Health, Eco Concerns Give Non-Phthalate Plasticizers a Push

New and improved formulations are displacing leading plasticizer DEHP; DINP’s future is also now shakier.

Phthalate ester plasticizers that long have dominated the flexible PVC market have some serious non-phthalate competition, including some newer alternatives. The phthalates’ strong market hold is losing steam —primarily in Europe, but in North America as well—industry sources say, because of health and environmental concerns, regulatory scrutiny, and increased consumer awareness. While phthalates constitute an extensive family, the two most important in terms of consumption are longtime industry workhorse di(2-ethylhexyl) phthalate (DEHP, aka DOP) and DINP (di-isonolyl phthalate).

Last year, Houston-based IHS Chemical reported that phthalates accounted for 70% of the world’s consumption of plasticizers in 2014, down from about 88% in 2005, and are projected to drop to 65% in 2019. An important IHS caveat, however, is that China accounts for such a large share of the total market. The 2015 IHS report placed DEHP at 37% of the global market, down from about 54% in 2010, and DINP now accounts for about 16%.

In Europe and North America, the phthalate debate has centered on allegations that some of them are human endocrine disruptors or probable human carcinogens. Regulatory actions that have been taken and/or are underway involve the ortho-phthalates, starting with DEHP, the largest-volume, most widely used and lowest-cost phthalate. Its use in children’s products has been prohibited for nearly a decade in the U.S. and the EU, though the latter is aiming to ban it altogether. This is also becoming the case with the other ortho-phthalates—DINP and DIDP (diisodecylphthalate). According to the U.S. Consumer Product Safety Commission, toys for children under age three are currently regulated in the U.S and the EU to contain less than 0.1% of several ortho-phthalates, including DINP and DEHP.

Ashok Adur, global development director at Indianapolis-based Vertellus, says most major toy producers have switched away from ortho-phthalates; however, toys imported from Asia still may contain them. Adur says big-box stores pushed Chinese manufacturers to convert; now, exports from the big Chinese toy suppliers supposedly do not contain the phthalates, though it’s unclear who is doing any testing. He adds, “We are also seeing real pushback in Europe for no phthalates in wire and cable that go into toys and electronic gadgets. This is also catching on in North America—part of the drive is a liability concern. Even in automotive wiring, this is starting to take place to some extent, with the push coming from the electronic companies.”

Mark Brucks, market-development representative for plasticizers at Eastman Chemical Co., Kingsport, Tenn., adds that there will be continued pressure on phthalates, not just on the regulatory front, but also from major retailers. Home Depot and Lowes are no longer selling PVC flooring that contains phthalates. Apple has eliminated them from cables for earbuds and power cords.

Mark Napiany, business director for plasticizers and oxo C5 alcohols at BASF, Florham Park, N.J., explains that the classification of DEHP in Europe as a Substance of Very High Concern (SVHC) has had a significant impact on conversion in that region. France’s 2015 law that restricts DEHP’s use in pediatrics, neonatology, and maternity applications has also driven changes in the medical device market. Addition of several ortho-phthalates to California Proposition 65 and the Consumer Product Safety Improvement Act of 2008 have resulted in some conversion in the U.S. away from both DEHP and DINP.

Eastman’s Brucks points out that the advent of non-phthalate plasticizers with good toxicology profiles has actually supported the continued use of PVC in several market segments, including medical applications. These include medical tubing for IV, infusion, intra-tracheal, and dialysis applications, as well as intravenous bags and self-injectables. Conversion is largely driven by the EU, whose new medical-device directives (for which a final decision is pending) aim to abolish use of phthalates by 2020-2026, depending on the patient’s illness. “Expect a knock-back effect in North America from brand owners and retailers with global business,” says Brucks. He also mentions the recent trend of mega-mergers in the medical device industry, noting that the impact they might have on the choice of plasticizers in medical applications remains to be seen.

