Global Competition - Extrusion: Imports Threaten Some Films And Maybe Profiles, But Not Sheet

Global competition from lower-cost manufacturers, primarily in Asia, affects individual extrusion markets differently.

Global competition from lower-cost manufacturers, primarily in Asia, affects individual extrusion markets differently. Concern is painfully acute among makers of commodity films, who are also suffering from massive imports of converted polyethylene retail bags.

In stark contrast, sheet extruders have no fear of imports at all. They specialize in short runs of custom products that incorporate trim scrap returned by customers–insurmountable hurdles for competitors an ocean away.

Import pressure is just beginning to be felt in window profiles. Chinese wares were sampled to U.S. window makers for the first time last year, at prices well below those of the leanest domestic producers. Because of their weight and bulk, other construction-related profiles like siding, fence, and pipe face little competition from imports.

Film is most vulnerable

The root of the problem for film producers is that a roll of film is a more compact way to ship plastic than even a gaylord of pellets. “No film product these days is completely immune to global competition,” says Luiz Stortini, global business director for Saran products and specialty films at Dow Chemical Co., Midland, Mich.

All film products aren’t equally susceptible to offshore competition. High-clarity, coextruded medical and food packaging films (especially barrier films) face less offshore competition because they have to meet FDA and environmental regulations. Specialty products like Dow’s film for window envelopes and its adhesive films also face less offshore competition.

Shrink film like label sleeves is also unlikely to be shipped from overseas because it needs a temperature-controlled environment. If it overheats in a closed container sitting on a dock, there go the shrink properties. Another special case is stretch film, which is wound more loosely than other film. “In its final form, it has a lot of air in it,” says James Chase, president of ITW’s Industrial Packaging Group, Glenview, Ill., which makes long distance shipping inefficient. “So normally most of what is used here is produced here. Theoretically, you could import very large master rolls and convert them here, but that isn’t happening much so far.”

An exception was in late 2005 when hurricanes blew U.S. resin prices sky high and opened a window of opportunity for Asian stretch films. Quality was a problem, however. “A lot of the imported stretch film couldn’t be sold,” says Randolph Scott, v.p. of global marketing at Pliant Corp., Schaumburg, Ill. “The film that came over was hand pallet wrap, which is less sophisticated than machine wrap, but even the hand wrap had quality issues.”

Low quality hurt imports, agrees Alfred Teo, chairman of Sigma Plastics Group, Lyndhurst, N.J., a large maker of both specialty and commodity films. He says a dry-cleaning distributor recently imported printed garment bags from China that smelled so strongly of chemicals from solvent-based ink that the bags couldn’t be used. The buyer offered them to Sigma to reuse as scrap, but Sigma declined. “They smelled so bad, you couldn’t stand next to a pallet,” Teo recalls.

Global film companies with production both in the U.S. and in lower-cost environments like Mexico or the Far East typically serve local markets from those plants. But not always. Alcan’s $6.5-billion Alcan Packaging Div., for example, includes the Food and Specialties unit of Alcan Food Packaging Americas, which produces film in the U.S., Mexico, and Canada. “We bought Novacel in Mexico four years ago and now produce film in three plants in Mexico, mostly servicing the Mexican market,” says Michael Curia, v.p. and general manager of Alcan Food and Specialties, Chicago. “But some of the Mexican films we import into the U.S. are sold as is or used in our own converting so we can more competitively serve our entire customer base in North America.” Alcan focuses on specialty films for packaging coffee, produce, pet food, condiments, snacks, cookies, crackers, and juice pouches.

Lower-cost converting offshore is also a threat to domestic processors. “We see a big cost difference in prepress charges for printed packaging from China and Korea–more than 50% below prices here,” says Bill Burke, COO and president of Nordenia North America in Jackson, Mo. German-based Nordenia has two film and converting plants in China and Malaysia. “We’ll bring printed film in from our own Asian companies if we think they can do it cheaper,” he adds. “But where speed to market and smaller volumes count, customers tend to source in the U.S.” Nordenia stays competitive with other domestic producers by using the most advanced equipment to produce proprietary laminated film structures like a high-moisture-barrier film for extended shelf life.

Japanese-based Toray Plastics (America) Inc. also has film plants in China and Malaysia and imports certain commodity films from them to complement what it produces here. “The vast majority of Toray films produced here are immune to imports because of innovative functionality like improved barrier performance or thinner gauge that is more economical on a cost-per-unit-area basis,” says Rick Schloesser, senior v.p. and general manager of the Torayfan Div. in N. Kingstown, R.I.

Threat or opportunity?

Global makers of specialty films see emerging offshore markets as opportunities to follow customers overseas. Pliant, a maker of stretch films and other specialty packaging, is looking at building plants in the Middle and/or Far East. “As our customers and customers’ customers set up plants over there,” says Randolph Scott, “packaging will follow because the customer isn’t here anymore.”

