Plastics Index Shows Fourth Consecutive Monthly Gain

December reading hints at slowing contraction as plastics industry outlook improves

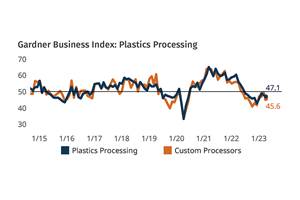

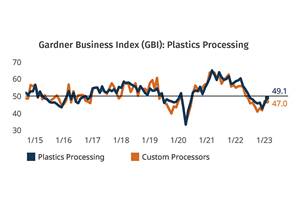

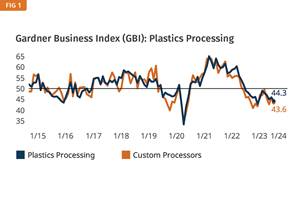

The Gardner Business Index (GBI) measures the current state of plastics processing activity through survey responses covering new orders, production, backlog, employment, exports and supplier deliveries. A reading above 50 indicates expansion; below 50 indicates contraction.

The plastics processing industry registered a GBI reading of 46.1 in December 2024. While still in contraction territory, the index has shown steady improvement over recent months, with supplier deliveries posting gains against both the previous month and year-ago levels amid normalizing supply conditions.

The GBI Components Scorecard reports the monthly change rate of primary plastics processing market factors contributing to the overall monthly index reading.

The GBI Components Scorecard reveals an overall positive performance across key metrics in December. Supplier deliveries emerged as the strongest component, showing gains both month-over-month and versus the previous year. Employment, production, exports, new orders and backlog all registered contractions from the previous month, though at improved rates comparatively. This suggests a positive outlook as we move into the new year.

Reading the Scorecard:

- Color indicates where a component value falls relative to 50 for the current month. Green indicates expansion; red indicates contraction.

- Shade indicates a value's distance from 50; the darker the shade, the further from 50.

- Direction indicates a value's change versus the previous period. Pointing up is always better.

The GBI Future Business Index is an indicator of the future state of the plastics processing market from industry respondents regarding their opinion of future business conditions for the next 12 months. Over 50 is expansion and under 50 is contraction.

The Future Business Index surged to 68.9 in December, reaching its highest level since late 2020, suggesting significantly improved optimism about business conditions in 2025.

Find the latest plastics processing market research and reporting at GardnerIntelligence.com

Related Content

Plastics Processing Continued Contraction in April

Despite some index components accelerating and others leveling off, April spelled contraction for overall plastics processing activity.

Read MorePlastics Processing Activity Contraction Continues in August

Four months of consecutive contraction overall.

Read MorePlastics Processing Activity Near Flat in February

The month proved to not be all dark, cold, and gloomy after all, at least when it comes to processing activity.

Read MorePlastics Processing Business Index Contracts Further

All components dip as index hits low point of 2023.

Read MoreRead Next

Lead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More