"Electrically Active" Compounds Surge In Performance

Designing a thermoplastic compound to conduct an electrical charge is difficult and costly, since most polymers are naturally ill suited to the task.

Designing a thermoplastic compound to conduct an electrical charge is difficult and costly, since most polymers are naturally ill suited to the task. Plastics generally have surface resistivities of 1012 ohm/sq or higher, which puts them at the insulative end of the electrical spectrum (see graph). That is advantageous in many uses, but is a liability in others. Indeed, some degree of electrical conductivity is critical to a growing number of plastics applications.

“Today, there are more reasons and better tools than ever for making electrically active compounds,” declares Mark Kaptur, product marketing manager for conductive compounds at LNP Engineering Plastics. One reason is more intensive use of electronics in cars, portable consumer devices, and appliances—plus their on-going miniaturization. Both trends increase the need to protect parts from ESD and EMI.

Another driver is the trend toward electrostatic spray painting of automotive and industrial parts. This method, in which paint drops are positively charged and the parts are grounded (negatively charged), is generating a flood of "e-paintable" compounds whose conductivity is tailored to optimize painting efficiency. E-painting is said to reduce overspray by up to 50%, thereby cutting both cost and volatile emissions.

There are even emerging applications for plastics to be nearly as conductive as pure carbon—such as bipolar plates and end plates for fuel cells.

It's no surprise, then, that underlying demand for conductive plastic compounds in North America is forecasted to grow 8-10%/yr from a current base of around 450 million lb.

Compounders have long mixed carbon black, carbon fibers, stainless-steel fibers, aluminum flakes, and other additives into thermoplastics to meet needs for antistatic performance, electrostatic dissipation (ESD), and electromagnetic interference (EMI) shielding.

New conductive technologies are emerging, one being a class of polymers intrinsically able to carry a current along their polymer chains. Inherently Conductive Polymers and Inherently Dissipative Polymers (ICPs and IDPs) differ in the range of conductivity they impart and the mechanism involved. Both categories are now melt-processable and thus highly efficient at creating conductive networks when alloyed with a thermoplastic matrix polymer.

Another advance is a novel class of vapor-grown carbon nano-tubes and nano-fibers. These impart a broad range of conductivity to plastics at far lower loadings than conventional carbon-based additives, while simultaneously providing reinforcement and enhanced thermal conductivity. However, the potential of these nano-carbon products is currently limited by their $50/lb or higher price tags. This compares with $15/lb for pitch carbon fiber and stainless steel, $8/lb for PAN carbon fiber, and less than $2/lb for carbon-black powder. Greater near-term potential is seen for a developmental low-cost pitch carbon fiber that boasts improvements in both conductive and reinforcing properties.

Polymerics spark interest

Because of its low cost, traditional carbon black is still the workhorse in conductive plastics. However, carbon black makes it difficult for compounders to hit a specific level of conductivity. It also imposes severe property tradeoffs and limitations on colorability. What's more, "sloughing" of conductive particles can damage microelectronic devices.

ICP- and IDP-based compounds promise to remedy all these shortcomings. They typically create a more uniform and complete conductive network than do dispersions of discrete particles of carbon black or even stainless-steel fibers. ICPs and IDPs often work at lower loadings, detract less from matrix-resin properties, and are more colorable than conventional products. IDPs even allow formulating transparent or translucent ESD products.

A particular strength of ICPs is their ability to drain off static charge in a highly exact and reproducible way, says Sam Dahman, product development engineer at RTP Co. RTP holds exclusive North American rights to develop ESD compounds based on the only commercial polyaniline ICP, a product supplied by Panipol of Finland. A recent breakthrough by RTP and Panipol maintains thermal stability and ensures uniform dispersion of polyaniline during melt processing.Conventional carbon black tends to suffer twin deficits when used to impart ESD protection: It dissipates across a wide range of surface conductivities, while disparities in voltage also tend to persist on the part surface in the form of “hot” and “cold” spots. RTP data, for instance, show that a part made of one carbon-black-filled PP has a surface resistivity ranging from 105 to 1012 ohm/sq. A comparable ICP-based part consistently hits a narrow range of 106 to 107 ohm/sq.

One of the difficulties with carbon black is that small changes in concentration in a plastic compound can produce large leaps in conductivity. The “smoother” ESD performance curve offered by ICP-based compounds is a big advantage, Dahman says. It is far easier to tailor performance for a specific end-use and thereby optimize cost-performance. ICP compounds are priced at an intermediate point between carbon-black and carbon-fiber compounds.