Klockner Pentaplast, which makes shrink-label film in North America and Europe, is adding shrink-film capacity in Rayong, Thailand. This will be its first shrink-label film production in Asia. The Thai installation is intended “to produce film locally to support regional growth, while allowing international brands and converters to source identical high-quality films globally,” notes Michael Tubridy, president and COO of Klockner Pentaplast/Americas, Gordonsville, Va.

Bemis Co. in Minneapolis produces films for medical-device packaging in Northern Ireland and Malaysia as well as in North America. If a customer moves medical-device production offshore, Bemis moves film production to its closest plant, says Melanie Miller, v.p. of investor relations and treasurer. For food packaging, Bemis has 56 plants around the world, largely producing films for local markets. Bemis is, however, “very protective of its proprietary and patented 7- and 9-layer barrier films,” notes Miller. These are only produced in North America and Europe.

Sheet goes unchallenged

Sheet bundles as densely as film rolls, so it ought to be efficient to import, but it hasn’t been so far. Extruded sheet isn’t typically imported. “It does happen, but it isn’t significant,” says George Abd, president and CEO of Spartech Corp., Clayton, Mo. “The logistics are difficult. There is a very high service aspect to the sheet business,” he explains. “Most production is in small custom orders, and a lot of it returns as regrind to be used in that customer’s product again.”

Where Spartech’s Abd does see both risk and opportunity is imports of lower-cost finished goods that compete with his sheet customers’ products. Spartech sees the migration of U.S. manufacturing offshore as a growth opportunity in wide sheet production. In 2003, Spartech built a major new plant near Monterrey, Mexico, to service a new customer, Whirlpool, which had previously made sheet in-house for its refrigerators. Whirlpool started out making that sheet in Mexico, then decided to outsource it. As a result, Spartech is already expanding its Mexican plant and sees it as a low-cost magnet for new business in the region. Spartech recently hired employees to identify similar opportunities in China and has created a new management position to develop international strategies.

Is it still possible for a small domestic U.S. sheet processor with only one or a few plants to survive? “I hope not,” Abd says–but he’s not talking about foreign competition. “It is our model to create a large business that offers so many solutions that it makes it very difficult for smaller companies to compete.” However, in compounding–a separate Spartech business–he thinks small, entrepreneurial companies still can provide value.

Profile competition looms

Of all profile extrusions, windows are potentially at the most risk from imports. Main window frames are the most cost-effective to ship, based on value for the space occupied, making them prime targets for overseas exporters, says Peter Dachowski, president of CertainTeed Corp. in Valley Forge, Pa. Current imports of either finished windows or component profiles are still small, but the invasion may be just over the horizon.

U.S. profile extruders are already foreseeing quality problems if U.S. window fabricators combine Chinese mainframes and U.S.-made smaller profiles. “All the Chinese profiles I’ve seen are inferior in quality. Their dimensions are way off, and formulations have more calcium carbonate filler and half the usual amounts of TiO2 and impact modifier,” says Hans Spijkerman, CEO and president of Chelsea Building Products in Oakmont, Pa. (a unit of Tessenderlo NV in the Netherlands). “If U.S.-made and Chinese profiles are mixed, the result would be a window that will weather unevenly. The Chinese profiles will fade and be brittle in cold weather.”

Some Chinese samples have even been tested and found to contain lead, which is forbidden here, industry sources say. Spijkerman is concerned: “The industry has worked for a long time to establish the quality level we have today. Low-quality imports will ruin the reputation of vinyl windows.”

Other processors of window profiles look farther ahead and feel that a bigger future threat than imported profiles is whole windows from abroad. “There is more labor in making windows than in extrusion,” says Paul Warner, senior v.p. of Quanex Building Products, which purchased Mikron Industries in Kent, Wash. “The window import numbers are small now, but we think they could grow.”

Spijkerman notes that it may take 80 different profiles to provide a whole window platform. “With short order times for builders and remodelers, it would be difficult to have a supply chain all the way to China for all those profiles.”

Vinyl siding, pipe, and fencing are relatively insulated from low-cost offshore competition for the medium term. Vinyl siding and fencing have to satisfy customer demands for speedy delivery and custom colors, which imports have trouble meeting. Fencing could be at future risk, however, because it’s typically packaged as kits to be assembled at the building site.

Related Content

How to Select the Right Tooling for Pipe Extrusion

In pipe extrusion, selecting or building a complementary set of tooling often poses challenges due to a range of qualitative factors. Here’s some guidance to help you out.

Read MorePart 2 Medical Tubing: Use Simulation to Troubleshoot, Optimize Processing & Dies

Simulation can determine whether a die has regions of low shear rate and shear stress on the metal surface where the polymer would ultimately degrade, and can help processors design dies better suited for their projects.

Read MoreHigh-Output Extruder Series Now Comes in Smaller Size

Series offers higher output, lower melt temperatures and energy savings.

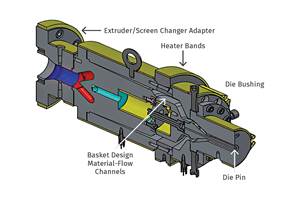

Read MoreCorrugated Tube Crossheads

Multiport spiral-flow design is said to provide a balanced compound distribution with no weld lines to the corrugator.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More