Prices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

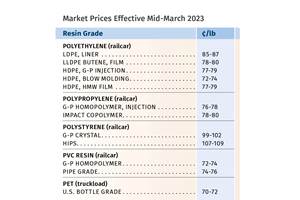

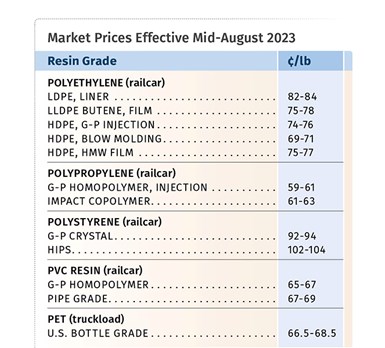

After further decreases in PE, PP, PS and PVC prices in the June-July time frame, the trajectory for third quarter’s second half was generally expected to be flat. This, barring production disruptions from a hurricane or other major event.

With the exception of PET, suppliers of the other four commodity resins had come out with price increases, a move largely viewed as one aimed at preventing further erosion and also attributed to some forecasts for a strengthening hurricane season. Continued lackluster demand, lower feedstock costs in some cases, generally ample supply despite lowered production rates, and new capacity are contributing factors.

These are the views of purchasing consultants from Resin Technology Inc. (RTi), senior analysts from Houston-based PetroChemWire (PCW), CEO Michael Greenberg of The Plastics Exchange, and Scott Newell, executive v.p. polyolefins at distributor/compounder Spartan Polymers.

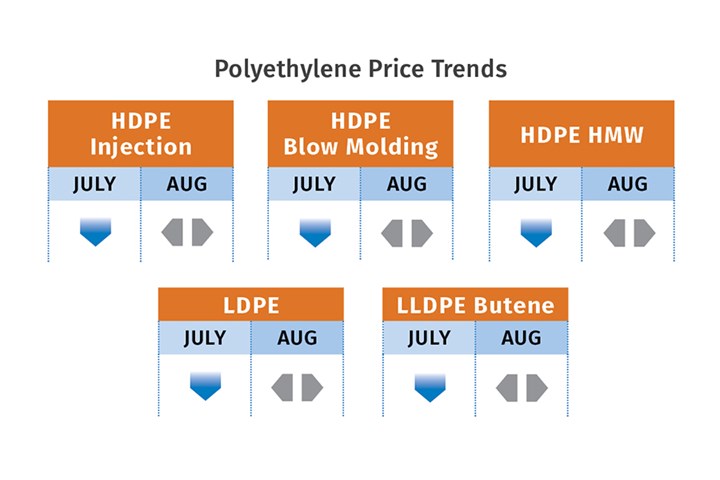

PE Prices Lower

Polyethylene prices dropped 3¢/lb in June, had the potential for a similar drop in July, and projected to be generally flat in August-September, according to David Barry, PCW’s associate director for PE, PP and PS, Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets, and The Plastic Exchange’s CEO Michael Greenberg.

These industry insiders did not see the possibility of any increase being implemented. While demand for exports was strong, domestic demand was generally described as flat, with production rates in the low-80s percentile. PCW’s Barry sees some potential for prices dropping a bit more this month, as Nova Chemicals was bringing on major new capacity and Shell was becoming more of a factor.

RTi’s Chesshire notes that for quite some time, there has been a double-digit delta between contract and spot prices. The Plastic Exchange’s Greenberg observes: “Market prices continued to see consolidation. The low end of the spectrum firmed as deeply discounted offers continued to dry up while the topside trimmed as contract buyers have been negotiating nonmarket adjusted deals since the spot vs contract/index disparity remained wide.”

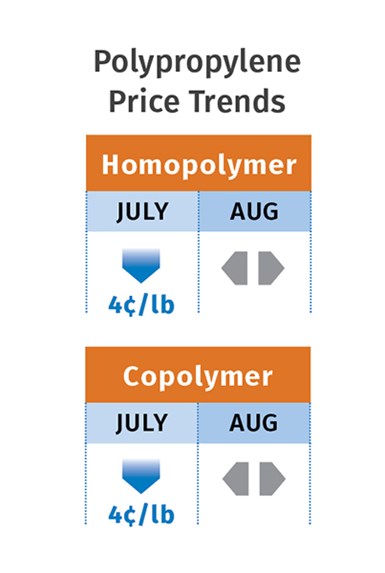

PP Prices Bottom Out

Polypropylene prices dropped 4¢/lb in June in step with propylene monomer contracts for a total of 19¢/lb since March, according to PCW’s Barry, Spartan Polymers’ Newell, and The Plastic Exchange’s Greenberg. They expect prices in July to be a rollover, and potentially trending that way within the August-September period. Meanwhile, at least four major PP suppliers had issued nonmonomer-related increases of 3¢/lb for August, which PCW’s Barry noted was unprecedented for this time of year. And this as new propylene monomer production was coming onstream, adding even more supply to a weak demand market.

