Nylon 66 Replacement With the Aid of a Materials-Savvy Distributor

PolySource helped two OEMs—one in beverage packaging, the other in winter sports vehicles—transition from nylon 66 to polyketone (POK) compounds after parts failure.

In a recent article (see April Close-Up) on the evolution of the role of knowledgeable materials selection and associated technical support in the plastics industry, we reported on a gap that has been created over the last few decades. That gap relates to expectations between the molder and OEM/brand owner when it comes to the materials-selection portion of a project, because that role has swung from the resin suppliers to molders and then increasingly to OEMs and brand owners.

As reported in April, a counter-trend appears to be emerging that could help bridge the materials knowledge gap. In addition to some savvy molders who are investing in new talent emerging from universities armed with materials know-how, others who have been stepping in to fill the gap include compounders, independent consultants, OEMs that have materials experts, and technically advanced materials distributors. One such materials distributor is PolySource, which differentiates itself based on its technical expertise in application development. The company discussed with Plastics Technology two case studies where its expertise solved performance problems in nylon 66 molded parts by converting to another engineering resin.

As previously reported (see Dec. ’18 feature) a global supply/demand squeeze in the last couple of years has led some thermoplastic suppliers, compounders and distributors to address continued nylon 66 capacity constraints and price increases by proposing alternative engineering resins. The nylon 66 supply constraints—which are related primarily to tight supplies of key precursor adiponitrile (ADN), are expected to continue through at least part of 2020. At the 12th annual Wood Mackenzie American Nylon Conference held in Atlanta in April, Invista gave updates on the company’s investments to bring on additional capacity of ADN. Said managing director of commercial development Eric Jones, “We see the recent market tightness as a short-term imbalance resulting from increased demand and unforeseeable disruptions in the nylon 66 value chain. We expect it will correct itself quickly through debottleneck work that we’re performing at our sites to add more capacity. In fact, with strong production from our Texas facilities in 2018, we are already seeing improvements in supply to the market.”

Meanwhile, in the two PolySource case studies shared with Plastics Technology, parts made of nylon 66 were replaced with aliphatic polyketone (POK). The POK base resin is produced by South Korea’s Hyosong Chemical. PolySource Integra POK comprises customized grades formulated by PolySource and toll produced to the company’s specifications

It is important to note that these two conversions to POK were deemed necessary not just because of nylon 66 tightness, but also because the applications suffered performance issues that necessitated alternative materials. In addition, the material conversion ensured stable pricing and material availability and exceeded all material specifications for these parts. Cliff Watkins, director of applications development at PolySource notes, “The new POK solution in each example was higher in price per pound than the nylon 66 it was replacing. However, when the life-cycle cost was analyzed, the POK material was lower in total cost, because the plastic part was achieving three to four times the usable life, compared to the nylon 66. Once initial test results were completed, the customer was able to easily measure the life-cycle cost benefit of POK.”

In both instances, PolySource worked directly with the OEM’s engineering department. “Our process is to ask a lot of questions aimed at defining the problem and then arriving at a solution. The OEM then sponsors a molding trial with their molder and one of our technical experts attends and assists with the mold trial. Our OEMs source their molded plastic parts with contract injection molders who have expertise in processing engineering plastics, demonstrated capability in tight tolerance molding to precise dimensions and exceptional capability in mold design.

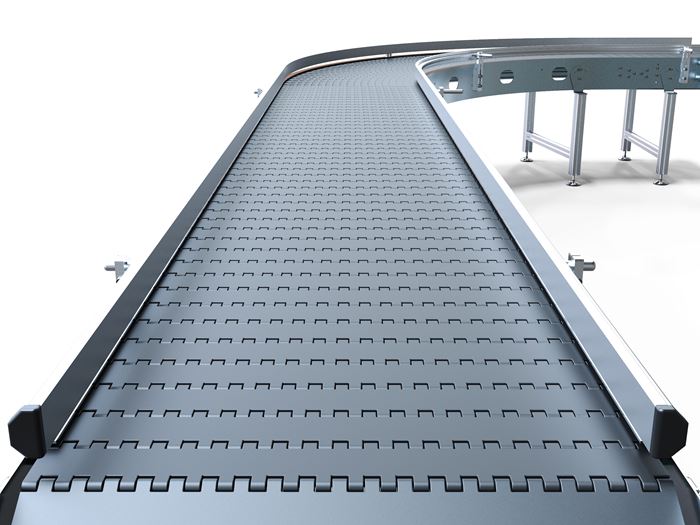

CASE STUDY A: BEVERAGE BOTTLE CONVEYOR

A modular plastic conveyor belt for 20-oz soda bottles in a beverage bottling plant was speed-limited because of too much frictional heat buildup in a corner section, where the conveyor made a 10° change in direction. The contact pressure between the side of the moving acetal conveyor and the stationary molybdenum disulfide-modified nylon 66 corner wear strip, when combined with the 300-fpm sliding speed, generated enough heat to cause the acetal conveyor to melt. The line speed had to be reduced to 200 fpm to prevent premature failure of the conveyor.

Upon further investigation, it was determined that the wear strip was losing its wear resistance over time as the nylon 66 absorbed moisture. The conveyor was located in an area of the bottling operation where frequent cleaning and rinsing with water were necessary to remove sticky buildup from spilled beverage, and this was causing the wear strip to reach moisture contents greater than 4.5%.