Brucks and others venture that the use of DEHP in medical applications will decline in North America and Europe. They all project the same for DINP in general, clarifying that it is not used for medical devices that go into the body but for more general, not highly sensitive, applications.

Says Paul Keeney, business director for epoxides at Arkema Inc., King of Prussia, Pa., “Issues with conversion may be fairly application/user dependent. Most of the alternatives, while similar in performance, are not always a direct shoo-in and often require some reformulation and testing of the PVC compounds. Our technical staff is working to optimize the balance of cost and performance in phthalate-free vinyl products.”

Here’s a look at some of the most recent non-phthalate alternatives that are getting increasing play. Included are new DOTP (diethylehexyl terephthalate, aka DEHT) versions offered by both Eastman and BASF; and BASF’s Hexamoll DINCH (disononyl cyclohexane dicarboxylate); VersaMax, based on a proprietary terephthalic ester from Eastman; a polyolester plasticizer called Pevalen from Sweden’s Perstorp (U.S. office in Toledo, Ohio); as well as biobased plasticizers, such as a new line of soy-based plasticizers sold under the Vikoplast designation by Arkema, and long-standing citric-acid-derived Citroflex plasticizers from Vertellus.

Other available alternatives that continue to draw interest include TOTM (trioctyl trimellitate) and polymeric plasticizers from BASF, Eastman, and others. These two groups of non-phthalates have been given a green light for low plasticizer migration in medical-device components made of ABS, PC, PS, and acrylic that come in contact with PVC components.

DOTP, HEXAMOLL DINCH IMPROVEMENTS

DOTP and Hexamoll DINCH are two leading non-phthalate alternatives gaining significant ground. DOTP from Eastman has been available for several decades as Eastman 168, and the company claims it is the market-leading non-phthalate plasticizer for PVC, offering performance equal to or better than most non-phthalates. It offers good performance properties, optimal low-temperature flexibility, and non-migration properties.

In 2013, Eastman launched the 168 SG (sensitive grade) version. This enhanced, high-purity grade offers the most stringent quality-assurance protocols for sensitive applications that include medical and children’s products. Recent industry studies indicate a nine-fold increase in consumption for overall DEHT/DOTP conversion in North America and Europe combined. Since its commercial introduction, 168 SG has been used in a wide range of sensitive applications, including IV infusion sets, blood/IV bags, tubing, childcare articles, and food-contact products.

Eastman sees its DOTP plasticizers as offering an easy replacement for DEHP and TOTM. Advantages cited include:

