PE Prices Firming, Others Flat or Lower

Flat to lower prices are projected for PP, PS, and PVC due to lower feedstock prices and better-balanced supply/demand.

Polyethylene prices are expected to grow firmer, driven by tight inventories, but flat to lower prices are projected for PP, PS, and PVC due to lower feedstock prices and better-balanced supply/demand. These were the views last month of purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas, and CEO Michael Greenberg of The Plastics Exchange, Chicago.

HDPE PRICES UP; MORE PE HIKES POSSIBLE

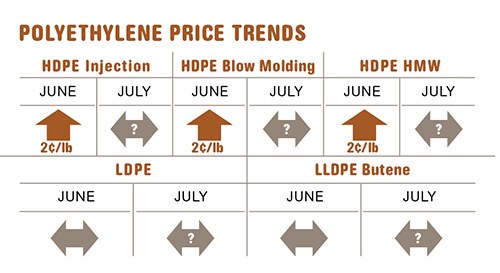

HDPE suppliers implemented a 2¢/lb increase in June. That apparently encouraged resin producers to attempt to push through their entire three-month pending hike of 2¢/lb for HDPE and 4¢ for LL/LDPE, effective July 1.

Mike Burns, RTi’s v.p. for PE, noted that PE pricing this year has been driven by inventory levels, not ethylene monomer. For example, the HDPE price hike was aided by very strong May exports to Latin America and Mexico, coupled with unplanned HDPE production disruptions. Burns said that ethylene monomer prices were 9¢/lb lower, while PE prices were 11¢/lb higher, than in 2012. Greenberg said that spot PE markets were very quiet at the start of the third quarter and that spot supplies were limited to a few remaining railcars held over from June and warehoused material offered by Houston traders and national resellers.

Neither of these sources expected much success for additional PE price increases, and Greenberg noted that processors would not only resist them but would seek a decrease. However, Burns allowed that PE pricing would trend upward or remain flat for the next 90 days. Factors supporting this view include low supplier inventories, which are below 35 days and will take time to recover; as well as processors stocking up for the approaching hurricane season, strong seasonal demand for packaging in North America and agricultural film-resin exports to Asia, and some planned maintenance outages.

PP PRICES UP, THEN FLAT OR LOWER

Polypropylene prices increased by 3¢/lb in June, in step with monomer prices. While there was a proposed 1¢ hike for July monomer contracts (which PP prices would follow), implementation was unlikely, said Scott Newell, RTi’s director of client services for PP. Barring any unusual production disruptions, both Newell and Greenberg saw potential for monomer prices to drop in July and August, meaning PP prices are likely to be flat or lower.

Meanwhile, PP sales have been strong since prices dropped a total of 17¢/lb between March and May, which had left a net 4¢/lb increase. Strong demand is attributed primarily to restocking and some to prebuying as processors had worked off inventories during the first and into second quarters and may want to stock up for the approaching hurricane season, according to Newell.

Spot PP supplies were characterized as extremely tight last month by Greenberg. He also reported that, sensing the current supply/demand dynamic, PP suppliers are publicly aiming to expand contract margins by 2¢/lb. Most have notified customers that their prices will reflect the change in monomer contract prices plus an additional 2¢. A similar attempt in the past failed, but resin suppliers currently have some pricing power. However, Greenberg pointed out that a significant number of processors are already locked into “monomer-plus” price contracts, and that delta is fixed, so it will be hard to reflect the increase market-wide even it is implemented in accounts with monthly negotiated prices.

PP operating rates are in the 90-94% range, above the average of about 88% year to date, according to Newell. PP exports have continued to erode—down 41% from 2012, due to higher domestic PP prices and availability of material from other sources.

PS PRICES DROPPING

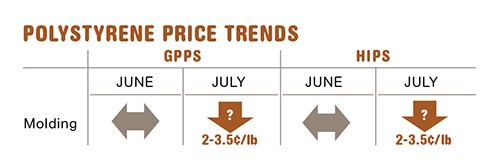

Polystyrene prices were flat in June and were poised to drop by the end of last month. Key drivers included a substantial 35¢/gal drop in July benzene contract prices; the three-month (April-June) settlement of ethylene contract prices at 45.5¢/lb, a 2.5¢ drop; and the expectation that seasonal demand for PS would decline through this quarter.

Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC, noted that the benzene price drop equates to a 3.5¢/lb lower cost to produce PS. Although PS suppliers will aim to protect their margins, PS prices were expected to drop 2¢ to 3.5¢ last month. Kallman also saw the market as fairly balanced. Although suppliers’ inventories were on the low side, due to seasonal second-quarter demand, plant operating rates were increased in May.

PVC PRICES FLAT TO DOWN

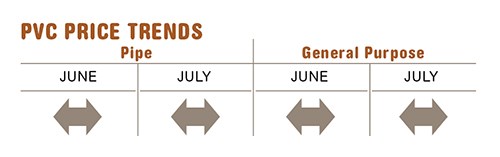

PVC prices were expected to remain flat last month and possibly this month as well, despite suppliers’ aim to implement a July 2¢/lb hike and another 2¢ increase in August. In fact, there is potential for PVC prices to fall this month.

Contributing factors cited by RTi’s Kallman include the drop in the three-month ethylene contract settlement and the potential for further decline due to an anticipated drop in exports because domestic PVC prices are not attractively competitive. Although domestic demand has been moderate, there is plenty of available material and suppliers’ inventories have been growing—despite two planned plant outages in the last two months which were shorter than anticipated and had no impact.

Related Content

Fundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MoreImproving Twin-Screw Compounding of Reinforced Polyolefins

Compounders face a number of processing challenges when incorporating a high loading of low-bulk-density mineral filler into polyolefins. Here are some possible solutions.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More