RTP offers ICP compounds based on PP, PS, PE, and PC/ABS. These provide permanent ESD, accept 25% recycle content, and have a wide range of colorability. The compounds have potential in industrial packaging and containers, material-handling boxes and totes, and shelves and racks for electronics. RTP is working to stretch ICP compound performance into the EMI-shielding range (10 to 100 ohm/sq).

Noveon (formerly part of BFGoodrich) has developed an IDP that works in the 106 to 1011 ohm/sq surface resistivity range, offering permanent static control. Noveon uses this IDP exclusively in its own Stat-Rite compounds for injection molding and extrusion. IDPs are generally elastomers (Noveon's is a TP urethane) that contain "charge-carrying blocks" able to conduct current, but in a more restricted part of the antistatic and ESD spectrum than is covered by ICPs. In some cases, the hydrophilic nature of an IDP helps boost conductivity at the part surface. In the past, thermal-stability limits confined IDP use to low-temperature matrix resins like HIPS, PETG, ABS, and TPU, but Noveon has recently expanded its Stat-Rite line to include PP and TPU/PC compounds.

Neil Hardwick, Noveon's marketing manager, says a recent initiative is tri-layer HIPS sandwich structures that optimize IDP cost-effectiveness in thermoformable sheets. For instance, one structure puts carbon-filled HIPS at the core (providing good volume resistivity and EMI shielding) while the skin layers include an IDP/HIPS compound to eliminate slough ing while ensuring excellent surface dissipation.

In recent years, others have introduced compounds based on IDPs comparable to (but different from) Noveon’s. New players include LNP, RTP, Lati USA, and DSM Engineering Plastics. DSM has just diversified its carbon-based ElectraFil line by adding IDP-based products.

LNP’s Stat-Loy family uses an IDP to impart permanent antistatic and ESD properties (109 to 1012 ohm/sq) to a variety of resins, including PC/ABS and a transparent ABS.

Permastat IDP-based compounds from RTP afford antistatic capability (1010 to 1011 ohm/sq) for business-machine and appliance parts, gears, and video cases. RTP recently introduced PermaStat Plus grades that extend the series' conductivity into the ESD range (“E” versions) or offer enhanced mechanical performance (“M” versions).

Lati recently launched the LatiOhm family of IDP-based compounds in PP, nylon 6, PBT, and PC. They are aimed at ESD roles in smoke detectors and power-tool housings. This family is said to provide surface resistivity from 104 to 1012 ohm/sq. Products are non-sloughing and are colorable in blue, purple, and green.

Promise of nano-carbons

"Nano-carbons may prove to be in the 21st century what aluminum was in the 20th," declares Max Lake, president of Applied Sciences, an advanced-materials R&D firm in Cedarsville, Ohio. Like aluminum, he says, the miniscule, high-aspect-ratio nano-particles impart extraordinary strength and light weight. In plastics, nano-carbons can also significantly enhance both electrical and thermal conductivity.

Suppliers of nano-carbons include Hyperion Catalysis, the sole commercial supplier in North America; Japan's Mitsui and Showa Denko; and an Applied Sciences affiliate, Pyrograf Products. The latter's developmental graphite nano-fiber is 100-200 nm in diam. x 100 microns long, giving it a 500-1000:1 aspect ratio. It's available in sample quantities at $70/lb. (A semi-works plant is being built.) At loadings of 0.5% to 5% by volume, Pyrograf's PF24 carbon nano-fiber boosts stiffness of plastics by 500% and drops their surface resistivity to the range of 1 to 1010 ohm/sq.

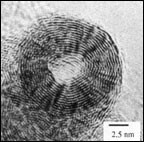

Hyperion's multi-wall graphite nano-tubes have 10-nm OD and are 10 to 100 microns long, for at least a 1000:1 aspect ratio. The small size and curvilinear shape of these “fibrils” makes them difficult to disperse in plastics. To ensure satisfactory dispersion, Hyperion supplies the fibrils in pelletized masterbatches containing 15-20% fibrils, which can be let down to as little as 0.5% by weight.

Pat Collins, Hyperion’s marketing manager, says fibril-based compounds can cover the full electrical spectrum at loadings at least 50% lower than would be needed with carbon fibers (which are gigantic in physical size compared with fibrils). Retention of toughness and ductility with the nano-tubes reportedly far exceeds that for the best conventional conductive compounds. Viscosity is minimally affected, Hyperion says, so its fibrils are highly suitable for thin-wall molding and provide excellent surface quality in appearance parts. There is less differential shrinkage and part warpage than with conventional filled compounds.

Hyperion’s initial slate of nylon 6 and 66, PBT, and PC masterbatches has recently been broadened to include PEEK, PEI (GE’s Ultem polyetherimide), PPS, nylon 12, and PS. Coming next are PP, PET, and EVA masterbatches. Current uses include a nylon 12 that replaces metal in automotive fuel lines. It combines excellent ESD performance plus elevated toughness, which translates into the added safety benefit of increased rupture resistance. E-paintable compounds based on nano-tubes impart the necessary conductivity at just 2-3% loadings while offering a Class A surface quality.