Both Barry and Greenberg report that spot PP prices were firming up, but that it was unclear whether this was due to an increase in ‘real’ demand or a temporary restocking phase. Says Spartan Polymers’ Newell, “The industry mood is still bearish and this rebound may not hold as some are forecasting a weak third quarter.” He notes that processors were running their plants in the range of 70-80%, with some as low as 50-60%. PP homopolymer was regarded as well supplied, and was expected to be even more so as Heartland Polymers was bringing on substantial new capacity. PP impact and random copolymer grades were somewhat snug. Demand for construction applications appeared to be trending a bit stronger but remained soft for housewares.

PS Prices Drop Further

Polystyrene prices dropped by 6¢/lb in July, following a 3¢/lb drop in June, as contract prices for both benzene and ethylene dropped, according to PCW’s Barry and RTi’s Chesshier. Still, styrene monomer prices were rising due to unplanned production outages, leading at least one major supplier to issue an August price hike of 5¢/lb.

However, both sources characterize domestic demand as continued low, with production rates throttled back to the low 50% range. Due to some forecasts of higher feedstock prices, they ventured prices in the August-September time frame could be flat to slightly up. Barry reports that spot prices for both general-purpose PS and HIPS remained flat going into August. The implied styrene cost, based on a 30% ethylene/70% benzene spot formula rose by 2.7¢/lb within July.

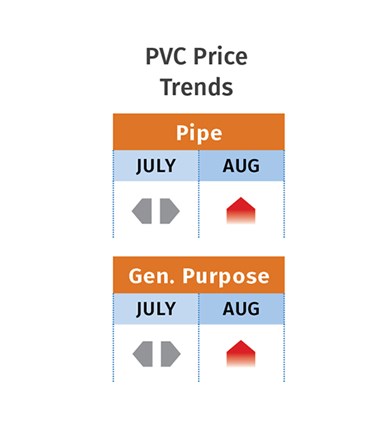

PVC Prices Drop

PVC prices in June dropped 2¢/lb, with a rollover in July, a potential increase of 1¢/lb to 2¢/lb in August, and another rollover in September, according to Paul Pavlov, RTi’s v.p. of PP and PVC and PCW’s senior editor Donna Todd. The latter noted that fourth-quarter forecasts were for flat prices for October, and a drop of 2¢/lb and 1¢/lb for November and December, respectively. Meanwhile, suppliers were out with an August increase of 2¢/lb.

According to Pavlov, production rates were increased to nearly mid-70s percentile from a low of 61%, owing primarily to higher exports demand, as domestic demand is characterized as lackluster. Todd says suppliers were confident they would get their August increase, but a similar increase for September lacked the support of one leading supplier.

But, she adds that some market participants did not rule out two increases going through. “Between the tightness of the domestic market and rising export prices, they believe there is sufficient justification to make the change. While demand in July dropped and was expected to remain slow through August, converters expect to see demand pick up after Labor Day. They don’t anticipate that demand will return to historical norms in the fall, however.”

PET Prices Flat

PET prices remained flat through June-July, with a potential fractional price drop in August and as much as 1.5¢/lb in September, based on raw material formulation contracts, according to Mark Kallman, RTi’s v.p. of PVC, PET and engineering resins. This, barring higher crude oil prices. He noted there was an uptick in demand in the bottle resin category due to record high temperatures. Despite lower industry production rates, material is readily available as are lower cost imports.

Related Content

Prices Flat-to-Down for All Volume Resins

This month’s resin pricing report includes PT’s quarterly check-in on select engineering resins, including nylon 6 and 66.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreRecycled Content to be Incorporated in PS Foam Packaging

Pactiv Evergreen and Amsty announced a collaboration that will bring ISCC plus certified product into select food packaging.

Read MorePrices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More