITY

Mauser’s effort to refurbish used containers and process new ones from scrap are two examples of its commitment to sustainability. The processor has devised what it calls the Eco-Cycle concept, which follows five principles:

•Renew: Investigating and developing new materials technology.

•Reduce : Minimizing raw-material use, energy consumption, and environmental impact.

•Recollect: The company’s NCG worldwide recollection system for industrial packaging.

•Reuse: Reconditioning packaging (again through NCG) as a high-quality solution with low environmental impact.

•Recycle: Closing the cycle, giving materials new life.

In its plants, Mauser has also deployed technology aimed at reducing energy consumption. It has retrofitted blow molding machines with a system that recaptures compressed air that still retains enough energy to perform useful functions. At various locations it has installed chiller technology furnished by Frigel North America, Inc., E. Dundee, Ill. This system uses ambient temperatures for mold cooling when outdoor temperature is 40-50 F. Depending on the plant location, the chiller load can be zero for up to eight months a year.

Related Content

New Bottle Base for Nitrogen-Dosed Products in 100% rPET

Sidel’s new StarLITE-R Nitro offers an alternative to petaloid bases with equal performance in a wide range of 100% rPET bottle sizes.

Read MoreBrewer Chooses Quick-Change Flexibility to Blow Wide Range of PET Beer Bottles

Beermaster Brewery found a “universal” stretch-blow machine from PET Technologies enables multiple changes per day among four sizes of beer bottles.

Read MoreAt NPE, Cypet to Show Latest Achievements in Large PET Containers

Maker of one-stage ISBM machines will show off new sizes and styles of handled and stackable PET containers, including novel interlocking products.

Read MoreCoca-Cola’s Redesign of Small PET Bottles Pushes Lightweighting Below Prior ‘Floor’

Coca-Cola thought it had reached the limits of lightweighting for its small PET carbonated soft drink bottles. But a “complete redesign” led to a further 12% reduction.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More