Cost is the major limit on nano-tube use, as Hyperion’s fibrils are priced at around $50/lb. Over the long haul, Collins argues, the start-up of world-scale plants will bring prices down.

Nano-tube-based compounds offering 104 to 109 ohm/sq surface resistivity at 4-7% loadings are offered by RTP. Scott Koberna, RTP product manager for conductive compounds, says RTP’s NTC-series compounds minimize occurrence of hot and cold spots and are suitable for high-purity ESD and e-paintable compounds. RTP puts nano-tubes into HIPS, acetal, and other engineering resins. NTC grades are priced 25% to 100% higher than comparable PAN-fiber compounds.

LNP’s Ultra-Clean Stat-Kon slate of ESD materials for high-purity applications uses nano-tubes in PEEK and PEI compounds for wafer-carrier and disk-drive components. Ionic contamination is said to be 65% to 90% lower than in carbon-fiber compounds.

Ticona offers conductive PPS grades that utilize an unconventional carbon-based conductive. The novel ingredient is said to offer many of the benefits of nano-tubes at considerably lower cost. This additive and proprietary compounding technique are said to ensure precise “tuneability” of ESD performance. The materials are also described as clean—non-sloughing and low in ionic contamination and outgassing—making them viable for use in liquid-crystal displays, electronic storage media, and microelectronic carrier trays.

New breed of pitch fiber

A novel pitch-based carbon fiber developed by Conoco Cevolution will be manufactured at a 4-million-lb/yr plant in Ponca City, Okla., due to come on stream in the second quarter of this year. Samples are already available. Eduardo Romero, industry manager for electrical/electronics, says Cevolution’s mesophase pitch fiber offers an order of magnitude higher electrical conductivity than PAN-type carbon fibers and significantly greater stiffness as well. The stiffness can be tailored to specific end-uses. Other benefits are outstanding purity and high thermal conductivity. These fibers will be priced to compete with PAN fibers in some applications. Romero sees potential in ESD, EMI shielding, e-paintable auto parts, and fuel-cell plates.

Cevolution’s fiber will be made with a continuous process that is capable of very high productivity and uses relatively low-cost feedstocks. The raw form is a randomly oriented, continuous-filament mat, but user-friendly forms (chopped and milled fibers and needled mat) are being developed.

Creative compounding

Jeff Frankish, director of global market development at PolyOne’s Compounds & Colors unit, says OEM users of conductive compounds are “raising the performance bar” for these materials. “Multi-functionality” is increasingly being built into formulations, he says. As examples, he cites ESD and EMI grades from PolyOne that are also lubricated, based partly on recycled resins, or modified to process on specific equipment.

PolyOne’s Stat-Tech slate includes some 20 base resins and spans a range from 1 to 1012 ohm/sq surface resistivity. Some of the less conventional matrices now being used include nitrile-rubber-modified PVC, polysulfone, and various TPEs. PolyOne is exploring use of metalized glass fiber to enhance electrical and thermal conductivity and provide reinforcement.

Teknor Apex's Plastics Div. recently launched a family of flexible vinyl compounds designed for consistent ESD and EMI performance. Carbon-black-filled Vidux PVCs offer 100 to 108 ohm-cm volume resistivity in cable jackets, flooring, grounding mats, shielding, and other items used in cleanrooms, hospitals, and factories. At under $2/lb, they are said to be more cost-effective than alternatives based on carbon or steel fibers.

Conductives hit the road

Automotive fuel delivery systems are a focus of interest for makers of ESD compounds. Parts subject to swift or turbulent gas flow (e.g., filler-line pockets or line connectors) require conductivity to thwart static build-up and the risk of sparks and explosion. That is a major reason why large-volume applications like fuel filler lines, chassis pipes, and fuel-pump housings are still overwhelmingly made of steel.

DuPont is one firm working to broaden plastics’ opportunities in these applications. DuPont has developed a pair of acetal compounds for injection molding. Delrin 300AS and 300AT utilize carbon fiber to provide ESD capability (106 ohm/sq) and enhanced stiffness. Delrin 300AT has twice the toughness of a standard acetal. It is aimed at fuel-tank caps and filler pockets. Delrin 300AS exhibits 300% higher stiffness than standard acetals and is aimed at uses inside the tank—such as a support flange on sender modules (a device that primes the fuel pump). DuPont has also launched nylon 66 ESD grades, some of them glass-filled, and plans to launch ESD versions of its Zytel HTN high-temperature nylon.