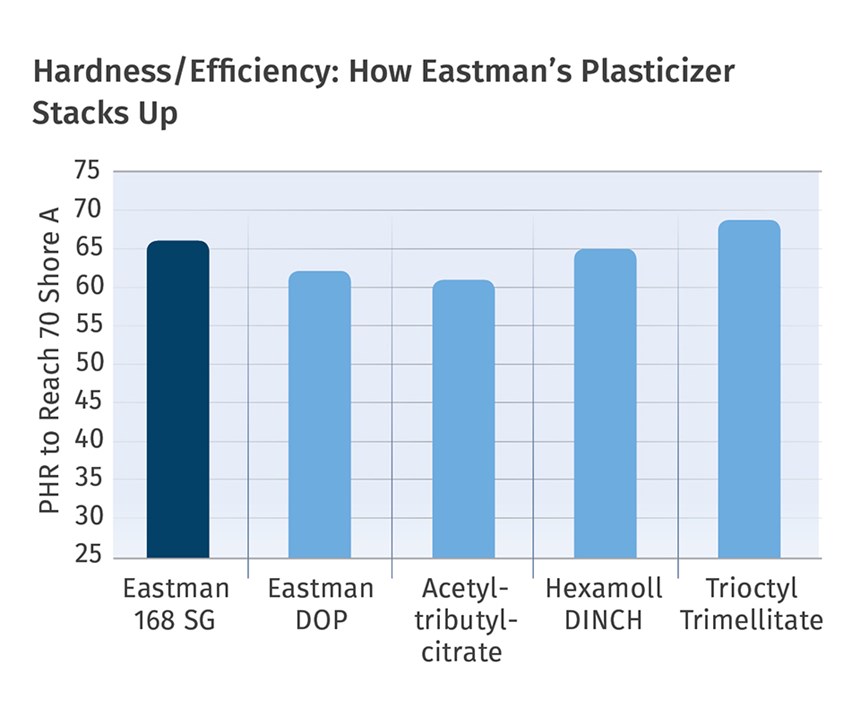

• Dry time fairly similar to that of DINP, and better than Hexamoll DINCH.

• Efficiency fairly similar to DINP and DINCH, while slightly lower than DEHP.

• Slightly longer dry-blending time with low-speed mixers than comparable plasticizers.

• Improved low-temperature brittleness compared with alternative offerings.

BASF launched Hexamoll DINCH in 2002. Thanks to its excellent toxicological profile and low migration rate, this additive has become an established plasticizer in PVC food packaging, medical devices, and toys. More recently, BASF reports that demand has also increased in floor and wall coverings as well as fitness equipment. In 2014, BASF doubled its capacity to 442 million lb/yr as a result.

At the same time, BASF also saw the value of DOTP, and launched Palatinol DOTP in 2013. Moreover, last year the company announced that it would start production of DOTP in North America in 2017 with dedicated product facilities in Pasadena, Tex. According to Napiany, the project will help meet the growing demand for non-ortho-phthalate plasticizers in North America, and will strengthen BASF’s position in this fast-growing market. BASF is also expanding its 2-EH capacity along with the DOTP investment, ensuring reliable feedstock integration for DOTP.

Asked what prompted the Palatinol DOTP introduction, in view of Hexamoll DINCH’s success, Napiany explains that DINCH has found use in medical devices and other medical plastics, while demand for DOTP has continued to grow in North America in a number of other important market segments. Included are flooring, film and sheet, consumer products, including some toys, and tubing for beverages.

BASF concedes that slightly higher processing temperatures are required for both DOTP and Hexamoll DINCH than for DEHP and DINP. For some processes, such as extrusion and injection molding, this is not a factor since the typical processing temperatures are more than sufficient. Plastisol processing does require somewhat higher temperatures than with conventional phthalates. In addition, Hexamoll DINCH has some inherent lubricating properties, so the use of other lubricants such as stearates may be reduced or eliminated.

Hexamoll DINCH and DOTP have both been extensively tested using the latest Organization for Economic Cooperation and Development (OECD) and other testing protocols. Both plasticizers present no relevant hazards to humans or the environment, as confirmed by the French Agency for Food, Environmental and Occupational Health & Safety (ANSES) in 2015 and other government authorities such as the European Food Safety Authority (EFSA).

BASF’s Napiany notes that while plasticizers like DOTP and DINCH are fairly comparable to DEHP, compounders must keep in mind that plasticizers are always a little different from each other. For example, slight modifications to the formulation and process are necessary to optimize the quality of the finished article. “Most customers in vinyl formulation are able to make these adjustments quite easily. In addition, the BASF technical service group offers exceptional expertise in helping them develop the right formulation. The key to making a good material decision is having sufficient data to thoroughly evaluate the product.”

Napiany and others note that the most commercially important ortho-phthalates have extensive toxicology data and have been subjected to a number of global assessments in North America and Europe. It is essential that alternative plasticizers, including biobased products, have the same type of extensive data to support their safe use as replacements.

TEREPHTHALIC ESTER FOR G-P USES

Eastman’s latest offering is the new VersaMax portfolio of general-purpose non-phthalate plasticizers, based on a proprietary terephthalic ester. VersaMax and VersaMax Plus, designed to meet different needs, both boast consistent and optimal performance compared with DEHP and DINP, making switching to non-phthalate alternatives easier for formulators.

