Economic Update: A Strong, But Not Spectacular, Year for Plastics

After the slight decline in U.S. output of plastics products in 2003, our latest forecast calls for a gain of 6% in plastics processing activity this year.

After the slight decline in U.S. output of plastics products in 2003, our latest forecast calls for a gain of 6% in plastics processing activity this year. The growth rate will be similar for total U.S. industrial production, where a gain of less than 1% in 2003 will be followed by a rise of 5% in 2004. This forecast assumes a continuation of the trend of gradual improvement that has recently emerged in the industrial production indices and other leading indicators of the plastics industry.

The second quarter of 2004 marks the two-year anniversary of the end of the last recession in the plastics industry. In other words, the trend in the monthly data for most sectors of plastics processing stopped heading downward in the first half of 2002. And though the data have not really receded in the past two years, they have not advanced very much either. In fact, the Federal Reserve Board's industrial production index that measures the output of plastics goods (processed products) has grown at the modest rate of only 1.4% per year since the end of the recession.

Every business cycle is unique, but by analyzing the historical data we can glean useful information about how the domestic plastics industry has evolved in recent years and what we might expect from future cycles. As the chart below illustrates, the pattern for plastics processing has changed significantly over the past three cycles.

It is clear that the plastics industry is a leading indicator of total industrial production. The high and low points in the plastics curve usually occur three to six months earlier than they do in the total production curve. This is because most plastics products are not finished goods, but rather parts that go into larger things. Pipe, film, auto parts, etc. usually all go into bigger finished products. So the trend in plastics leads the way, but it is reliant on the overall industrial sector to push it from behind and drive it upward.

In the first half of the 1990's, especially during the three years immediately following the recession in 1991, the plastics industry was going gangbusters. Average annual growth for the total U.S. industrial sector during the years 1992 through 1994 was a solid 4% per year. By comparison, plastics processing in the U.S. was growing at nearly 9% per year during that time period. Those were very heady times for many plastics products, including extruded film, siding, window profiles, and conduit; injection molded caps, auto parts, and packaging; and blow molded containers for all types of beverages.

Growth for plastics moderated in the second half of the 1990's, and it slipped a bit below the average growth of the overall industrial sector. During the period from 1996 through 2000, total U.S. industrial output grew by just over 5% per year while production of plastics products increased at an average annual rate of a little more than 4%.

A gradually declining average annual growth rate is typical of a maturing industry. As the total size of the industry gets larger and larger, it becomes more difficult for it to grow at faster rates. And maturing industries are often times more sensitive to cyclical downturns. During the overall economic recession in 1991, the growth rate in the plastics industry just barely dipped into negative numbers while the overall industrial sector declined by nearly 2%. However, 10 years later in the recession of 2001, plastics processing decreased by 5% compared with a 4% drop in the overall index. And though things looked marginally brighter for processors in 2002 compared with total industrial production, it is now apparent that the plastics sector performed marginally worse in 2003.

So what does all of this tell us about the future? First, it would be unreasonable to expect that plastics processing will grow significantly faster than the overall industrial sector. But this is not necessarily bad. The U.S. manufacturing sector is enormous, and the domestic plastics processing sector has also grown to be quite large. A trend of steady, sustainable growth in U.S. industrial output will generate demand for a huge volume of all types of plastics products. The current level of total industrial growth is currently below a sustainable rate, but it also appears to be strengthening. This will push up demand for plastics products. The cyclical recovery has been less-than-impressive during the past two years, but things are getting better.

The biggest problem facing plastics processors and the overall economy at present is energy prices. Oil and gas prices are also cyclical, and they are currently at cyclical highs. If not for the high energy prices (and the resulting high materials costs for processors), then the recovery in the U.S. industrial and plastics sectors would be much more vigorous by now.

The most likely scenario is that the overall economy will improve during the remainder of 2004 and into 2005. This will drive demand for all types of manufactured goods, including plastics products. At the same time, we expect a gradual downtrend in energy prices to start later this year. This will strengthen the overall economic demand and provide further relief to plastics processors.

Bill Wood, an independent economist specializing in the plastics industry, heads his own firm, Moutaintop Economics & Research, Inc. in Greenfield, Mass. He may be contacted by e-mail: BillWood@PlasticsEconomics.com

Related Content

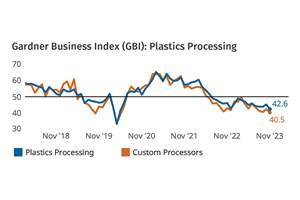

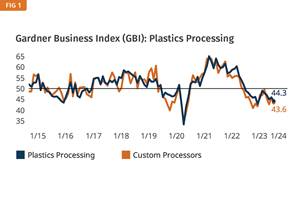

Plastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

Read MorePlastics Processing Activity Drops in November

The drop in plastics activity appears to be driven by a return to accelerated contraction for three closely connected components — new orders, production and backlog.

Read MoreProcessing Takes a Dip in June

Plastics activity took a relatively big downturn in June, ending at a low for the year and lower than the same month a year ago.

Read MorePlastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More