PolySource worked with the OEM’s engineering department to come up with a material solution that would allow them to increase the line speed back to 300 fpm, while maintaining long conveyor life. The recommendation was to replace the lubricated nylon 66 corner wear strip with a lubricated POK—PolySource’s Integra POK 9060 LX BK-4000.

The POK base resin has low coefficient of friction even without lubricant; its frictional and wear performance are unaffected by moisture; and it has a melting point of 428 F/220 C. By adding a lubricant to the POK, the line speed could be increased to 380 fpm while still achieving the desired conveyor lifetime. Explains Watkins, “PolySource has an active in-house materials development program and we identified the lubricant package that best optimized the line speed and wear resistance of the POK compound. We then collaborated with a trusted compounding partner to produce the compound to our specifications.”

The limitation in line speed at 200 fpm versus budgeted output based on 300 fpm, had an enormous cost impact—both in terms of variable cost and the potential to require capital investment for additional production capacity. The cost to add a production line was estimated at $1.2 million. “Converting the wear strip to Integra POK raised the material cost by 16%, but the 100 fpm increase in line speed that the new material enabled lowered the total cost by 27%,” Watkins sums up.

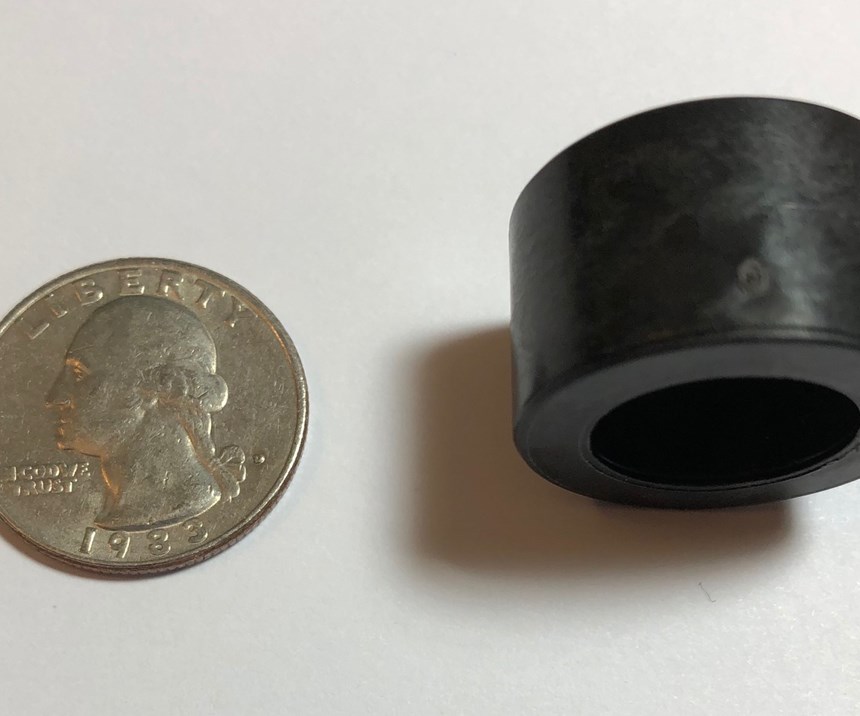

CASE STUDY B: WINTER SPORTS VEHICLE

A snowmobile recently introduced by a U.S.-based company encountered a warranty problem that arose from a shock-absorber assembly’s elastomer seal that could be dislodged by ice and rock impact.

After the seal failed, water and dirt could then get into the shock-absorber mechanism. The shock absorber glided through a lubricated glass-reinforced nylon 66 bushing. Soon after seal failure, the bushing absorbed moisture and swelled, altering the interference fit between the shaft of the shock absorber and the I.D. of the bushing. The device quickly “destroyed itself” and failed.

PolySource worked with the OEM’s engineering department to find a material solution—converting the nylon 66 bushing to a lubricated, 30% glass-reinforced POK (Integra POK 9030 GA6 LX3 BK-4000). The POK compound’s low moisture absorption combined with high melting point, low friction and high mechanical strength solved the problem and enabled the current 16-cavity mold to be used without any adjustments. The fast crystallization of POK yielded an extra bonus, a 17-sec reduction in the injection molding cycle.

Says Watkins, “The OEM estimated the replacement cost at $55,000 to $60,000 if they did nothing to solve the root cause, and just provided replacement parts and/or rebuilt the shock sub-assembly. Loss of brand value by not achieving a root-cause solution that eliminated warranty claims could not even be computed, but an approximation of $500,000 was used in life-cycle calculations. On an annual basis, switching to the Integra product will save the OEM $13,000 compared with just accepting the warranty cost.”

Related Content

Foam-Core Multilayer Blow Molding: How It’s Done

Learn here how to take advantage of new lightweighting and recycle utilization opportunities in consumer packaging, thanks to a collaboration of leaders in microcellular foaming and multilayer head design.

Read MoreFor Extrusion and Injection-Blow Molders, Numerous Upgrades in Machines and Services

Uniloy is revising its machinery lines across the board and strengthening after-sales services in tooling maintenance, spare parts and tech service.

Read MoreABC Technologies to Acquire Windsor Mold Group Technologies

The Tier One automotive supplier with compounding and blowmolding machine capabilities adds the 50-yr-old molder and moldmaker.

Read MoreMedical Molder, Moldmaker Embraces Continuous Improvement

True to the adjective in its name, Dynamic Group has been characterized by constant change, activity and progress over its nearly five decades as a medical molder and moldmaker.

Read MoreRead Next

Beyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More