For dryblends and plastisols, VersaMax Plus is said to provide improved dry times, better efficiency, and a broader formulation window compared with ortho-phthalates or other non-phthalate options such as Hexamoll DINCH. By providing comparable mechanical properties and improved processing parameters, VersaMax Plus is said to be an ideal replacement for DINCH and DINP.

For dry-blend compounders, VersaMax is said to offer improved dry times relative to other plasticizers, including DINCH, plus enhanced compatibility in PVC formulations, and high efficiency, requiring reduced amounts of plasticizers. Faster fusion is also claimed. It has demonstrated performance consistent with DEHP across a variety of Shore A hardness levels while outperforming DINP.

BIOBASED PLASTICIZERS

At NPE2015, Arkema launched the Vikoplast soy-based plasticizers for consumer and industrial applications as direct replacements for phthalates. They reportedly perform similarly in terms of physical properties, with one key difference: The same level of flexibility and performance can be achieved by using 20-30% less Vikoplast, according to Arkema. The soy-based plasticizers also have a lower solvation temperature, which reduces energy consumption.

Vikoplast is derived from vegetable oils, which are fairly comparable in cost to petrochemicals, but their higher efficiency in use enables them to be competitive in PVC compounds. The company continues to develop and add to the Vikoplast range in order to meet the needs of this still new and emerging opportunity.

According to Vertellus’ Adur, the company is seeing an increased interest in biobased plasticizers as most users are expecting bans or regulations on use of phthalates, in addition to growing consumer appetite for “natural” biobased materials. In PVC compounds, Vertellus’s Citroflex citric-acid-based plasticizers reportedly provide value through the superior mechanical properties they bring at lower dosages in certain applications. Citroflex reportedly has broader regulatory approvals in medical applications than other biobased plasticizers used in PVC and biopolymer compounds.

There are six Citroflex grades in the company’s portfolio. They are said to be non-toxic and rapidly biodegradable; they boast low volatility to reduce leaching and superior tensile strength and elongation vs. DEHP. Target applications include PVC and PVDC food packaging, medical bags and tubes, toys, films, wire/cable, roofing membranex, and tarpaulins.

POLYOLESTER FOR G-P USE

Perstorp’s newest plasticizer introduction is Pevalen, a non-phthalate family launched in late 2013. Pevalen is a polyolester plasticizer that has four chains attached to a penta core—structurally more similar to citrates than phthalates, which have two chains attached to a central phthalate core, according to Perstorp’s Anders Magnusson, technical market development manager. This general-purpose non-phthalate boasts high efficiency and requires less plasticizer in most formulations. Low migration and volatility, along with excellent UV stability, are claimed. It is also said to blend faster and easier with PVC than most other plasticizers, which reduces processing time. Perstorp is seeking food-contact approvals. In addition to flooring and wall coverings, the company has targeted toys like jumping balls, artificial leather, and wire and cable, where there is interest in non-phthalates for applications such as consumer computer cables.

Related Content

Consistent Shots for Consistent Shots

An integral supplier in the effort to fast-track COVID-19 vaccine deployment, Retractable Technologies turned to Arburg and its PressurePilot technology to help deliver more than 500 million syringes during the pandemic.

Read More3D Printed Spine Implants Made From PEEK Now in Production

Medical device manufacturer Curiteva is producing two families of spinal implants using a proprietary process for 3D printing porous polyether ether ketone (PEEK).

Read MoreMedical Molder, Moldmaker Embraces Continuous Improvement

True to the adjective in its name, Dynamic Group has been characterized by constant change, activity and progress over its nearly five decades as a medical molder and moldmaker.

Read MoreCustom Molder Pivots When States Squelch Thriving Single-Use Bottle Business

Currier Plastics had a major stake in small hotel amenity bottles until state legislators banned them. Here’s how Currier adapted to that challenge.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More