Ticona recently introduced an ESD acetal grade for auto fuel-line parts. Celcon CF802 uses novel compatibilizer technology to bond reinforcing fiber to the matrix. That is said to minimize mechanical property tradeoffs and increase resistance to attack by fuels.

Electrostatic paintability without need for a conductive primer is another property that makes conductive plastics attractive to auto makers. GE Plastics is taking a new tack in formulating Noryl PPO alloys for e-paintable auto parts. Five years ago, GE was one of the first to adopt Hyperion’s carbon nano-tubes in Noryl 990E, used in mirror housings. That grade has been discontinued for unstated reasons, but cost certainly played a role in the decision.

GE has now shifted its attention to e-paintable PPO compounds for automotive body panels like fenders. It is using carbon-black powder and a high-temperature PPO that can withstand 400 F bake temperatures for the E-Coat anticorrosion treatment. This e-paintable PPO is due to be commercialized this summer.

GE is also focusing on fuel filler doors, 78% of which are made of steel and painted on-line with other steel parts. GE sources believe that conversion of this application to plastics requires on-line e-paintable compounds. GE is proposing a nylon-modified PPO (Noryl GTX) made electrically conductive with carbon black.

Bayer has concluded that blends of various carbon-based conductive additives, including Hyperion’s nano-tubes are a cost-effective way to tackle e-painting needs. Indeed, compatibilized blends of carbon additives are employed in new 30%-glass nylon 6 and TP polyester molding compounds that reportedly provide superior surface smoothness in door handles, fuel flaps, and large exterior auto parts.

EMI protection is another area of major growth potential for conductive plastics in automotive. Stimulating factors are increased use of sensitive electronic gadgetry in cars, a pending shift to 42-volt battery power, and the need to preserve space under the hood, according to David Riffer, electrical-electronics market manager for EMS-Grivory. His company has long put carbon and stainless steel into ESD versions of its nylon 6, 66, and 12 compounds for automotive fuel-line and under-hood applications. Now, the company is moving into nylon EMI-shielding compounds using stainless steel as the conductive ingredient. These are aimed at automotive electronics as well as business-machine housings and coaxial-cable connectors.

EMS-Grivory is also compounding nickel and zinc ferrite powders into nylon 12 and high-temperature nylons for use in “soft” magnets. These molded devices become magnetized in the presence of a current, thereby providing EMI protection for air-bag connectors and other sensitive control elements. Polymer magnets are more durable than the sintered magnets they replace, and also offer greater design freedom and the potential for lower-cost manufacture and assembly. Polymer magnets could also provide EMI protection to computers and appliances, Riffer says.

Stainless-steel fibers are the key ingredient in the Faradex line of EMI shielding compounds that LNP recently acquired from DSM. They are aimed more at consumer electronics and business machines, namely thin-wall housings for cell phones and computer equipment. Unlike carbon additives, stainless steel does not limit colorability, but the fibers are easily damaged in melt processing. LNP uses a special compounding technique to retain fiber length for good shielding.

Related Content

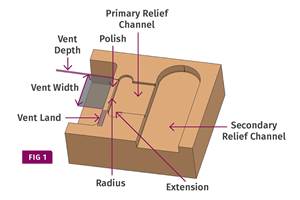

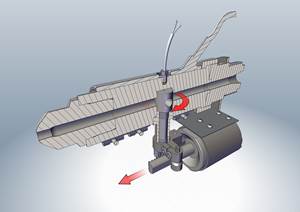

Back to Basics on Mold Venting (Part 2: Shape, Dimensions, Details)

Here’s how to get the most out of your stationary mold vents.

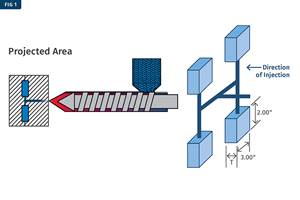

Read MoreIs There a More Accurate Means to Calculate Tonnage?

Molders have long used the projected area of the parts and runner to guesstimate how much tonnage is required to mold a part without flash, but there’s a more precise methodology.

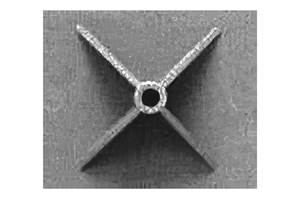

Read MoreHow to Reduce Sinks in Injection Molding

Modifications to the common core pin can be a simple solution, but don’t expect all resins to behave the same. Gas assist is also worth a try.

Read MoreKnow Your Options in Injection Machine Nozzles

Improvements in nozzle design in recent years overcome some of the limitations of previous filter, mixing, and shut-off nozzles.

Read MoreRead Next

For PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More